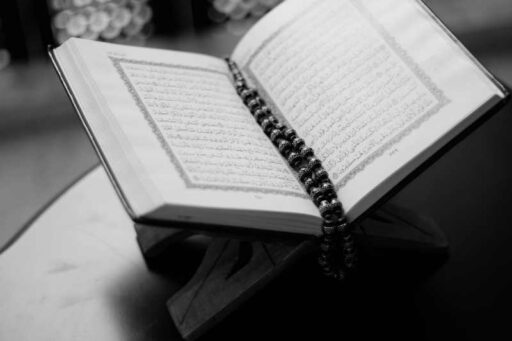

Shariah compliant describes financial transactions, investments, or other activities that follow the tenets of Islamic law, or Sharia.

This concept is especially important when discussing finance and investments, as it establishes particular rules to guarantee adherence to Islamic moral principles.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some of the facts might change from the time of writing, and nothing written here is financial, legal, tax or any kind of individual advice, nor a solicitation to invest.

Shariah Compliant Meaning

Shariah(Sharia) places a strong emphasis on moral behavior, beneficial social effects, and financial gains.

It favors profit-sharing schemes like mudarabah and musharakah and forbids riba or interest.

To fairly distribute risks, investments must steer clear of haram (“sinful and prohibited”) activities like gambling, alcohol, and weapons while focusing on profit and loss sharing.

For transactions to encourage genuine economic activity, they must be asset-backed, connecting them to physical goods or services. To further guarantee openness and justice, too much uncertainty and speculations are avoided.

Shariah Compliant Property Investment

This is used to describe real estate investments that follow Islamic law, guaranteeing that all financial operations are in line with Shariah.

Some types of shariah compliant property investments include:

- Islamic REITs: These are specially designed to adhere to Islamic law, with an emphasis on properties that generate income and a steer clear of interest-based financing. They conform to Shariah principles by providing consistent dividends from rental income.

- Direct shariah compliant land investing: As long as there are no interest-bearing loans involved, buying land or buildings directly may be legal. When buying real estate, investors can take advantage of Islamic finance options that don’t charge interest.

- Real estate crowdfunding: Compared to more conventional approaches, certain platforms provide chances for group investment in Shariah-compliant real estate projects with lower investment minimums.

- Waqf Properties: Waqf or endowment properties are a socially conscious choice for investors since they uphold Islamic values and promote community welfare.

Shariah Compliance Requirements

A few important considerations should be made by investors to guarantee adherence to Shariah principles.

The first step is to have an equity-based investment structure like the Islamic REITs mentioned above, as they make money by collecting rent instead of interest.

A comprehensive screening procedure ought to be carried out to eliminate businesses engaged in illegal activity and guarantee moral behavior.

Seeking advice from certified Shariah boards or advisors can offer insightful information about whether particular investments adhere to compliance requirements.

What you need for Shariah Compliant Land Investing

Investors must make sure that any property or investment vehicle conforms with Shariah principles by doing extensive research. This involves looking over the financing structure and the underlying assets.

To guarantee continuous adherence to Shariah principles, evaluate investment performance and compliance status on a regular basis.

Investors should diversify their portfolios across different Shariah compliant investment options in order to trim risk exposure.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.