This is the last part of a three-article series about your options when opening a high interest savings account in Canada.

In this article, you will learn about three financial institutions that offer a high interest savings account in Canada with an interest rate of 1.25%.

Table of Contents

Three Institutions Where You Can Open a High Interest Savings Account in Canada

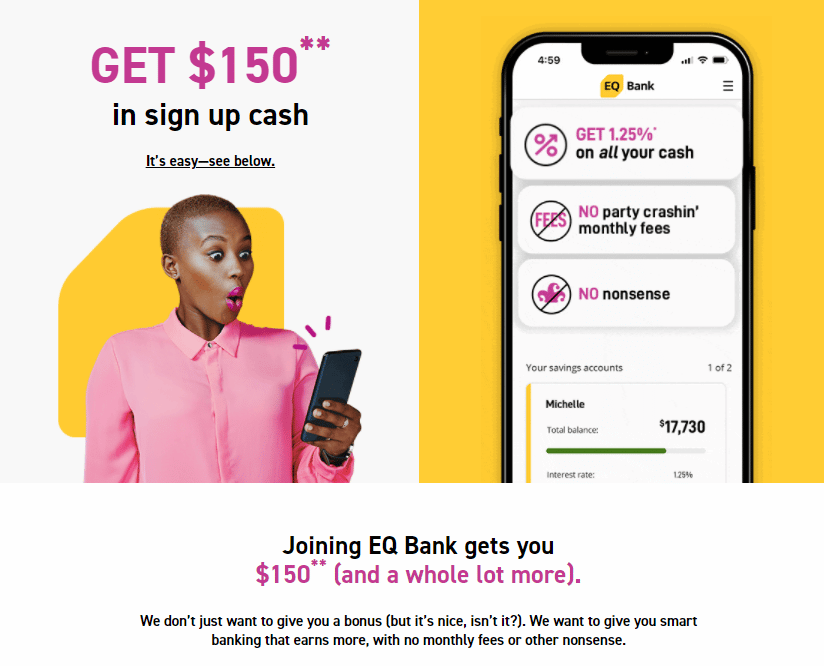

1. EQ Bank

The Savings Plus Account at EQ Bank offers an interest rate of 1.25% per annum.

To open a Savings Plus Account, you must be a Canadian resident of legal age with a Social Insurance Number. However, EQ Bank does not operate in the province of Quebec.

If interested, you can fill out their online application form.

There is no minimum balance requirement. But you can only save up to $200,000 in this high interest savings account in Canada. You also don’t have to worry about paying monthly maintenance fees because EQ Bank doesn’t charge you any.

At the same time, account holders can enjoy almost all of their features for free. The following services come at no cost:

- Everyday banking fees

- Deposits

- Electronic fund transfers (EFT)

- Interac e-Transfers

- Transfers between EQ bank accounts

Those are just around half of what EQ Bank doesn’t charge you for. If you want to know more about the rest of the services that they offer for free, you can access their webpage here.

The maximum amount that an account holder can deposit or withdraw ranges between $3,000 and $250,000. For deposits using Interac e-Transfer, there is a ceiling amount of $25,000 per transaction. If you need to deposit higher amounts of up to $100,000, then doing so by cheque would be more suitable.

EQ Bank does not offer a debit card or direct access to an ATM. However, funds can be accessed by linking an external bank account to the platform. This way, you can transfer money from EQ Bank to a bank where you have an ATM card.

With this, it is important to link a bank account to your Savings Plus Account to deposit and withdraw funds. EQ Bank allows a maximum of 10 external accounts to be linked to your account.

Moreover, accounts are considered dormant if there are no activities within 12 months. For dormant accounts that have a $0 balance, they will be automatically closed without notifying you prior. However, even if you have as little as $1 in your dormant account, EQ Bank will send you a “Dormant Account Notice” via email. This similarly comes at no cost.

A referral bonus is also given to current account holders who encourage their friends and family members to open an EQ Bank account. To do so, you can send them your own unique link. They have to make use of the link to open a bank account. Then, they are required to make a deposit of at least $100 within 30 days.

Once done, EQ Bank will issue the referral bonus to your account. You can earn $20 for the first 3 clients that you refer, but it can increase to $40 thereafter. A referral bonus will only be given up to the 15th client that uses your unique link. The person who accepted your referral will also receive $20.

Your money at EQ Bank is insured by the Canada Deposit Insurance Corporation. A maximum of $100,000 is included in this coverage.

2. Outlook Financial

The High Interest Savings Account at Outlook Financial offers an interest rate of 1.25% per annum.

Take note that the parent company of Implicity Financial, Entegra Credit Union, recently merged with the parent company of Outlook Financial, Assiniboine Credit Union. Because of this, individuals interested in creating an account at Implicity Financial should do so at Outlook Financial instead.

To create an account, you must be at least 18 years old. Apart from that, you will need a cheque to fund your initial deposit. It should have been issued by a Canadian Financial Institution.

It will only take around 5 minutes of your time to complete an application for this specific high interest savings account in Canada.

The minimum initial deposit comes with a small fee of $1.00. But you would also have to pay for an additional $5 membership share at the Assiniboine Credit Union. This minimal fee gives you the right to vote for the union’s Board of Directors. Not only that, you can nominate another member or even yourself to run for election to become a board member as well. Lastly, you can make your voice heard by submitting a Resolution. This will undergo votation by the members and, if favorable, could be implemented.

Because of this, you will need at least $6.00 to open a High Interest Savings Account at Outlook Financial.

There is no minimum balance requirement to maintain your account. Every month, you will get 1 free transaction for each of the following: cheques, Interac direct payment, ATM withdrawals, pre-authorized debit, bill payments, and transfers. If you use any of the aforementioned services more than once, you will be charged $1.00 per transaction.

They also have services for online and mobile banking. The Outlook Financial Mobile app is available for both iOS and Android users.

100% of the money that you deposit into your account will be insured by the Deposit Guarantee Corporation of Manitoba (DGCM).

3. WealthONE Bank of Canada

The WealthONE High Interest Savings Account offers an interest rate of 1.25%.

To open an account, you must be a resident of Canada and of legal age. You also have to prepare your full contact details, Social Insurance Number, and information about your employment or occupation. Then, just complete the 5-step online application.

You will not be charged any monthly fees. At the same time, there is no minimum balance that you will be required to maintain.

With this account, you will be entitled to an unlimited number of free transactions between your WealthONE account and an external account that you have linked. This is applicable to both cash ins and cash outs.

In terms of bill payment transactions, you will receive 10 free ones. Any more than that will be charged at $5 per transaction.

When using Interac e-Transfer, receiving money will come at no cost. But you will need to pay $1.50 for every transaction that involves sending money.

Your money in this institution will be eligible for insurance from the Canada Deposit Insurance Corporation.

High Interest Savings Account in Canada: A Summary

| Financial Institution | Interest Rates | Initial Investment | Limitations |

| EQ Bank | 1.25% | $0 | Maximum balance of $200,000 |

| Outlook Financial | 1.25% | $1.00 | Additional $5.00 to purchase membership shares |

| WealthONE Bank of Canada | 1.25% | $0 |

Conclusion

We have reached the end of the three-article series about the different high interest savings accounts in Canada. Before choosing which financial institution to open an account with, remember that interest rates are just a part of a bigger picture. You may also want to look into accessibility, fees, security, and rewards. With this, you can see how it fits into your lifestyle, preferences, and goals. And, ultimately, decide on the best high interest savings account in Canada for you.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.