When it comes to sending money internationally, choosing the right service can save you both time and money. Two popular options dominate the market: Western Union, a traditional money transfer giant, and Wise (formerly TransferWise), a modern fintech disruptor.

But which one is actually better for your specific needs?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

In this comprehensive comparison, we’ll break down everything you need to know about Western Union vs Wise. This ranges from fees and exchange rates to transfer speeds and accessibility, thus helping you make an informed decision for your next money transfer.

What Is Western Union and How Does It Work?

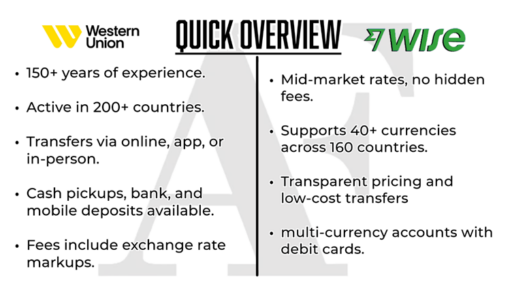

Western Union stands as one of the oldest and most established money transfer services in the world, boasting over 150 years of operation. With its expansive global network spanning more than 200 countries, it offers unparalleled reach for international transfers.

But how exactly does Western Union work?

The process is surprisingly flexible. Users can initiate transfers through multiple channels. These include online through the Western Union website, via the mobile app, and in-person at thousands of physical agent locations worldwide.

When sending money, you have several payment options, including:

- Cash

- Bank transfers

- Credit or debit cards

- Phone transactions (available in select regions)

Recipients enjoy similar flexibility, with the ability to collect funds as cash at agent locations or have them deposited directly into their bank accounts.

Every transaction generates a unique Money Transfer Control Number (MTCN), allowing both the sender and recipient to track the transfer’s progress.

Processing times vary significantly depending on your chosen method and destination, ranging from minutes for urgent cash pickups to several days for bank transfers.

What Does Wise Do?

Wise, formerly known as TransferWise, represents the new wave of financial technology companies designed specifically to address the pain points of international money transfers.

What makes Wise different from traditional services?

At its core, Wise operates on a simple principle: transparency.

The company uses the real mid-market exchange rate (the same one you’ll find on Google) without the hidden markups common among traditional money transfer services.

Wise currently supports transfers to over 70 countries, with funds delivered directly to recipients’ bank accounts. Users can fund their transfers through:

- Bank transfers

- Credit or debit cards

- Apple Pay

The service has gained popularity among both individuals and businesses who make regular international payments, thanks to its user-friendly online platform and commitment to low fees.

Unlike Western Union, Wise operates almost entirely in the digital space, with minimal physical presence.

This online-first approach allows them to keep operational costs low – savings they pass on to customers.

Western Union vs Wise Fees

When comparing costs between Western Union and Wise, you need to consider two key components: the upfront transfer fee and the exchange rate markup.

Western Union Fees

Western Union’s fee structure can be complex, varying based on:

- The currency you’re sending

- Your chosen payment method

- The destination country

- The amount being transferred

Beyond the visible transfer fee, Western Union also applies an exchange rate markup.

It also charges an additional hidden fee by offering a less favorable exchange rate than the mid-market rate.

Therefore, after factoring in their exchange rate markup, the recipient would receive significantly less money than expected.

To get an estimate regarding the fees and other charges, you can use Western Union’s “Price Estimator”.

Wise Fees

Wise takes a different approach with a straightforward fee structure:

Wise Fees Simplified (April 2025)

Nobody loves talking about fees, but here’s what you need to know about Wise’s pricing structure:

Getting Started:

- Account setup costs nothing.

- A physical multi-currency card cost a one-time $9 fee.

- Holding your money in up to 40+ currencies is free.

Wise Transfer Charges:

- Sending or converting between currencies starts at 0.33% (depends which currencies you’re using)

- Shopping with your Wise card is free.

Wise Withdrawals:

- Free withdrawal up to 2 times, up to a certain monthly allowance (the limit may differ between countries).

- For additional withdrawals, expect fees charged based on how many times you withdraw and how much you withdraw.

- Topping up e-wallets comes with a 2% fee.

Wise Receive Money Charges:

- Getting paid in 23 different currencies? Totally free

- Local transfers to your Wise account? No charge

- International transfers have fixed fees:

- $6.11 for USD wire and Swift transfers

- £2.16 for GBP Swift payments

- €2.39 for EUR Swift payments

- Varying fees for receiving money in other currencies by Swift.

The key difference? Wise uses the actual mid-market exchange rate without markups.

While this upfront fee is higher than Western Union’s, the recipient ultimately receives more money because Wise doesn’t apply any exchange rate markup.

You can use Wise’s “Send Money” feature to get an exact estimate of the costs and currency conversion rate.

Western Union vs Wise Transfer Methods and Speed

Beyond costs, transfer methods and processing times are critical factors when choosing between these services.

Western Union Transfer Options

Western Union excels in flexibility with multiple delivery options:

- Cash pickup at agent locations

- Direct bank deposits

- Mobile wallet transfers in select markets

This versatility makes Western Union particularly valuable for sending money to recipients without bank accounts or in regions with limited banking infrastructure.

Transfer speeds vary widely:

- Cash pickups can be available within minutes

- Bank deposits typically take 1-3 business days

- Transfers funded by bank accounts generally take longer than those paid by card

Wise Transfer Options

Wise offers a more streamlined but limited approach:

- All transfers are delivered to bank accounts

- No cash pickup options available

- Operates entirely online with no physical agent locations

Wise transfers typically take:

- 1-2 business days for major currency routes

- Up to 3-4 business days for less common currency pairs or bank-funded transfers

What Are the Disadvantages of Western Union?

While Western Union offers impressive global reach and flexibility, it comes with several notable drawbacks:

High Fees

Western Union’s fees can be substantial, particularly for:

- International transfers funded by credit cards

- Cash pickup options

- Transfers to certain regions

Hidden Exchange Rate Markups

The exchange rate markup significantly reduces the amount received by your recipient, often making transfers more expensive than they initially appear.

Limited Transparency

Users may find it challenging to calculate the total cost upfront due to the complex fee structure that varies based on numerous factors.

What Are the Cons of Using Wise?

Despite its competitive pricing, Wise isn’t without limitations:

Bank Account Requirement

Both senders and recipients need bank accounts, making it unsuitable for underbanked populations or regions with limited banking infrastructure.

Slower Processing for Some Transfers

Bank-funded transfers may take several days to process, making Wise less ideal for urgent transfers.

No Cash Pickup Option

The lack of cash pickup options limits Wise’s utility in areas where banking infrastructure is underdeveloped.

Frequently Asked Questions

Q. Can I trust Western Union?

Yes, Western Union is a highly reputable service with over 150 years of experience and robust security measures including unique tracking numbers for each transaction.

Q. Which is cheaper, Western Union or Wise?

Wise is generally cheaper for bank-to-bank transfers due to its transparent fee structure and use of mid-market exchange rates without markups.

Q. Is Wise Bank safe?

Yes, Wise is regulated by financial authorities in multiple countries and employs advanced encryption technologies to protect user data and transactions.

Q. Is it worth getting a Wise card?

A Wise card is valuable for frequent travelers or those making international payments, as it allows spending in multiple currencies at real exchange rates without conversion fees.

Q. Does Western Union have a card?

Western Union offers prepaid cards in certain regions that can be used for receiving funds or making purchases, though availability varies by country.

Is Western Union Better Than Wise?

The better choice between Western Union and Wise ultimately depends on your specific transfer needs:

Choose Western Union if:

- You need to send money to someone without a bank account

- Cash pickup is required

- You’re sending to a remote location

- Speed is your top priority for an emergency transfer

Opt for Wise if:

- Both you and your recipient have bank accounts

- Getting the best exchange rate is your priority

- You’re making regular international transfers

- You prefer complete fee transparency

- You’re comfortable with a digital-only service

When deciding between Western Union and Wise, consider your specific circumstances. As yourself the following questions to decide better.

- Where is the money going?

- How quickly does it need to arrive?

- Does your recipient have a bank account?

- How important are fees versus convenience?

By carefully weighing these factors against the strengths and weaknesses of each service, you can select the option that best meets your international money transfer needs.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.