Is buying property in Colombia a good investment?

Due to its beautiful scenery, rich cultural legacy, and welcoming people, Colombia attracts many international real estate investors. Colombian real estate demand has surged as North American tourists and residents visit the country more often.

It might be overwhelming to understand the complexities of purchasing real estate in Colombia or other nations, especially the regulations and rules.

We know it’s hard to understand the real estate market in simple terms. This guide is here to help you with that!

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

How is the real estate market in Colombia?

Colombia’s property market has been steadily heating up. The Housing Index showed new property prices rising from 116.13 points in the fourth quarter of 2022 to 119.59 points in the first quarter of 2023.

Rising prices may benefit international buyers of Colombian real estate. There may be chances for people wishing to acquire real estate if Colombian nationals and permanent residents decide against purchasing property due to concerns about inflation and rising rates.

Foreign buyers of Colombian real estate, however, would want to move soon since prices will probably keep going up for the foreseeable future.

Buying Property in Colombia 101

Can foreigners buy property in Colombia?

Foreigners in Colombia have the same property rights as foreigners and permanent residents, unlike many Caribbean and Latin American countries. You may search for Colombian homes for sale in any area of your choice. Additionally, unlike when you buy real estate overseas, you won’t have to worry about leasing the property from the government or having a citizen as a co-owner.

In Colombia, you will really possess the same rights as locals regarding property ownership since foreigners and locals buy property the same way. A valid passport and enough money to buy the property are the only requirements. The most amazing part is that Colombia allows foreigners to buy property without a visa.

Residency by real estate investment in Colombia

Having real estate allows you to live and secure residency in Colombia.

Depending on the size of their investment, foreigners who buy real estate in Colombia may be eligible to apply for a Resident (R) or Migrant (M) visa.

Visas for Migrants

The necessary investment for a Migrant (M) visa is 350 times Colombia’s minimum income, or 285 USD per month. It can also go for more than 100,000 USD, approximately.

You must prove three things to receive this visa:

- a proof of ownership of the property you want to buy.

- a document you can acquire from Banco de la República’s International Exchange Department. It needs to state that you purchased the property using foreign investment funds.

- Your investment is at least 350 times what Colombia’s minimum salary is.

After a minimum of five years as a visa holder, the migrant (M) visa permits the person to proceed with obtaining a resident visa.

Visa for Residents

The minimum investment required for a Resident (R) visa is 650 times the minimum income in Colombia, or 185,000 USD.

You must provide a certificate from Banco de la República’s International Exchange Department in order to get this visa. It should state that you have made foreign investments in your name, with the sum exceeding 650 times the Colombian minimum salary, as previously indicated.

The Resident (R) visa is valid for an unlimited period of time. However, the bearer must not leave Colombia for more than two years in a row in order to maintain their resident visa status.

Real estate prices in Colombia

In Colombia, purchasing real estate entails paying a higher amount than the asking price. Making a realistic budget might be aided by having a firm grasp of the extra expenses related to buying a house in Colombia.

The following factors contribute to the overall cost of real estate in Colombia:

Property Values

Colombian homes vary in different aspects. The price actually depends on its size, age, location, and condition.

The bulk of single-family homes cost between 50,000 and 100,000 USD. Luxury properties can cost 1 million USD. As of June 2023, a 44-square-foot Bucaramanga house for 19,191 USD and an eight-bedroom, 41,872-square-foot Cartagena property for 12 million USD

Taxes

The same taxes that Colombian nationals pay must be paid by foreigners who buy real estate there. The local tax levied by most towns is around 1.05%. Taxes are usually split evenly between the buyer and seller.

Sellers must pay 1% income and sales tax on property purchases. Buyers won’t pay these taxes, but sellers should be informed in case you sell them.

Charges

At the time of closure, there will be additional fees for taxes. Among them are:

- Attorney fees, which often total around 800 USD and go toward paying for papers, completing due diligence, and managing the close

- A registration charge, which is typically between 0.5 and 1% of the selling price,

- Traditionally, in Colombian real estate closings, buyers and sellers divide the following costs equally:

- Notary costs, which usually amount to between 0.30 and 0.35% of the transaction price

- Transfer fees equal to about 0.15% of the selling price

Additionally, the seller will have to pay real estate agency costs, which come out to around 3% of the acquisition price plus 19% VAT. Sellers may raise their asking prices to partially offset these expenses.

Protection

If your house is destroyed, homeowners’ insurance can shield you from monetary loss. The majority of plans offered for residences in Colombia cover damage caused by strong storms, lightning strikes, smoke, hail, floods, landslides, fire, and vehicle accidents that result in structural damage. You could have to pay more for riders if you want coverage for robbery, liability, and damage brought on by political turmoil.

The location and value of the property are the main factors influencing the cost of homeowners insurance in Colombia, which is often less expensive than what you would pay for comparable coverage in the United States.

To compare premiums and anticipate expenditures, it’s a good idea to get homeowners insurance costs from many insurance providers while comparing houses.

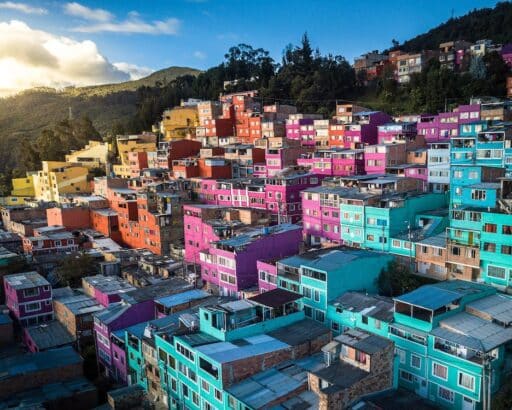

Where are the best places to buy property in Colombia?

The ideal locations for real estate purchases in Colombia depend on your own objectives and tastes. Retirees could search for properties close to top-notch medical facilities and leisure activities. The availability of services and facilities, as well as the quality of the local schools, may be the top concerns for families. At the same time, residences in popular tourist locations can be of particular appeal to investors.

Some of the most well-liked locations in Colombia for real estate purchases are as follows:

- Santa Marta: Those wanting a beachfront property on the Caribbean Coast might choose Santa Marta, which offers nature only a few steps away from your front door.

- Bucaramanga: Known as the City of Parks, this plateau-style city in the Colombian Andes offers an abundance of outdoor activities.

- Medellin: This Andean city on the Porce River is home to a sizable expat community, premier hospitals, international schools, and a popular tourist destination.

- Cartagena: This Caribbean coast city is a popular tourist destination due to its beautiful beaches and affluent lifestyle.

- Saldo: If you’re someone who looks for a perfect spot for your outings and coffee tastings, then this place is perfect. There are many visitors from all over the world who, with no regrets, converge on this resort town in Colombia’s coffee-producing area.

- Leticia: Situated in the center of the Amazon Basin, Leticia has emerged as a popular ecotourism destination in Colombia.

Why choose real estate investment in Colombia?

Buying Colombian property offers many benefits. Here are some country property buying considerations:

- Favorable Rates of Exchange. The growing value of the US dollar and euro is helping foreign purchasers who want to acquire real estate in Colombia by offering attractive exchange rates for the Colombian peso. Customers can now save up to 30% compared to what they would have paid in the years before the major international currencies rose in value by purchasing more Columbian pesos with foreign currencies than in previous years.

- A More Efficient Route to Residence. Purchasing Colombian real estate might serve as a means of obtaining a residence visa for those who want to relocate there. Through Colombia’s Resident Investor’s Visa program, anyone with property valued at least 200,000 USD may get a visa for permanent residency. Usually, their wives or long-term companions are also eligible for the visa. In general, if a property owner’s parents and kids rely on them financially, they may get visas for them.

- Low Living Expenses. In general, Colombia has much cheaper living expenses than the US, Canada, and Europe. Monthly costs are 75% lower than in the US. Colombia’s main cities are cheaper than the largest US city. Medellin, Colombia, has 69.5% lower monthly real estate costs than New York City, and Bogota, Colombia, has 70.8% lower costs. Another is that when buying a home in Colombia to move overseas, clothing, entertainment, food, and utility costs drop significantly. Foreigners moving to Colombia will enjoy a greater return on their salary or retirement funds. Also, the cheap cost of living in Colombia is another advantage for real estate investors. A home’s maintenance and repairs will likely cost less here than they would back home, and hourly wages for cleaning staff—who are necessary to get the property ready for visitors—will likewise be much more reasonable.

- Advanced Tourism. While travel bans and government shutdowns hindered tourism in 2020 and 2021, Colombia’s tourist sector recovered more quickly than that of many other Latin American nations. The Colombian government has launched a number of programs to attract visitors and assist the travel and tourism sectors. Colombia is a prominent tourist destination, so prospective investors may expect high demand for rental homes, especially in cities like Medellin that are most popular with foreign tourists. Additionally, rising tourism can lead to a gradual rise in the value of properties in well-known locations, creating opportunities for significant gains where investors can decide to sell in the future.

Some tips for buying property in Colombia

Here’s a list of resources that you could find useful, as well as some last-minute advice on how to make sure the transaction is fair and safe.

Make cautious selections while choosing a real estate agent.

A real estate agent can make the purchasing process a lot easier and assist you in locating a house that suits your requirements and budget. However, as Colombia does not have a licensing system for agents, you should exercise care while choosing one.

Make sure you choose an informed expert by paying attention to these pointers:

- Post suggestions in social media groups and expat community forums.

- Ask for a list of references, then get in touch with them to hear about their experiences.

- Select representatives are connected to renowned global real estate companies.

- Look up the real estate agent’s name online. After finding a legitimate source, see if there are any news stories about them.

- Examine internet reviews for both the real estate agent and the company they represent.

- Conduct interviews with several agents, inquiring about their years of experience, specializations, and rates.

- Acquire funding in your nation of origin.

Due to the nation’s very strict banking laws, most financial organizations in Colombia won’t lend money to customers who haven’t established credit in the nation. Consequently, it could be challenging for you to obtain acceptance for a mortgage with a Colombian bank. Even if you are approved, you could have to pay a substantial down payment of thirty to forty percent, and the bank might have unfavorable interest rates.

Owing to the difficulties presented by stringent lending regulations, a large number of foreigners buying real estate in Colombia look for financing via banks back home.

Consult a knowledgeable Colombian lawyer.

As was already noted, anybody wishing to purchase foreign real estate in Colombia would be well advised to work with an expert Colombian real estate lawyer. An attorney may supervise the closing for you. You just have to make sure you complete all the required documentation, which will assist you in identifying fraud.

Avoid making blind real estate purchases in Colombia.

It is feasible to examine properties without traveling to Colombia by using virtual property tours. They still can’t replace doing your own home inspection and taking a solo stroll around the area.

Make a shortlist of properties to examine using virtual tours, and then arrange a trip to Colombia to see the houses in person to make sure you know precisely what you’re purchasing.

Consult some advice from a tax expert.

If you buy a property in Colombia to invest in, you may have to pay taxes in your home country. Hence, tax experts may assist you. This ensures you have adequate advice on what and how much income tax or other taxes you must pay on Colombian home rentals.

Final Thoughts

All things considered, Colombia’s predicted sustainable growth rate is encouraging for real estate investors since it shows that the economy of the nation is robust and expanding, making it a desirable location for real estate investments. Due to Colombia’s expanding economy, increasing security, and accommodating attitude toward international investment, many foreigners see the country as a land of opportunity.

Additionally, the government has put laws into place that facilitate the purchase of real estate by foreign nationals, including streamlined visa procedures and tax breaks.

Nonetheless, property rights and land ownership are governed by Colombian laws. It’s critical to comprehend the legal system and confirm that the property you want to purchase is free of liens and has a clear title.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.