Only a handful of countries, including India and Vietnam, are not yet participating in CARF, making country selection increasingly important for crypto investors.

The Crypto-Asset Reporting Framework (CARF) is an international initiative designed to improve reporting and compliance of crypto-asset holdings across jurisdictions.

For expats, investors, and financial institutions, understanding CARF and which countries participate—or do not—is critical to ensuring regulatory compliance and avoiding penalties.

This article covers:

- What is crypto asset reporting framework?

- How does CARF ensure ongoing compliance?

- Which countries are not part of CARF?

- How to avoid capital gains tax in crypto?

Key Takeaways:

- CARF introduces automatic global reporting for crypto assets.

- Reporting begins in phases from 2027 to 2029.

- Crypto exchanges and custodians carry the reporting burden.

- CARF reduces the ability to hold crypto offshore without disclosure.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is CARF reporting?

The Crypto-Asset Reporting Framework, or CARF, is a global standard for the collection and exchange of information on crypto-asset holdings and transactions.

It requires crypto service providers, such as exchanges and custodians, to report users’ crypto activities to tax authorities.

CARF aims to increase transparency, reduce tax evasion, and harmonize reporting standards internationally.

CARF reporting covers various types of crypto-assets, including cryptocurrencies like Bitcoin, Ethereum, and other tokens that meet the framework’s definition of crypto assets.

What is the purpose of CARF?

CARF’s primary goal is to ensure that taxpayers accurately report crypto holdings and transactions to their local tax authorities.

By enabling automatic exchange of information (AEOI) between participating countries, CARF seeks to:

- Prevent tax evasion through anonymous or cross-border crypto transactions

- Improve compliance among financial institutions and crypto service providers

- Standardize reporting requirements globally, making compliance easier for international investors

CARF Reporting Requirements

CARF requires crypto service providers to collect and report user identity and crypto transaction data to tax authorities.

In practice, this means exchanges, custodians, and certain wallet providers must report information such as customer identification details, crypto-asset balances, and transaction activity.

Reports are typically submitted annually and shared automatically between participating tax authorities under information-exchange agreements.

Who is likely to be affected?

Anyone using a CARF-compliant crypto platform may be affected, regardless of where they live.

This includes individual investors, expats, and offshore clients holding crypto through exchanges or custodians operating in CARF jurisdictions.

Crypto businesses themselves are also directly affected, as they carry the reporting and compliance burden.

Non-CARF Countries

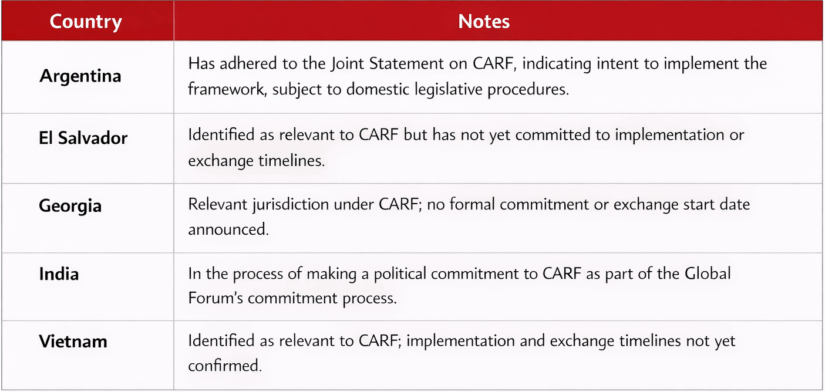

As of December 2025, only five relevant jurisdictions, like Argentina, remain non-CARF while over 75 jurisdictions have committed to CARF reporting between 2027 and 2029, as per the OECD.

Non-CARF countries are jurisdictions identified as relevant to the Crypto-Asset Reporting Framework but that have not yet formally committed to implementing CARF.

The Global Forum has identified the following jurisdictions as not yet committed to CARF implementation:

- Argentina

- El Salvador

- Georgia

- India

- Vietnam

Some of these jurisdictions have expressed intent to adopt CARF in the future, but until domestic legislation and exchange agreements are in place, they remain non-CARF jurisdictions.

Importantly, non-CARF status does not mean crypto activity is unregulated or tax-free.

Local tax reporting obligations may still apply, and CARF reporting can still occur indirectly if crypto platforms operate in CARF-participating countries.

Which countries are part of CARF?

CARF countries, such as the UK and UAE, are jurisdictions that have formally committed to implementing the Crypto-Asset Reporting Framework and exchanging information automatically.

The Global Forum has grouped CARF countries by their planned first exchange year:

Jurisdictions undertaking first CARF exchanges by 2027

- Austria

- Belgium

- Brazil

- Bulgaria

- Cayman Islands

- Chile

- Colombia

- Croatia

- Czechia

- Denmark

- Estonia

- Faroe Islands

- Finland

- France

- Germany

- Gibraltar

- Greece

- Guernsey

- Hungary

- Iceland

- Indonesia

- Ireland

- Isle of Man

- Israel

- Italy

- Japan

- Jersey

- Kazakhstan

- Korea

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- San Marino

- Slovak Republic

- Slovenia

- South Africa

- Spain

- Sweden

- Uganda

- United Kingdom

Jurisdictions undertaking first CARF exchanges by 2028

- Australia

- Azerbaijan

- Bahamas

- Bahrain

- Barbados

- Belize

- Bermuda

- British Virgin Islands

- Canada

- Costa Rica

- Cyprus

- Hong Kong (China)

- Kenya

- Malaysia

- Mauritius

- Mexico

- Mongolia

- Nigeria

- Panama

- Philippines

- Saint Vincent and the Grenadines

- Seychelles

- Singapore

- Switzerland

- Thailand

- Türkiye

- United Arab Emirates

Jurisdictions undertaking first CARF exchanges by 2029

- United States

The United States is notable as it does not participate in CRS but will implement CARF-style reporting through its own regulatory and tax enforcement framework.

How many countries are crypto legal?

Crypto is legal or permitted in roughly 110–120 countries worldwide.

In these jurisdictions, individuals can generally own, trade, or use crypto assets, though regulatory treatment varies widely.

Note:

- Legal or tolerated: about 110–120 countries

- Restricted or partially banned: about 30–40 countries

- Broadly banned: fewer than 10 countries

Even in countries where crypto is legal, restrictions may apply through banking access, exchange licensing, taxation, or reporting obligations such as CARF or CRS-style rules.

How much crypto can I cash out without paying taxes?

There is no universal tax-free crypto withdrawal threshold under CARF.

CARF governs reporting, not taxation.

Whether tax is due depends on local rules, including capital gains thresholds, holding periods, and whether crypto is treated as income or an asset. In many jurisdictions, even small gains may be taxable.

What is the difference between CARF and CRS?

CARF applies to crypto assets, while CRS applies to traditional financial accounts.

CRS covers bank accounts, investments, and custodial assets. CARF fills the gap by targeting crypto-assets that previously fell outside standard financial reporting frameworks.

Together, they create broader global financial transparency.

What are the key differences between FATCA and CRS?

FATCA is US-focused, while CRS is a global standard.

FATCA requires reporting of US persons to the IRS. CRS enables mutual exchange of financial information between participating countries.

CARF follows the CRS model but focuses specifically on crypto-assets rather than bank or investment accounts.

| Feature | CARF | CRS | FATCA |

| Full name | Crypto-Asset Reporting Framework | Common Reporting Standard | Foreign Account Tax Compliance Act |

| Scope | Crypto assets (cryptocurrencies, certain tokens) | Traditional financial accounts (bank accounts, investments) | US persons’ foreign accounts |

| Issuing body | OECD / Global Forum | OECD | United States (IRS) |

| Who must report | Crypto exchanges, custodians, certain wallet providers | Banks, financial institutions | Foreign financial institutions |

| Who is reported | Crypto asset holders | Account holders | US citizens, residents, and entities |

| Type of reporting | Automatic exchange of crypto-asset information | Automatic exchange of financial account information | Reporting to the IRS |

| Geographic reach | Global (OECD-led) | Global (100+ countries) | US-centric |

| First reporting period | 2027–2029 (phased) | Ongoing | Ongoing |

| Covers crypto? | Yes | No | Indirectly (through US tax rules) |

| Covers bank accounts? | No | Yes | Yes (for US persons) |

| Penalties for non-compliance | Determined by local tax law | Determined by local tax law | Severe US penalties and withholding |

Bottom Line

As CARF rolls out from 2027 to 2029, the scope of crypto reporting will expand rapidly.

Investors using exchanges or custodians in CARF jurisdictions should expect greater tax authority visibility, even if they reside in non-CARF countries.

FAQs

What is the penalty for not reporting crypto?

Penalties for failing to report crypto depend on local tax law, not CARF itself.

CARF enables information sharing, but enforcement is handled domestically. Penalties may include fines, interest on unpaid taxes, audits, or criminal charges in cases of deliberate tax evasion.

Do I need to report crypto if I didn’t sell?

Yes, reporting may still be required even without selling.

Under CARF, exchanges can report holdings and balances, not just disposals. Tax obligations depend on local rules, but visibility to tax authorities may exist regardless of activity.

What is a non-CRS country?

A non-CRS country does not automatically exchange financial account information with other jurisdictions.

Similarly, non-CARF countries do not participate in automatic crypto-asset reporting, though this does not remove local tax or disclosure obligations.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.