Are you interested in investments such as stocks, commodities, gold, silver or most assets for that matter, but you are worried about the downside if things go wrong?

Well, read on, because this article is for you!

As a way of introduction. I have been helping expat and high-net-worth clients for over a decade. I have changed my mind about something.

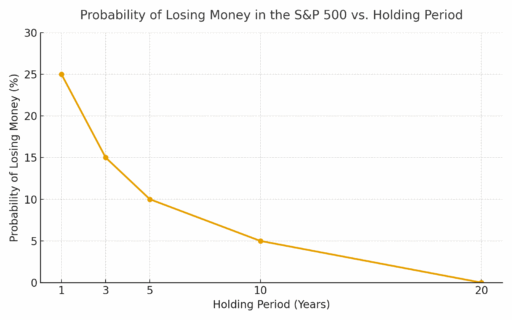

Previously, I believed that people shouldn’t worry about the stock markets falling if they own the whole market, for example, the S&P500, which tracks five hundred of the biggest companies in the world, rather than an individual company.

The reason is simple. It is risky if you hold it short-term, but it isn’t risky if you hold it long-term, as the graph below illustrates.

However, in the real world, people panic. They sell when there is a stock market crash. They think “this time is different” every time there is a crash, which are the four most dangerous words in investing, as per John Templeton’s famous words.

People watch the media.

I saw it in 2016 when people didn’t want to invest due to the possibility of Trump and Brexit happening.

I saw it during 2020 with COVID at the start of the year, and worries about a disputed election at the end of the year.

I also saw it at the start of the 2022 war between Russia and Ukraine.

I also saw it on various occasions during much more minor events, such as various US Government shutdowns.

Even though markets bounced back quickly from these events, and anybody buying at those lower levels has benefited, many people didn’t stay invested.

And yes, that included people who pledged that they would never be the person who panics!

So, if you want to invest but are afraid of crashes and external events, what can you do?

One strategy is just to invest in many different assets at the same time. Markets, bonds, gold, commodities and cash held together won’t produce super high returns, but they will lower the returns during bad years like the 2008/2009 Global Financial Crisis.

With that being said, you will still see some volatility – for example, a 15% decline rather than a 50% fall during severe market turbulence.

So, another option is to have downside protection. Below are two examples:

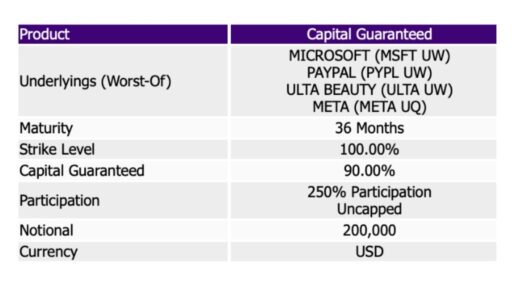

- 100% or 90% capital-protected investments (meaning that you lose 10% in the worst case). An example of the latter is shown below. It is also possible to get a 100% capital-protected investment linked to major indexes like the S&P500 or MSCI World.

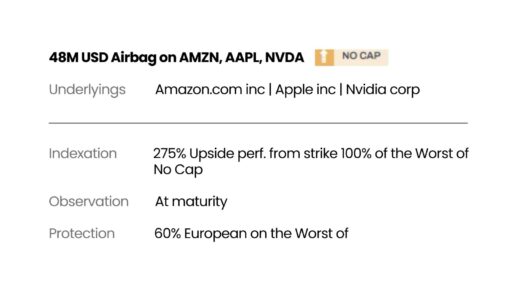

- You invest in downside-protected instruments linked to stocks (and other assets you like) with significant downside protection. The example below looks at three big tech stocks where you can’t lose money unless they fall by more than 50% by the end of the term.

As these guarantees are often backed up by A-rated banks, the security levels are quite high, and the minimums can be relatively low – you certainly don’t need to be rich to gain access to them!

Whilst these instruments are shown merely for illustrative purposes, it is possible to embed downside-protection into almost any asset you are interested in.

What are the downsides? It does depend on the instrument, but often being locked in for a few years is the worst feature of such instruments, but who said that you could have your cake and eat it?

You usually need to appoint a company or advisor to buy these instruments, so reach out to me if you are interested in exploring these instruments.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.