Are you looking for the cheapest country to retire in as an expat?

Instead of just focusing on one particular nation, we’re including 10 among the best countries to retire cheaply, in no particular order, based on a GOBankingRates study.

- Czech Republic

- Slovenia

- Portugal

- Japan

- Malaysia

- Oman

- Taiwan

- Croatia

- Bulgaria

- Lithuania

To determine the rankings, the study considered many aspects including average rent, serenity, medical care quality, purchasing power, and living expenses. The only nations included were those with higher peace scores.

For seniors looking to relocate to a cost-effective, secure, and peaceful nation while making the most of their financial resources, these rankings are a helpful resource. They can help with decisions for a happy retirement.

If you are looking to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or WhatsApp (+44-7393-450-837).

This includes if you are looking for alternatives or a second opinion.

Some facts might change from the time of writing. For updated guidance, please contact me.

Let’s look into the specifics of cost of living for the best expat retirement countries, as well as other details retirees may find important.

Short List of Most Affordable Countries for Expats to Retire

Czech Republic

Retirement visas are not specifically issued in the nation. Instead, retirees must apply for long-term visas. These are renewable once a year. The application price for both long-term and permanent residence is 2,500 Czech koruna.

Monthly cost projections from Numbeo include 63,784 koruna for a family of four, excluding rent, while a single person’s costs are around 19,232 koruna.

Dining at an inexpensive restaurant costs approximately 200 koruna.

Basic utilities amount to 6,896 koruna.

Rent for a one-bedroom apartment is 19,475 koruna in the city center and 15,308 koruna outside. The price per square meter to buy an apartment is 111,662 koruna in the center and 82,082 koruna outside.

Slovenia

This country does not have a retirement visa for expats.

So as to reside in the nation, non-EU nationals must secure a temporary residence permit. It gives the go-ahead for stays of up to a year at a time. But the actual permission can be renewed for three years at most.

Individuals are eligible to apply for a permanent residence permit once they have had a temporary residence authorization for five years straight.

Residents and foreigners who are registered and pay into the health insurance system can receive public healthcare in the country. It also has a friendly expat community, particularly in cities like Ljubljana.

The projected monthly expenses for a family of four, excluding rent, are roughly 2,767 euros, which is a comparatively modest cost of living. Without rent, a single person’s expected monthly expenses come to roughly 816 euros.

Lunch at a cheap restaurant costs about 12 euros, and a monthly utility bill totals about 244 euros. The average rent for an apartment with one bedroom in the city center is 710 euros; the rent outside is approximately 580 euros.

For every square meter, the cost of an apartment is around 3k euros to 4k euros to purchase.

Portugal

The D7 visa, which is well-known in the country, is perfect for pensioners and individuals with passive earnings. For wealthy retirees, the Golden Visa that requires an investment can be an option too.

On top of an excellent healthcare system, Portugal has a moderate cost of living. Lisbon and Porto have thriving expat communities and a moderate climate, which can be beneficial.

The nation appeals to a lot of people because of its reputation for safety, walkability, and effective public transport.

A family of four can expect monthly expenses of about 2,360 euros without rent, while one person’s are roughly 670 euros. Dining costs around 10 euros, utilities average 115 euros per month.

Rent for a one-bedroom apartment is more than 700 euros to 953 euros. The acquisition price per square meter is around 3,440 euros vs 2,305 euros outside.

Japan

Although there isn’t a special retirement visa offered by Japan, retirees who meet certain financial requirements may qualify for a long-term stay visa.

Though some foreigners may find it difficult to communicate in the local tongue, the nation is respected for its first-rate healthcare system and high standard of living. Japan is praised for both the depth of its cultural experiences and its safety too.

Living expenses differ significantly between urban and rural regions, with Tokyo being among the costliest.

While a single person’s monthly expenditures are roughly 130,288 yen without rent, a family of four can anticipate 459,592 yen.

The average monthly cost of utilities is 25,627 yen, while a meal costs roughly 1,000 yen.

Rentals for a one-bedroom apartment are roughly 58k to 89k yen. Acquisitions are around 550k to 960k yen per sqm.

Malaysia

Under the Malaysia My Second Home or MM2H scheme, expat retirees who satisfy certain income and liquid asset conditions can remain in the country long term. The nation is secure for foreign nationals and has a substantial expat community, especially in the capital city of Kuala Lumpur.

Malaysia has a cheap cost of living and offers reasonably priced, excellent healthcare. Another attractive aspect is the warm weather.

Without rent, the forecast costs for a family of four are about 8,096 ringgit each month, while the estimated costs for an individual are about 2,288 ringgit.

About 15 ringgit is spent on a meal at a low-priced restaurant, while 217 ringgit is spent on utilities each month on average.

The approximate cost of renting a one-bedroom flat in the city center is 1,591 ringgit. The cost outside the area is 1,132 ringgit. The per-square-meter price for buying sits within the range of about 4.8k to 8.7k ringgit.

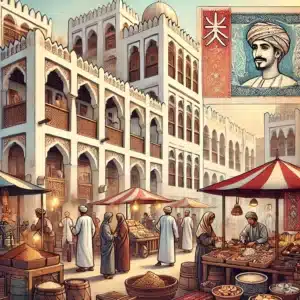

Oman

This nation provides a five-year renewable retirement visa to certain qualified expats.

Although foreigners usually require private health insurance to obtain treatments, the nation’s healthcare system is quite good.

Oman is a desirable location for retirees due to its pleasant weather and safety. The country offers an interesting cultural setting, and the expat community is expanding, particularly in Muscat.

A family of four would likely spend about 975 rials per month, not including rent, due to the moderate cost of living. The approximate monthly expenses for an individual are 281 rials.

The average cost of utilities is 39 rials monthly. A meal at a cheap restaurant costs roughly 2 rials.

A one-bedroom apartment fetches for 140 to 214 rials per month. In the city center, apartments cost roughly 595 rials per square meter; outside the area, they cost around 399 rials.

Taiwan

The country has no retirement visa for foreigners, but you can apply for foreign investor visas and business visas, subject to certain conditions.

Without rent, a family of four pays roughly 88,820 NT$ per month in expenses, whereas the costs for an individual are approximately 24,370 NT$.

A meal would cost around 150 NT$. Utilities are roughly 2,564 NT$ monthly.

Approximate costs for renting a one-bedroom flat could reach 14,733 NT$. The cost per square meter for an apartment could go up to approximately 271,876 NT$.

Croatia

Retirees who can demonstrate their financial stability may apply for the Croatian digital nomad visa.

The nation has a lovely Mediterranean climate and excellent healthcare.

Expat communities are expanding in cities like Split and Zagreb, where it’s generally safe.

Living expenses are fair, particularly when one is not in a popular tourist area.

An estimated 2,516 euros are spent each month on a family of four vs nearly 719 euros for a single individual.

A simple meal can cost 10 euros.

Renting an apartment with one bedroom can be anywhere from 460 euros to 590 euros. Meanwhile, buying one can go over 2.5k but under 3.5k euros per sqm.

Bulgaria

Certain expats can access so-called retirement D visas and temporary residence permits. This applies to retirees from outside the European Union whose state pension is at least as high as the minimum wage per month in Bulgaria.

Considered a safe location for foreigners, the nation boasts a burgeoning expat community, especially in towns like Sofia.

Bulgaria boasts one of the lowest costs of living in Europe, along with readily available and reasonably priced healthcare.

A single person’s monthly expenses come to about 1,155 lev, whilst a family of four is expected to spend about 4,075 lev.

A cheap lunch is about 18 lev, while a month’s worth of utilities is roughly 213 lev.

A one-bedroom apartment in the city center rents for about 806 lev, while apartments outside rent for about 617 lev. Apartments cost roughly 2,718 to 4,074 lev per square meter.

Lithuania

Retirees who can demonstrate sufficient income may apply for a temporary residency permit.

Living expenses are minimal, and medical care is of high quality. Lithuania enjoys a moderate temperature, and its cities, such as Vilnius, are renowned for their lively cultures and walkability.

The number of foreign residents is increasing, and one benefit for immigrants is safety.

When rent is excluded, a family of four spends about 2,560 euros every month. The monthly expenses for an individual are around 743 euros.

The expense of eating out is roughly 10 euros, while the cost of utilities is about 195 euros.

A one-bedroom flat may be rented for under 600 euros.

Apartments can be had for over 2k and 3.6k euros per sqm, depending on the location.

What to consider for choosing best cheapest country to retire

When creating a checklist for the least expensive country to retire in, it’s helpful to look into different factors to align with your retirement plan.

You must be satisfied with healthcare, weather, security, entertainment and environment, walkability and transport.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.