Know the different ways to send money from Mexico in this article.

Nothing written here should be considered as financial advice, nor a solicitation to invest.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via advice@adamfayed.com

It is usually better to “kill two birds with one stone” and invest as an expat, rather than send money home to buy shares or a house.

Introduction

When it comes to finding ways to send money from Mexico to other countries, whether it be to the USA, Nigeria, or the rest of the world, there are different money transfer services to choose from. However, we have compiled some of them, taking into consideration their convenience of use, transfer fees, and processing time.

Ways to Send Money From Mexico

1. Global66

Global66 was founded in 2017. It is trusted by over 500 thousand users around the world. Local and international transfers totaling more than 31 million dollars per month are performed using this platform. Users from nine countries, including Mexico, can send money using Global66 to recipients in 55 destinations.

For example, sending 10,000 MXN to the US will not be charged any commission fees. But a 300 MXN exchange rate cost will be deducted. Because of this, only 9,700 MXN will be converted using the real exchange rate. With an exchange rate of 1 MXN = 0.049 USD, the recipient will get 475 USD through their Global66 Wallet or bank account. The money transfer is often completed in real time or on the same day.

The minimum amount to send money from Mexico is 409.00 MXN (20 USD), while the maximum amount is dependent on the method of payment. For an electronic transfer through a bank account, the maximum amount is 30,000 USD, or its equivalent (612,962.40 MXN), per month. When using PayCash, a maximum of 1,000 USD, or its equivalent (20,432.08 MXN), can be sent every 24 hours. PayCash allows users to fund the transfer through cash deposits.

Signing up for an account at Global66 will automatically entitle users to a free Multi-Currency Wallet. This feature allows them to load money, convert it to a different currency, and send it to the relevant recipients. At the same time, the amount in the wallet can be withdrawn in the local currency of the user.

Global66 purely operates digitally and does not have physical branches. They have an online site and a mobile application on the App Store and Google Play.

- Payment Method: cash or bank transfer

- Receiving Method: Global66 Wallet or bank account

- Processing Time: within the day

2. OFX

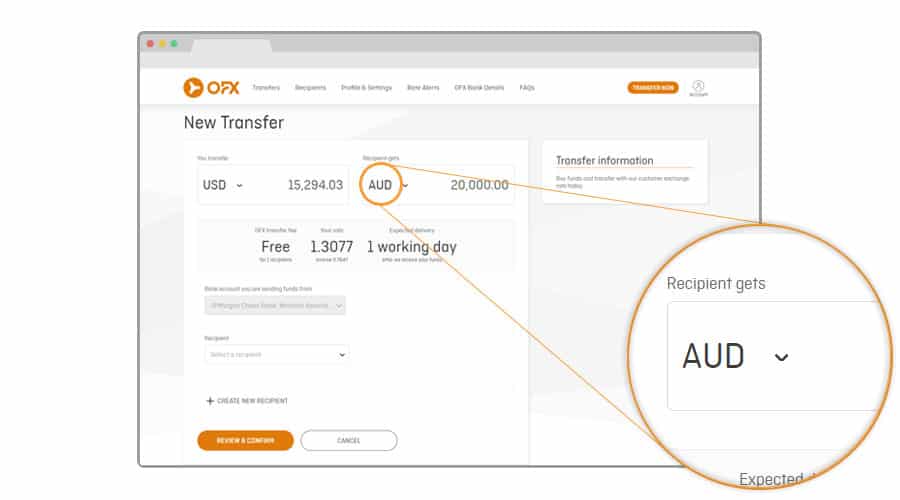

OFX was initially founded as OzForex in 1998. Today, users can make transfers in over 50 currencies to more than 190 countries worldwide.

For example, when you send 10,000 MXN to the US with a market (interbank) rate of 1 MXN = 0.0489 USD, the recipient will get 488.87 USD. However, this does not provide a complete picture of what a money transfer would look like using the platform. Specific OFX customer rates can only be obtained by registering for an account online or through their mobile app.

In general, a money transfer can be paid using a direct debit from a bank account or through a wire transfer. Cash or cheques are not accepted for this purpose. On the other hand, the recipient will get the money through their bank account. This is often completed within the day. But there are instances where it can take up to 1–4 business days, depending on the currencies involved in the transaction.

OFX also offers services for recurring transfers, which provide the convenience of scheduling regular payments at one time. Furthermore, users can set up a “Forward Exchange Contract” that allows them to lock in an exchange rate for a maximum period of 12 months. This provides protection from fluctuating exchange rates.

- Payment Method: direct debit or wire transfer

- Receiving Method: bank account

- Processing Time: 24 hours or up to 5 days

3. MoneyGram

MoneyGram International was founded in 1998. But even before then, the company had already been rooted in years’ worth of experience operating as Travelers Express. Over 80 years later, they have become favored by more than 150 million customers. And, at the same time, they have expanded into 200 countries by establishing 380,000 physical locations and entering the digital sphere.

Currently, MoneyGram only offers in-person money transfers for individuals in Mexico. In order to do so, you must prepare your I.D., details of the recipient (full name and location), and cash to be sent plus payment for the transfer fee. Then, head on over to any MoneyGram agent location that is most convenient for you. Upon completing the transaction, you will be issued a receipt that contains an 8-digit reference number. The recipient can get the money within minutes through cash pick-up, wherein they will need the reference number. Alternatively, the money can be credited directly to their bank account or mobile wallet.

The minimum and maximum amounts to send money from Mexico through MoneyGram are dependent on the receiving country. In addition to this, the fees charged for the money transfer differ according to the amount sent.

- Payment Method: cash

- Receiving Method: cash pick-up, bank account, or mobile wallet

- Processing Time: within minutes

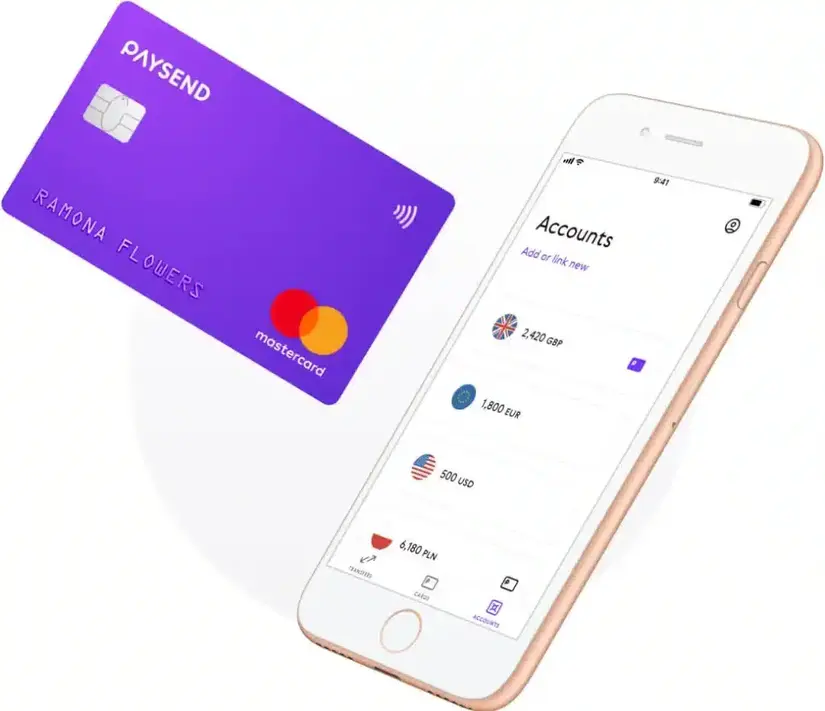

4. Paysend

Paysend is a financial technology (FinTech) company that was established in 2017. They operate in more than 150 countries, catering to the needs of over 6 million people and small-to-medium enterprises (SMEs). By partnering up with Mastercard, Visa, UnionPay, and other institutions, they enable users to send money at whatever time of the day.

For example, to send 10,000 USD from Mexico to Nigeria through Paysend, a 2.00 USD fixed fee will be charged. On the same day, the recipient will get 9,998 USD through their Mastercard card, bank account, or cash pickup. The money transfer fee charged is the same regardless of the amount sent and how the recipient gets the money.

It is also important to note that only the USD currency can be sent from Mexico. The money transferred will be delivered in the local currency of the recipient country.

Interested individuals can create a Paysend account online. A mobile app, which can be downloaded from the App Store or Google Play, can be used to track and create new transfers.

- Payment Method: Mastercard card, Visa debit, credit card, prepaid card

- Receiving Method: Mastercard card, bank account, cash pickup, or mobile wallet

- Processing Time: within minutes or up to 3 days

5. Western Union

Western Union was founded in 1851. Since then, they have grown to serve over 150 million customers scattered throughout 200 countries and territories. They also support transactions in 130 different currencies.

To send money from Mexico through Western Union, you can do so by physically visiting an agent location. Make sure to bring a valid official ID that has your photo on it. At the same time, be prepared with information about the recipient, such as their full name and location (city, state, country).

Individuals can also download Western Union’s mobile app from the App Store or Google Play. However, this can only be used to initiate a money transfer. The transaction should still be completed at an agent location within 12 hours. In addition to an official, valid ID, you must also bring the Money Transfer Control Number (MTCN) generated on the mobile app.

A maximum amount of $7,499 USD, or its equivalent (153,202.55 MXN), can be transferred in a single transaction per day. But agent locations can also have their own send limits, which are less than what was previously mentioned. Furthermore, money transfer fees will vary depending on the amount sent. In general, it can range between 150 MXN and 696 MXN, with the highest fees applied to transfers ranging from 15,001.00 MXN to 97,500.00 MXN. The money transfer and relevant fees charged by Western Union must be paid for in cash.

The recipient can expect to get the money within minutes or after a day through cash pickup.

- Payment Method: cash

- Receiving Method: cash

- Processing Time: within minutes or up to a day

6. HSBC

HSBC was established in 1865. Since then, 40 million personal, wealth, and corporate customers have been entrusting their banking needs with the financial institution. HSBC also supports transactions in 64 countries and territories.

They offer international transfer services through internet banking to HSBC account holders. To avail of this feature, you must add or register a beneficiary to your account by providing their name, direction, and account number. After two hours, you can proceed with the transaction. This can only be done during business hours. At the same time, they only support six currencies, namely, the US dollar, Euro, British Pound, Canadian Dollar, Japanese Yen, and Mexican Pesos.

The money transfer fees will depend on the HSBC account that you have. Premier, patrimonial, premier executive, and private clients are entitled to 2 free international transfers per month. Any more than that will be charged 31 USD, or its equivalent (633.19 MXN), plus VAT per transaction. There is no limit to the amount that can be transferred.

For clients under HSBC’s personal banking and advance segments, a fee of 31 USD plus VAT will be charged per international transfer. The maximum amount that can be transferred is 150,000 MXN. The recipient can expect the money within 4 days.

HSBC also has the “Global View and Global Transfers” service, similarly offered through internet banking. This is advantageous for users who have HSBC Advance or Premier accounts both inside and outside of Mexico. With this feature, account holders can send and receive money between their own local and international HSBC accounts in real time at any time of the day throughout the week.

A transfer fee of 139.00 MXN plus VAT will be charged for Advance account holders. On the other hand, the transaction is free of charge for those with Premier accounts. Regardless of the account owned, the maximum amount that can be transferred per day is 400,000 USD, or its equivalent (8,171,892.00 MXN).

Conclusion

In general, MoneyGram and Western Union in Mexico only offer payment methods in cash. Because of this, using their services would require a visit to one of their branches. On the other hand, OFX and Paysend only accept payment through online means, with no option for cash. In this regard, Global66 provides broader options for funding money transfers. In terms of the maximum amount that can be sent, HSBC offers the highest limit, at least according to what is published.

With this, we have provided six different ways to send money from Mexico to other countries. The best thing to do to determine the transfer limits, fees, and exchange rates will be to create an account with them. This is because specific information relevant to your situation can only be obtained by then.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.