In today’s rapidly digitalizing world, managing money globally has never been more crucial.

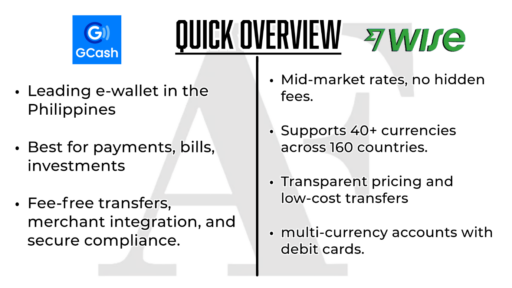

Two giants have stepped into the ring: GCash, the top e-wallet in the Philippines, and Wise (formerly TransferWise), a cross-border money transfer company.

But which is best for you?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

Let’s dive into an in-depth comparison of GCash vs Wise to assist you in making the right choice.

What Is Gcash Used For?

GCash began as a basic payment application and grew to be the leading financial ecosystem in the Philippines, with over 40 million registered accounts.

But what actually can you do with it?

At its most basic, GCash can do the following:

- Pay for food delivery

- Pay subscription fees for streaming services such as Netflix and Spotify

- Make charitable donations

- Transfer money to another GCash account at no charge

That is just the tip of the iceberg. GCash has transitioned from basic transactions to now having features such as:

- GInvest:

This enables investing because it enables users to invest in the financial markets for as little as ₱50.

Filipinos can invest in five investment fund products handled by ATRAM via GInvest, ranging from money market funds to global consumer trends funds and equity index funds.

- GLife:

An in-app e-commerce component linking users to more than 30 leading merchants such as McDonald’s, KFC, and Lazada—all without having to download various apps.

- GCash QR on Demand:

A secure payment system that keeps users’ privacy intact by removing the necessity to disclose personal details such as mobile numbers just to pay.

What Does Wise Do?

Wondering what makes Wise different from traditional banks?

Wise is a London-headquartered niche global money transfer company (formerly called TransferWise from 2021).

It was founded by Taavet Hinrikus (who is also a founding member of Skype) and Kristo Käärmann.

Wise is now a global fintech titan.

Unlike GCash, which is more focused on domestic transactions, Wise is the low-cost international money transfer company that has found an innovative solution.

When you transfer money abroad with Wise, your money never actually leaves your nation.

Instead, you pay into the Wise account in your nation, and they use their account in the receiving nation to pay out in the local equivalent.

This stroke of genius avoids the eye-watering fees and rubbish exchange rates that are the normal lot when working with foreign banks.

Wise provides:

- Support for 40+ currencies and 160 countries

- International virtual bank accounts to make payments in foreign currencies

- A Wise debit card to spend overseas without paying foreign transaction fees

Fees Comparison: GCash vs Wise

GCash Charges 2025

GCash offers a range of financial services with varying fee structures. Here are the essential fees to know:

💰Cash In Fees:

- Free for first PHP 8,000 monthly (over-the-counter)

- 2% fee on amounts exceeding PHP 8,000 monthly

- Bank transfers: BPI and UnionBank (PHP 5), PayPal and Payoneer (1%)

💰GCash Card:

- ATM withdrawal fees: PHP 0-18 (charged by ATM providers)

- Withdrawal limits: PHP 20,099 per transaction, PHP 40,099 daily

💰Investment & Loans:

- GFunds: No transaction fees, annual management fees range from 0.50% to 1.75%

- GGives loans: 0-5.49% monthly interest rate

- Late payment penalties: 1% of loan amount plus 0.15% daily on outstanding balances

For a detailed overview of GCash fees, you can refer to their help section covering fee details.

Wise Fees and Charges 2025

Wise offers multi-currency financial services with various fees:

💰Account Setup & Maintenance:

- Account registration: Free

- Multi-currency card: 9 USD (one-time fee)

- Holding and managing multiple currencies: Free

💰Sending & Converting Money:

- Sending/converting money: varies by currency or country (e.g. from 0.33% in the UK, from 0.57% in the US)

- Pay with Wise card in any currency: Free

- Account funding transactions (e-wallet top-ups): 2%

💰ATM Withdrawals:

- First 100 USD (or 200 GBP) per month (max 2 withdrawals): Free

- Above the monthly limit: 1.50 USD per withdrawal + 2% (or 0.5 GBP per withdrawal + 1.75%)

💰Receiving Money:

- Account details for receiving in 23 currencies: Free

- Domestic non-Swift payments in supported currencies: Free

- Receiving international payments (Swift/wire):

- USD: 6.11 USD per payment

- GBP: 2.16 GBP per payment

- EUR: 2.39 EUR per payment

For a detailed overview of fees charged by Wise, you can refer to their “Pricing Page”.

Security: Can You Trust These Platforms?

Is It Safe to Use GCash?

You’ll be glad to know that GCash employs multiple security layers:

- Industry-standard encryption protocols

- Mobile PIN (MPIN) system for transaction authorization

- Biometric authentication options (fingerprint and facial recognition)

- Strict regulatory compliance with the Bangko Sentral ng Pilipinas (BSP)

- Transaction limits (₱1-₱100,000) to mitigate fraud risks

- Requirement for Philippine phone numbers as an additional verification layer

- Real-time monitoring systems to detect suspicious activities

How Trustworthy Is Wise?

Wise has established itself as highly reliable with:

- Oversight from multiple financial authorities (FinCEN in the US, FCA in the UK)

- Two-factor authentication for account access

- End-to-end encryption for data transmission

- Regular security audits

- Segregation of client funds from operational expenses

- Transparent fee structure that builds trust

Despite leadership changes in recent years, Wise has maintained its reputation for reliability and customer trust.

FAQs

Can GCash Be Used Internationally?

Simply put, GCash has significant limitations for international use:

- It requires a Philippine mobile number for registration in most countries

- People with Philippine IDs living abroad can seamlessly use it

- While GCash functions primarily as a domestic tool rather than a global payment solution in a strict sense, it can be used for cashless payments abroad at partner merchants.

- The GCash card can also be used for ATM withdrawals and payments overseas, so long as the business accepts Visa and Mastercard.

Can You Use Wise Internationally?

Absolutely! Wise’s entire business model centers on international transfers:

- Available in 160+ countries

- Supports 40+ currencies

- Provides local bank details in multiple countries

- Designed specifically for cross-border financial activities

Is Wise Connected to GCash?

No, there is no direct integration between Wise and GCash as of March 2025. The two platforms operate as separate financial services with distinct ownership structures and target markets.

To move funds between these platforms, you would typically need to:

- Withdraw funds from one platform to a personal bank account

- Transfer from that bank account to the other service

This indirect method usually results in additional processing time and potentially extra fees.

Can I Withdraw Money from Wise?

Yes, Wise offers multiple withdrawal options:

- Direct transfer to a linked bank account (typically 1-2 business days)

- ATM withdrawals using the Wise debit card (subject to daily and monthly limits)

- Direct purchases at merchants accepting Mastercard or Visa

For larger sums, Wise recommends transferring to traditional bank accounts rather than keeping them in your Wise account for extended periods.

Is Wise App Good or Bad?

The Wise app receives consistently positive reviews for:

- Intuitive interface that simplifies complex international transactions

- Real-time tracking of transfers

- Strong performance with minimal downtime

- Regular security updates

- Biometric authentication and instant notifications

- In-app customer support

While its domestic payment capabilities are more limited than specialized local apps, the Wise app excels at international finance management.

Is GCash Only in Philippines?

No, GCash is no longer exclusively available in the Philippines. The firm has expanded its operations to serve Filipinos living abroad.

Final Verdict: Which Platform Is Right for You?

Still wondering which platform best suits your needs?

Choose GCash if you:

- Live in the Philippines

- Need a comprehensive local e-wallet

- Want to make domestic payments, investments, and transactions

- Prefer a platform integrated with local services and merchants

- Want easy payments abroad via Gcash card with no extra charge

Choose Wise if you:

- Need to transfer money internationally

- Want the best available exchange rates

- Require multi-currency accounts

- Travel frequently and need to spend in different currencies

- Value transparent pricing and no hidden fees

Both platforms excel in their respective domains; GCash as a domestic Philippine e-wallet and Wise as a global money transfer service.

Understanding their fundamental differences allows you to select the appropriate platform based on your specific financial needs.

By leveraging the strengths of each platform, you can optimize your digital financial experience, regardless of whether you need to manage daily finances within the Philippines or conduct cross-border transactions internationally.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.