In today’s podcast I will speak about some of the news articles that have caught my eye in the last few days, including:

- The Japanese Nikkei 225 touching 30,000 for the first time in three decades. This was something I mentioned about previously, and which was picked up by the News on Japan website a few months ago.

- The jump in the oil price and for that matter “riskier” markets and currencies

- The UK’s poor economic performance in 2019

What’s the commonality between these stories?

To give credit to the author’s, I have copied the original articles below and linked to them

Japan’s Nikkei 225 Stock Average touched 30,000 yen for the first time since August 1990 on signs economic recovery is intact at home and on progress with the U.S. stimulus package.

The gauge rose as much as 1.6% on Monday, taking it a step higher on the climb back to its bubble-era levels. The rally follows the broader Topix Index’s recent record-breaking highs, as it rose to the highest point in nearly three decades. While equities globally have hit new heights in recent months, the Nikkei 225 still needs to gain almost another 30% to surpass its record of 38,915.87 yen. That was reached in the final trading session of 1989, before the index went on to lose more than half its value in three years after the economic bubble burst.

The brief breach of the 30,000 shows that “all sorts of investors are jumping in to buy Japanese equities with a totally bullish view,” said Shoji Hirakawa, chief global strategist at Tokai Tokyo Research Institute Co.

In data announced Monday, Japan’s gross domestic product grew an annualized 12.7% from the prior quarter in the three months through December, as exports continued to roar back, businesses started to invest again and government stimulus fueled consumer spending despite the coronavirus. The S&P 500 ended last week at an all-time high ahead of a three-day weekend, adding more than 1% for the week, as investors looked to signs that Washington is moving ahead with a spending bill.

Like the Dow Jones Industrial Average, the Nikkei 225 is a price-weighted measure. The two highest-weighted stocks, Uniqlo operator Fast Retailing Co. and SoftBank Group Corp., make up almost 19% of the gauge and as such have an outsized impact on its movements. Both of those stocks have surged in the past year, benefiting from the pandemic and the latter from Masayoshi Son’s record-breaking buybacks.

The price-weighted nature of the index has attracted criticism over the years for failing to accurately reflect the state of Japan’s equity market — or as being “a Flintstones index from the abacus era,” in the words of one critic.

It is also notable for its lack of some of Japan’s biggest stocks, including gaming giant Nintendo Co. and robotic automation specialist Keyence Corp. The Nikkei 500, a gauge that contains these two firms, passed its bubble-era peak in September and has continued to hit fresh records since.

- Government data released Monday showed Japan’s economy growing 12.7% on an annualized basis in October to December last year. The preliminary reading for fourth-quarter gross domestic product was higher than economists’ median estimate of a 9.5% gain, according to Reuters.

- Markets in China, Hong Kong, Taiwan as well as the U.S. are closed on Monday for holidays.

SINGAPORE — Stocks in Asia-Pacific rose in Monday morning trade, with multiple markets in North Asia closed for Lunar New Year holidays.

South Korea’s Kospi led gains in the region as it jumped 1.35%.

In Japan, the Nikkei 225 rose 1.09% in early trade while the Topix index gained 0.82%.

Government data released Monday showed Japan’s economy growing 12.7% on an annualized basis between October and December last year. The preliminary reading for fourth-quarter gross domestic product was higher than economists’ median estimate of a 9.5% gain, according to Reuters.

Stocks in Australia edged higher, with the S&P/ASX 200 up 0.9%.

MSCI’s broadest index of Asia-Pacific shares traded 0.37% higher.

Markets in China, Hong Kong, Taiwan as well as the U.S. are closed on Monday for holidays.

Oil prices jump

Oil prices were higher in the morning of Asia trading hours, with international benchmark Brent crude futures up 1.22% to $63.19 per barrel. U.S. crude futures gained 1.66% to $60.46 per barrel.

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 90.43 after weakening earlier this month from the 91.2 handle.

The Japanese yen traded at 105.03 per dollar, weaker than levels below 104.8 against the greenback seen last week. The Australian dollar was at $0.7762 following its rise last week from levels below $0.772.

3. Sterling on track for fourth week of gains, BOE statement supports – Nasdaq

LONDON, Feb 5 (Reuters) – Sterling edged higher against the dollar and the euro on Friday after the Bank of England avoided sub-zero rates for now, putting the pound on track for its fourth week of gains versus the dollar.

Focusing on the prospects for a post-lockdown rebound, the BOE gave British lenders at least six months of breathing space before negative interest rates are a possibility.

BOE’s Deputy Governor Ben Broadbent said on Friday it was reasonable for the BoE to give banks at least six months to prepare for the possible introduction of negative interest rates.

“The BOE’s strong hints that negative rates would not be used at this stage in the economic cycle triggered a substantial re-pricing in the UK money market curve and GBP,” said Petr Krpata, chief EMEA FX at ING in a note to clients.

Sterling was 0.2% higher at $1.3695 versus the dollar at 1026 GMT, gaining more than a cent against the greenback since the BOE’s meeting on Thursday. GBP

It also hit its highest against the euro since May 2020 at 87.38 in earlier trade, before flattening at 87.45 against the single currency. EURGBP=D3

Adrian Schmidt, head of FX strategy at Continuum Economics, said the pound strength this week was a response to an “excessive” rise in UK yields, with ten-year gilt yields rising to their highest levels since March 2020. GB10YT=RR

“GBP was in any case already generously priced relative to the previous yield levels. While we can see a case for gains against the euro, the rise against most other currencies looks excessive.”

Money markets pushed forward expectations of a rate cut by six months to February 2022, before paring them back to December 2021. Before the BOE statements, bets were for rates to be cut to sub-zero in August 2021. BOEWATCH

Figures from mortgage lender Halifax showed on Friday that British house prices fell last month for the first time since May, taking the annual rate of increase to its weakest since August.

4. UK economy suffered record annual slump in 2020 – BBC

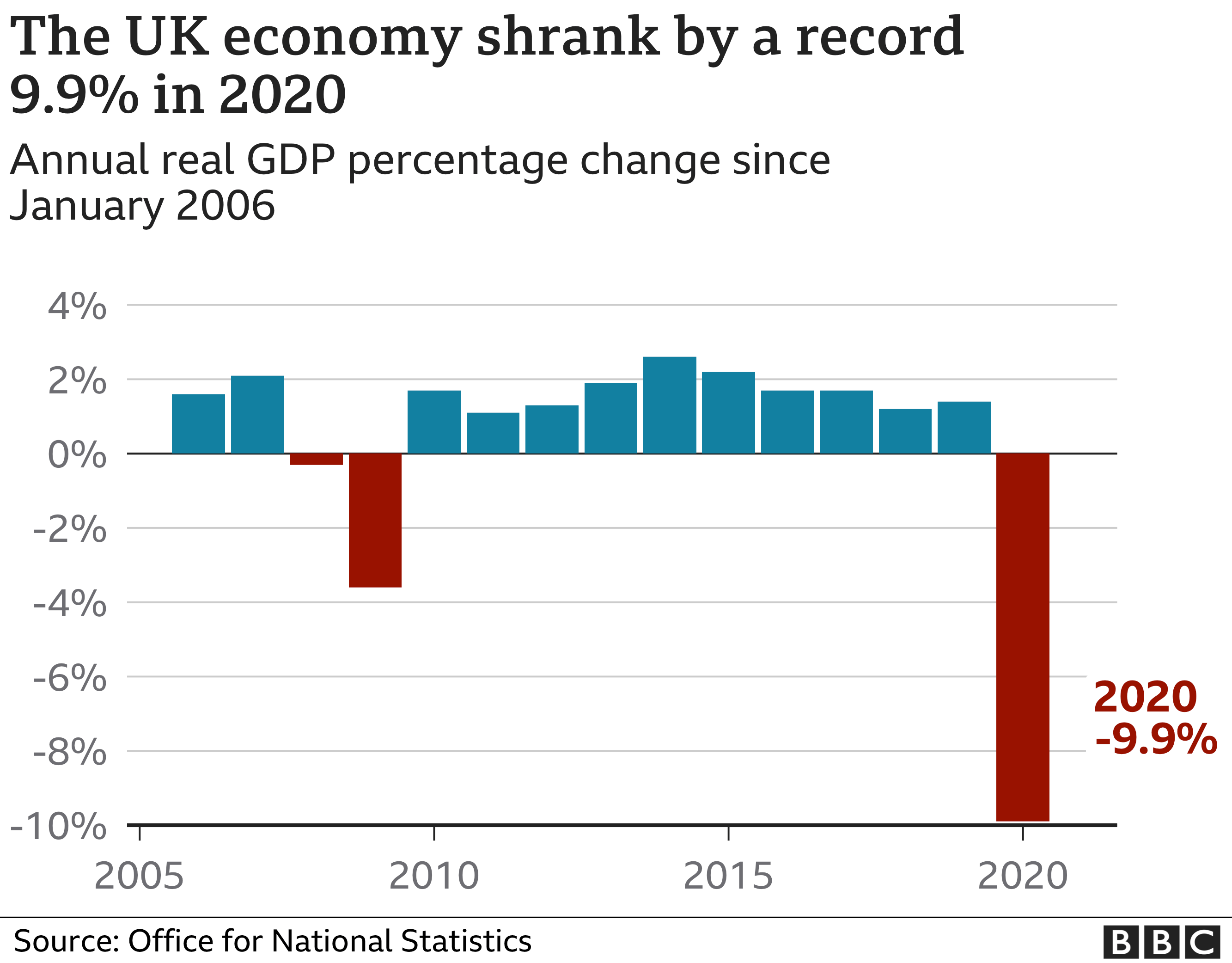

The UK economy shrank by a record 9.9% last year as coronavirus restrictions hit output, official figures show.

The contraction in 2020 “was more than twice as much as the previous largest annual fall on record”, the Office for National Statistics (ONS) said.

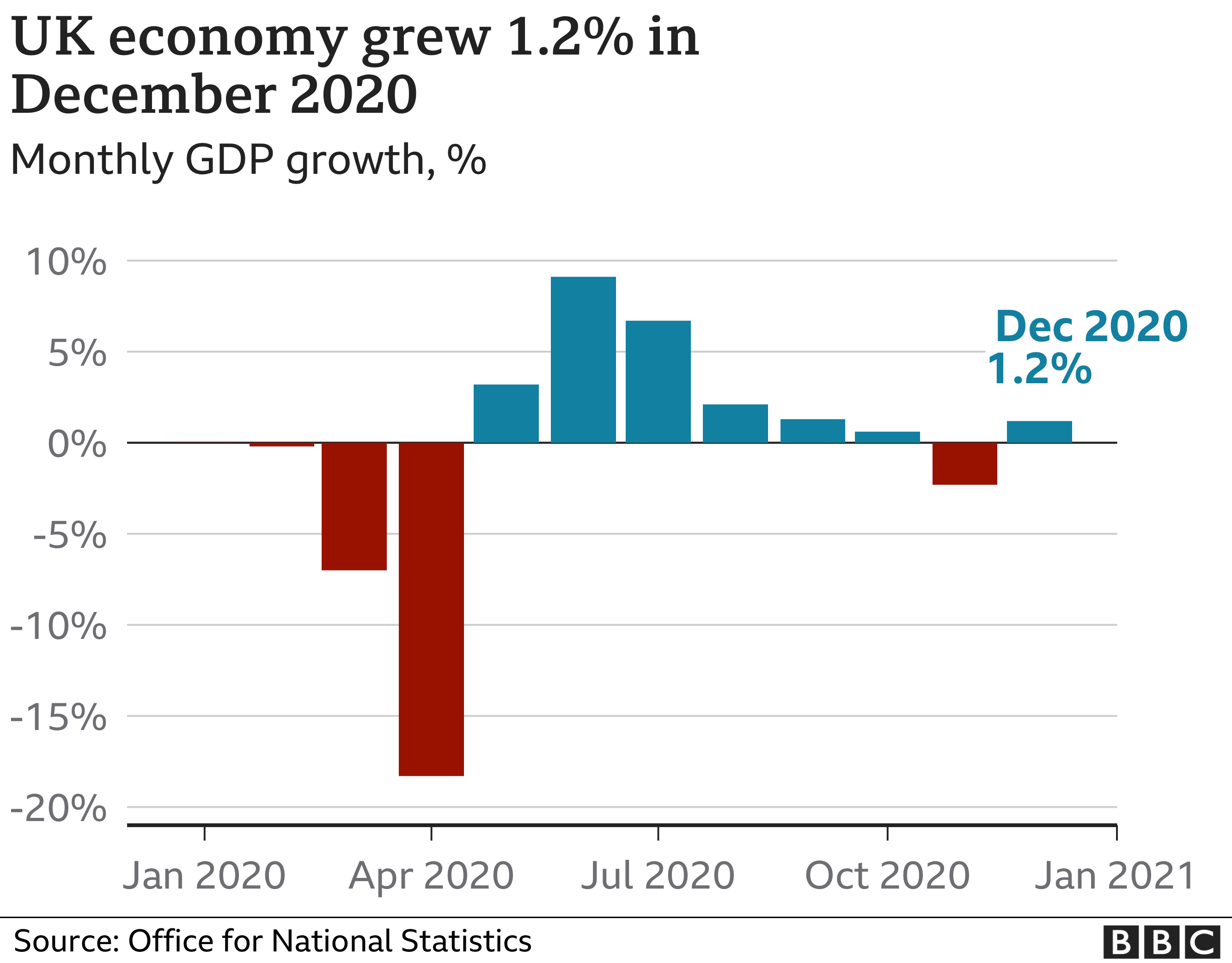

However, the economy looks set to avoid a double-dip recession after growth picked up at the end of the year.

In December, the economy grew by 1.2%, after shrinking by 2.3% in November, as some restrictions eased.

Hospitality, car sales and hairdressers recovered some lost ground, the ONS said.

The growth meant that in the October-to-December quarter the economy expanded by 1%. As a result, the UK is expected to avoid what could have been its first double-dip recession since the 1970s.

A double-dip is when the economy briefly recovers from recession, only to quickly sink back. A recession is generally defined as two consecutive quarters where the economy contracts.

ONS deputy national statistician Jonathan Athow said: “An increase in Covid-19 testing and tracing also boosted output. The economy continued to grow in the fourth quarter as a whole, despite the additional [lockdown] restrictions in November.”

GDP was first measured in the aftermath of the Second World War, and the measure has never previously dropped by more than 4.1% in a year. However, the Bank of England models GDP going back centuries, and the 2020 contraction could be the worse since 1709.

Suren Thiru, the head of economics at the British Chambers of Commerce, said: “Despite avoiding a double-dip recession, with output still well below pre-pandemic levels amid confirmation that 2020 was a historically bleak year for the UK economy, there is little to cheer in the latest data.”

All four economic sectors tracked by the ONS saw a drop in output, with the highest fall coming in the construction sector, which contracted by 12.5%.

Chancellor Rishi Sunak told the BBC: “Today’s figures show that last year our economy experienced a significant shock, and also some signs of resilience over winter.

“You know what’s clear is right now, many families and businesses are experiencing hardship. That’s why we’ve put in place a comprehensive plan for jobs to support people through this crisis, and we will set out the next stage of our economic response at our Budget in early March.”

But shadow chancellor Anneliese Dodds said: “These figures confirm that not only has the UK had the worst death toll in Europe, we’re experiencing the worst economic crisis of any major economy.

“Businesses can’t wait any longer. The chancellor needs to come forward now with a plan to secure the economy in the months ahead, with support going hand-in-hand with health restrictions.”

However, Mr Sunak said international economic comparisons were not necessarily a useful yardstick.

“We calculate GDP in a different way to pretty much everybody else. And if you either correct for that difference or look at it in a way that’s more comfortable with nominal GDP, what you find, as the Bank of England and the ONS have pointed out, is that our performance is very much in line and comparable to other countries.”

Economists said that with Covid-19 restrictions expected to remain until early spring, the hit to the economy will continue over the next few months.

“We anticipate a sharp decline in activity during the first quarter of the year,” said Kemar Whyte, senior economist at the National Institute of Economic and Social Research. “Nevertheless, growth will pick up from the second quarter onwards as restrictions ease on the back of a successful vaccination programme.”

As expected the economy stabilised in the last quarter of 2020. But the latest set of statistics confirm the scale of the hit over the whole of last year.

A technical return to recession has been avoided, with the economy returning to growth at the end of last year. But the economy is certainly falling again so far in the first three months of 2021, due to the tough national lockdowns, as well as some impact from increased trade barriers with the European Union.

The chancellor and Bank of England will be paying much more attention to what is going on right now. The renewed lockdown has hit growth considerably again, but not as hard as last April.

Businesses and households remain in holding pattern ready to unleash pent up growth when the economy is reopened.

While the vaccine will eventually unlock that growth, the precise timing is still uncertain, and the government remains under pressure to maintain significant sums in economic support.

‘Coiled spring’

Last year’s contraction is steeper than almost any other big economy, although Spain suffered an 11% decline.

Britain has reported Europe’s highest death toll from coronavirus and is among the world’s highest in terms of deaths per head of population.

Much of the damage to the UK economy is attributed by economists to a high dependence on the service sector, which suffered particularly badly during the year because of lockdown.

However, Britain has vaccinated many more people than other European countries so far, raising the prospect of a bounce-back for its economy later this year.

That potential fast rebound prompted the Bank of England’s chief economist to describe the economy as like a “coiled spring” ready to release large amounts of “pent-up financial energy”.

Andy Haldane said on Thursday that consumer confidence would surge back thanks to the vaccine programme, with the economy firing “on all cylinders” by spring.

Mr Sunak told the BBC: “There are reasons for cautious optimism, because the vaccine roll-out is going really well.

“The prime minister will set out a roadmap for exiting restrictions in the next few weeks and months. It will be the week of February, 22nd, and it’s related that we base our roadmap on the best possible evidence of data.”

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 230 million answers views on Quora.com and a widely sold book on Amazon.

Further Reading

In the article below I spoke about:

- Is it possible to be rich with a low net worth?

- Why are technology stocks soaring? Are we seeing another bubble?

- Is it true that people pretend to be passionate about something when it is all about money?

- Would Steve Jobs have been wealthier than Jeff Bezos if he was alive today?

To read more click below: