Can you use crypto as collateral? Let’s discuss it in this post and cover a few more important points, including:

- How crypto loans work

- How to use crypto as collateral

- Are banks using crypto as collateral for loan?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for alternatives or a second opinion.

Some of the facts might change from the time of writing, and nothing written here is formal advice.

For updated guidance, please contact me.

Using Crypto as Collateral

What is a collateral?

Whatever a borrower offers to a lender as security for a loan is dubbed a collateral. Usually, it is an asset of great value like stocks or a house.

Now, should the borrower fail on the loan, this arrangement offers some protection to the lender in order to recoup their losses during the default.

Can you use crypto as collateral?

Yes, you can definitely do so.

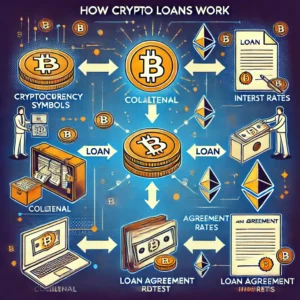

How crypto loans work

Crypto loans are secured loans that allow you to obtain funding from lenders by using crypto as collateral. By doing so, you give lenders the right to seize your digital assets if you don’t repay the debt you took on during the given time frame and as per the conditions set.

Lenders often approve loans for up to 90% of the value of the collateral.

Centralized platforms retain your cryptocurrency assets during the loan term in centralized finance loans, and obtaining a loan usually requires depositing security.

Meanwhile, smart contracts on blockchain systems are used for decentralized financing lending. Although the smart contracts automatically enforce the loan terms and have the authority to liquidate your collateral if you default, you retain control over your crypto when you take out a DeFi loan.

How to use crypto as collateral

Depending on your preferences, you will first need to select a lender—CeFi or DeFi—to get started.

This is how it works, normally:

- Pick the crypto you want to secure your debt and make sure the lender transacts using such coin. BTC and Ethereum are the usual stablecoins accepted.

- Register with the loan platform, connect your crypto wallet, and verify identity.

- Transfer the crypto to the lender’s wallet so the borrowed sum can be released to you. The loaned amount can be in fiat currency or stablecoins, depending on the agreed terms and the platform.

- Loan terms might differ; they usually range from a few days to a few years. Make sure you comprehend the terms of the repayment plan, including any late fees.

- You will get your collateral once you have paid back the loan in full. You will receive an equal amount of cryptocurrency back even if the value of your collateral grows throughout the course of the loan.

Are banks using crypto as collateral for loans?

So as to obtain funding without having to offload your holdings, multiple banks can now provide personal loans to you with cryptocurrency assets as collateral.

Businesses too can do the same.

Lenders keep a careful eye on the collateral’s worth; if the cryptocurrency loses a lot of value, borrowers might have to produce more collateral or face having their holdings liquidated.

For instance, Customers Bancorp Inc. previously announced that it will try to close its first loans with Ethereum and Bitcoin as collateral. This was a big step forward for traditional banks looking to integrate cryptocurrencies into their lending processes.

What are the advantages and disadvantages of using cryptocurrency as collateral?

Benefits of Using Crypto as Collateral

- Borrowers can keep their investment positions intact because they can easily obtain cash without having to sell their crypto holdings.

- Unlike selling the assets, using cryptocurrency as collateral spares you from capital gains taxes.

- When compared to regular loans, crypto-backed financing frequently have faster funding and approval times.

Risks of Using Crypto Collateral

- How much a crypto’s worth can fluctuate greatly, putting lenders and you at risk. A plunge in value may result in collateral liquidation.

- You as the borrower and banks as lender both face difficulties and uncertainty amid the constantly evolving regulatory landscape surrounding cryptocurrency.

- Cryptocurrencies are susceptible to cybersecurity and hacking risks since they are digital assets. Such could lower the value as collateral.

- Your crypto assets could be seized by the lender if you don’t make loan payments.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.