When transferring money internationally, Western Union and PayPal are two of the leading companies.

In this article, we provide a detailed comparison of their services based on transfer fees, speed, convenience, and security measures.

Our aim is to provide you with factual information that will enable you to make an informed decision on which platform is most suitable for your business or personal remittance needs.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

Western Union History

Founded in 1851 as a telegraph company, Western Union eventually became the world’s largest money transfer business.

The company was an early leader in financial innovation, introducing groundbreaking products such as the first stock ticker and a consumer charge card before eventually focusing its business on money transfers.

What are the services of Western Union?

- International money transfer to 200+ countries

- Cash pickup from over 500,000 agent outlets worldwide

- Deposits into bank accounts

- Transfers to mobile wallets

- Bill payment services

- Prepaid cards and money orders

- Business payment solutions

PayPal History

Originally established in 1998 as Confinity by Luke Nosek, Max Levchin, and Peter Thiel, PayPal subsequently merged with Elon Musk’s X.com in 2000.

Paypal has risen as one of the earliest and most widely used digital payment systems. The service was later acquired by eBay in 2002, and then spun off as an independent company once again in 2015.

What are the services of PayPal?

- Domestic and cross-border fund transfers

- Online business payment processing services

- Buyer and seller protection programs

- PayPal Credit financing facilities

- Buying, holding, and selling cryptocurrencies

- PayPal Business accounts with enhanced features

- E-commerce solution integration

Western Union vs PayPal: Who has better rates?

What are Western Union fees?

Western Union has one of the biggest payment networks globally with more than 500,000 agent offices.

It has a fee structure based on a variety of factors like the amount of transfer, receiving country, payment mode, and speed of delivery chosen. For instance, cash-to-cash transfers are usually the costliest and will range between roughly $5 and $95 based on the transfer amount and receiving country. Conversely, online bank transfers cost less, with small, domestic transactions costing around $2.99. Hence, there is an extra 2–3% on top of the usual fee incurred by a credit card.

Promotional prices to hot spots such as Mexico and the Philippines are offered from time to time.

In addition, Western Union’s exchange margin is a hidden commission that makes up much of the cost of a transfer, especially for large amounts. This is typically between 3% and 6% over the mid-market rate for major currencies, and higher for less major ones.

Speed of delivery is also something that incurs a charge; “Money in Minutes” costs more than “Next Day” or regular delivery.

Besides these, the customers also have to remit local office or agent bank fees which are not Western Union’s decision.

To get a precise estimate, you can use the Western Union price estimator.

What are PayPal fees?

PayPal charges using a fee schedule that has fixed sums and percentages, both varying according to transaction type and region.

For instance, domestic payment from a connected bank account or PayPal balance has no fee and is suitable for payment to family and friends. Sending money by cards do have an added cost of 2.9% plus a fixed amount ($0.30 in the United States).

International personal transactions are charged an additional 5% fee on top of that. Currency conversions may also cost you 3~4%.

Withdrawals to a bank account, in certain places—primarily outside the U.S. and Europe—are going to incur a fee.

PayPal raised its highest fee increase in a decade by raising the processing fees on its Buy Now Pay Later (BNPL) product from 3.49% to 4.99% plus a flat charge on January 13, 2025. This 43% increase made BNPL the most lucrative payment method for the platform, even surpassing normal credit card charges.

For American merchants, the tiered fee structure is as below:

- Card-present or QR code transactions through PayPal Zettle: 2.29% + $0.09

- QR code payments: 2.29%+ fixed fee $0.09

- Credit card and debit card payments: 2.89% or 2.99%+ fixed fee

- PayPal Checkout: 3.49% + fixed fee $0.49

- Transactions with Pay Later option: 4.99% + fixed fee $0.49

- Invoicing transactions: 2.99% to 4.99% + a fixed fee $0.49

For transactions requiring currency conversion, an additional spread (3~4%) can be charged on top of domestic rates.

There are extra fees for such occurrences as chargebacks ($20) and payment disputes ($15).

While these fees subsidize PayPal’s vast foreign network and simplicity, the interoperability of percentage fees, flat fees, and exchange rate markups can become very costly to low-value cross-border payments made by foreign firms.

Refer to PayPal’s detailed fee overview for precise estimates.

Which is better, Western Union or PayPal?

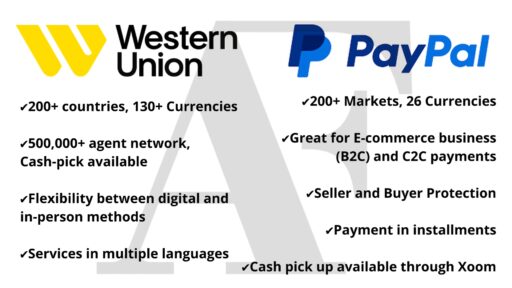

Western Union has an unrivaled brick-and-mortar presence, having financial services across even the smallest locations and newly emerging economies in over 200 countries and territories. It provides varied speeds of delivery—ranging from premium, fast services in minutes paid up-front to economical ones delivered within 3–5 days.

The web-based products of the company have increased significantly, taking a larger portion of its business. The customers also receive discounts on subsequent purchases with the MyWU rewards club.

Western Union offers specialized services for commercial payments and NGOs that operate in difficult markets, complementing its flexibility in addressing varied financial requirements.

PayPal is also available in more than 200 countries and supports 26 currencies, so it is one of the world’s most globally available payment systems. It allows near-instant transfers between PayPal accounts, and bank transfers generally take 1–3 business days.

Its comprehensive Seller Protection program allows sellers to control fraud risk, and Buyer Protection ensures buyers will receive the goods or services described.

In addition, PayPal has further expanded its coverage of service to encompass point-of-sale options such as PayPal Here and QR code payments to better enhance offline and online flexibility.

Conclusion

In brief, both PayPal and Western Union have their advantages.

Western Union’s long history and wide physical presence are best suited to traditional remittance services.

Whereas PayPal provides the ease of a virtual platform with smooth integration into online transactions.

Assessing your particular needs and staying abreast of any service innovations through ongoing due diligence will help you make the most cost-efficient and secure decision.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.