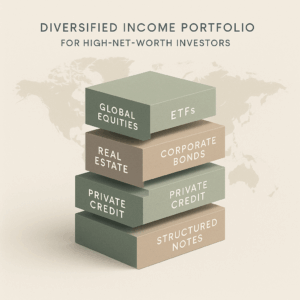

Expats and high-net-worth individuals have several income options than just cash and government bonds. Modern portfolios mix dividend-paying global stocks, income-focused funds and ETFs, and high-quality corporate or emerging-market bonds.

In addition, many investors add real estate, REITs, private credit, structured notes, and multi-asset income solutions for diversification.

HNWIs and expats face a unique challenge: earning reliable income in a world where traditional fixed-income assets no longer behave the way they did 10, 20, or 30 years ago.

Global mobility, rising government debt, inflation uncertainty, and stricter banking rules mean today’s income strategy can’t rely solely on the safe old-school options anymore.

This article covers:

- Best portable investments

- Is Fixed Income Still a Good Investment?

- Income strategies for expats

- Why is probability important?

Key Takeaways:

- Income strategies must be portable across countries for expats and HNWIs.

- Traditional cash and government bonds often fail to keep up with inflation.

- Modern options like corporate bonds, ETFs, private credit, and structured notes offer higher yields.

- Balancing risk, liquidity, and access is essential for stable revenue.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Income Planning for Expats and HNWIs: Why Is It Different?

Expats and HNWIs can’t rely on the same income strategies used by domestic investors. A fund available in one country may be restricted in another. Some banks even close client accounts when they relocate.

These cross-border restrictions —combined with shifting tax rules and banking limitations—mean that many traditional products simply aren’t accessible or portable once you move countries.

Best Portable Income Investments for Expats

For expats, the best income investments are those that remain accessible regardless of where you live.

These options must work across borders, survive residency changes, and continue paying income even if a bank or platform restricts local clients.

Expats usually seek:

- Retirement income

- Passive income for financial freedom

- Education funding for children abroad

- Wealth preservation through trusts, foundations, and insurance structures

- Second residencies or passports

- Portability of assets across multiple jurisdictions

Because people move more often, working 1–2 years in one country before shifting again, income portfolios today must be flexible and globally accepted.

Why Traditional Fixed Income No Longer Works

The real issue isn’t just low yields. It’s the shift in global financial conditions since 2008.

Traditional tools no longer deliver safe, reliable income the way they once did, and two areas show this most clearly: cash savings no longer beat inflation, and government bonds are riskier than before.

Why cash savings lose value for expats?

Cash may feel safe, but it steadily loses purchasing power, especially for expats dealing with inflation and currency fluctuations.

The once-reliable advantage of earning interest above inflation has disappeared, making cash a shrinking asset rather than a stable income tool.

Historically, cash paid around 2% above inflation. But after 2008, and especially post-2020, this trend collapsed:

- Cash savings rarely keep up with inflation

- Even strong currencies like USD, GBP, and EUR have lost purchasing power over time

- Many expats also face currency depreciation, which magnifies the loss

Governments with high debt levels often prefer moderate inflation (4%-5%) because it helps reduce their debt burden indirectly. For retirees living abroad, this is a silent but significant risk.

Why are bonds no longer a safe haven?

Government bonds no longer act as the defensive anchor they once were. Rising interest rates, high national debt, and broken correlations mean bonds can now fall at the same time as stocks.

This also affects traditional allocation models like 50/30/20 or the classic 60/40 portfolio, which relied on bonds providing stability when equities dropped.

For decades, the 60/40 approach worked because stocks and bonds typically moved in opposite directions. But today’s environment is different.

In 2022, during the Russia-Ukraine shock, stock markets fell—and so did medium and long-term government bonds.

Short-term bonds did better, but they provide limited yield and still cannot guarantee protection in the current backdrop.

Modern Income Solutions for Expats and High-Net-Worth Investors

Because traditional fixed income has weakened, expats and HNWIs now turn to modern alternatives like corporate bonds, structured notes, etc.

These options offer higher yields, better diversification, and stronger long-term consistency if chosen carefully.

Best corporate bond funds for international investors

For international investors and expats seeking predictable cash flow, high-quality corporate bonds stand out as the best option.

They offer stronger yields than government bonds, lower corporate leverage, and easy access through ETFs and global trading platforms, which make them a practical choice for modern income portfolios.

High-quality corporate bonds now offer:

- 5–6% annual returns (better than many government bonds)

- Lower debt levels than some governments

- Easy access through ETFs and major trading platforms

But you must watch for:

- Duration risk (long-term bonds pay more but are less liquid)

- Junk bonds disguised as high-yield opportunities

Corporate bond ETFs can be a solid portfolio diversifier but shouldn’t dominate an income strategy. Investors must be able to manage duration and credit risk.

High-yield ETF income strategies for expats

For expats looking for easily accessible, income-focused investments, high-yield ETFs provide attractive yields of 5–7% through covered call or global dividend strategies.

While they remain tied to stock markets, they are a convenient, low-fee way to generate consistent cash flow without complex structures.

Pros:

- Yields of up to 7%

- Easy to buy, low fees

Cons:

- Capital appreciation is low (0%–2% in many cases)

- Still correlated to stock markets

- Withholding taxes for non-US investors

These are income-focused but not risk-free.

Private credit income funds for high net worth individuals

Private credit offers institutional-level yield and lower volatility by lending directly to stable private companies.

It can be an appealing alternative to public bonds for sophisticated investors.

Why private credit is attractive:

- Higher yields than public bonds

- Lower volatility (not stock-market-listed)

- Backed by institutional-grade borrowers

Downsides:

- Lower liquidity (30–90 days to exit)

- Typically requires adviser access

- Country-dependent availability

For sophisticated investors, private credit often delivers better long-term risk-reward than most conventional fixed-income assets.

Structured notes income strategy for wealthy expats

For expats who need predictable, customizable income, structured notes issued by A-rated banks can deliver guaranteed or conditional returns of 8–20%.

With terms ranging from 1 to 6 years and adjustable risk levels, these products are especially suited for private-banking clients who want more controlled and reliable income than standard investment vehicles.

Examples of structured notes include:

- Low-risk notes tied to diversified indices

- Medium-risk autocallable income products

- High-yield single-stock notes with capital protection

Structured notes are popular among expats because they can generate consistent income while managing risk.

Like private credit, availability depends heavily on where you live.

Why Portability Is Important More Than Ever

For expats, the biggest risk isn’t just yield, it’s being locked out of your own account.

Modern income strategy must be built on portable platforms and internationally accepted structures to avoid forced liquidations.

Many banks and platforms close accounts when clients:

- Move to a different country

- Lose local residency

- Change tax residency

A globally portable income portfolio must be:

- Multi-jurisdictional

- Managed by a provider that can service expats

- Structured to avoid forced asset liquidation

- Free from country-locked products

Without portability, even the best income strategy collapses once you relocate.

Bottom Line

Income strategies must now be portable, diversified, and inflation-resilient.

Traditional safe income assets no longer behave safely. Cash loses value, government bonds wobble during crises, and expats face unique challenges with access and account closures.

There are now better, more modern income solutions—from high-quality corporate bonds to private credit and institutional-grade structured notes.

FAQs

What income is considered high net worth?

High-net-worth individuals (HNWIs) are typically defined as those with investable assets of $1 million or more, excluding primary residence.

Some definitions also consider annual income thresholds, usually $200,000+.

Where do high net worth individuals put their money?

HNWIs diversify across global equities, corporate bonds, real estate, private credit, structured notes, and multi-asset portfolios to balance growth, income, and risk.

Offshore accounts and trusts are also common for tax planning and portability.

Which country is the best to earn money in the world for foreigners?

Popular options for foreign earners include the UAE, Singapore, Switzerland, and certain EU countries offering favorable tax or business regimes.

Certain offshore jurisdictions like the Cayman Islands, Singapore, Luxembourg, Jersey, and the UAE can also be attractive for foreigners to earn, preserve, and grow wealth.

They often offer tax efficiency, access to global investment opportunities, and structures like trusts or foundations that generate income while protecting assets.

However, not all offshore jurisdictions are ideal for earning active income, so local regulations, banking access, and reporting requirements must be considered.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.