What are the best investment options for UK expats?

UK expatriates typically choose among investing in their country of residence, investing back in the UK, or using offshore platforms. The right choice depends on your residency status, tax situation, and long-term goals.

Whilst it is impossible to speak about every country in the world, given the 180+ places where British expats reside, I will try to generalize, based on the evidence and my experience as a Brit living overseas.

This article will focus on the best investment options for UK expats residing abroad, rather than non-British expats living in the UK, although there will be some commonalities in the analysis.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

How to Invest as a UK Expat

Start by assessing where you’re tax-resident and whether you plan to return to the UK. This will shape your investment options and how they’re taxed.

Some expats prioritize access and flexibility by using platforms regulated in their country of residence.

Others keep ties to the UK via pensions or property, especially if they expect to retire there.

A third group uses offshore or international platforms for more portability across jurisdictions.

The best choice often combines two or more strategies, depending on your goals, risk appetite, and cross-border obligations.

1. UK Expat Investments in Your Country of Residence

As a British expat, you can invest directly in your country of residence, whether that’s Spain, Dubai, Hong Kong, Singapore, or elsewhere.

The options include local stock market investments, real estate and bank deposits. This section will go through each option:

Local Stock Market

If you are living in a place with a quality stock market, which has had 100-200 years of great performance like the US Stock Markets, it makes sense to invest with a local brokerage firm.

Likewise, some countries make it very difficult from a tax point of view to invest overseas. Again, this is especially the case in the US where they make overseas investing tax-inefficient for American tax residents.

So, if you are a British tax resident in the United States, it almost always makes sense to invest locally, from a tax point of view.

In comparison, if you live in a place like China, Colombia or any other place with a stock market which is quite unstable, you are taking a lot more risks investing locally.

I met so many British expats whilst I lived in China, that got caught up with the whole “China growth story“, forgetting that GDP and stock market growth aren’t connected.

It is of course possible to have a brokerage account in country A, and it is focused on investing in stocks in country B.

For example, you can open up an investment account in most countries, which allows you to trade on the US, UK and Mainland European stock markets.

The problem with this is if the investment platform or brokerage is too localized, it might not allow you to continue to invest if you leave that country.

As an expat, especially if you are moving a lot, it makes sense to have a portable option which can ensure that your accounts continue to function if you leave.

Not only that, but unless you are living in a 0% capital gains environment, you can be hit by very high taxes if you automatically invest in your country of residence.

Local Real Estate

Another option is buying local real estate in the country where you currently reside. In general, this makes the most sense if you plan to stay in that location long-term and use the property as a home rather than a pure investment.

For those considering rental properties, it’s important to weigh the risks.

Real estate is an illiquid asset, and selling can be challenging, especially in markets where legal systems, languages, or property rights differ from what UK-based investors are used to.

This is particularly relevant for British expats living outside native English-speaking environments.

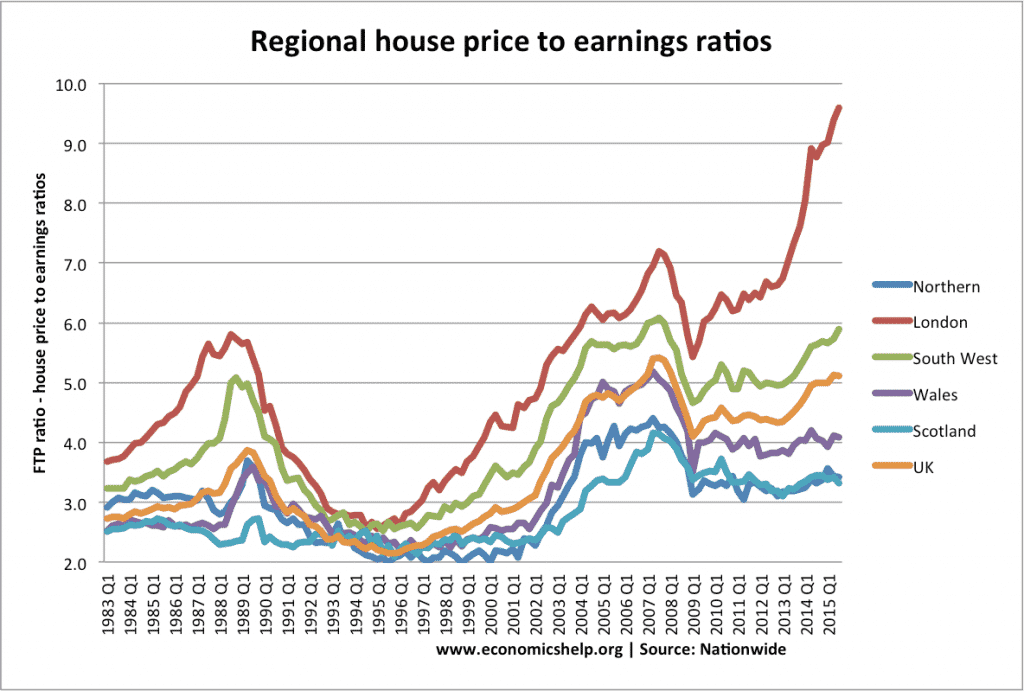

Additionally, property valuations in many emerging markets have risen sharply over the past 10–15 years, closing the gap with UK housing prices.

Before 2007–2010, investors often received a discount to compensate for the additional risks.

Today, some overseas property markets are as expensive or even more expensive than the UK.

Even some developed markets have appreciated significantly relative to UK property values.

Local Banking

All expats need to bank for daily needs, and local accounts are often set up by employers when relocating abroad.

However, many expats also benefit from third-country banking solutions, particularly in jurisdictions with more flexible currency controls.

For example, expats in countries like China or Vietnam, where moving money across borders can be difficult, often choose to have part of their salary paid into accounts in places like Hong Kong or Singapore.

They do so to ensure smoother international transfers and greater currency flexibility.

That said, bank deposits should not be considered a real investment. In most countries, deposit rates are below inflation, meaning your purchasing power declines over time.

In some emerging markets, you may find double-digit deposit rates. however, these typically come with high currency and inflation risks.

2. UK Investment Options for British Expats

Can British expats still invest in the UK? Yes, but it comes with trade-offs.

While you can send money back to invest in UK stocks or existing accounts, expats often lose access to tax advantages like ISAs, and face additional scrutiny.

UK Stock Market Investments and ISAs

Some British expats choose to send money home and invest through UK-based platforms.

This is especially true for those on short-term assignments or maintaining close ties to the UK.

This can include stock market investments, pensions, or existing UK-based accounts.

While this may seem familiar or convenient, it’s not always tax-efficient or practical.

In fact, for most long-term expats, investing back home comes with significant limitations:

- ISAs are not available to non-UK residents, so your gains may be taxable both in the UK and your current country.

- UK brokers and banks may restrict access or close accounts if you’re no longer a UK resident.

- HMRC’s Statutory Residence Test means regular transfers and connections to the UK can blur your tax residency status, potentially triggering tax obligations.

- Anti-money laundering checks may delay or complicate transactions, as banks increasingly request proof of income or source of funds from expat clients.

While UK-based investments can still make sense in specific cases, such as keeping an existing pension active or investing before relocation, they are usually not the most efficient option for permanent expats.

UK Real Estate

Many British expats are interested in rental properties in the UK, but profitability has become more challenging over time.

Recent tax changes have reduced the appeal for non-resident landlords, including higher stamp duties, reduced mortgage interest relief, and broader capital gains tax rules.

Both major parties supported increased taxes on overseas buyers in their 2019 manifestos, further tightening the landscape.

Mortgage access has also become more limited, with many UK lenders imposing stricter requirements on expats. That said, expat mortgages are still available, albeit with higher thresholds.

Despite these hurdles, UK property valuations, particularly outside major cities, may be more reasonable compared to some overheated global markets.

So if you can find an excellent buy, buying a UK property isn’t the worst option.

It is merely just much more difficult compared to the past, to do it profitably.

UK Bank Deposits

As mentioned earlier, it doesn’t usually make sense for British expats to send large amounts of money to a UK bank account for investment purposes.

Small amounts of money to pay bills is a different matter, of course. It also makes sense to at least keep UK bank accounts open, with small balances, in case you ever return to the UK.

This also allows you to keep a UK “correspondent address” whilst still living overseas.

3. Investing in a Third Country (Offshore Investments for UK Expats)

British expats can invest through platforms based in third countries, which are jurisdictions outside both the UK and their country of residence.

Examples of third countries could include Luxembourg, Isle of Man (technically part of the UK but with different regulatory environments), Bermuda and any other 0% capital gains country.

International Stock Market Investing via Offshore Platforms

There are many advantages to expats investing with a third country solution.

The main advantage is that an expat-focused account in the Isle of Man, Bermuda, Luxembourg, or another popular jurisdiction is both tax-efficient and more likely to be portable.

By portable, I mean that as many international providers are specialised in the expat market, they allow customers to simply update their details online, if they move from country A to country B.

The only exceptions tend to be if you move to the US or to a country under US sanctions, like Iran or Venezuela, which applies to very few British expats.

From a tax point of view, it is quite essential to be invested in a 0% capital gains environment as well.

Taxes on capital gains can be hundreds of thousands or more, especially if you are a long-term investor.

Many people don’t consider how important taxes are to the cost equation, especially if they are only starting with a small investment. Small monthly investments soon add up over the years, though.

The biggest reason stopping people from investing in the stock market is fear.

Typically after a negative news story about an election, virus or the economy, people worry and try to time the market — meaning, decide when the best time to invest is.

This is almost impossible to do. At a previous client event, the Shark Tank (previous Dragons Den) star Kevin O’Leary admitted that he had tried and failed to time the markets:

If somebody worth an estimated $400 million can’t do it, then very few people (if any) can.

International Real Estate

Investing in property in a third country does have some of the same risks as buying in your country of residence.

Real estate remains an illiquid asset, and you may face legal or language challenges in unfamiliar jurisdictions.

The increasingly high valuations in countless places also makes this an increasingly risky option, unless you pick very wisely.

That said, international real estate offers distinct advantages. You can shop globally for the best deals, comparing rental yields, tax regimes, and long-term growth prospects.

You don’t need to pick America, Australia, Canada, Bulgaria, or Romania.

You can merely speak to a property expat, look objectively at valuations and rental yields, and make your decisions based on data — not hype.

In many countries, property ownership also opens the door to citizenship-by-investment schemes. In other words, you can get a second residency, in return for property ownership.

This is especially popular for expats that have finished their work assignment but still want to live abroad.

Expat Offshore Bank Account

Whilst it should be mentioned again that bank accounts shouldn’t be used as investments, having an expat bank account in a third country makes a lot sense.

The main advantage is portability. When your bank understands that you’re an expatriate, you’re far less likely to face account closures, frozen funds, or excessive documentation requests when you relocate.

Expat-friendly bank accounts usually support multiple currencies, offer online international transfers, and comply with international banking standards.

Although offshore accounts are not designed for investment growth, they are often a key part of a well-structured international financial plan.

They offer flexibility, currency control, and sometimes access to global financial services that local banks might not provide.

Do UK expats pay taxes on investments?

If you are non-resident for UK tax purposes:

- You don’t pay UK tax on foreign income or capital gains (except on UK property).

- However, UK-sourced investment income, like dividends or rental income from UK real estate, may still be levied.

- ISAs stop being tax-free once you become non-resident. No new contributions allowed, and gains may be taxable in your country of residence.

Most countries tax worldwide income, so your local tax laws may require you to declare and pay taxes on your investments even if they’re offshore or in the UK.

Many jurisdictions have double taxation agreements with the UK to prevent being taxed twice, but you must file correctly to benefit from these.

Investments held in jurisdictions like the Isle of Man can offer tax deferral or efficiency, but are not tax-free unless structured correctly.

Investing Tips for British Expats

- Clarify your tax status early. Know if you’re still a UK tax resident or not as it affects whether ISAs or UK-based investments are advantageous.

- Avoid over-concentration. Diversify across jurisdictions to reduce geopolitical, currency, and regulatory risk.

- Use expat-friendly platforms. Choose international providers familiar with cross-border compliance and portability.

- Keep emergency funds accessible. Don’t lock all your capital in illiquid property or long-term vehicles.

- Review your plan when relocating. Each move may change your optimal strategy due to new tax rules or investment access.

- Consider local currency exposure. Weigh whether to hedge or accept foreign exchange risk based on your long-term targets.

UK Expat Investing: Final Thoughts

In general, it makes sense to focus on “third country” or offshore options when it comes to banking and investing as a UK expat. This is especially the case for those moving from country to country every few years.

The reasons are simple enough. It is usually more tax-efficient and specialised in the expat niche.

The main exceptions to this rule are if you live in the United States, and/or you are only on a short-term expat assignment. If you are short-term, you are often still considered a UK tax resident in any case.

The fall in markets which has happened during March 2020, after the unexpected government shutdowns globally, once again shows that nobody can predict stock markets. Therefore, having a long-term plan is always best, which you can follow, through thick and thin.

Long-term, investing makes a lot more sense to keeping money in cash.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Further Reading

I am the most viewed writers on social media platform Quora for investing and personal finance, receiving over 218 million views in the last few years.

I regularly share answers from that platform on adamfayed.com. In the answers below, I answer the questions including:

- What does a beginner need to know in terms of investing in the stock market? More importantly perhaps, what things are often neglected by people new to investing.

- Is it possible to support yourself financially from a stock market investment portfolio? In other words, can you eventually stop working due to your stock investments? What do people get wrong when they think about “passive income”?

- If you want to become a millionaire investing in stocks, how much do you need to invest every month or year? Is it less or more than you might expect?

As a preview of the answers I have copied a section below:

The basics in any domain is key. If you want to get fit, the basics of good nutrition, exercise and posture is important.

The same is true in investing. It is a myth that you need to be very intelligent to be a good investor as the quote below says:

What people need is

1.Actually get started – 80% of success is just showing up. The same in investing. Just setting up that investing account sounds obvious, but it is key. Beyond that, simple tricks like investing one day after you are paid can increase how much you invest dramatically. Some studies have even shown that people are able to invest 3x more by investing at the start of the month, as opposed to at the end. Over time, how much you invest and for how long, will be even more important than compounded returns.

2.Time and patience – The easiest way to make money, with less risk, is to leverage time. Stocks are risky if you only hold them for a year. Even some of the bets ETFs and indexes are. If you hold them for decades, they aren’t. Don’t confuse volatility and risk.

3. Be diversified. If you hold stocks and bonds together, it is even safer:

4.Basic knowledge at the very least – Or outsource the process to somebody that does have that knowledge. Plenty of people make the mistake of investing without knowing that much about it.

5. Nobody can predict the future – Now sure, countless people can get one prediction right. Some can even get many right. Plenty have an excellent run at predicting things. Over a 40–50 year period, however, it is very unlikely that you will beat the market by making moves based on listening to the talking heads on the media. Countless academic studies have shown that people can’t beat the market by listening to CNBC, Bloomberg and many other media outlets. At least on a long-term basis.

6. Emotional control – This is the most undervalued point. Most people think that the bets investors are the most knowledgeable ones. Yet a very emotional and super knowledgable person doesn’t do well in investing. Every time there is a crash, they panic sell. Even some PHDs in portfolio theory have been found to have broken their own rules in investing.

With the last point, what’s more important is nobody knows how they will react to a stock market crash until they experience one.

Back in early 2020, the stock market hadn’t really crashed in a big way since 2008.

I personally know so many people who “pledged” to me that they would never panic sell like those “idiots” (to use their words) in 2008.

Then 2020 came along, the media screamed this time is different like they always do, and many of those people panic sold.

Another part of emotional control is not getting too excited during the good times or too depressed during the bad times.

Most people look at a stagnant stock market and think it isn’t worth investing in.

Few people wanted to invest in the S&P500 in 1982 after 17 years of stagnation.

Likewise, few wanted to invest in it in 2010 after a “lost decade” . Yet after both periods, stocks went on long bull runs from 1982–2000 and 2009–2020.

Likewise, people shouldn’t be put off by the fact that some markets like the FTSE All Stars has underperformed the US markets in recent times.

To read more, click below:

This is some of the clearest advice out there – a godsend to confused expats such as myself so many thanks!!!! Can you recommend any specific providers of the “portable” third party country, 0% capital gains investment accounts for expats that you speak of above in this article?? As it’s difficult to uncover them online if you use the wrong words to search for them, which I think I am doing.

Hi Kristen – thanks for your message. I will email you.

One of the key things is if you want to DIY invest or use an advisor. Swissquote and Saxo Bank are fine for DIY investing.

Excellent post. I just emailed you about investing

Thanks David I will email you.

British National been working overseas since 2005, still have bank account in UK to transfer money to to pay bills as you mentioned. Need some advice on how to boost pension and where and is it worth back paying NI stamps?

Hi Louise – thanks I will email you

the negative comments about Saxo bank on Trust pilot are a real turn-off.