Understanding 8 of Warren Buffett’s rules for success and investing is crucial for effective overseas investment management and maximizing your financial opportunities.

He is the third wealthiest people in the world, who has been named as one of the most influential people in the world by countless publications. What are Buffett’s top rules for success in business and investing?

1. Read a lot

Buffett spends up to 80% of his time reading every day, which doesn’t make him unique amongst very wealthy people. Mark Cuban spends around 3 hours reading daily. Reading helps you gain a competitive advantage, find new ideas and adapt to changing times.

2. Don’t care about what others think

Buffett is known for being humble and open-minded to new ideas, but he doesn’t have a problem if somebody tells him he is wrong. He has claimed that in such situation, he merely sits back, and looks at the facts.

3. Focus on compounding

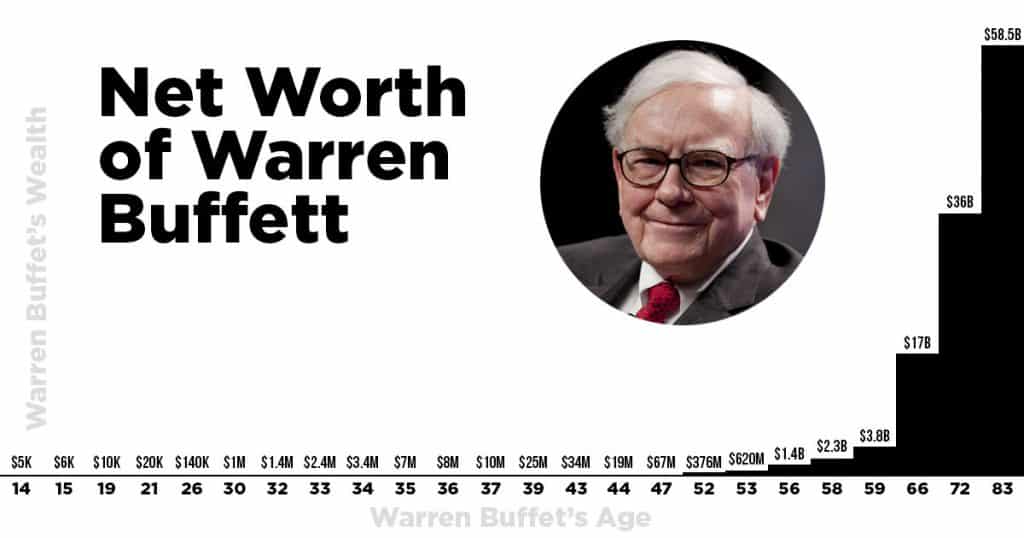

Einstein called compounding the 8th wonder of the world, and that was before the days of Buffett. He has accumulated most of his wealth after his mid 50s for this very reason:

4. Have a competitive advantage

If you succeed for a short period of time, there will be people that take notice, that want to eat your lunch. To maintain your position at the top of the castle, or even close to the top of the castle, you need to do two things; have a competitive advantage and adapt to changing times.

5. Cash is a bad investment

Assets might be more volatile than cash, and Buffett has been known to have significant amounts of cash during certain periods of his life, but he recommends that pretty much every average investor gets out of cash. It is one guaranteed way to lose to inflation or relative to other investments.

He does, however, recommend a small cash surplus. “Cash is like oxygen, you want to make sure enough is around, but you don’t want to have excesses of it” he once remarked.

In other words, cash isn’t an investment. It should be used to buy investments.

6. You don’t have to get everything right

When Buffett first met Bill Gates, Gates told that everybody would soon need a computer. Buffett was skeptical and told him that “I will stick to chewing gum and you can stick to computers”. Of course, Gates was proved right, however Buffett isn’t losing any sleep about it. You only need to get 4-5 main decisions right, to make decent money.

7. Focus on what the asset produces

Focus on how much your investment yields, and don’t worry about how much your asset will be sold for. Take property as an example. If the rental yields are 8%-10% per year after costs, that is a decent investment.

If, in comparison, you are hoping the capital value will increase 8%-10% per year, that is a speculation which may or may not come true. Hoping the person coming after you will pay more for the same asset, isn’t a productive decision.

This is one reason Buffett doesn’t like gold – it doesn’t pay a yield, coupon or dividend.

8. Focus on market investments

Buffett has advises most investors to keep in the stock and bond markets ultra long-term. He has famously predicted that the Dow will one day hit $1m, due to the natural compounding of the stock market.

Further reading

Courtesy