Learn the top 10 investing tips for international school teachers and what international asset management strategies can offer significant financial planning advantages.

In previous articles I have spoken about investment options for Brits, Canadians and Americans.

In this article I will speak about international school teachers and the mistakes to avoid.

Before doing that, you can also receive our free beginners guide for expat teachers to invest whilst living overseas by clicking here.

- Thinking this can wait. Most people don’t consider teachers to be rich. However, back at home, many teachers are indirectly millionaires at retirement. The reason? If you have $40,000 or currency equivalent in pension income at retirement, you would need $1m to support the same lifestyle if you invested for yourself as per the “4% rule of retirement“. So as an international school teacher, you might be paid more than at home, but you will need to save and invest more as well.

2. Focusing on sending money back home. In small doses, sending money home can make sense. For American teachers and expats, it can in fact sometimes make sense across the board. In many countries though, it can cause problems. For example, in the UK system, expats can’t legally set up ISAs or invest in a tax-efficient way. Moreover, due to the “ties rule”, the more ties you have in the UK, such as pension, houses and businesses, increases the likelihood of tax issues. Beyond tax questions, I have lost count of the number of Brits, Canadians and others that have had payments held by their bank back home, due to anti-money laundering rules. These issues were all resolved once the expats proved it was a legitimate payment but it caused a lot of hassle and stress.

3. Thinking investing is for the rich. You don’t need to be rich to invest. Other expats might sometimes earn more, but in some ways mid-income expats need to invest even more than high-income ones. Countless of my teacher clients admitted that they didn’t reach out to me for a long time, as they assumed all my clients are high net wealth. Whilst countless are, I also have teachers as clients.

4. Overspending – you need to enjoy yourself overseas. Nobody wants to stay at home 24/7 but having a rebalance is key. Avoid the keeping up with the Jones’ you can see in Singapore, Dubai, Shanghai and beyond. In the same way that nobody can outrun a bad diet, nobody can out-earn awful spending habits. So if you overspend, the hangover will last in retirement.

5. Trying to time the stock markets – you will never be younger than today and nobody, even professionals, can consistently time the stock markets. That doesn’t mean that markets might not rise or fall time, this year or next year. The point is, long-term, markets do fine. So just invest for the long-term and forget about it.

6. Focusing only on property – Property can be a good investment but it isn’t a one way bet. Property is an illiquid and even high-risk investment, especially in developing countries. So it can be part of your investment portfolio, but not your pension. If you get to 65 and have 3 rental properties, and something like corona happens again, you suddenly have zero income. Unlike index funds and other liquid investments, you can’t easily sell them.

7. Being too risk adverse – or taking too many risks. Calculated risks are needed to get you to retirement. There is no such thing is zero risk anyway. Cash in the bank will lose to inflation and potentially there could be huge currency falls. By the same token, don’t believe in get rich quick schemes predicting 40% returns every year. Even Buffett has “only” made about 25% in the last 4-5 decades! If 40% per year was easy, everybody would do it.

8. Not taking advice – anybody can learn a language but having a teacher can help. Likewise, a gym instructor can help us use the equipment and also motivate us – just one more rep is sometimes the cry during those early morning routines! Likewise, a good financial advisor can not just help you with investment advice, but also assistant you emotionally during the tough times. For instance, during the worst of the lockdown in March 2008, or the 2008 financial crisis, countless investors panicked. Too many people “buy high and sell low” when they invest for themselves or say “let’s wait and see”. In reality, investing every month and forgetting about it often beats other strategies.

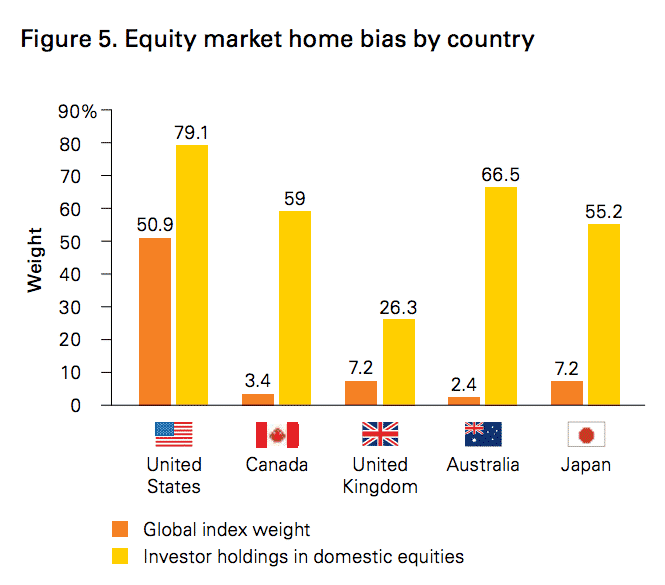

9. Only investing in your home country – as an internationally-minded person, you might not retire back in your home country. Many people come overseas pledging a 3, 4 or 5 year stints but that can often become 20-30 years+. Many investors have “home country bias”. That means they tend to invest in their home country. This is to be avoided Spreading your risk across the globe reduces risks, including currency risks.

10. Don’t assume job security. Many people go into teaching in part due to its safety and security. In the overseas job market, I have unfortunately witnessed a lot of age discrimination. Some countries even have an age limit for people to get work permits as expats, with a few provinces in China setting it as low as 55, and others at 60 or 65. Many of the teachers who struggle to get positions try their luck back home, but having been overseas for a while, many struggle. So being overseas has its positives and negatives. You are usually paid more, incur less taxes in countless countries and have many side benefits. However, you also need to invest for yourself and face risks your peers don’t back home. Take advantage of this and protect yourself by investing during the good times.

If you want to contact me about portable expat investing advice, please use this form.

Further Reading

The UK announced falling house prices this week. Very understandable you might say, given coronavirus and the lockdown.

What is less reported is that real, inflation adjusted, UK house prices are still down on 13 years ago.

Would like to have a first contact to assess the investments options i have.

Sure I will email you Sabrina.