Individuals who want a more diversified basket are looking into the prospect of cask whisky investment vs vintage cars.

In this comparison,we’ll explore the particulars of each investment type like costs, pros and cons, possible revenue.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternatives.

Some of the facts might change from the time of writing, and nothing written here is formal advice.

For updated guidance, please contact me.

Is buying a cask of whisky a good investment?

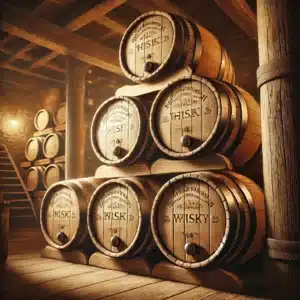

The value of casks of whisky can appreciate over time as they age.

Since whisky is a tangible asset that can be enjoyed while it appreciates, its appeal is derived from both the financial returns and the enthusiasm for whisky culture.

How much does it cost to invest in a whiskey cask?

Depending on the quality and brand, whisky cask investment price can be up to 3,000 pounds. Even more expensive are premium casks from renowned distilleries.

To guarantee that the whisky matures properly under ideal circumstances, investors must account for storage expenses which can reach 300 pounds annually.

Cask insurance is necessary and can cost at least 100 pounds more per year.

The whisky may incur fees if you choose to bottle it as well.

How to sell whiskey barrels?

Keep on top of well-known distilleries and whisky types so that you can price your barrel competitively.

Review local laws and the licensing requirements for the sale of alcohol.

Whisky that has been properly aged and stored under ideal conditions increases its worth.

Examine your options for selling, including direct sales to collectors in your network, specialist brokers, and online whisky auctions.

Provide comprehensive documentation like proof of authenticity and information about the product’s origin to gain the trust of the buyer and ensure a smooth transaction.

Whisky cask investment returns

According to different sources, investing in cask whisky can result in yearly returns of 8% to 20%. Irish whiskey has reportedly hit a profit of over 10% annually over a five-year period.

Rare whisky bottle prices have risen 322% over the past ten years, according to the Knight Frank Luxury Investment Index. This indicates a solid demand for premium whiskies.

Of course, these earnings are not assured and are reliant on the whisky’s quality and market demand, among other variables.

Since whisky ages and gains value, cask investments usually need a longer holding period to yield noticeable returns. It’s typically advised to hold on for at least 5 years.

What are the risks of investing in whiskey cask?

The market for whisky can be volatile, with prices changing according to consumer preferences and trends.

It’s a risky investment option. They don’t always increase in value; some might even decrease.

The market for investing in cask whisky is mainly unregulated, which means that there are no set procedures or standardized price lists for cask sales.

Many investors don’t know how they’re going to sell their cask when it matures.

Bottling whisky entails extra expenses for investors, such as excise taxes and VAT.

Are vintage cars good investments?

Old cars are a timeless investment option that blends financial potential with sentimentality. Well-kept vintage cars can increase in value with time, in contrast to most other vehicles that lose value.

Cost of investing in vintage cars

Classic cars can range in price from affordable models that cost about $10,000 to expensive collectibles that cost millions of dollars.

It can be costly to restore a vintage vehicle. The expenses can be higher than the original purchase price, according to many investors.

At least $50 a month can be spent on proper storage, which is essential.

Insurance is an added cost too. One important factor in determining the car’s insurance value is its current age and price.

How to sell vintage cars

- Assess the market value of your vintage vehicle by looking at its condition, rarity, and historical significance, or by speaking with experts or using valuation guides.

- Maintain and clean the vehicle, take care of any mechanical problems, and arrange service logs so that prospective purchasers have a comprehensive history.

- Compile the necessary documents, such as the registration, title, and service records, to expedite the selling process.

- Use websites to advertise your vehicle to collectors and fans of vintage cars or social media platforms to get in touch with possible buyers directly.

- Take a look at classic car auction houses to get competitive bids and possibly higher sale prices.

- Look into state-specific laws pertaining to the sale of vintage vehicles, such as those governing title transfers and relevant taxes.

- Get ready for buyer negotiations and use a Bill of Sale to record the transaction.

Classic car investment returns

Over time, vintage automobiles have demonstrated significant appreciation. Even higher returns are possible for some models from well-known manufacturers, especially for rare or limited-edition ones.

The vintage car market has proven resilient during recessions owed to the excitement of investors and collectors who are prepared to shell out top dollar for desirable models.

Similar to whisky casks, vintage cars typically need a long investment horizon in order to yield the highest returns. Holding onto one for a few years can greatly increase its value since classic cars get rarer over time.

Disadvantages of buying old cars

- The cost of buying a vintage car can be high.

- Regular maintenance is necessary for vintage cars, and it can be expensive. Restoration work frequently costs more than the original purchase price.

- Similar to whisky, the market for vintage cars can fluctuate depending on the state of the economy and the interest of collectors.

- Depreciation from rust or damage can result from improper storage.

- The market demand might not always coincide with your selling timeline.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.