Fundsmith is a British investment management company with its headquarter in London.

In this article, we will talk about who Fundsmith is, why the founder Terry Smith is referred to as “the English Warren Buffett”, how much they charge, how their performance has been, and its pros and cons.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Who is Fundsmith?

Fundsmith is a UK-based investment company, which was started in 2010. It has about £17bn in assets under management, making it one of the biggest fund managers in Europe.

Terry Smith is the founder of the company. He manages Fundsmith Equity and appears to have a strategy to hold a small number of “quality firms”.

On their website they list some of the criteria they look for to invest in companies.

That criteria includes

- Business that are hard to copy by competitors. In other words, profitable companies that have a unique selling point and can’t easily be copied by newer and more noble competitors. As an example, it is less likely that Microsoft can be copied, compared to a newer firm like Netflix, which faces a lot of competition in the streaming space. Another example would be healthcare companies with patents.

- Quality businesses that can sustain a high return on operating capital employed. For example, Microsoft and Philip Morris, both get a high return on capital employed.

- Firms that do not rely on debt to fuel expansion. So leverage fuelled companies like banks aren’t preferred.

- Companies that have a high degree of certainty about growth from reinvested capital. So that includes firms that have a history of deploying capital wisely, back into the business.

- Businesses that are resilient to changes in the market, technology and other changes. This is especially important in the era of technological disruption we face.

- Firms with good valuations. They especially good at firms with a good price-to-earnings ratio.

Smith has been compared to Warren Buffett for his approach to investing, due to his performance and criteria.

So which companies meet his criteria? Companies currently in the fund include:

- Microsoft

- Philip Morris

- 3M

- Unilever

- PayPal Holdings Inc

- The Estee Lauder Companies Inc

- Stryker Corp

Where are they sold?

They have a huge presence in the UK but that doesn’t mean they don’t have a global audience.

Fundsmith are an “off the peg” solution sold by advisors globally, to both expats and locals, and not just in the UK.

They are also sold on both DIY platforms and advisor-lead solutions.

What are the fees like?

The fees depends on two things; which platform you invest on and how much you invest.

Using the global equity fund as an example, the fund fees are:

- R Class: Has a 1.5% fee. This option has a 1,000GBP minimum investment but no minimum monthly investment. This is the cheapest option from the three.

- T Class which has a 1.0% annual fee minimum but the minimum investment is just 1000 GBP.

- I Class – the cheapest option at 0.9% per year, but the minimum investment is £5 million.

Remember though, the platform you buy these investments on might have some significant charges, especially when it comes to expat investments, as I have explained before.

What has the performance been like?

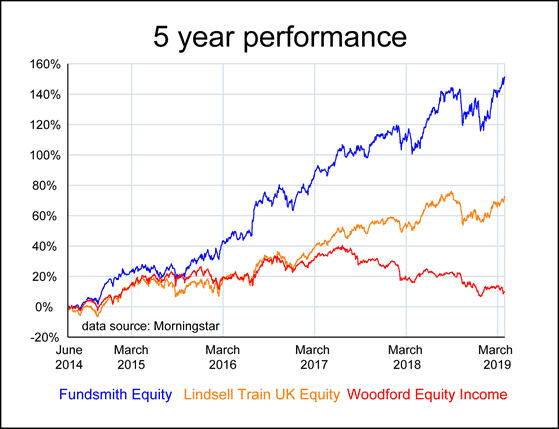

Some of Fundsmith’s funds have vastly outperformed the competition. This is especially the case with their flagship global equity fund:

The Fundsmith Global Equity returned 150% in the 5 years up to October 2019, compared to 67% for the average fund in their sector.

Not all of Fundsmith’s funds have performed so well. This has especially been the case for the emerging market fund, which has suffered.

This can’t be blamed on the fund managers alone, however. Emerging markets have struggled for years, but it does show that picking quality companies across the world in difficult conditions, isn’t always easy.

In addition to that, and perhaps more importantly, they have recently seen big outflows from their trademark global equity fund and performance has suffered.

Regardless of the current performance, one of the biggest misconceptions is to assume that past performance is a guide to the future. Neil Woodford’s funds are a case in point.

He beat the FTSE100 consistently for 15-20 years as per the graph below, and therefore was considered the biggest star in UK fund manager, before his recent fall from grace:

Neil Woodford performed well for decades before a few years ago.

There are countless less extreme examples of “star fund managers”, that have outperformed for a significant period of time, that stop doing so.

I am not saying that Fundsmith will follow in the same direction, but what is clear is that over-performance is hard to maintain in the fund manager space.

We have seen an early warning sign, with the fund falling more than the general market in recent times, during the global health pandemic.

Again, you could argue that Fundsmith’s managers couldn’t have foreseen this recent crisis coming.

Nobody could have. If you would have told the world in January or February, than even liberal democracies would go into lockdown, nobody would have believed you.

That does show the limits of being able to “research the market”. No professional, no matter how hard they work, can foresee the future.

What are the positives and negatives associated with Fundsmith?

Let’s dive deeper and discuss some of the remaining pros and cons:

The main positives associated with these funds are:

- They are a well run fund. These funds have been some of the best performers in recent years. As per the information above though, that is no guarantee of future performance but it does show that they are professionally managed.

- They are well-diversified like a broad-based index such as MSCI World. So even though they are concentrated on a few stocks, they aren’t focused on just one country or region. Their emerging market fund is more risky than their flagship global equity find for this reason.

- They are coming from a well-regulated country and space.

- They aren’t investing, for the most part, into illiquid opportunities.

- Even if the past performance isn’t replicated, it is highly unlikely that you will lose money in this fund.

The primary negatives associated with these funds is

- They are much more expensive than some passive funds. These fees could eventually compound and ensure the funds lose their way relative to MSCI World.

- Historically, today’s winners are tomorrow losers in the fund industry. So it isn’t simple to just buy funds based on past performance and hope for the same results in the future. If it was so easy, why isn’t everybody making 15%-20% per year?

- They are prone to black swan events. By picking a small number of individual stocks, those picks could go down for any number of reasons. This has been shown in the recent times of the global pandemic. Some of their hotel picks have been hammered by the lack of travel. They couldn’t have seen this coming and can’t be blamed for that. However, that is the point. There are too many unknown variables to be able to predict the future. So sometimes more diversified funds, like MSCI World, outperform for this reason long-term, even though concentration helps short-term.

- A concentrated and selective portfolio only helps performance if that sector is “hot”. For example, technology has outperformed recently, so many FAANG funds have outperformed, due to Amazon, Netflix and other tech firms doing well. Even though this fund isn’t just focused on technology, it is betting big on 2-3 sectors.

Conclusion

Some of Fundsmith’s funds have performed extremely well relative to their peers.

However, in comparison to some passive funds that have performed well for decades, it is statistically unlikely that they will carry on their performance.

In terms of risk, the main risks are not market risks. If you stay invested long-term, you don’t need to worry about markets declining.

What is more concerning is that as global conditions change, this fund’s overperformnace won’t continue.

Since the fund’s inception, the same factors have been in place. This includes low interest rates, rising GDP and QE from the central banks.

If any of those conditions change, which might be upon us given the global pandemic we are currently seeing, this fund might suffer.

We are also in a world where beating the market has progressively harder, as more institutional investors like hedge funds and bank join the market.

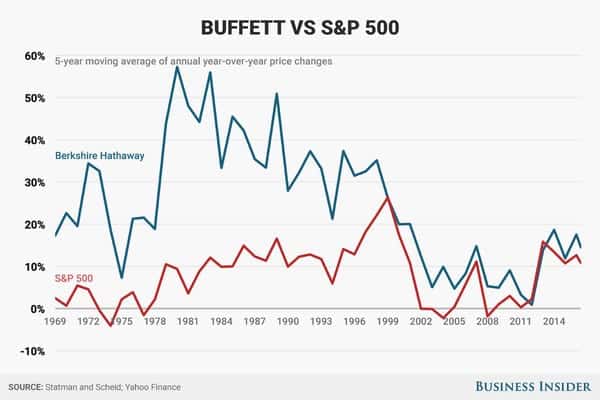

Even probably the best investor ever, Warren Buffett, is no longer beating the S&P500 as per the graph below.

So this fund might beat MSCI World or the S&P500 for a few more years, or might not, but it is unlikely to beat it over 30 years.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.