Ethical investing and index funds – What are they and how can you invest in them?

That will be the topic of this article, which will also speak about some of the downsides associated with these investments and things to look out for more generally.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some of the facts might change from the time of writing, and nothing written here is financial, legal, tax or any kind of individual advice, nor a solicitation to invest.

What are Index Funds?

Index funds are a type of mutual fund or an exchange-traded fund (ETF) with a portfolio designed in order to match or track the components of a financial market index. For example, the Standard & Poor’s 500 Index (S&P 500) is considered as an Index Fund.

An index mutual fund provides broad market exposure, low expenses for operating and low turnover for the portfolios. These funds follow their benchmark index regardless of the state of the markets.

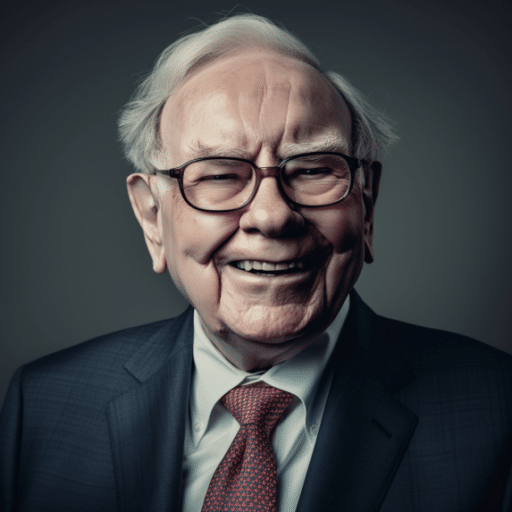

Generally, Index funds are considered as ideal portfolio assets available for the individuals having retirement accounts, such as ‘Individual retirement accounts (IRAs)’ and ‘401(k) accounts’. Legendary investor Warren Buffett suggests index funds to be a haven for savings for the later years of life.

Index funds have been available to investors since the 1970s. The popularity of passive investing, the availability of low fees, and a long-running bull market have combined to send them soaring by the year 2010.

According to the research by Morningstar, in the year 2018, investors made investments in the Index funds where the investment was more than US$458 billion across various types of asset classes.

During the same period, actively managed funds have experienced $301 billion in the form of investments.

The first-ever Index fund, which was founded by Vanguard chairman John Bogle in the year 1976, is still considered to be one of the best available index funds for the overall long-term performance and low costs that it offers to the investors.

The Vanguard 500 Index Fund has tracked the S&P 500 for many years, in terms of composition as well as performance.

For example, It posts a one-year return of 9.46% when compared to the return of the index’s 9.5%, as of March 2019. For the Admiral Shares of Vanguard 500 Index Fund, the expense ratio is set at 0.04%, and its minimum required investment amount is around $3,000.

Instead of choosing from individual stocks for investment, Warren Buffet says that it is more beneficial for an average investor to buy all of the companies that are present within the ‘S&P 500’ index for the low price an index fund offers.

Index funds usually track indexes that have implementation rules like efficient tax-management, minimized tracking error, large block trading strategies or patient/flexible trading strategies that allow for greater tracking error along with lower market impact costs.

Index funds may also be subjected to some rules that screen for social and sustainable criteria of ‘ESG (Environmental, Social, and Governance) investing.

The main advantage of making an investment in the index funds for investors is that they don’t require a lot of time, in order to manage as the investors don’t have to spend time analyzing various stocks or stock portfolios.

Many individual investors also find it difficult to beat the performance of the S&P 500 Index due to their lack of experience/investing skills over many years.

Index Funds are a type of passive management fund. Instead of picking the stocks and timing the market with the help of a portfolio manager on a regular basis, that is, choosing the appropriate securities to make an invest in and creating a strategy for buying and selling those securities, the fund manager creates a portfolio of which the holdings replicate the securities of a particular index.

The idea of doing this is to match the profile of a certain index where the performance is considerably good.

One of the most popular index funds in the United States is the Index fund that tracks the index of ‘S&P 500’. There are some other index funds as well, whose performance is considered to be good. Some of them are:

- ‘Russell 2000’ – which is made up of stocks of several small-cap companies.

- ‘Wilshire 5000’ – which is considered to be the largest U.S. equities index.

- ‘DIJA (Dow Jones Industrial Average) – which consists of 30 large-cap companies.

- ‘MSCI EAFE’ – which consists of foreign company stocks such as stocks from Europe, Australia, Asia, etc.

- ‘Barclays Capital U.S. Aggregate Bond Index’

- ‘NASDAQ Composite’ – which is made up of 3,000 stocks that are listed on the NASDAQ exchange.

The index funds always contribute to the companies that are owned with the index. For example, index funds tracking the DJIA would invest in the same 30 large and publicly owned companies that are present within that index.

The portfolios of index funds only change when their benchmark indexes change. If the fund is following a weighted index, the managers of the fund may rebalance the percentage of different securities periodically in order to reflect the weight of their presence in the benchmark.

The method used to balance out the influence of any single holding in an index or a portfolio is known as ‘Weighting’.

Investments in index funds are considered to be a form of passive investing. The opposite type of investing is active investing, as shown in actively managed mutual funds, where the investors would have to manage their assets on a regular basis.

People involved in active trading would often have to deal with activities such as picking securities, timing the market, managing their portfolio, etc.

One of the major advantages that index funds have when compared to their actively managed counterparts is the lower management expense ratio.

A fund’s expense ratio, which is also known as the management expense ratio, consists of all the operating expenses such as the payments that need to be made to advisors and managers, transaction costs, taxes, and accounting fees.

Since the index fund managers are simply copying the performance of a benchmark index that they track, there is no requirement for the services of research analysts and other types of experts that assist in the process of selecting a stock.

Managers of index funds trade holdings less often and hence have fewer transaction fees and commissions. In contrast to this, actively managed funds require bigger and professional staff and result in more transactions, increasing the cost of doing business.

The extra costs of a fund’s management are usually reflected in the fund’s expense ratio and are passed on to the investors. As a result of this, cheap index funds often cost much less than a percent, which can be somewhere around 0.2%-0.5% on average.

There are some firms that might offer even lower expense ratios which might cost somewhere around 0.05% or even less when compared to the much higher fees that are required by the actively managed funds.

The actively managed funds typically charge around 1% to 2.5% which is significantly higher.

The overall performance of a fund is directly impacted by the expense ratios.

Actively managed funds, which are considered to have often-higher expense ratios, are automatically at a disadvantage when compared to the index funds, and therefore struggle in order to keep up with their benchmarks in terms of overall return.

It is clear that lowered expenses always lead to better performance of an asset. Advocates most often argue that passive funds have always been successful in outperforming most of the actively managed mutual funds.

It is true that most of the mutual funds fail to beat the performance of broad indexes. For example, according to SPIVA Scorecard data from S&P Dow Jones Indices, during the five years up to December 2018, 82% of large-cap funds have generated a return that is low when compared to the returns of the S&P 500.

Another major aspect that needs to be taken into consideration is that passively managed funds (index funds) do not attempt to beat the market.

The strategy of passively managed funds instead seeks to match the overall performance (such as risk and return) of the market, based on the theory that the market would always win.

Passive management leading to positive performance is often proved to be true over the long term. With shorter timespans, actively managed funds (such as mutual funds) are considered to have relatively better performance.

The SPIVA Scorecard indicates that during the time span of one year, only up to 64% of large-cap mutual funds had a performance which was considered to be lower than that of the S&P 500.

In other words, more than one-third of the mutual funds have beaten the performance of the S&P 500 in the short term.

Also, in many other aspects, actively managed assets have more advantages when compared to that of the passively managed assets.

For example, nearly 85% of mid-cap mutual funds beat the performance of the S&P mid-cap 400 Growth Index benchmark, within the time span of one year.

What is Ethical Investing?

Ethical investing refers to the investment practice of using a person’s ethical principles as the primary aspect while making the selection of securities for investing. Ethical investing depends on the perception of the investor.

Ethical investing is sometimes interchangeably used with terms such as ‘socially conscious investing’, however, socially conscious funds typically have a comprehensive set of guidelines that are made use of, while selecting the portfolio. whereas ethical investing brings about a more personalized result such as the ethical perception of a specific individual.

The main aspects of ethical investing are as follows:

- Ethical investing is the process of selecting investments based on the application of ethical or moral principles of a specific individual.

- Choosing the investments depending on the ethical preferences might not guarantee the performance or profits of an investor.

- Ethical Investors often usually avoid trading with the products and services that are related to alcohol, gambling, smoking, weapons, Etc.

- Analyzing and choosing an investment according to the ethics of an individual should also include the activities of the company of the respective ethical investment asset as well as their performance.

Ethical investing gives the individual the availability of making an investment in companies, whose practices, activities, and values are similar to that of their personal beliefs. Some beliefs are maybe based upon the environmental, religious, or political precepts of an individual, whereas, some investors might choose to eliminate specific industries or prioritize their investments to other sectors that are based on the individual’s ethical guidelines.

For example, some ethical investors avoid certain assets such as sin stocks, which are the companies that are often involved or primarily deal with activities such as gambling, alcohol, or weapons that are considered to be unethical or immoral activities.

Choosing an investment based on ethical preferences is not a factor that decides the performance of an investment asset.

In order to make an investment in ethical assets, investors should carefully choose and research about the investments, which they would need to avoid and which are sharing the same interest/belief as them.

Research is the most essential aspect for precisely determining whether an investment asset or group of investment assets that coincide with the personal beliefs of one’s ethics, especially while making an investment in an index or mutual fund.

The most important aspect that often influences ethical investing is ‘Religion’.

When religion is set as a motivation, industries with activities and practices which are designed in such a way that they oppose the religion’s principles are avoided by the investors belonging to that respective religion.

The first and foremost recorded example of ethical investing in history was in America. It was done by the 18th century by Quakers, who prohibited their members from spending their time or money in the activities involving the slave trade.

Somewhere around the same time, John Wesley, who was a founder of Methodism, often used to preach the importance of refraining from investments in industries/companies that can cause harm to an individual’s neighbor (such as chemical plants).

Another example of a religious-based ethical investing aspect, which is seen in Islamic banking and finance.

According to them, Islamic investors are prohibited from making investments in alcohol, gambling, pork, and other forbidden items that are not in compliance with the Shariah principles.

Upon the arrival of the 20th century, ethical investing gained popularity based on an individual’s social views when compared to that of their religious views.

Ethical investments usually try to replicate aspects such as political climate and social trends of a particular time. In the U.S. during the 1960s and 1970s, ethical investors primarily showed more interest on several companies and organizations that used to promote the equality and rights for workers and showed less interest in the companies that supported or gained profits from the Vietnam War.

Somewhere around in the 1990s, ethical investments began to focus primarily on issues and topics that are related to the environment. Ethical investors showed less interest in coal and fossil fuel companies and supported the companies that supported clean and sustainable forms of energy.

Nowadays, ethical investing continues to play a major role and primarily focuses on impacts on the environment as well as society.

Socially Responsible Investing:

A socially responsible investment strategy is the type of strategy that actively focuses on successful investment returns as well as responsible corporate behavior in an equal ratio.

SRI investors primarily believe that by combining certain social criteria along with certain sets of investment standards, individuals can be able to identify the securities that can be able to earn competitive returns as well as contribute to making the world a better place.

Ethical Index Funds:

The Index funds that match the portfolio of a financial market index and primarily focus on the ethical values of an individual are known as the ‘Ethical Index Funds’.

While selecting ethical index funds, in addition to making an analysis of investments using ethical standards, certain important aspects such as the historical data, current data, and projected performance of the investment should also be taken into consideration.

To check whether the investment is capable and has the required potential in order to achieve significant profits, the review of a company’s history, activity and finances should also be considered. It is also important to check with the company’s commitment to ethical practices that are considered and practiced by the investor.

Although Index funds have been considered to have obtained maximum benefits for the investors, it should be kept in mind that the investments that are made based on the ethical perception are not guaranteed to bring the expected amount of profits to individuals. It doesn’t either mean that investing ethically would give lower returns to the investors.

Index Funds vs Ethical Index Funds

It isn’t an aspect of surprise that there has been a sudden increase in the interest of making investments in socially responsible assets, including funds which avoid industries and companies that are considered to be major polluters such as the fossil-fuel industry.

But according to the statistics of industrial data, this is more of a talk rather than an action.

It was estimated that only 4% of company 401(k) retirement plans available to the investors offer the option of a socially responsible mutual fund as one of its available investment options. And only 9% of the investors are interested in investing such type of funds among the investors having access to it.

However, research by Morningstar states that instead of a surge in the interest for ethical investing and socially responsible mutual funds, the total invested amount was very low.

They also stated that the number of funds jumped from 50% in the year 2018 and the fund flows were estimated to be around $5.5 billion. The total investment amount made in the socially responsible assets was just $161 billion by the end of that year.

The amount is very low when compared to the investment amount made in all the stocks and bond funds. This makes it clear that ethical investing/socially responsible investing has to achieve a lot of milestones that the news headlines suggest to the people.

Index funds usually invest passively across the market and they don’t have any sort of ethical distinctions between companies and their activities, says ‘Matt Patsky’, who is the CEO of a socially responsible investment company called ‘Trillium’. He also states that making an investment in a simple investment fund would be considered an immoral activity.

Socially responsible funds/ethical index funds take responsibility for various social factors before they choose to invest in a company. Some types of activist funds invest in certain companies, which they consider as bad actors in order to bring the change in management with pressure.

Others (ethical index funds/socially responsible index funds) avoid making an investment in certain companies, whether it might be stocks of a tobacco company, or defense contractors, or companies that deal with fossil-fuels.

It is also considered that the socially responsible index funds have brought a lot of profits to their investors when compared to that of the regular kind of index funds. An example to support this statement is the energy sector. The S&P Energy sector has obtained returns of 44% whereas, the S&P 500 index has returned up to 242% over the past ten years.

This proves that Socially responsible investing opportunities are suggesting investors that they need not compromise their values in order to make money.

If an investor is able to approach socially responsible index funds like any other investment that they would deal with, the investor may be able to put their money into something that both supports your values along with achieving greater benefits.

Conclusion

If a person opts to make an investment in ethical index funds, not only they get the profits from their investments if it performs well, they would also be likely to have the satisfaction of having made money by doing something based on their personal/ethical beliefs.

Although Index funds are considered to be a passive form of investment, some individuals might be able to receive profits from their investments.

So it is suggested as the best advice to have a strategy created by taking the help of a good personal financial advisor in order to gain maximum profits for your investments while making an investment in the ethical index funds.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.