This article will tell you how to invest in the Nasdaq from countries outside the US, including the UAE and Australia.

If you are looking to invest in the Nasdaq, you can use the WhatsApp function below, or email me (advice@adamfayed.com).

Introduction

NASDAQ is a global electronic trading platform for buying and selling securities. NASDAQ was created by the National Association of Securities Dealers (NASD) to enable investors to trade securities in a computerized, fast, and transparent system, and began operations on February 8, 1971.

The term “Nasdaq” is also used to refer to the Nasdaq Composite, an index of more than 3,000 shares listed on the Nasdaq Exchange, which includes the world’s largest tech and biotech giants such as Apple, Google, Microsoft, Oracle, Amazon and Intel.

NASDAQ officially split from NASD and began operating as a national securities exchange in 2006. In 2007, it merged with the Scandinavian OMX exchange group to become the Nasdaq OMX group, which is the largest listed company in the world, operating 1 in 10 of the world’s securities transactions.

NASDAQ OMX, headquartered in New York, operates 25 markets, mainly stock markets including options, fixed income, derivatives and commodities, as well as one clearing house and five CSDs in the US and Europe. Its advanced trading technologies are used by 70 exchanges in 50 countries. It is listed on the NASDAQ under the symbol NDAQ and has been in the S&P 500 since 2008.

The NASDAQ computerized trading system was originally conceived as an alternative to the ineffective “specialist” system that has been the dominant model for nearly a century. Rapid advances in technology have made the NASDAQ e-commerce model the standard for global markets.

As a leader in trading technology from the outset, global tech giants preferred to be listed on the NASDAQ in their early years.

As the tech sector became more prominent in the 1980s and 1990s, the NASDAQ became the most popular representative of this sector. The boom and bust of technology and dot-coms in the late 1990s is exemplified by the ups and downs of the Nasdaq Composite during this period.

The index crossed the 1,000 mark for the first time in July 1995, rose sharply in subsequent years and surpassed 4,500 in March 2000, and then fell by almost 80% by October 2002 as a result of a subsequent correction.

Here was a short introduction about one of the famous trading platform we will talk in this article. A lot of people, investors, and businessmen are searching ways to invest in Nasdaq, and in this article you will know how to do that and get acquainted to all the possible ways. So let’s start our journey.

- Investing in NASDAQ

Like most of us, you’ve probably envisioned buying stock in a company that would skyrocket in value in a couple of years and make you enough money to travel and vacation for the rest of your life.

Maybe even NASDAQ was among your best candidates to buy its stock, or it will. In fact, investing is a little more difficult than waiting for the birds to fly into your mouth already cooked and fried, but you have to start somewhere.

The good news is that, unlike at that time, today you can buy stocks of companies like NASDAQ completely online and this article explains in simple language how you can buy stocks in general, using the NASDAQ as an example. It’s up to you whether your first stock should buy the NASDAQ or not.

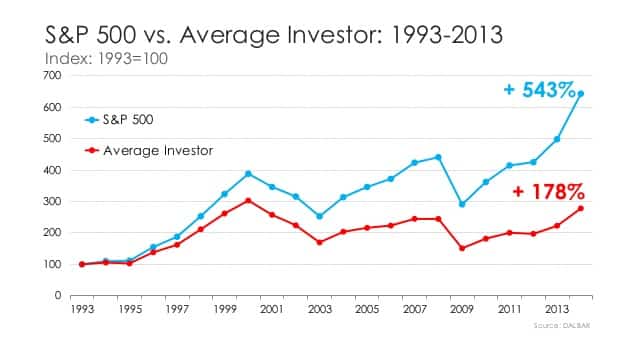

With that being said, it is a statistical reality that DIY investing doesn’t work compared to using advisors.

In the March 2020 crash, Fidelity claimed that 35% of people panic sold between March and May.

This helps explain results like these:

Everybody says they won’t be emotional when markets crash, yet few people seem to be able to follow up with actions when a crash happens.

How to invest in NASDAQ?

So, for your own reasons, you’ve decided to buy the NASDAQ, this is a good start. Let’s see what lies ahead before you can officially declare you are a NASDAQ shareholder!

The process is pretty similar to any stock of any company, and again, we’re only taking NASDAQ as an example. Let’s see what steps the process is consisted of.

Step 1

You have to find an online broker, but this is not that easy. One of the characteristics of an online broker is the exchanges to which they have access.

Not all brokers allow you to buy NASDAQ stock simply because they don’t have access to the NASDAQ. Needless to say, you need a broker that gives you access to this exchange.

The next important thing with a broker is that it should work for you too.

Not all brokers allow every citizen to open an account with them; some brokers are very expensive, if you just want to buy a couple of NASDAQ stocks from time to time, some brokers may be completely free. You can really get great advice on choosing the right broker by using our questionnaire:

If you want to contact people to find a broker for you, make sure they take the following factors into account, such as the broker’s commission, the trading platform, the markets available to trade, and how easy it is to open an account.

If you are an expat, you need to ideally find an expat-specific service, such as ourselves, because you need portability.

In other words, you don’t want your account to be closed down if you move from country to country.

Step 2

After you find your online broker, you need to open an account. This is very similar to a regular bank account and usually opens completely online.

For some brokers this is as fast as opening a new Gmail account, for some brokers it takes a couple of days before they do some background checks. Instead of storing money on it, you will be storing your stocks there, so you will definitely need this to buy and hold NASDAQ stock.

Step 3

The next step is to deposit money to your account. You will pay in cash to buy these NASDAQ shares. This money must first be sent to your broker. This is usually very simple and fast, in fact even easier than opening a brokerage account.

The most common ways to deposit money is by bank transfer and using a credit / debit card. With some brokers, you can even deposit into your investment account from different e-wallets such as PayPal.

Step 4

Here it is the most important step. What you have? You already have an account, money, and a stock target.

The last step is to hit the buy button! You log into your online broker, search for NASDAQ stocks, enter the number of stocks you want to buy, and click the Buy button, which initiates a purchase of the stock.

When placing an order, you can choose from different types of orders. A market order buys at the actual market price, while a limit order allows you to specify the exact price at which you want to buy a share.

Final Step

You are not finished after you purchased NASDAQ stock. It is now important to keep track of your investments.

This basically means following your investment strategy. If you bought NASDAQ stock for a longer hold, you can attend the annual meeting and collect all news and information about the company.

If you plan to sell it after you notice a slight increase in price, you can use other position management tools.

For example, you can set a target price at which you want to sell the stock at a profit, or use a stop loss to set the price at which you want to sell the stock to avoid further losses.

*Where to invest?

If you want to invest in the NASDAQ in general, you can buy an ETF that tracks the performance of the entire NASDAQ Index, an ETF that only tracks the top 100 NASDAQ stocks, or an ETF that tracks specific sectors in the NASDAQ.

These ETFs are based on the NASDAQ Composite Index (IXIC), which tracks all stocks listed on the NASDAQ, or the NASDAQ-100 Index (NDX), which tracks a subset of the top 100 non-financial stocks on the NASDAQ.

But you can also invest in specific NASDAQ stocks. There are thousands of stocks available on the NASDAQ, but some of the more popular options include:

- Amazon (AMZN)

- Apple (AAPL)

- eBay (EBAY)

- Facebook (FB)

- Microsoft (MSFT)

- Netflix (NFLX)

- Tesla (TSLA)

In general, stock picking doesn’t work for the average investor compared to buying the index.

- Investing in NASDAQ Index

Investing money is important in preparing for retirement, not just putting money in a savings account.

Instead of buying individual stocks or bonds, another strategy is to invest in index funds, which track the performance of the NASDAQ Composite Index (ticker IXIC), one of the major US stock market indices. While past earnings are not a guarantee of future performance, the NASDAQ has historically performed well.

According to Morningstar, the NASDAQ index has had an average annual return of 16.03% over the past 10 years. If you want to know how to invest in NASDAQ index funds, here’s what you need to know. First of all let’s see what the NASDAQ Index is.

*What is the NASDAQ Index?

While you can buy individual stocks or bonds yourself, it can be costly, time consuming, and risky. Another approach that can help you invest smarter is to invest in index funds.

An index fund is a type of investment, such as a mutual fund or exchange-traded fund (ETF) that aims to invest in a group of securities that follow the performance of an established benchmark or index.

Index funds can invest in stocks or bonds and can be composed of hundreds or even thousands of different securities. While there are many different indices, three of the most popular are the S&P 500, Dow Jones Industrial Average and NASDAQ Composite Index.

The NASDAQ Composite Index is an index of approximately 3,000 common stocks listed on the NASDAQ stock exchange.

Securities in the index include stocks, real estate investment funds, and American depository receipts. Some of the largest companies on the NASDAQ Composite Index include Amazon, Intel, and PepsiCo.

If you want to invest in the NASDAQ index, you have two main options: mutual funds and ETFs.

- Mutual investment funds

In a mutual fund, a company combines your money with that of other investors to buy securities such as stocks and bonds.

As an investor, you buy shares in a fund. The fund is professionally managed and has a relatively low minimum investment.

Mutual funds usually invest in hundreds or even thousands of securities at once so that you can diversify your investments.

If you’re looking for a mutual fund that tracks the NASDAQ index, the Fidelity NASDAQ Composite Index Fund (FNCMX) is a popular option. This fund is committed to providing results that closely match those of the NASDAQ Composite Index. Its overall expense ratio is 0.28%.

- ETF

Like mutual funds, ETFs allow you to pool your money with other investors to buy stocks and bonds.

However, ETFs are traded on the national stock exchange and at market prices that may or may not correspond to the net asset value of the shares.

If you are looking to invest in an ETF that tracks the NASDAQ index, consider the Fidelity NASDAQ Composite Index Tracking Stock (ONEQ) ETF. This fund invests 80% of its assets in the common stocks included in the index and seeks to provide a return on investment that is in line with the index. The gross expense ratio is 0.21%.

How to invest in the NASDAQ Index?

If you are sure you want to invest in NASDAQ Composite Index, follow the next steps:

Step 1

Decide what makes the most sense for you: invest in mutual funds or ETFs. Once you’ve determined which one is best for your needs, you can research the top performing funds that track the performance of the NASDAQ Index.

Can’t choose between them? Note these key differences:

Trading Time: Mutual funds can only be traded once a day. All trades are made after the close of the market at 16:00. If you place an order after this time, it will not be executed until the next day after the market close. If the share price of a mutual fund changes, you may have to pay a higher price. In contrast, ETFs can be traded throughout the day.

Minimum Investment: Mutual funds typically have a minimum of $ 1,000. If you don’t have a lot of savings yet, an ETF might be your best bet. You can often start with the value of one share.

Order Types: ETFs are more flexible than mutual funds when it comes to pricing. For example, you can set limits on the automatic buying or selling of securities when a certain price is reached.

Step 2

If you currently have an IRA or 401 (k), you can buy shares of mutual funds or ETFs in your checking account.

To do this, simply log into your account and search for the tickers of the desired NASDAQ index funds. You can specify how many shares you want to buy and set up automatic contributions to keep buying shares in the future.

Step 3

If you don’t have access to a retirement account, you can open a brokerage account to start investing in index funds.

When choosing a brokerage firm, compare the companies’ minimum investments, commission fees, and the type of investment they offer. Some companies allow you to invest in individual stocks, mutual funds and bonds, while others only specialize in ETFs.

If you prefer to be a passive investor, you can register with a brokerage firm that is also a robot advisor.

The company will consider your financial goals and risk tolerance, and develop a portfolio and asset allocation that meets your needs.

Investing in NASDAQ Composite Index allows you to invest in various large and small companies and various securities.

By taking advantage of index funds that follow the NASDAQ index, you can track its performance and diversify your portfolio.

*About the benefits of Index Investing

If you want to invest your money in the stock market, investing in index funds is one option, such as funds that track the performance of the NASDAQ index rather than buying individual stocks.

You can buy shares of mutual funds or ETFs. The fund manager will buy all securities within an index or a representative sample.

If you had to buy individual stocks yourself, you would have to buy thousands of stocks to replicate the diversification of the NASDAQ index, requiring you to spend hundreds of thousands of dollars and execute thousands of trades.

But when you invest in index funds, you can invest in mutual funds and ETFs and instantly diversify your portfolio in a single transaction.

ETFs and mutual funds are a good option for passive investors. They don’t need to be actively managed, so they tend to have lower commissions than other investment options. The average commission for mutual funds is 0.68% and 0.20% for ETFs.

*About possible risks while investing in NASDAQ

Investing is always associated with certain risks. You can reduce almost all of these risks by being as long-term as possible.

If you invest for 5 years, your chances of losing money are much higher than 30 years.

The Nasdaq, and S&P500, have never been down over a 30 year period.

Another risk is to spend all your savings on one or two stocks. If the stocks goes bankrupt, you will lose all your money invested.

With a tracker or index-linked ETF, this can’t happen. In other words, in this situation, if 1-2 big firms go bust, they will just be replaced with new companies.

So diversification and being long-term are key.

Some useful tips for beginning investors in stock markets

- Do a lot of reading and invest yourself, assuming you aren’t going to be emotional, or use an advisor. Many DIY investors invest without having much knowledge.

- Invest in what you understand if you are investing yourself: This principle will help you not to give in to emotions: if you understand the business of a company and are confident in it, then it will be easier for you to resist selling its shares at the first fall.

- Diversify your portfolio to include stocks and bonds: Diversification is one of the most important principles of a successful investor. By investing in different instruments (for example, stocks and bonds), you reduce risks. However, a novice investor may not know how to properly assemble a diversified portfolio.

- Rebalance from stocks to bonds, and vice versa, when something like a market crash happens. For example, in March, short-term bonds went up, and stocks went down. That was a good opportunity to sell some of the bonds, and buy some undervalued stocks.

- Determine your appetite for risk: Each investor, before choosing instruments for investment, needs to determine the appetite for risk. For example, if you are not ready for the fact that your capital will decrease in a short period, then it is better not to invest in stocks, but to choose bonds. You need to be prepared for the fact that the value of shares in the short term may decline.

And finally, is NASDAQ a good investment?

It depends on how it works. As with any investing, there is a risk here. The NASDAQ lists a wide variety of companies, but is best known for its abundance of technology stocks. Over the past two decades, the NASDAQ 100 has outperformed the S&P 500.

The NASDAQ Stock Market, located in New York City, is the second largest stock exchange in the world by market capitalization after the New York Stock Exchange. It is home to some of the world’s most renowned companies including Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Facebook (FB), Alphabet (GOOG and GOOGL) and Netflix (NFLX), the parent company of Google, and the growth of everything. the index reflects this.

NASDAQ also offers high liquidity and trading opportunities for over 3,300 listed stocks.

So if held long-term, tracking the Nasdaq is a good idea, if it is part of a wider portfolio.