Structured notes are complicated, but widely sold, investments in the expat market and beyond, including by many banks that target locals around the world.

This article will example these investments in more detail. If you have structured notes in your portfolio and want a review, my contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What are structured notes?

A structured note is a financial derivative that tracks certain assets. They claim to be able to protect investors from the downside of markets.

They typically track numerous asset classes for a period of time and have something called a protection barrier and coupon trigger or investment yield.

For example, a structured note could track 4 indexes. In this case let’s give an example of the UK FTSE 100, the US S&P 500 Index, the Japanese Nikkei and the Shanghai Composite Exchange.

The note may last for 5 years, from 2019, until 2024. The notes pay out 2% quarterly (this is the coupon trigger or the investment yield), so 8% per year.

However, the investor only gets this quarterly payment, if the investments don’t fall below 20% of their original value.

If any of the investments within the note fall below 20% during the 3 month period, the investor doesn’t get the payment, even if the other 3-4 assets have risen in value!

The note is also protected, up to a point. So, in this case, the client gets their money back, at the end of the 5 years, provided the markets don’t fall by more than 35%.

In many cases, if even 1 of the 4 or 5 underlying investments falls below the 35% barrier at matruity, the investor can lose a lot of money.

The above is one example (in this case based on indexes) of how structured notes are used. Many other notes track individual stocks, commodities and other assets.

They are all based on the same principles though. Downside protection and the chance to make yields.

What’s not to like? Provided markets don’t fall more than 35%, you don’t lose money AND you will get many 2% quarterly payments?

Well it isn’t that simple. This article will explain this in more detail.

Where are structured notes typically sold?

They are widely sold in the expat markets, within lump sum products, as the article below explains in more depth. They are also sold in other onshore markets, focused on the local populations.

Impact of Global Economic Changes on Structured Notes

The landscape for structured notes continually evolves, significantly influenced by global economic shifts.

These shifts include interest rate fluctuations, inflation variations, and geopolitical events, all of which play a critical role in shaping the returns of structured notes.

In this section, we will explore the current factors affecting structured notes and understand why staying informed is crucial for investors.

Decelerating Global Economic Growth

Recent trends indicate a slowing global economic expansion. Before the financial crisis, the global economy could sustainably expand about 4% a year.

That figure fell to about 3.5% in the 2010s and now seems to be limited to 3%. This deceleration impacts structured notes by altering investor expectations and the perceived risk of different markets, potentially leading to shifts in demand and pricing for these financial instruments.

Labor Market Fluctuations and Recovery

The labor market has experienced significant fluctuations, with the job openings rate hitting 4.4% in February 2020, then falling to 3.5% early in the pandemic, and finally leaping to a record high of 7.4% in March 2022 as the economy recovered.

These changes affect consumer spending and overall economic health, which in turn can influence the stock markets and indices to which many structured notes are linked.

Asymmetrical Global Economic Recovery

The global economy is on track for strong but uneven growth as the COVID-19 pandemic continues to have an impact.

Some regions and sectors are recovering faster than others, leading to a patchwork of economic conditions worldwide.

For structured notes, this means the performance of those tied to specific regions or industries may vary widely, necessitating a careful, informed approach from investors.

Revised Growth Projections and Supply Disruptions

Projected global growth has been adjusted, with a slight decrease anticipated for 2021 due to supply disruptions in advanced economies and worsening pandemic dynamics in low-income developing countries.

These supply chain issues can lead to inflationary pressures, affecting the interest rates and market indices that many structured notes are tied to.

The Role of Interest Rates

Interest rates are a cornerstone in determining the value of structured notes. An increase in rates typically decreases the value of these notes, especially if linked to bond yields.

Conversely, a decline in rates can increase their value. The current global economic climate, with its potential for interest rate hikes to combat inflation, could significantly impact the performance of structured notes.

Inflation’s Influence

Inflation variations play a critical role. High inflation can erode the purchasing power of the fixed payments from structured notes, making them less attractive.

Conversely, low inflation or deflation can increase their real value. Monitoring inflation trends is thus essential for predicting the potential performance of these financial instruments.

Geopolitical Stability and Risk

Geopolitical events, such as political unrest, trade disputes, or significant policy changes, can cause market volatility, affecting the performance of structured notes.

Investors must remain vigilant about global events and their potential impacts on investment stability and returns.

What are some of the negatives of structured notes?

The above example shows how complicated structured notes are. You should also be wary of complexity, as opposed to simplicity.

Many structured notes may have a 35% protection barrier, but remember that still has a significant currency risk, especially as it only requires 1 asset to fall significantly.

Take the last 5 years as an example. The FTSE stock market didn’t fall by 30% after Brexit in British Pound terms, but did in US Dollar terms.

In fact, many currencies have fallen by 20%-30% in USD terms in the last 5 years . So all of a sudden, that 35% protection barrier doesn’t seem safe.

All you need is a 15%-20% devaluation + a 15%-20% falls in the stock market to breach the barrier, or indeed a 35.1% currency depreciation and 0% stock market growth.

In addition to that, structured notes have the following negatives:

Lack of dividends

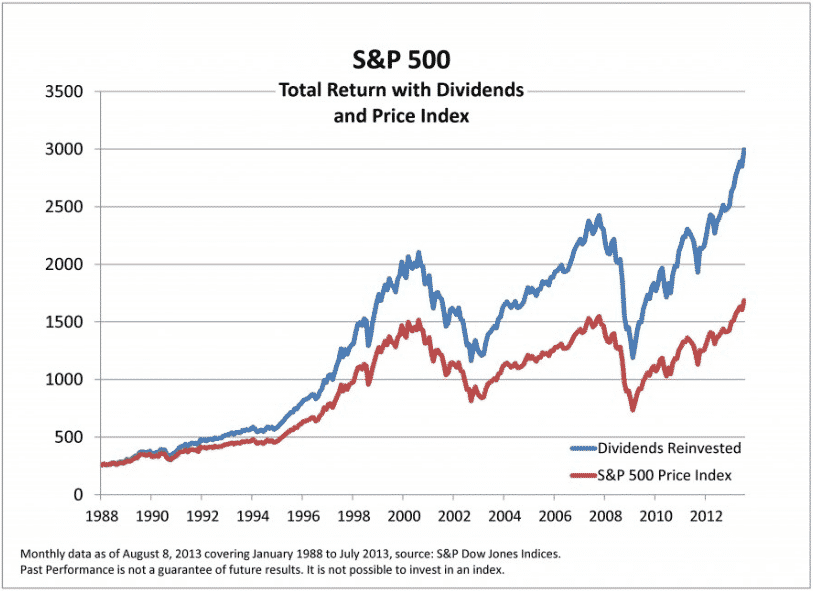

They don’t pay dividends. This is huge. As per the chart below, dividends have historically accounted for a huge part of the S&P’s historical performance:

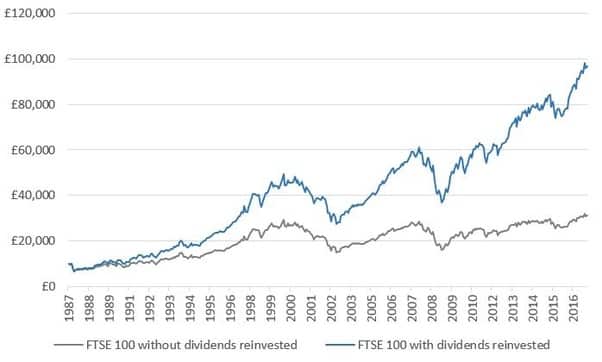

In the UK in recent times, dividend yields have played an even bigger role in the performance of the stock market, due to the FTSE 100 having a 4.5% dividend yield, and less impressive capital appreciation:

Liquidity

It isn’t easy to sell structured notes early, unlike liquid funds. So if you need desperately need some cash, it isn’t easy to sell out. In addition to that, you can’t rebalance a portfolio very easily.

One of the positives about liquid investments, is that you can rebalance if one component is performing especially well. For example, if your US funds are doing better than your UK ones, you might want to sell some of them, and thereby taking advantage of lower valuations in UK markets.

With structured notes, this isn’t easy. In fact, it is often impossible.

Hidden costs

A lot of structured notes have hidden costs, and indeed, hidden risks.

Complete failure

They can completely fail. If the issuing bank fails, an investor could lose all of their money. A guarantee is only as good as the guarantor’s ability to keep to their promises.

Let us not forget that Lehman Brothers produced a lot of guaranteed products and notes.

So in the same way that a debt promise made by the US Government is worth more than the Zimbabwean Government, which is why US Treasury Bills pay so little interest compared to emerging market debt, this risk level varies.

A structured note issued by Goldman Sachs or HSBC, is worth more than one offered by a tiny boutique bank in a developing country, without proper regulation.

In comparison, an investment like an index fund can’t completely fail, unless there is a nuclear war and stock markets no longer exist……

Riskier assets

The assets that are typically picked, within this note, can cause losses. To give the structured notes their price, at least 1 of the 4-5 assets tends to be riskier. This significantly increases the chances of missing coupon triggers and maturity payments.

Remember if your note is based on the aforementioned 4 assets, you could lose money even if 3 of the markets have increased in price by 50%, by one has fallen by 35.1%.

Missing payments

Markets like the US S&P have historically given 10% returns. Granted, this is merely a long-term average.

Between 1985 and 1999, and 2009-2017, markets have exceeded those averages. Likewise, from 2000 until 2009, markets didn’t meet these averages.

Nevertheless, you have to remember that getting 7%-8% sounds good, but in reality is below market returns.

If you miss some of the quarterly payments, you could end up with 5% or less, for taking huge risk.

So are structured notes always awful investments?

I am not suggesting that 100% of structured notes are awful. Some are riskier than others.

Some very sophisticated investors have used them well. If they are 5% of your total wealth, you probably aren’t going to have many products.

In general, however, there are more sensible ways to manage your risk than this. Being long-term (time in the market as opposed to timing the market) and having a greater government bond exposure, are all tried and tested ways to manage market risk.

Comparison with Other Derivative Products

Key Trends Affecting Structured Notes and Derivatives

Regulatory Environment and Its Implications

Regulators worldwide are heightening their scrutiny and demands for transparency in the derivatives market.

This trend is crucial for investors considering structured notes, as increased regulatory oversight can influence the risk and return profile of these products. Understanding the evolving regulatory landscape is key to evaluating structured notes alongside other derivatives.

Market Volatility and Investor Strategy

With market leaders at major derivatives exchanges underscoring the importance of navigating market trends wisely, investors must consider how structured notes perform under volatile conditions.

Unlike standard derivatives, structured notes might offer some capital protection but often at the cost of limited upside potential. As such, they may be more suitable for conservative investors compared to traditional options or futures in a volatile market.

Comparative Analysis: Structured Notes vs. Other Derivatives

Flexibility and Customization

Structured notes often stand out for their ability to be tailored to specific market views and risk appetites.

Unlike standard options or futures, structured notes can provide a range of payoffs based on various market outcomes. However, this customization comes with increased complexity and sometimes higher costs.

Risk and Return Profiles

While derivatives like options and futures offer clear strategies for speculation or hedging, structured notes present a more nuanced risk-return profile.

They can be structured to limit losses but also cap gains. Investors need to weigh these trade-offs carefully against more straightforward derivatives.

Liquidity and Market Access

Liquidity can vary significantly between structured notes and other derivatives. Options and futures are often traded on established exchanges, offering greater liquidity and transparency.

In contrast, structured notes are typically over-the-counter products, which may lead to less liquidity and more opaque pricing.

So why are structured notes popular?

There are two reasons. The banks and some other financial institutions can make a lot of money from these notes.

This is because the amount a bank saves on interest is worth more than the option is worth, often 2%-3% more, and they get to charge a commission for the product.

They are, therefore, aggressively sold by some institutions. Secondly, they have a captive audience with some investors.

Because losses are more painful than gains are pleasurable, many investors don’t want to invest in the stock markets at all.

This isn’t sensible, because long-term, stocks have always gone up in a big way. Many new and inexperienced investors, are sold the idea that they can have their cake and eat it.

Get 70%-80% of the potential market gain, whilst having downside protection. In reality, there is no such thing as a free lunch.

It is also true to suggest that some investors assume a very sophisticated investment, is better than a simple one. So structured notes are disturbing other “professional investor type assets” like hedge funds, for this very reason.

However, if an advisor knows what he/she is doing, they can be used intelligently.

Are there any positives about structured notes?

It is true that they are very flexible. You can pick numerous currencies, indexes and individual investments within the same note.

They can be tax-efficient in many countries, as the gains are considered long-term capital gains, although most equity investments into low-cost funds are also tax advantageous.

Finally, if the actual investment or index is going down, they can be a good deal. In other words, let’s say you have a structured note linked to 3-4 indexes, including the US S&P500. It pays out 8% per year. During the next 5 years, the S&P500 falls by 10%.

All of a sudden, you are making 8% per year, when the market is falling. However, remember that historically, you don’t need to worry about market falls.

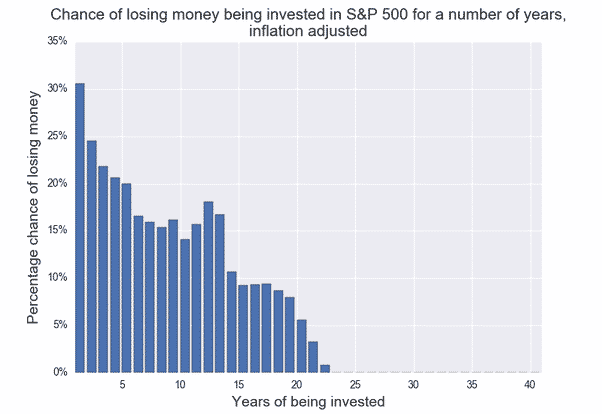

As the graph below shows, indexes tend to rise over time, meaning your chances of losing money fall over time:

So often you don’t need these protection barriers, taking huge risks in the process, to get such “protections”.

The biggest positives with notes is if they are used in an intelligent way, which often means picking very specific ones.

The Role of Credit Ratings in Structured Notes

Understanding Credit Ratings in Structured Notes

Credit ratings, issued by agencies like Fitch and S&P, assess the creditworthiness of the note issuers. A high credit rating indicates a lower risk of default, which is particularly important for structured notes as they often involve derivatives and underlying assets that can be volatile.

Fitch Ratings recently updated its criteria for Single- and Multi-Name Credit-Linked Notes, reflecting the evolving market conditions and risk assessments. These updates are essential as they guide investors on the current stability and risk associated with structured notes.

Impact of Global Economic Conditions

Economic Fundamentals and Structured Finance

The performance of structured finance assets, including structured notes, is expected to weaken as global economic fundamentals deteriorate. Factors like tight monetary policy, high interest rates, and widening credit spreads are poised to impact refinancing and overall stability.

Regional Bank Ratings and Structured Finance

The credit ratings of U.S. regional banks, which often play a significant role in structured notes, have seen limited impact on the ratings of structured finance transactions. This is due to limited exposure and structural features designed to mitigate risk.

The Global Bond Market and Structured Notes

As global bond issuance is expected to rise, understanding the interconnectedness between the bond market and structured notes is crucial. The overall health of the bond market can significantly influence the performance and stability of structured notes.

What has been the recent performance?

In the last 10 years, markets have been fairly positive. So this has resulted in two things; most notes haven’t completely failed, but have produced much lower than market averages.

Let’s therefore, look at the how many structured notes might have performed from 2008 (the year of the crisis) and the aftermath. In 2018, many indexes were down by 36%-37%.

Structured notes would have likely fallen by 25%-30%, which sounds good in comparison, even though no dividends was paid to ease the fall.

Then in 2009, markets increased by 26%, meaning that structured notes investors would have lost out on a lot of growth. A 8% coupon doesn’t sound so good when markets are increasing by 26% a year!

And in reality, for most years of this current bull market, structured notes investors would have missed out on a lot of growth.

They would have only outperformed during one year most likely – the year of 20008-2009.

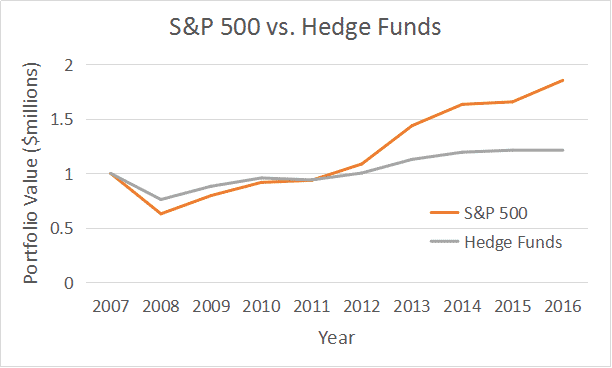

Warren Buffett had a famous $1m bet with a hedge fund manager more than 10 years ago, for charity. The bet was simple; hedge funds wouldn’t be able to beat the S&P500 over 10 years, even if they could do it for 1-2 years.

Buffett knows the maths behind hedge fund fees (which are similar to structured notes fees in a different kind of way), would impact net returns.

Here was the result over the 10 year period:

So with the excerption of 1-2 years, the hedge funds vastly underperformed. I highly suspect Buffett would also be willing to bet on structured notes failing to beat indexes over any 10 year period!

Regulatory Landscape and Compliance for Structured Notes

The regulatory landscape for structured notes is complex and varies by jurisdiction. Compliance is key to ensuring the safety and legality of issuing and trading these financial instruments.

Navigating the Regulatory Framework

Understanding the regulations governing the issuance and trading of structured notes is crucial for issuers and investors alike. These regulations are designed to protect investors and maintain market stability.

Key Regulatory Bodies and Standards

Where the note is sold and domiciled will often affect the regulation.

Regulatory bodies worldwide, including the SEC in the United States and similar entities in other countries, set standards and guidelines for structured notes. They focus on disclosure, trading practices, and risk management.

Innovations and Future Trends in Structured Notes

In the evolving landscape of financial markets, structured notes have emerged as a key player, offering unique investment opportunities tailored to varying investor needs.

With advancements in technology and shifts in market dynamics, the structured notes market is experiencing rapid growth and transformation.

This section will delve into the latest innovations, market trends, and the impacts of global events on structured notes, drawing from recent developments and expert insights.

Platforms Deliver Real Differentiators

The rise of multi-dealer platforms has revolutionized the structured products market. These platforms enhance growth opportunities by simplifying the process of analyzing, trading, and monitoring structured products.

They’ve evolved to meet the needs of pricing platforms and improve the technology underlying the creation, distribution, and management of structured products.

For issuers, platforms mean a shift to electronic operations and a focus on managing risks and lifecycle events, while sales and distribution are streamlined through these platforms.

They provide quick price discovery and transparency, allowing investors to compare real-time quotes from multiple issuers and make fast transactions, a crucial feature for those seeking quick execution and protection.

Enhancing Transparency and Liquidity

Platforms are democratizing the structured products market by offering real-time views on pricing and risk, thus adding transparency and solving traditional problems associated with structured products.

They cater to the growing demand for speed, offering quick execution, pre-trade analysis, and portfolio management tools.

This trend towards electronic distribution is reshaping how investors engage with structured notes, making them more accessible and understandable.

Key Trends In The Marketplace

The marketplace for structured products is witnessing several key trends driven by innovation and changing investor needs.

The demand is shifting from a small segment of ultra-high net worth individuals to a broader population seeking portfolio protection with a defined outcome.

This shift necessitates the simplification of products and their terms, making analytics more accessible to a wider audience.

There’s also a growing demand for more exotic payoff ideas and complex features aimed at increasing yield.

As competition between issuers tightens, there’s a push towards automating the front office to facilitate wider distribution and better meet investor demands in a low-interest rate environment.

The Push for Simplification and Protection

Investors are increasingly favoring a “passive” trend, seeking more protective measures for their portfolios.

This trend is driving structured products towards generating better overall portfolio outcomes. Simultaneously, there’s an “active tactical” trend where investors seek complex payoff structures to maximize yield.

These dual trends reflect the diverse needs of investors and the market’s response to cater to these varying demands.

Differences In Regional Usage

Structured products are now an investment staple worldwide, but their usage and types vary significantly across regions.

Europe leads in advanced usage, while the Asia-Pacific region, particularly Singapore and Hong Kong, actively engages in structured products.

The U.S. market, comparatively less advanced, shows substantial growth potential. Investor education is pivotal for market expansion, especially in regions new to structured notes.

The underlying assets of structured products also vary by region, reflecting the unique characteristics and needs of local investors.

Adapting to Local Market Needs

Understanding the country-specific needs and market conditions is crucial in structured products’ distribution and acceptance.

For instance, U.S. structured products are primarily equity-based, while in Asia-Pacific, products based on the FX space are more common. This regional variation underlines the importance of customizing structured notes to suit local investor needs and market conditions.

Impact of COVID on The Structured Products Market

The COVID-19 pandemic has significantly impacted the structured products market, accelerating the shift towards digital platforms and highlighting the need for robust risk management and analytics tools.

The pandemic-induced market volatility has underscored the importance of reliable risk models, real-time price updates, and better calculation methodologies.

Moreover, the shift to digital platforms has reduced reliance on traditional sales methods, making structured products more accessible and popular among a broader audience.

Accelerating Digital Transformation

The pandemic has accelerated the adoption of digital platforms for structured product distribution, offering lower fees, greater transparency, and more comprehensive data.

This shift has made structured products more popular, offering a middle ground between the low yield of fixed income and the high risk of equities.

As the market continues to adapt to these changes, the role of technology and digital platforms in structured products’ growth and accessibility is expected to increase further.

Conclusion: are structured notes a good investment?

Structured notes can be used intelligently by professional investors or those who are being advised by an advisor.

For the average investor without an advisor, they generally aren’t suitable. Therefore, if you have them in your portfolio, you should consider an alternative investment, once the investment has ended.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Interesting article thanks Adam. I was sold these investments before.