There are various benefits of indexed universal life insurance which we will focus on in this post. But since investment options have their positive and negative sides, we’ll also touch on some disadvantages of IUL.

Because it strikes a mix between growth potential and protection, index-linked universal life insurance is a popular option for people who want to protect their loved ones while simultaneously taking advantage of market gains.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

Note that IUL insurance can be a quite complicated investment, so seeking financial advice especially for beginners is advised.

Pros and cons of IUL insurance

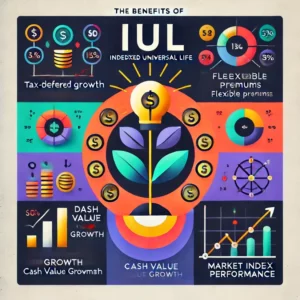

Benefits of Indexed Universal Life Insurance

In the case of the insured’s passing, beneficiaries of an IUL policy are guaranteed financial security. Interest may accumulate over time in the cash value portion of IUL plans. Policyholder liquidity is facilitated by the tax-free access to this monetary value through loans or withdrawals.

Advantages related to taxes are also among the main benefits of indexed universal life insurance. There are no tax obligations on the cash value growth of the scheme as long as the funds are retained within it. It is also usually not necessary for recipients to pay taxes on the death benefits.

One other important aspect is premium flexibility, which lets policyholders modify their payments based on their financial circumstances. This can be very useful if their finances go better.

IUL policies allow policyholders to take advantage of market advances while guarding against value reductions because they link the growth of the cash value to the direction of a stock market index, say the S&P 500.

The cash value is protected from declining, offering a buffer against possible losses, should the indexed account perform poorly.

IULs can also be a helpful instrument for inheritance transfer and estate planning. They provide an effective means of transferring wealth to next generations, frequently with little tax ramifications. This makes IUL insurance a desirable choice for people trying to strike a balance between financial flexibility, development potential, and protection.

Why IUL is bad

IUL insurance can be complicated and challenging to comprehend, as cash value growth is influenced by participation rates and caps, among other things.

IUL policies often have greater premiums and additional expenditures than whole life or term life insurance, which might lower potential earnings.

The efficiency of the insurance may be limited by the maximum returns, which are frequently regulated, and the participation rate that determines the policyholder’s portion of the market’s gains. IUL policies don’t distribute dividends like whole life insurance does.

Furthermore, their prospective profits may be limited because they track an index rather than making direct investments in stocks. If the insurance is terminated early, there may be surrender fees associated with it, which might add up.

Utilizing an IUL product for cash value growth and life insurance may mean missing out on potentially greater returns from other investments, and there is a danger that the policy’s returns will fall short of predictions in a slumping economy.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.