This article was updated on December 26, 2023

RBC wealth management review/reviews. That will be the topic of today’s article.

This article will review RBC. After speaking about some good investment options for Canadian expats before, this article will look more closely at one of Canada’s largest banks which also services the expat community.

It will explain why RBC aren’t bad for pure banking solutions, although many challenger online banks will undoubtedly take market share in the coming years, but far better options exist for wealth management.

If you are looking to invest especially in expat-focused solutions, or have any questions in general, you can contact me on this page, or email me – advice@adamfayed.com.

Table of Contents

Introduction

Wealth management is an investment advisory service that integrates other financial services to meet the needs of wealthy clients.

This is a consultative process in which the consultant collects information about the financial goals of the client and develops an individual strategy using appropriate financial products and services.

A wealth management advisor or asset manager is a type of financial advisor that uses a range of available financial disciplines such as financial and investment advice, legal or property planning, accounting and tax services, and retirement planning to manage wealthy client’s assets for one established contribution.

Wealth management practices vary by country, for example, if you are in the United States vs Canada.

Wealth management is something more than just an investment advice, as it can cover all parts of a client’s financial life.

The main idea is that instead of trying to combine financial advices and different products from a number of professionals, high-income people extract from a holistic treatment in which a manager coordinates all the services essential to operate their funds and plan their own or current and the future needs of their family.

Although the use of a money manager is based on the theory that he will be able to provide services in any aspect of the financial sphere, some prefer to specialize in certain areas. This may be set up on the experience of the wealth manager under consideration or in the core business of the wealth manager.

*Some short points.

- Wealth Management is an investment advisory service that integrates other financial services to meet the needs of their wealthy clients.

- A Wealth Management consultant is a qualified professional who operates the wealth of a high-net-worth client for one set fee.

- Wealthy customers benefit from a holistic approach in which a manager coordinates all the services needed to operate their funds and plan their future.

- This service is mostly suitable for wealthy people with a big investment and a wide range of various needs.

In this article we will review one of the largest and powerful companies, called RBS Wealth Management, which provides high-quality services, high-level advices and try to show an individual approach to every client they work with. Let’s go!

Evaluating RBC Wealth Management’s Digital Tools and Online Services

Overview of the FinTech Industry’s Growth

Emergence and Impact of FinTech: FinTech, a rapidly growing segment, delivers financial services efficiently and innovatively using advanced technologies like Big Data and cloud computing. It initially focused on online payment services but now extends to credit, insurance, and investments, representing a significant disruptive force in the financial sector.

Drivers of FinTech Expansion: The growth of e-commerce necessitates secure online payment services. FinTech leverages vast data from e-commerce, social media, and internet searches to tailor financial services, making data more critical than collateral.

FinTech’s Contribution to Financial Accessibility

Facilitating Global Remittances: Digital cash transfer platforms, a key FinTech offering, significantly aid migrant workers by enabling efficient money transfers to unbanked families. These platforms have become crucial for economies where remittances form a substantial part of GDP, offering lower fees than traditional channels.

Expanding Credit Access: FinTech helps improve credit access for small and medium-sized enterprises and remote areas, offering alternatives to traditional lending through smartphone apps. These apps can assess creditworthiness without a conventional repayment track record and customize loan terms based on risk profiles.

RBC Wealth Management’s Adoption of FinTech Innovations

Embracing Digital Payment and Credit Solutions: RBC Wealth Management integrates large global payment networks and digital wallet services, enhancing global commerce and offering a range of services like merchant payments, peer-to-peer payments, and cryptocurrency trading.

Support for Small Merchants and Financial Institutions: Merchant processors under RBC Wealth Management enable small merchants to accept electronic payments, and technology providers assist small-to-midsize financial institutions in digitizing their services.

Key Features of RBC Wealth Management Online Services

Safe and Convenient Account Access: Clients can view their account information securely from any device, ensuring privacy with advanced encryption technology.

Comprehensive Online Benefits: The online platform offers convenience, security, paperless options, and mobile management, promising a new experience on the RBC Mobile app.

Eco-friendly Initiatives: RBC Wealth Management encourages the use of eDocuments, contributing to environmental sustainability by partnering with Tree Canada for tree planting initiatives.

Versatile Online Functionality: Clients can check account values, obtain real-time market quotes, manage eDocuments, connect with RBC Online Banking, and access services through a mobile app.

- RBS Wealth Management Overview.

RBC Wealth Management is a division of RBC Capital Markets, LLC, which is a branch of Royal Bank of Canada.

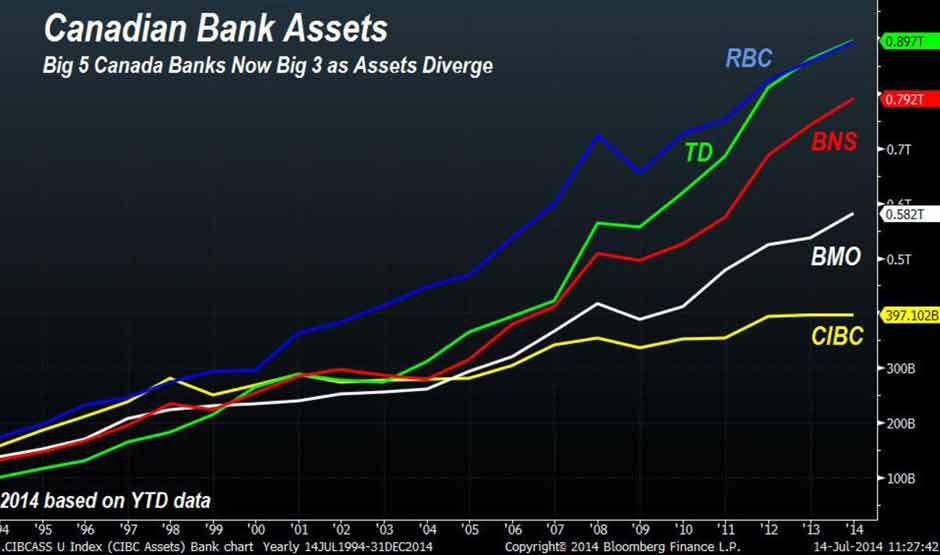

The company manages about $ 348 billion of private customer assets in the United States and they are the biggest bank in Canada on some measures as per the stats below:

It employs 1,800 financial advisors and works in 200 locations in 40 states. The division offers financial services for all kind of individuals and families, senior citizens, business owners, as well as corporations and institutions. Minimum company bills vary by program and service and start from $ 2,500.

RBC Wealth Management provides a full range of banking, investment services, in addition asset management services through its own business and with the help of third parties.

RBC in Canada, the US and offshore are often separate entities.

*About third-parties

As noted above, some RBC Wealth Management programs can be operated by a third party.

In particular, the company’s RBC Total Portfolio is a unified managed account controlled by Envestnet Asset Management, which can also oversee RBC’s unified portfolios.

Various programs include various investment managers or overhead management fees, in addition to the RBC Wealth Management fee, which applies to all accounts.

RBC Wealth Management has been in its present form since 2008. The firm initially was spreading its activity under the name Dain Rauscher until it was obtained by the Royal Bank of Canada in 2001.

The firm comes from numerous regional firms in the U.S. that come together to form an asset management company, which is currently the fifth largest asset manager in the world by asset, according to a 2017 Scorpio Partnership on Global Private Banking review.

Royal Bank of Canada and its branch offices work under the main RBC brand.

It is one of the largest banks in Canada and one of the largest banks in the world based on market capitalization. RBC is one of the leading diversified financial companies in America, which provide personal and commercial banking services.

The company has about 79K full-time and part-time employees who work with more than 15 million individuals in Canada, in the United States, and 44 other countries.

Pros:

- Offers personalized investment advice.

- Includes tax planning and estate planning.

- Wide range of wealth management services.

- Competitive investment cost ratios.

- The World Economic Forum has called RBC one of the most sustainable large organizations in the world for investing in the communities where they live and work.

- High-quality financial advisors.

Cons:

- Minimum amount of about $2500 to open an account.

- Fee schedule is not multi-level, which may not always work in favor of customers with higher prices.

- High fees in general. Much cheaper and better options are out there.

- Often they are actively managing accounts rather than buying ETFs

- They often make it very difficult for customers to leave and try to delay the process. I have spoken to numerous people who claimed that the bank delayed once they told them they were joining another wealth management company, with coronavirus being one of many excuses made.

- They are trading on brand name.

- How RBC chooses its clients?

RBC Wealth Management is a global organization. The business model is based on building relationships in the long run.

The company calls itself aimed on customer finance growth. Beginning in 1910, they began a steady expansion in 2000 and the opening of the London office really marked the beginning of their global journey, meanwhile the company moved from the American continent to Europe.

Actually, this spurred their further journey around the world. Diversification of knowledge and deepening of understanding are the company’s key points to success.

They strive to attract investors with a global exorcism to superiority. Judging by the investor satisfaction index of 2013, they are among the best “players”. Thus, as of 2013, the level of investor satisfaction exceeded the industry average.

The question is what served as the basis for this view. How or what led to this kind of performance? Well, in this context, you need to understand the business model. Their approach to investors is super crucial.

As already mentioned, RBC Wealth Management is working with individuals and families, as well as with retirees.

The company’s services for these customers include cash and credit solutions, insurance solutions, trust services, retirement income planning, financing education, gift and charity decisions and responsible investment.

It also specializes in working with business owners, offering many of the above services as well as retirement plans.

Corporations and Institutions are also included in the client base of The RBC Wealth Management. For these clients, RBC can provide pension plans, corporate and executive services, as well as fiduciary support through institutional advisory services.

However, a bigger issue is that RBC often cross sells people between bank accounts and wealth management accounts, taking advantage of their position in the market.

- RBC Accounts.

Such as many huge and powerful asset management companies that offer a wide range of account types and services, RBC Wealth Management has minimum account demands which are varying by the chosen program. Individual consulting services provided by the company have the following minimums:

- RBC Unified Portfolio: $2,500

- Portfolio Focus: $50,000

- RBC Advisor: $25,000

- Consulting Solutions: $100,000 for accounts using RBC Wealth Management as the manager may have another account minimum. These minimums depend on the model portfolio selected and can range from $2,000 to $250,000, for fixed income accounts.

- Managed Account Program (MAP): $100,000

- RBC Total Portfolio: $250,000 for accounts utilizing model portfolios and $25,000 for accounts utilizing only mutual funds

However, the minimum for the company’s Institutional Consulting program is about $5 million.

*Accounts for high-net-worth individuals.

For affluent investors, RBC has a special offer called ‘The RBC Private Wealth’ program, available exceptionally to customers who have invested at least $ 5 million in RBC.

This program aims to meet financial needs arising from vital wealth. The program has three main areas of activity; the accumulation, the protection and the distribution of wealth during your life and after you die.

Wealth accumulation includes investment management, stock options trading strategies, and limited interests in stocks and businesses.

The coverage of the areas such as insurance and power of needs is the responsibility of wealth protection part, while material distribution extends to donations to family members and charities.

For rich families, RBC also has a special offer, the idea is a group of asset management professionals. It provides the clients with wider access to experts through the RBC global network who are experienced in fields such as wealth protection and real estate planning.

Understanding RBC Wealth Management’s Approach to Risk Management

Foundational Strategies in Risk Management

Tailored Investment Policy Statements

At RBC Wealth Management, each client’s risk tolerance and investment objectives are meticulously outlined in a written Investment Policy Statement.

This document is a cornerstone of their strategy, ensuring accountability and immediate response if the portfolio deviates from the set objectives.

Dedicated Risk Management Group

The RBC Portfolio Implementation and Risk Monitoring Desk plays a pivotal role in managing portfolios. They ensure strict adherence to the Investment Policy Statement and fundamental investment guidelines, focusing on prudent management practices like diversification and suitable asset mix.

Innovative Risk Management Measures

Diverse Techniques for Stability

RBC Wealth Management employs multiple risk management strategies, including: Automatic Rebalancing to mitigate emotional decision-making during market volatility.

Cash Wedge Strategy, reducing sequence of return risk. Unbiased, ongoing monitoring of sub-managers. Use of stop-loss orders on individual stocks to limit potential losses.

Recognition and Growth

National Recognition for Financial Advisors: In 2023, Financial Planning magazine recognized eight financial advisors from RBC Wealth Management among the top brokers under 40.

This accolade underlines the firm’s commitment to nurturing talented advisors who contribute fresh ideas and perspectives, further strengthening their risk management approach.

RBC Wealth Management’s Market Presence

RBC Wealth Management, a division of RBC Capital Markets, LLC, is a significant player in the wealth management sector.

With $489 billion in total client assets and more than 2,100 financial advisors across 186 locations in 42 states, the firm’s extensive network and resources play a crucial role in its comprehensive risk management strategies.

- How to open a RBC account?

There is actually nothing difficult in opening an account, to open it with RBC Wealth Management, you will have to sign a consultative agreement before registering with any of the available programs.

This agreement gives you a allowance to make several transactions in your own account and update it when needed. But for opening accounts called Consulting Solutions, MAP, Portfolio Focus, RBC Advisor or RBC Total Portfolio, you need to sign a separate client agreement; Single Program Agreement.

This is literally the same agreement as in the previous one, but it may have slightly other conditions. The firm offers potential customers two ways to start this process and talk with a consultant: the first option is when they provide their contact information so that RBC could contact them, or the second one is that they just fill in a short survey to find a consultant that suits their goals and desires. Also you can find a local advisor, with the help of the provided special page in their website.

RBC Wealth Management sponsors a range of specialized counseling programs. In each RBC program, managers work with clients to determine their goals and needs, which will determine their investment strategy. Let’s see what kind of programs the company offers:

- RBC Unified Portfolio: Customer accounts are unified, and are managed by RBC or a third-party manager, in this case the third-party manager is Envestnet Asset Management.

- RBC Total Portfolio: Another single managed account in which the accounts are uniquely managed by Envestnet Asset Management.

- Consulting Solutions: Customers can choose an investment manager, an investment strategy and a model provider.

- Managed Account Program (MAP): The accounts are being managed by a single or more investment managers, according to their risk profile.

- Portfolio Focus: The accounts are operated by RBC according to their risk tolerance and an assessment of their goals and expectations.

- RBC Advisor: Customers receive non-discretionary advice on appropriate securities, and an investment strategy according to their risk profile.

- RBC Investing Fees.

RBC Wealth Management practices a fee-only payment model.

The principal privilege of this model is that clients do not need to worry about the fact that their money managers are affected by commissions when providing financial recommendations.

Paid consultants have a fiduciary responsibility towards their clients, which means that they are legally obliged to put the interests of their customers in the first place and cannot sell them a product that they do not need or that runs counter to their goals or risk tolerance.

The company may charge its customers a percentage of wealth under management, fixed fees and usually other commissions for its investment advisory services. Customers who have accounts registered in the advisory program pay an annual asset-based commission due on a quarterly basis.

The precise fees differ depend on the program, and also on the size of the account, the time during which you have a RBC account, the total amount of activity that you build with RBC, plus the types of security services provided.

Anyways, RBC Wealth Management claims that the maximum annual fee is usually less than 3%. Company’s schedule of commissions shows the annual rate for accounts up to $ 25 million is 2.50%.

For higher value accounts, the commission rates are negotiable. Differently, clients having Managed Accounts Program have an option to choose between a fee method and a commission method.

Besides the program fees, clients can pay management fees to investment managers and model suppliers, tax fees, and overhead management fees.

Let’s see more detailed how you have to pay for financial advices according to your invested amount.

As already mentioned, for investments up to $25 million you will be charged only 2.50%. If you want to invest an amount of $500.000 the fee for advices will be 2.50%, which is equal to $12.500. If you invest $1.000.000, you’ll have to pay $25.000, etc.

Please note also that RBC in Canada, America and other locations might charge different fees.

*Commissions and other fees.

The correspondence between commissions and direct fees is crucial. This often helps you understand the final payouts. Usually, this is a key factor in determining the type of commission.

It is the 5th global wealth management company in terms of revenue. It offers high-level services and is proud of deep customer relationships. In the end, the company must do something right in order to become one of the best global companies. Surely, the fee structure plays the most essential role.

Regardless of commission or direct fees, clarity is crucial and the transparency is also becoming very important. Typically, commissions are determined as a percentage of the service suggested.

The structure of direct commissions has a fixed payout schedule. As in every kind of business the more you sell, the better you earn. Paid structure is relatively more expensive than other wealth management companies.

Analyzing the Tax Efficiency of RBC Wealth Management Strategies

RBC Wealth Management’s Approach to Tax Planning

Holistic Tax Strategies for Wealth Preservation

RBC Wealth Management emphasizes the importance of including tax strategies in financial planning to potentially reduce the tax burden and preserve wealth. They focus on blending different types of planning to address complex tax obligations effectively.

By considering each client’s unique situation, RBC Wealth Management tailors tax planning to achieve objectives in the most tax-effective manner, whether it’s for immediate needs, retirement planning, or wealth transfer.

Customized Tax Solutions

RBC Wealth Management recommends potential tax strategies suited to individual situations, such as income splitting through family trusts or spousal loans, tax-efficient investment vehicles, investing in registered accounts like RRSPs, TFSAs, or RESPs, charitable giving, and effective asset distribution.

They ensure these strategies are implemented effectively in collaboration with clients’ tax advisors.

Current Economic Context and Implications

Anticipating a U.S. Recession in 2023

RBC Wealth Management acknowledges the likelihood of a U.S. recession in 2023, which is expected to shape the investment landscape over the next 12–18 months. They advise that understanding and preparing for this economic downturn is crucial for investors.

Interest Rate Trends and Investor Strategies

With an expected transition in interest rates in 2023, RBC Wealth Management suggests that rates might rise in the first half of the year before falling in the second.

This insight is vital for investors to align their strategies with the anticipated economic conditions, particularly regarding bond yields and equity investments.

Recent Developments at RBC Wealth Management

Leadership Promotions

RBC Wealth Management has recently promoted two veterans to leadership roles, reflecting its commitment to strong and experienced management, which is crucial for implementing effective wealth management strategies.

Focus on Long-term Equity Performance

RBC Wealth Management is exploring the impact of generative AI on long-term equity performance, indicating their adaptability to evolving market trends and technologies. This forward-thinking approach is part of their strategy to drive stock market gains and offer innovative investment opportunities.

Community Engagement

Demonstrating their commitment to social responsibility, RBC Wealth Management has been involved in initiatives like supporting the U.S. Soccer Foundation program to improve youth health and well-being. Such community involvement reflects the company’s broader values and ethos.

- More about services provided by RBC.

There exists several wealth management companies that suggest a full range of services, to compare there are others with a limited service profiles.

But all services provided by RBC have its costs. As a rule a full-service company processes a full package of services, in this way, they help you create trusts and operate portfolios.

Certainly, these full-service firms should also hire high quality staff. It is this quality of staff that determines the success of their investments, and only they help the company to grow and include investors.

When the growth is between better investments and higher rates, you will choose the first one.

Compared to this, lower level specialists often work in a limited service company, they are software based and rely heavily on automation.

In fact, the growth prospects are completely different, but possibly in the context of RBC Money Management, this is a key factor.

Before taking vitality into account, you need to consider quality and usually, the wider the service, the higher the fee.

So if you see the structure of expensive commissions, study the services the company suggests you and everything will be understandable.

It is very important to describe in detail the scope of services they offer, investors should conduct an in-depth study of RBC’s asset management, and transparent documentation of their services will help investors make better decisions.

This is what will help you to determine the possible success you can expect. In many ways, this is the biggest factor.

The Role of RBC Wealth Management in Global Investment Trends

Navigating Market Volatility and Economic Challenges

Adapting to Market Shifts

RBC Wealth Management advises that, despite potential economic downturns in 2023, investors might see the equity market begin a new bull market cycle before the end of a recession.

In fixed income, the firm suggests that the window for investment is currently open but could close unexpectedly, underscoring the need for timely portfolio alignment with long-term strategic recommendations.

Resilience in Corporate Earnings

The outlook for corporate earnings in 2023, as viewed by RBC Wealth Management, is more favorable compared to previous economic stress periods.

With S&P 500 earnings possibly remaining stable, there’s an anticipation of resilient household spending, supported by strong employment trends and high savings levels.

Impact of Inflation Trends

RBC Wealth Management anticipates that declining inflation in 2023 could positively influence equity market sentiment, with trends in commodities and goods prices already suggesting this shift.

Strategic Portfolio Management

Emphasizing Long-Term Strategic Allocation

The firm emphasizes the importance of aligning investment portfolios with long-term strategic allocation recommendations, cautioning against trying to time the market. It advises that missing key market rallies could lead to detrimental long-term performance impacts.

Identifying Emerging Opportunities

RBC Wealth Management suggests keeping an eye out for opportunities in small-capitalization and midcap segments of the U.S. equity market, as well as the Energy sector within the large-cap S&P 500, due to their relative value and potential for earnings support in challenging economic periods.

Federal Reserve’s Role and Economic Policy

Federal Reserve’s Dual Mandate and Future Focus

In 2023, RBC Wealth Management expects the Federal Reserve to focus on financial stability as its unofficial third mandate, following its actions in 2021 and 2022 to achieve full employment and price stability, respectively.

The firm anticipates a more cautious approach from policymakers in response to domestic and global financial vulnerabilities.

RBC Wealth Management’s Approach to Sustainable and Ethical Investing

RBC Wealth Management (RBC WM) demonstrates a committed approach to sustainable and ethical investing, adapting to the evolving financial landscape and aligning with the values of its clients.

Responsible Investment Strategies

Embracing ESG Factors

RBC WM systematically incorporates material ESG factors into investment decision-making, recognizing the potential risks and opportunities these factors present.

Screening and Thematic Investing

The firm applies positive and negative screens to include or exclude assets based on ESG criteria, and invests in assets involved in specific ESG-related themes or addressing social or environmental issues.

Impact Investing

RBC WM focuses on investments intending to generate measurable positive social or environmental impact, reflecting a deep commitment to ethical investing practices.

Corporate Commitment and Leadership

Michael Armstrong, CEO of RBC Wealth Management – U.S., emphasizes the firm’s dedication to aligning investments with clients’ values.

RBC WM is a leader in sustainability, listed in several responsible investing indexes. The firm has set an ambitious target of $500 billion in sustainable finance by 2025 as part of its enterprise climate strategy, the RBC Climate Blueprint.

This strategy aims to accelerate clean economic growth, monitor and report efforts towards net-zero emissions, and promote climate literacy.

Recognition and Awards

RBC WM’s efforts in sustainable and ethical investing have been recognized with various awards, including:

- Best Place to Work for LGBTQ Equality in the U.S. by the Human Rights Campaign’s Corporate Equality Index 2022.

- Best Private Bank for Digital Marketing and Communication (North America) at the PWM Wealth Tech Awards 2022.

- Best Bank for Sustainability and ESG Thought Leadership (Global) at the WealthBriefing Wealth for Good Awards 2022.

Sustainable Investment Initiatives

RBC WM advocates for investing in sustainable technologies, or “SusTech,” to drive the transition to a net-zero economy. SusTech includes innovations like electric vehicles, green energy, and smart city technologies.

This approach not only aligns with current environmental needs but also paves the way for a green recovery, boosting global economies through investments in technology that reduce greenhouse gas emissions, create jobs, and prioritize equity and equality.

Innovations in SusTech

RBC’s commitment to SusTech is evident in their focus on environmentally friendly technologies that assist industries in transitioning from fossil fuels to renewables.

This includes significant investment in GreenTech, AgriTech, FoodTech, and Smart Cities, showcasing RBC WM’s forward-looking and innovative approach to sustainable global economic growth.

- Plausibility of the company.

The wealth management company you are interested in must also be properly audited. It is important to know that you invest your funds in safe hands.

The privilege of a full-service company is that they hire qualified and certified accountants, which means that experienced professionals take care of your assets.

In contrast, you will see that a limited service company also offers some general services.

According to some public reviews RBC was one of the best asset managers and this type of public reviews can also enhance recognition.

This shows the relative popularity of the company that you decide to choose. In this context, it is important to mention that RBC Wealth management is not an accredited any of the reviewers. This is usually the accreditation that companies are looking for by themselves.

If RBC’s wealth management is not accredited, this may mean that they have not submitted an application. This may not reflect directly on the aspect of trust. This helps people figure out what the business situation is, this is more like an investigative exercise.

So in this context, the idea is to identify a potentially strong player. So accreditation is certainly a big advantage, but at the same time, his absence cannot be connected to failure.

- Conclusion

RBC is fine as bank account facilitator. Using them in this way has many advantages for expats, especially those who are Canadian expats in nearby locations like the United States.

On the wealth management front, there are much better options than RBC.

Their fees are too high, they have been known to make withdrawals difficult and they often actively trade clients accounts.

Many people using them have complained of a lack of transparency and not sharing the details of their portfolio.

Clarity and transparency are critical when dealing with your investments.

In the future, excellent challenge banks like Monzo and Revolut might take more market share from these traditional providers.

On the expat front, people need speedy and portable advice no matter where they go in the world.

In some ways, covid and the lockdown has also exposed how outdated many banking models are.

Most of the banks were slower to adapt to service client requests compared to digital providers.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.

Further Reading

The article below asks if there will be new expat taxes on the horizon due to the huge government deficits.

Will there be new global and expat taxes?