Privacy coins are at the helm of digital privacy and regulatory oversight debate. They offer enhanced anonymity in financial deals, raising important questions for investors, regulators, and exchanges.

While their technology promises discretion and security, their legal status and adoption vary across jurisdictions, creating a complex landscape for anyone looking to understand or invest in them.

This article covers:

- What is a privacy coin?

- List of privacy coins

- Top privacy coins

- Privacy coins outlook 2026

Key Takeaways:

- Privacy coins offer greater anonymity than standard crypto.

- Anonymity Enhanced Coins are innovative but heavily regulated.

- Access and legality vary across jurisdictions and exchanges.

- Investors must weigh privacy benefits against compliance and adoption risks.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What are privacy coins?

Privacy coins, also dubbed Anonymity Enhanced Coins, are crypto assets designed to protect users’ identities and transaction details.

They offer a level of anonymity that traditional cryptocurrencies like Bitcoin do not.

Unlike regular coins, privacy coins obscure sender, receiver, and transaction amounts to prevent third-party tracking.

For investors, privacy coins represent both a technological innovation and a regulatory risk, since the very features that make them appealing can also attract scrutiny from governments and exchanges.

Understanding how privacy coins work and their legal, investment, and adoption landscape is essential before considering exposure.

Are privacy coins legal?

Privacy coins are legal in many jurisdictions, but their status varies widely. Some countries allow them fully, others restrict or ban their use due to concerns about money laundering, terrorism financing, or tax evasion.

Expat and offshore investors should note that even where privacy coins are legal, exchanges, banks, and crypto service providers may refuse to handle them, creating practical limitations.

Regulatory risk is a key consideration when holding or trading privacy coins internationally.

What makes privacy coins unique?

Privacy coins differ from standard cryptocurrencies through enhanced anonymity features.

- Obscured transactions: Sender, receiver, and amounts are hidden.

- Enhanced blockchain privacy: Some coins use ring signatures, stealth addresses, or zero-knowledge proofs.

- Financial confidentiality: Users can transact without linking identity to the blockchain publicly.

This makes privacy coins attractive for users valuing confidentiality, but also creates regulatory and exchange acceptance challenges, especially in high-compliance jurisdictions.

Privacy Coins Crypto List

The most widely recognized privacy-focused cryptocurrencies include Monero, Zcash, Dash, and Verge.

- Monero (XMR) – The most privacy-centric coin; transactions are private by default using ring signatures, stealth addresses, and confidential amounts.

- Zcash (ZEC) – Uses zero-knowledge proofs; privacy is optional rather than mandatory.

- Dash (DASH) – Offers optional privacy through transaction mixing (PrivateSend), though it is not fully private by default.

- Verge (XVG) – Focuses on network-level anonymity by routing transactions through Tor or I2P.

- Secret Network (SCRT) – Enables private smart contracts and encrypted data on-chain.

- Firo (FIRO, formerly Zcoin) – Uses privacy protocols to hide transaction origins.

- Beam (BEAM) – Implements the Mimblewimble protocol to obscure transaction details.

- Grin (GRIN) – Also based on Mimblewimble, prioritizing simplicity and privacy.

- Pirate Chain (ARRR) – Enforces mandatory privacy using zero-knowledge proofs.

Among these, Monero is generally regarded as the strongest privacy coin, while others trade off privacy for usability, optional transparency, or compliance adaptability.

Privacy Coins Banned

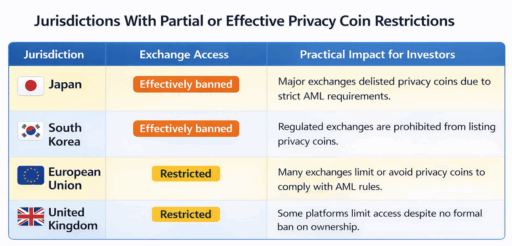

Privacy coins are not globally banned, but they are heavily restricted in several jurisdictions and frequently delisted by regulated exchanges.

Most regulatory action targets access and liquidity rather than outright ownership.

Common restriction methods include:

- Exchange delistings on regulated platforms

- Banking and fiat on/off-ramp restrictions

- Enhanced AML and reporting requirements

Jurisdictions with partial or effective restrictions include:

- Japan – Major exchanges delisted privacy coins due to AML concerns

- South Korea – Privacy coins removed from regulated exchanges

- European Union (via exchanges) – Many platforms restrict or avoid listing privacy coins to meet AML standards

- United Kingdom (exchange-level) – Some platforms limit access despite legal ownership In most cases, privacy coins remain legal to hold, but are difficult to trade, convert, or custody through regulated providers.

In most cases, privacy coins remain legal to hold, but are difficult to trade, convert, or custody through regulated providers.

Are privacy coins a good investment?

Privacy coins can offer high reward potential due to niche demand. However, they also come with elevated risk:

- Regulatory crackdowns or exchange delistings can sharply reduce liquidity.

- Price volatility is often higher than mainstream cryptocurrencies.

- Adoption outside privacy-focused communities is limited.

For offshore investors, privacy coins may work as a small, speculative allocation, but they should not be relied on as a core portfolio holding.

Risk management and regulatory awareness are critical.

Are privacy coins dead? 2026 Outlook

Privacy coins are not dead, with 2026 crypto poised to be a turning point.

- Regulatory scrutiny is increasing globally.

- Major exchanges may delist coins deemed too risky.

- Technological advancements in privacy and compliance may shape adoption.

The market will likely consolidate, favoring privacy coins that balance anonymity with regulatory compatibility.

Do privacy coins have a future?

Yes, privacy coins have a future if they adapt to compliance and regulatory pressures.

Layered solutions such as optional privacy, enhanced reporting for regulators, or integration with compliant exchanges may ensure survival.

The demand for financial privacy, international transactions, and censorship-resistant payments ensures a continuing niche market, but mass adoption remains uncertain.

Will privacy coins be banned?

A full global ban is unlikely but possible in certain jurisdictions. Governments may restrict use on exchanges, enforce KYC for trading, or limit banking access.

Notably, the European Union is expected to ban privacy coins by the second half (H2) of 2027.

For expats and offshore investors, the risk is that privacy coins may remain legal to hold but difficult to spend or exchange, creating liquidity challenges.

Ongoing monitoring of local regulations is essential.

Bottom Line

Privacy coins remain a compelling option for those seeking financial anonymity, yet their appeal comes with significant caveats.

This market continues to evolve amid increasing regulatory attention and technological development.

Their future depends on balancing privacy with compliance, and only coins that can navigate both are likely to survive long-term.

Investors should treat them as niche holdings, using caution and careful evaluation of each coin’s privacy features, compliance adaptability, and market access.

FAQS

What is a private cryptocurrency?

A private cryptocurrency is a digital currency designed to conceal transaction details and user identities, offering greater anonymity than standard coins.

Can privacy coins be tracked?

Some privacy coins are nearly untraceable, but advanced blockchain analytics can sometimes infer patterns. Absolute anonymity is rare.

Why are privacy coins pumping?

Prices often surge due to speculation, regulatory news, or adoption by privacy-conscious users, rather than mainstream use.

What if you put $1000 in Bitcoin 5 years ago?

Bitcoin’s growth has been massive over the last five years, often turning a $1,000 investment into tens of thousands, highlighting crypto’s volatility and potential returns.

What coin has the best future?

Bitcoin is widely considered to have the strongest long-term outlook due to its first-mover advantage, broad institutional adoption, regulatory recognition, and deep global liquidity.

Unlike privacy coins, Bitcoin benefits from clearer legal treatment in many jurisdictions, integration with regulated financial platforms, and growing acceptance as a store of value.

Other coins may thrive if they balance privacy, compliance adaptability, and community support, but outcomes remain uncertain.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.