Here’s a simple guide on how to set up a company in Sint Maarten.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Introduction – The Dutch Sint Maarten

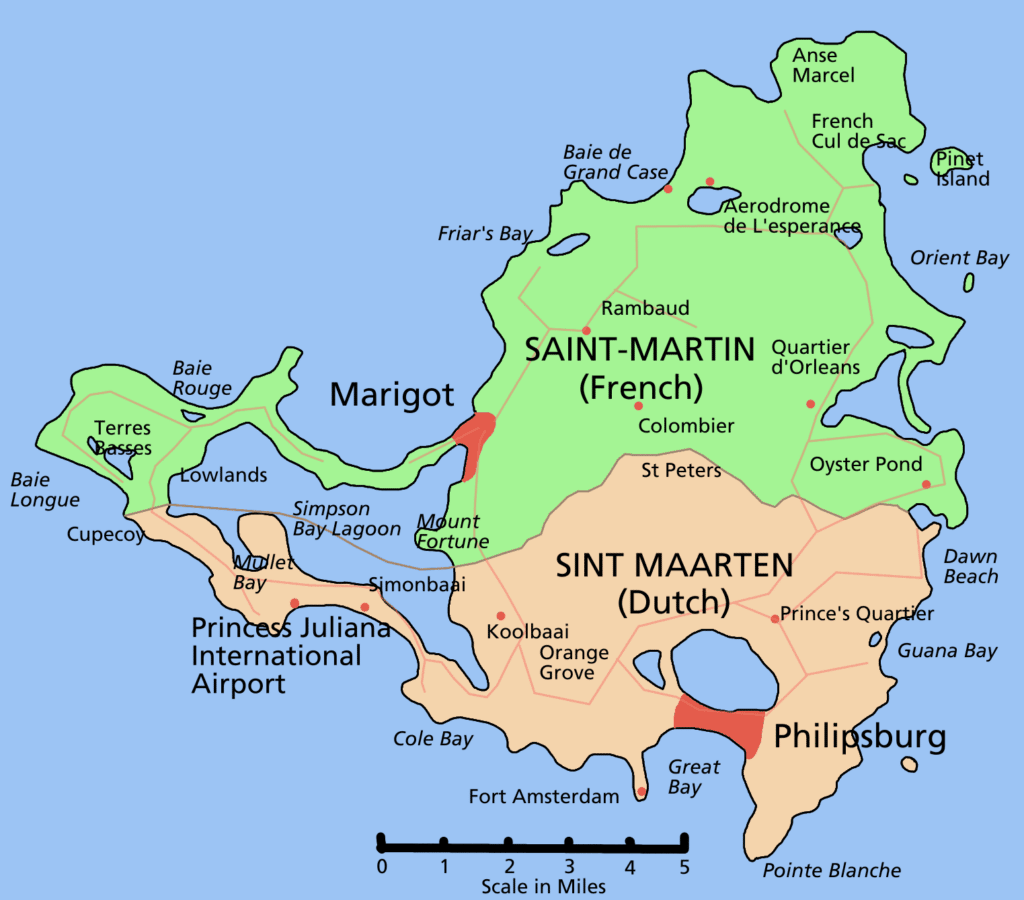

Sint Maarten is a small island (37 square miles) with a strong reputation for restaurants, resorts, and a lively nightlife. St. Maarten (Sint Maarten) is the Dutch half of the island, and St. Martin is the French half. According to legend, a gin-drinking Dutchman and a wine-guzzling Frenchman strolled around the island to see how much land each could claim for his nation in a day; the Frenchman travelled longer, but the astute Dutchman grabbed the more valuable piece of property.

Philipsburg, the Dutch capital, curls like a doll hamlet around Great Bay. The village is located on a thin sand isthmus that connects Great Bay and the Great Salt Pond. In 1763, Commander John Philips, a Scot in Dutch service, established the capital. Fort Amsterdam was erected in 1737 to guard Great Bay.

How to Set Up a Company in Sint Maarten

There are various factors to consider when launching a business in Sint Maarten. Once you’ve identified the nature of your business, there are a few legal issues to address. You have the option of forming a sole proprietorship or a formal entity, commonly a B.V. (‘private limited liability company’) or N.V. (‘public limited liability company’).

Determine the legal entity or structure. As previously said, a legal entity is not required, but it is common and generally preferable. The most compelling considerations are that the business owner is not (automatically) liable for the company’s debts and liabilities, as well as tax benefits. There are a number of other benefits that will not be mentioned here. A broad (non-exhaustive) summary of the processes for a corporation and a sole proprietorship is provided below.

Company Incorporation: General Structure and Procedure

- Notary. To establish a legal entity in Sint Maarten, a notary is necessary. Often, the notary will also handle the registration of the legal structure (typically NV or BV or another legal structure) with the Sint Maarten Chamber of Commerce (‘CoC’).

- Company Board of Directors. At the time of incorporation, one or more Directors might be selected. At least one of them must be a Sint Maarten resident.

- Don’t forget about the required licenses. According to the Ordinance on the Establishment of Businesses (‘Vestigingsregeling voor Bedrijven’), a Directors’ and Business license is necessary. Foreigners and Dutch nationals who were not born in Sint Maarten must get a business license. In addition, depending on the type of company – for example, a restaurant – a (extra) operating license may be required, as well as industry-specific requirements. This may, of course, be discussed with a notary and/or lawyer who is helping you set up your company.

How to Register a Sole Proprietorship

There is a distinction between ‘Antilleans’ (born in the Caribbean) and ‘Non-Antilleans.’ Non-Antillean citizens must apply for a business license at the Department of Economic Affairs (Government Building). Antilleans can register with the Chamber of Commerce on their own. A sole proprietorship is reasonably simple to set up.

However, keep in mind that if you run a sole proprietorship, you are totally and entirely accountable for your company’s obligations. In other words, you are not as well protected from responsibility as a legal entity (NV/BV).

Please visit a notary or a lawyer for further information and thorough guidance.

Tax System in Sint Maarten

The Dutch Kingdom includes the island of St. Maarten. The Kingdom has its own set of tax regulations (Belastingregeling voor het Koninkrijk or BKR). The BKR’s principal goal is to prevent double taxation inside the Kingdom. Furthermore, St. Maarten is a signatory to a convention between the United States of America and the Kingdom of the Netherlands on the exchange of tax data.

The whole tax structure used in the former Netherlands Antilles has been adopted by St. Maarten. The St. Maarten tax system consists of corporate and individual taxes. Corporations are classed as either resident or non-resident for tax reasons. The income tax (inkomstenbelasting), dividend tax (dividendbelasting), profits tax (winstbelasting) and company turnover tax (belasting op bedrijfsomzetten or BBO) are the most important corporate taxes in St. Maarten. Payroll tax (loonbelasting) is one of the taxes levied on people.

The turnover tax (BBO) is charged on the delivery of products and any services supplied ‘inside the territory’ by resident or non-resident entrepreneurs in the course of their business. The BBO rate is 5%.

Non-resident visitors of hotels and other guesthouses, including holiday villas and condo rentals, are subject to a 5% room tax (logeergastenbelasting). Time-share owners pay a weekly fixed charge of NAF 90 (USD 50) that is included in their annual maintenance fee. Excise taxes are imposed on gasoline and cigarettes. The transfer of real estate is subject to a 4% transfer tax (overdrachtsbelasting). There is also a Real Estate Property Tax (grondbelasting).

This yearly tax is based on the market value of the property. The tax rate is 0.3 percent of the value of both unimproved and improved land with structure, and it is paid by the property owner. Inheritance tax (successiebelasting) must be paid by everyone who receives money or property from a deceased person’s estate.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Hello sir I want to create my company on Saint Martin (Dutch coast) here are my questions.

1: Company creation questions

(Several associates)

– what are the regulations on Saint-Martin on the Dutch side?

-which status would be best suited for a security and protection company?

-how to open a professional account on Saint-Martin?

– what are the charges in force on Saint-Martin for a company?

2: Bearing arms

– how to obtain a port of arms on Saint-Martin?

– Explain the carrying of weapons. Client in danger and a port of arms for society.

3: Creation of the Security store

-same question as the creation of the protection company.

– What are the import conditions for defense equipment?

(Bullet vest, Gas, tear gas, taser, telescopic baton, clothes….)

4: dwelling

– do you have to be domiciled in Saint-Martin?

Best regards

Mr Yann Leblanc CEO ADSecurityGroup

👌🏻

Looking to open a cosmetic store in St Marteen