FCNR vs GIFT City comes down to a fundamental choice between a regulated offshore-style financial hub in India and a low-risk foreign currency deposit designed for NRIs.

While both offer tax and currency advantages, they serve very different roles in wealth management and cross-border planning.

This article covers:

- What is the difference between FCNR and GIFT City FD?

- Who is eligible for GIFT City or FCNR?

- What are the pros and cons of FCNR account and GIFT City?

Key Takeaways:

- FCNR is best suited for capital preservation and currency protection.

- GIFT City offers broader investment opportunities with higher complexity.

- Many NRIs can benefit from using both, not choosing just one.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What is the difference between GIFT City and FCNR?

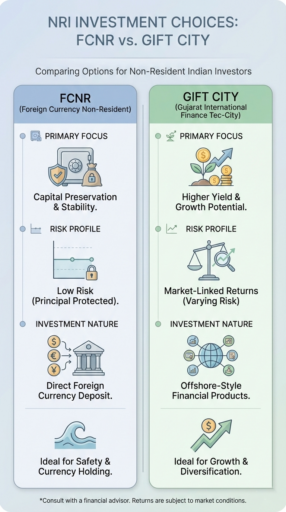

The difference between GIFT City and FCNR lies in their purpose and investment framework: FCNR is a low-risk foreign currency deposit for NRIs, while GIFT City offers a broader range of offshore-style financial products within a special economic zone.

FCNR accounts are fixed deposits held in approved foreign currencies, designed primarily for capital preservation, predictable returns, and protection against INR depreciation.

They are straightforward, regulated by Indian banks, and ideal for NRIs seeking a safe, low-maintenance way to manage foreign earnings.

GIFT City, on the other hand, is a financial hub that allows international banking units (IBUs) to offer products such as foreign currency FDs, bonds, funds, and structured investment products.

These options provide potentially higher returns, diversification, and tax advantages, but come with greater complexity, regulatory considerations, and market exposure.

In essence, FCNR focuses on stability and simplicity, whereas GIFT City enables NRIs to access innovative, higher-yield investment options within India’s regulated offshore financial ecosystem.

Choosing between them depends on risk tolerance, investment horizon, and whether the goal is preservation or growth.

Who is eligible for GIFT City?

GIFT City is open to NRIs, foreign investors, and global institutions that qualify under India’s international financial services regulations.

Eligible participants normally include:

- Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) – investing or holding assets in foreign currency

- Foreign investors and global institutions – accessing India-linked offshore markets

- Multinational corporations – managing treasury, funding, or cross-border operations

- Family offices and high-net-worth individuals (HNIs) – seeking diversified or tax-efficient structures

Eligibility ultimately depends on the specific product or service such as funds, bonds, structured products, or deposits, offered by international banking units (IBUs) operating within GIFT City.

Who is eligible for FCNR?

FCNR accounts are available only to non-residents of Indian origin who earn or hold funds in foreign currency.

FCNR accounts are available to:

- Non-Resident Indians (NRIs) – earning income outside India

- Persons of Indian Origin (PIOs) – residing abroad with Indian lineage

- Overseas Citizens of India (OCI) – holding OCI status while living overseas

Resident Indians and foreign nationals without Indian origin are not eligible to open FCNR accounts.

What are the advantages of FCNR vs GIFT City?

FCNR offers safety and simplicity, while GIFT City offers broader investment access and potentially higher returns.

Advantages of FCNR include:

- Full protection against exchange rate risk

- Guaranteed and predictable returns

- Clear and well-established regulatory framework

- No exposure to market volatility

- Easy repatriation of both principal and interest

Advantages of GIFT City include:

- Access to offshore-style financial products within India

- Potential tax efficiencies depending on structure

- Foreign-currency–denominated investments beyond fixed deposits

- Exposure to higher-yield instruments such as bonds, funds, and structured products

In practice, FCNR suits conservative capital preservation, while GIFT City suits investors seeking flexibility, diversification, and return potential.

What are the disadvantages of FCNR vs GIFT city?

FCNR is limited by low return potential, while GIFT City carries higher complexity and risk.

Disadvantages of FCNR include:

- Lower returns compared to GIFT City investment products

- Limited long-term growth potential

- Fixed tenures with penalties for early withdrawal

- No access to diversified instruments such as bonds, funds, or structured products

Disadvantages of GIFT City include:

- Greater regulatory and structural complexity

- Higher exposure to market and product risk

- Less suitable for short-term or purely conservative investors

- Requires careful selection of providers and instruments

As a result, FCNR favors stability, while GIFT City demands a higher risk tolerance and stronger understanding of offshore-style financial products.

How NRIs Can Combine FCNR and GIFT City for a Balanced Portfolio

Rather than viewing FCNR and GIFT City as mutually exclusive, NRIs can use both strategically to balance safety, liquidity, and growth.

An FCNR account provides a stable, low-risk base for preserving foreign earnings and protecting against INR depreciation.

This ensures a portion of your portfolio remains insulated from currency and market volatility.

GIFT City, on the other hand, offers higher-yield investment options such as offshore-style deposits, bonds, and structured products, along with potential tax efficiencies.

Allocating a portion of funds to GIFT City can help NRIs pursue long-term growth, diversification, and exposure to India’s evolving financial markets.

By combining the two, NRIs can create a tiered strategy: using FCNR for short-term stability and repatriation needs, while leveraging GIFT City for growth-oriented investments.

This approach also allows investors to adjust allocations based on changing risk appetite, market conditions, and financial goals, rather than committing fully to a single product.

In essence, using FCNR and GIFT City together can transform a portfolio from merely safe or speculative into balanced, flexible, and globally aligned, reflecting both caution and opportunity.

Conclusion

Choosing between FCNR and GIFT City is not just about returns or safety but also reflects how you want to engage with India’s evolving financial landscape.

FCNR offers a straightforward, reliable way to safeguard foreign earnings, while GIFT City opens doors to innovative, cross-border financial strategies that can complement a global portfolio.

For NRIs, the real advantage comes from thinking strategically: using FCNR for stability and GIFT City for opportunity can create a balance between security and growth.

Ultimately, the decision is as much about financial goals and risk mindset as it is about the instruments themselves.

FAQs

What happens to FCNR deposit on maturity?

On maturity, an FCNR deposit can be renewed in the same foreign currency, converted into a new FCNR deposit, transferred to an NRE or NRO account, or fully repatriated abroad.

The exact option depends on the depositor’s residency status and long-term financial goals at the time of maturity.

Is FCNR better than NRE?

Yes, FCNR is better than NRE if currency stability is a priority.

-FCNR protects against INR depreciation

-NRE accounts are exposed to currency conversion risk

However, NRE accounts may offer better liquidity for those spending in India.

Is investing in foreign currency a good idea?

Investing in foreign currency can be a smart strategy to hedge against domestic currency risk, diversify global exposure, and preserve wealth earned abroad.

However, such investments should always align with your income source, investment horizon, and overall asset allocation to ensure they fit your financial goals and risk tolerance.

Is it worth buying property in GIFT City?

Yes, buying property in GIFT City can be worthwhile for long-term or commercial investors seeking exposure to India’s financial hub.

However, it is not a short-term or low-risk investment, and regulatory conditions continue to evolve, so careful planning and due diligence are essential.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.