Becoming a permanent resident in Germany has many benefits that temporary residents are not entitled to. Because of this, one may wonder how exactly to start this process. Continue reading the article to find out more.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Introduction

Germany has one of the world’s highest standards of living.There are many educational and employment opportunities that can help individuals realize their full potential. Apart from that, the country does not skimp out on culture, the arts, gastronomic experiences, and thrilling activities. Although this might be enough to entice foreign individuals to move, the list does not end there.

Benefits of a Permanent Resident in Germany

Being a permanent resident in Germany allows holders to stay in the country as long as they wish. They will also receive social security and health insurance, all supported by the state. This provides more security to individuals because they are not limited to the number of years they can stay in Germany. At the same time, they will be socially protected from unfortunate events, such as job losses or the development of health conditions.

Furthermore, permanent residents can also apply for a bank loan. This can be used to purchase properties and start building a home with family members.

Jet-setters can travel within the EU without applying for a visa in their respective countries. The German permanent residence permit will be enough to allow them entry.

After eight years of continuous residence in the country, they can even apply to become citizens. With this, obtaining permanent residence in Germany is highly sought-after.

But before becoming a permanent resident, one should be a temporary resident first. When this is out of the way, the application for permanent residence can be pursued.

What Do I Need to Do to Become a Permanent Resident in Germany?

A holder of a temporary residence permit should apply for a Settlement Permit to become a permanent resident in Germany.

Expats who are not of EU or EEA nationality but have lived in Germany for a given number of years can apply for a Settlement Permit. It is also known as the “Permanent Residence Permit.” The specific number of years in which an expat should have resided in Germany depends on certain conditions.

However, regardless of the specific duration, applicants must have resided in the country uninterruptedly.

To start the process, one can drop by the local immigration office to obtain an application form and schedule an appointment. It can also be downloaded from the internet. Make sure that you are well-informed about the conditions and requirements of this pursuit prior to beginning.

Conditions to Apply for a Settlement Permit in Germany

There are different requirements in order to apply for a settlement permit in Germany. These depend on what category the applicant belongs to, which are specifically the following:

- Asylum seekers and refugees

- International graduates of universities in Germany

- Family members of German nationals

- Professionals

- Holders of the EU Blue Card

- Children 16 years of age or older

- Self-employed individuals

Required Years of Residence in Germany

Skilled workers and researchers should have resided in Germany for at least four years prior to application.

The duration is shorter for foreign individuals who work as civil servants and have a life tenure term with a German public service employer. Anyone who meets this condition is only required to have lived in the country for three years prior to becoming a permanent resident in Germany.

Similarly, self-employed individuals only have to wait 3 years before initiating the process. This also applies to family members of German nationals.

Individuals who received vocational training or obtained a degree in the country need only wait two years after working as skilled workers or researchers. By then, they can apply for a settlement permit.

Those who hold an EU Blue Card can apply for a settlement permit in Germany after 33 months of residence. The condition is cut down to 21 months if applicants can show sufficient proficiency in the German language.

General Requirements to Become a Permanent Resident in Germany

In general, anyone interested in becoming a permanent resident in Germany should fulfill the following requirements:

- Must have a temporary residence permit for 5 years

The temporary residence permit should have been issued for the following purposes: reunification with a family member, employment, freelance activity, or humanitarian reasons.

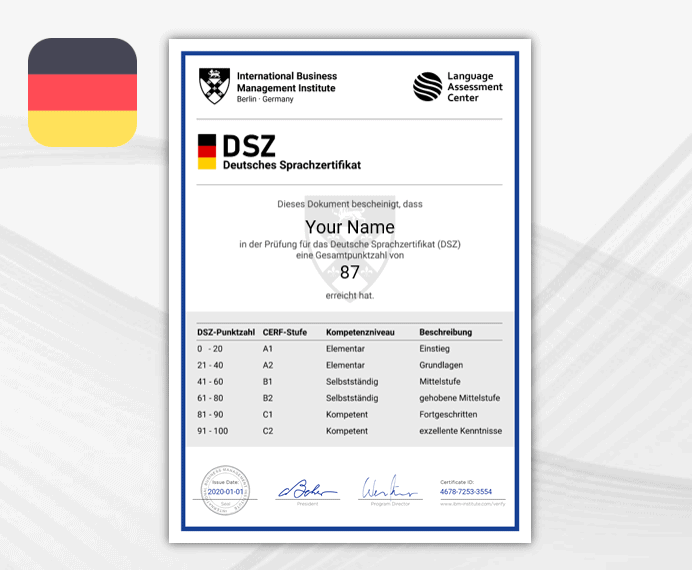

- Must have sufficient knowledge of the German language

At least level B1 of the Common European Framework of Reference for Languages must be obtained. This means that the applicant is intermediately proficient in German. They can communicate in settings such as work, school, and leisure activities without language barriers getting in the way.

- Must have basic knowledge of the legal and social order and living conditions that are well-established in the country

- Must have sufficient and secure sources of income

Applicants should not be beneficiaries of job centers or social welfare offices. This means that they do not receive unemployment benefits or social assistance.

However, for applicants who are married or in same-sex civil partnerships, they can submit proof of the income of their spouses or civil partners.

- Must have contributed to the Statutory Pension Insurance for a minimum of 60 months

If applicants have not contributed to the statutory pension insurance, they must have voluntarily contributed to a private insurance company that has similar benefits. The same minimum period applies.

This requirement can similarly be fulfilled by spouses or civil partners of applicants who are married or in same-sex civil partnerships.

- Must have adequate coverage for health insurance

Applicants who have contributed to the statutory health insurance are automatically adequately insured.

However, for applicants who have private health insurance, the type and scope of the plan should be comparable to what the state provides.

- Must have no criminal record

Temporary residents must do their best to avoid even the simplest of fines, as it is also taken into consideration in the application. This can have a negative impact on becoming a permanent resident in Germany.

- Main residence in Germany

Applicants must provide documentation that ascertains their residence in the state where they are located.

Necessary Documents to Apply for a Settlement Permit in Germany

When the aforementioned conditions are met, applicants must prepare a couple of documents to complete the application for becoming a permanent resident in Germany.

- Completely and accurately filled out application form

- Valid passport

- One copy of a recent biometric photo

When having the photo taken, make sure to look straight at the camera, keep your mouth closed, and maintain a neutral facial expression. The background should be light-colored. Have the photo printed at a size of 35mm x 45mm.

- Proof of income

There are different documents accepted by the immigration office for this purpose.

For applicants who are employed, they can submit any of the following: employment contract, certificate of employment from the employer, salary slips for the past 6 months, and history of pension insurance. The certificate of employment should have been issued 14 days prior to the application, at most.

For applicants who are self-employed or are freelancers, they can submit any of the following: a completed audit report or last tax assessment. The audit report must have been conducted by tax consultants, auditors, or tax agents. Additional documents to the audit report must also be included, such as information from the commercial register.

For applicants who are pensioners, a pension notice can be submitted.

As previously mentioned, proof of income of spouses or life partners are also accepted.

In the unfortunate event that an applicant develops a disability or has a reduction in earning capacity, the following documents should be included: notice of pension due to such reasons, a recent report from the Federal Employment Agency, or a legitimate medical certificate.

- Documentation of health insurance

For applicants who have statutory health insurance, the health insurance company should provide a document that confirms their membership.

For applicants with private health insurance, they should submit the insurance policy and bank statements that prove their up-to-date contributions.

- A lease agreement or purchase agreement

Applicants should prove that they are residing in the country. The agreement between the applicant and their lessor should specify information about the living space. Fees for monthly rent should also be included.

If the applicant has their own property, whether it be a house or an apartment, the cost of living has to be proven.

- Proof of residence in Germany

The certificate of registration of the apartment or rental agreement and confirmation from the landlord are required.

- Integration Course Certificate, subject to availability

If available, applicants should also include the document that certifies their participation and the results obtained from the final tests in the integration course.

The general integration course consists of a language course and an orientation course. There are hundreds of lesson units available to anyone who partakes in this program. They can learn how to communicate in the German language in vital aspects of daily life. At the same time, general information about Germany, such as history, culture, the legal system, values, and life in the community, will be taught. Attending this course can be helpful in transitioning into a new environment.

- Retirement provision

Documents that state information about pensions from the German Pension Insurance should be submitted.

Applicants who are enrolled in a different insurance or pension institution should prove that the benefits they are entitled to are similar to those of the state.

This document can come from the applicant’s spouse or civil partner.

- Proof of receipt of other services

Applicants who receive child benefit, child supplement, parental benefit, care allowance, or other benefits of the like should submit evidence of such.

Specific Requirements for Certain Types of Applicants

- Marriage certificate

This is applicable if applying as the spouse of a German citizen.

- Professional license

This is applicable if the applicant works in a regulated profession.

- Proof of having graduated from a German university or having obtained a vocational certificate

Submitting the Application for a Settlement Permit in Germany

When all your documents are ready, schedule an appointment at the local immigration office.

During this time, applicants will be quickly interviewed for around 10 minutes or so. Be ready with your knowledge of the law, politics, and society. The officer can ask questions about such topics and your reason for applying.

If applying as the spouse or partner of a German citizen, they must come with the applicant to their appointment.

At the same time, the officer will ensure that documents are complete and that nothing is amiss. When done, the applicant should wait until a decision has been made. If there are missing documents, another appointment has to be scheduled by the applicant.

How Much are the Fees When Applying for a Settlement Permit in Germany?

Skilled workers have to pay a fee of EUR 113.

Freelancers or self-employed applicants have to pay EUR 124.

Highly qualified professionals pay a larger fee of EUR 147.

Turkish nationals only have to pay EUR 28.80.

This can be paid for with cash, an EC Card, or bank transfer. More information will be provided during the appointment.

How Long is the Processing Time?

Upon submission of the application, individuals must wait for 2-3 weeks before hearing back from the immigration office.

Limitations of Being a Permanent Resident in Germany

It is important to note that being a permanent resident in Germany does not automatically translate into becoming a citizen of the country and obtaining a German passport. At the same time, it does not grant holders the right to freely work in other EU member states.

There is also a maximum number of months in which permanent residents can be outside Germany. Specifically, anyone not in the country for more than 6 months will have their permits revoked.

Conclusion

With this, an expat who already has a temporary residence permit and has resided for a specific number of years should seriously consider becoming a permanent resident in Germany. This will bring numerous benefits that are advantageous not just to the applicant, but also to their family members.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.