Choosing a financial advisor means finding someone who understands international tax rules, cross-border investments, and residency regulations.

The right expat financial advisor helps you grow and protect your wealth while avoiding compliance mistakes that can cost you money.

This guide explores:

- What kind of financial advisor should I get?

- How to choose a financial advisor?

- What are the red flags of financial advisors?

- How much should you have before hiring a financial advisor?

- How to tell if your financial advisor is good?

- What not to tell your financial advisor

- Do you need more than one financial advisor?

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What kind of financial advisor do I need?

Expats need a licensed, internationally qualified financial advisor who can manage wealth globally with confidence.

A qualified advisor for expats should:

- Have international credentials such as CFA, CFP, or CISI.

- Offer expertise in cross-border tax planning, offshore investments, and currency management.

- Understand your residency rules and local financial regulations.

For high-net-worth individuals, consider a multi-family office. For mid-tier portfolios, an independent advisor experienced in expat wealth management may suffice.

The type of financial advisor you need varies based on your goals and complexity of your finances.

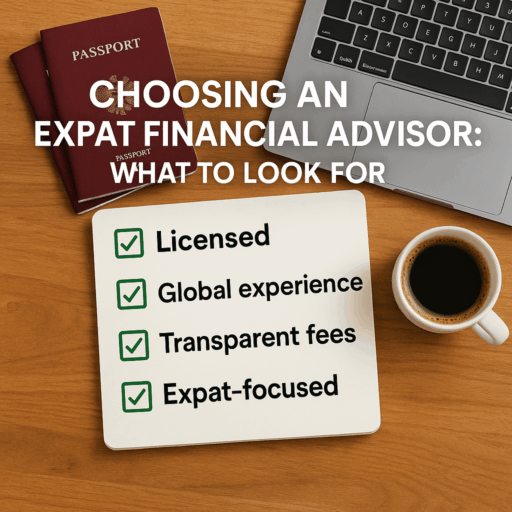

How to choose a trustworthy financial advisor?

A trustworthy advisor is licensed, transparent, and recommended by other expats. To choose a reliable advisor:

- Verify licenses and certifications recognized in their jurisdiction.

- Ask for references from other expats.

- Confirm transparency in fees and investment strategies.

- Ensure the advisor provides a clear financial plan tailored to your circumstances.

What is a red flag for a financial advisor?

Major financial advisor red flags include:

- Promises guaranteed high returns.

- Lacks proper licensing or international qualifications.

- Pushes products for commission without explaining risks.

- Avoids answering questions about fees, conflicts of interest, or investment strategy.

If your advisor avoids discussing risks or conflicts of interest, it’s a warning sign to walk away.

At what net worth should you consider a financial advisor?

Even portfolios of USD $250,000–500,000 may benefit from expat wealth management advice. Advisors help with tax optimization, investment diversification, and international compliance.

For high-net-worth individuals (USD $1 million+), professional guidance becomes essential for estate structuring, trusts, and international wealth transfer.

How to tell if a financial advisor is good?

A good financial advisor:

- Offers transparent, customized advice.

- Demonstrates experience with expat clients and cross-border investments.

- Explains strategies clearly and adjusts plans as your goals evolve.

- Provides ongoing monitoring and reporting of your portfolio.

What not to say to your financial advisor?

Avoid giving vague instructions like “invest all my money quickly” or withholding critical personal or financial information.

Being open about your goals, debts, and spending habits allows your advisor to design the most effective, compliant plan.

Should you put all your money with one financial advisor?

No. Diversification of advice is just as important as diversification of investments.

While a primary advisor can oversee your global wealth plan, consider secondary opinions for major decisions, particularly for alternative investments, offshore holdings, or tax strategies.

FAQs

How to choose a financial advisor for beginners?

Start with licensed advisors offering clear fee structures, and focus on those experienced with international or expat clients. Ensure they can explain strategies in simple, actionable terms.

How to choose a financial advisor for retirement?

Look for advisors with expertise in retirement planning, multinational tax optimization, and income generation. They should provide a detailed plan for withdrawals, currency risk, and pension portability.

How to find a financial advisor for investing?

Search for advisors with a proven track record in global investment portfolios, portfolio diversification, and risk management. Confirm they are registered with recognized regulatory authorities.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.