Sick of shelling out high charges for cross-border money transfers?

You’re not the only one.

The quest for cheap, safe, and easy cross-border money transfers has driven people to seek other options outside of traditional banks.

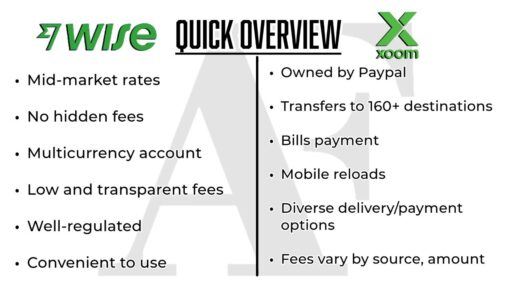

In this particular scenario, Wise and Xoom are two firms reshaping the international money transfer landscape. But which one do you use?

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for a second opinion or alternative investments.

Some facts might change from the time of writing. Nothing written here is financial, legal, tax, or any kind of individual advice or a solicitation to invest.

In this comprehensive comparison of Wise vs Xoom, we’ll dissect all you need to know about these top transfer service providers. This includes the fee structure, security features, and much more.

By the end of it, you’ll have everything you need to make a smart choice based on your particular requirements.

About the Company

What is Wise used for?

This money transfer company was established in the UK in 2011 as TransferWise and renamed Wise in 2021.

Wise was built on one fundamental mission: to make money transfers overseas mainstream.

Now, the company is a global force, providing financial technology services to over 12 million customers.

But you might be asking yourself, what can you actually do with Wise?

In effect, Wise offers international money transfers with competitive exchange rates.

You can send one-off or regular payments using the mid-market exchange rate, which is the actual rate you receive on Google.

There are no hidden fees, as the fees are revealed before the transaction.

For US users in particular, Wise offers:

Multi-Currency Account:

- Exchange and hold 40+ currencies.

- Accept payments using local account details for USD, GBP, EUR, etc.

- Send money to 160+ countries with low fees and the real exchange rate.

Wise Multi-Currency Card:

- Shop in the country and abroad with the Wise Multi-Currency Card.

- Withdraw cash at ATMs all over the world.

Other Features:

- Control your account and monitor transactions via the Wise app.

- Get instant transaction alerts.

Want to know the best part?

All transactions can be arranged online or through the user-friendly Wise mobile app, making it incredibly convenient regardless of your location.

What is Xoom used for?

Xoom, which was purchased by PayPal in 2015, provides a wider array of international financial services from its San Francisco base.

In addition to simple money transfers, Xoom provides:

- Transfers to more than 160 destinations such as Italy, Germany, France, Australia, India, Canada, UK, Mexico, and many more

- Bill payment services for friends and family abroad

- Mobile phone reloading for prepaid phones abroad

- A multitude of delivery options such as hand delivery, pickup, or deposit into the direct bank account

Like Wise, Xoom is also about convenience, with clients making transactions at any time through smartphones, tablets, or computers.

Convenience is a great selling point of Xoom, especially for clients who need to send money abroad while traveling.

Does Wise charge a fee?

You may ask yourself – what’s the catch? What’s the actual fee charged by Wise?

Wise proudly flaunts its transparency with a simple fee structure that consists of two general sections:

- A fixed amount charged for a transaction

- A variable amount for exchanging currency (starts from 0.57%; depending on the country, currency, etc.)

What differentiates Wise from others?

It shows the fees totally and transparently before any transaction and does not come with any surprises in the form of hidden fees.

For big payments, Wise provides automatic discounts for savings that could amount to plenty of money as well. Discounts are available for those above the monthly equivalent of 20,000 GBP, which are tier-based.

- For 20k–300k, the estimated discount is 0.1%

- For 300k–500k, the estimated discount is 0.15%

- For 500k–1m, the estimated discount is 0.16%

- For 1m+, the estimated discount is 0.17%

And would you believe, opening a Wise account is totally free of cost?

The organization has also shown a policy towards charging lesser fees in the long term to get a better return on the customers’ money.

To get an estimate of the fee snapshot, you can visit Wise’s pricing page.

Does Xoom charge a fee?

Xoom’s fee structure is a bit more complicated, with fees depending on several different variables:

- The receiving country

- The exchange rate of the received currency

- The amount of the transfer

- The source of funding (PayPal balance, bank account, debit card, or credit card)

- The delivery method

Want to cut back on your expenses?

The lowest fees usually occur when funding is coming from a PayPal balance or a local bank account.

Keep in mind, though, that transactions funded from accounts can be slower because they include more financial institutions.

Credit or debit card funding is costlier but is processed faster.

For instance, if a sum of $500 to some country costs you $4.09 with a PayPal or bank account, it will be $15.49 with a credit or debit card.

It is worth mentioning that apart from the transaction fee, Xoom also charges a currency exchange fee.

The currency fee is based on the current exchange rate of the destination country plus Xoom’s margin.

You can try Xoom’s “calculate fees” feature to get an estimate of what your transaction would cost you.

Safety and Security

Is Wise safe?

Security is a top concern when sending international money transfers.

So how does Wise stack up?

Wise is generally considered to be a safe provider for international money transfers, with over 12 million customers worldwide.

The company uses robust security measures:

- It is regulated by international financial regulators like the Financial Conduct Authority (FCA) in the UK, ASIC in Australia, and FinCEN in the US

- In India, Wise is regulated with the Reserve Bank of India and has local banking partners

- Each account is put through strict verification processes

- Round-the-clock teams and anti-fraud technology work to protect customers

All these strict processes have made Wise attain an “Excellent” rating from customer reviews on Trustpilot, thus indicating extremely high levels of satisfaction with their security processes.

Is Xoom Safe to send money?

Simultaneously, Xoom is strongly committed to security for its cross-border remittance business too. Here are the details:

- 128-bit encryption data protection procedures to protect information passing between customers’ browsers and the Xoom site

- It is privacy-accredited and -certified by independent bodies

- The company is state-licensed as well as federal US government-agency licensed

- The company provides a money-back guarantee if the recipients fail to get their cash

It should be noted that the security measures employed by Xoom occasionally entail additional verification processes which some clients find tedious.

Xoom has been reported for withholding money for extended durations and subjecting it to excessive additional paperwork.

Such aggressive procedures, however, are utilized to prevent money laundering and terror funding and ultimately tighten security even further.

Is Wise better than Xoom?

While selecting between Wise and Xoom (a PayPal subsidiary), certain key factors will guide your choice:

Geographic coverage:

Xoom facilitates sending to over 160 countries, which is pretty much the same as Wise.

If your destination country is less in demand, Xoom can be your go-to option.

Fee structure:

Wise generally offers more transparency and potentially lower fees on bigger transactions. It can specifically come in handy when paying through the mid-market exchange rate.

Xoom can be cheaper on small transactions if paid out of a PayPal balance.

Delivery options:

Xoom provides additional delivery options, such as cash pick-up and hand delivery in addition to bank deposit.

Wise explicitly offers bank-to-bank deposits.

Speed:

Both services can facilitate rapid transfers, but Xoom credit/debit card-backed transfers are usually faster than bank-funded transfers.

Wise processing times vary by country.

Other services:

In order to pay foreign family bills or just top-up foreign cell phones, there are such services available on Xoom.

Whereas on Wise, only money transfer services are available.

Ultimately, the best option for you will depend on your circumstances and requirements.

FAQs

Is Wise a real bank?

Although it provides services comparable to those provided by banks, Wise is not a bank nor a financial institution but a financial technology firm.

The Wise account is a multi-currency account and not a normal bank account.

Is Xoom the same as PayPal?

It should be noted that even though PayPal owns Xoom, they function independently.

PayPal maintains an independent online transfer feature aside from Xoom, and it gives clients a choice of multiple options under the same corporate umbrella.

How to avoid Wise fees?

Want to save money with Wise?

The most effective way is to send more money less often, as the fixed fee element becomes proportionally smaller.

Also, taking advantage of the automatic discounts for bulk transfers can save a lot of money.

How to avoid fees on Xoom?

Need to minimize Xoom charges?

Sometimes leveraging a PayPal balance for funding transfers will exempt a service fee, but currency exchange fees would remain.

Credit/debit cards replaced with bank account funding will lower charges but perhaps at increased processing time.

Conclusion

Both Xoom and Wise provide worthwhile international money transfers with varying strengths.

The decision between Wise and Xoom will always come down to your particular destination country, transfer amount, delivery options, and additional services desired.

For value in currency exchange alone, Wise usually has the edge, but Xoom is more flexible in delivery options and destination coverage.

It’s most important to identify the best service to fit your individual transfer requirements so your money is received safely, quickly, and yes, economically.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.