PPLI can hold property exposure, but typically not through direct real estate ownership inside the policy.

In most jurisdictions, real estate must be structured indirectly through approved funds or SPVs to comply with investor control and diversification rules.

This article covers:

- How do PPLI policies work?

- Does life insurance protect your assets?

- What are the investment options for PPLI?

- What is the downside of private placement life insurance?

Key Takeaways:

- Direct real estate ownership inside PPLI is usually restricted.

- Indirect ownership through funds or SPVs is the compliant approach.

- Compliance with investor control and diversification rules is essential for tax and regulatory benefits.

- PPLI works best as a long-term tax and estate planning wrapper.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

We also offer bespoke structuring solutions tailored to your situation. The information in this article is for general guidance only, does not constitute financial, legal, or tax advice, and may have changed since the time of writing.

How does PPLI insurance work?

Private Placement Life Insurance is a customized life insurance policy designed for affluent investors.

Unlike retail life insurance, PPLI allows policyholders to:

- Place large premiums into a policy

- Allocate those premiums into separately managed investment accounts

- Grow assets tax-efficiently

- Transfer wealth with potential estate tax advantages

Legally, the insurance company owns the underlying investments, not the policyholder.

The policyholder owns the insurance contract, and the cash value grows based on the performance of the investments inside the policy.

To preserve tax benefits, the policy must satisfy diversification rules and the investor control doctrine in jurisdictions like the United States and parts of Europe.

What can a PPLI invest in?

A properly structured PPLI can invest in publicly traded securities, private market assets, hedge funds, structured products, and professionally managed investment funds.

Typical allowable investments include:

- Public equities

- Bonds

- Hedge funds

- Private equity

- Structured products

- Investment funds

- Certain alternative assets

Direct real estate ownership is commonly restricted because it can violate diversification requirements and investor control rules.

For that reason, insurers generally require property exposure to be held through regulated funds, institutional vehicles, or professionally managed structures rather than direct personal ownership of a specific asset.

Direct Ownership vs Indirect Ownership Through a Fund or SPV

The key challenge in holding property inside a PPLI policy is that direct ownership is usually prohibited, making structure and compliance critical to accessing real estate exposure.

Direct Ownership

In most regulated insurance frameworks, direct ownership of real estate by the policy account is problematic because:

- It may breach diversification requirements

- It could trigger investor control violations

- Valuation may be difficult

- Liquidity is limited

- It can create compliance risk

For example, in US-based structures governed by the Internal Revenue Code, strict rules prevent policyholders from exercising direct control over specific investments, or the tax-advantaged status of the policy could be jeopardized.

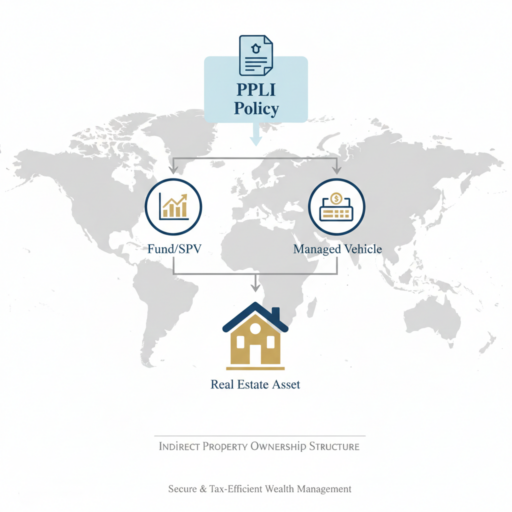

Indirect Ownership Through a Fund or SPV

A more practical solution is indirect exposure through:

- A regulated real estate fund

- A professionally managed private equity real estate vehicle

- A Special Purpose Vehicle (SPV) managed by an independent manager

In this structure:

- The insurance carrier owns units in the fund or SPV.

- The fund or SPV owns the property.

- The policyholder does not directly control the asset.

This approach allows PPLI to gain real estate exposure while maintaining compliance with diversification and investor control rules.

However, the structure must be carefully designed to avoid violations and preserve the policy’s tax efficiency.

What are the common misconceptions about PPLI?

One common misconception is that PPLI is just an investment account.

Misconception 1: PPLI is just an investment account.

It is legally a life insurance policy with an investment component, not a brokerage account.

The insurance wrapper provides tax efficiency, estate planning benefits, and asset protection, which a regular investment account does not offer.

Misconception 2: You can invest in anything you want.

Investor control rules limit how much influence you can exert over investment decisions.

This ensures the policy remains compliant with insurance regulations and preserves its tax-advantaged status.

Misconception 3: It eliminates all taxes.

PPLI can provide significant tax efficiency, but it does not eliminate taxes entirely.

Outcomes depend on the policyholder’s tax residency, proper compliance, and local regulatory rules.

Misconception 4: You can freely place your own property inside the policy.

Directly contributing personal real estate to a PPLI policy is usually prohibited.

Property exposure must typically be structured through regulated funds, SPVs, or professionally managed vehicles to remain compliant.

Can PPLI protect my assets?

Yes, in many jurisdictions, life insurance policies offer creditor protection, estate planning efficiency, privacy, and tax-deferred or tax-free growth (based on local law).

The level of protection is determined by the jurisdiction where the policy is issued and the policyholder’s country of residence.

PPLI is often used alongside trusts or foundations for cross-border estate planning particularly for globally mobile families.

What are the disadvantages of private placement life insurance?

Private placement life insurance involves high costs, structural complexity, regulatory constraints, and limited liquidity.

The main disadvantages are as follows:

- It requires substantial minimum premiums, often making it inaccessible to most investors.

- It involves complex legal and tax structuring that increases setup costs.

- It carries ongoing insurance, administrative, and management fees.

- It must comply with strict regulatory frameworks, including investor control and diversification rules.

- It limits liquidity, especially in the early years of the policy.

- It restricts how much influence the policyholder can exercise over investment decisions.

It is typically suitable only for high-net-worth or ultra-high-net-worth individuals with long-term planning horizons.

Alternatives to Holding Property in PPLI

If direct real estate exposure is restricted, alternatives include:

- Real estate funds

- REITs

- Private equity real estate vehicles

- Structured notes linked to property indices

- Offshore investment bonds (in certain jurisdictions)

- Trust structures holding property outside the policy

For clients already considering estate tools especially those comparing insurance wrappers and trust structures, the decision often comes down to tax residency, control preferences, and succession objectives.

Given your broader content focus on wealth structuring, this is a classic control-versus-efficiency tradeoff discussion.

Conclusion

A PPLI can provide exposure to property, but the opportunity lies in strategically structured, indirect ownership rather than direct real estate holdings.

The policy’s true strength is in integrating real estate into a compliant, flexible framework that aligns investment growth with tax efficiency, asset protection, and estate planning objectives.

Success comes from leveraging funds, SPVs, or professionally managed vehicles to maintain regulatory compliance while capturing economic benefits.

For sophisticated investors, the value of property in a PPLI is not the asset itself, but how it enhances long-term wealth, control, and strategic flexibility within a cohesive planning structure.

Ultimately, it is a tool for disciplined, insight-driven wealth management rather than direct ownership.

FAQs

What is the difference between a PPLI and a trust?

A trust is a legal arrangement where a trustee holds and manages assets for beneficiaries, while a PPLI is a life insurance policy with investments legally owned by the insurer.

The main difference between a trust and PPLI lies in their purpose: trusts focus on control and succession, whereas PPLI focuses on tax efficiency and asset protection.

What is the difference between PPLI and VUL?

The main difference between VUL and PPLI lies in the level of customization and investment flexibility: VUL is a standardized retail product with limited options and higher fees, while PPLI is an institutional-grade, highly customizable policy designed for sophisticated investors with broader investment choices and lower internal costs.

Is PPLI considered an investment?

Yes, PPLI is considered an investment in economic terms, even though legally it is a life insurance policy.

Its cash value grows based on the performance of the underlying investments, making it a tax-efficient investment wrapper.

Can I cancel my life insurance policy and get my money back?

Yes, you can cancel a life insurance policy and receive its cash value through surrender.

However, early surrender may incur fees, trigger taxes on gains, and liquidity can be limited, especially for PPLI policies designed for long-term planning.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.