This Percent Investing review is for those looking for an alternative investment platform and private credit investments.

We will explore the reasons why it could be a viable investment as well as show the risks involved. There are also certain qualifications to note in order to open a Percent investment account.

Let’s first dig into the details of how Percent came about.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

What is Percent?

Percent was launched in 2018 as a platform for alternative investments with the goal of increasing their visibility, accessibility, and liquidity. Before changing its name to Percent in early 2021, the platform was known as Cadence. It made its public debut in June 2019.

Authorized investors have access to private credit investing which can be made in various asset-backed loans, including those secured by consumer and small business loans, trade receivables, merchant cash advances, corporate loans, and venture financing. Small firms, startups, and individuals who lack access to traditional forms of financing often turn to the private lending sector.

Investors look to private credit investments as attractive substitutes for or complements to more conventional investment vehicles like stocks and bonds. They are often of a short-term character, with a maturity period of no more than nine months.

Individuals can play the role of lender and get interest payments by purchasing such debt instruments. The repayments are usually collected as the loan matures, but this can vary depending on its terms.

If the debt is refinanced, the principal and interest could be returned in just a month. Investors gain mobility and the possibility of higher, more rapid returns with this shorter duration.

The returns on private credit investments are typically higher than those on government bonds because there is a greater potential for loss with non-bank financing. So, investors who take on this risk could receive higher interest rates.

Moreover, private credit investments tend to be unaffected by substantial shifts in the stock market. Many investors use private loans as a way of portfolio diversification. Investment strategies that incorporate private credit have the potential to lessen the effects of stock market volatility and increase their overall stability.

As of May 31, 2023, the average loan term on the platform was 9 months, and the annual percentage yield (APY) was 17.04%. The firm has disbursed almost $29.5 million in interest.

Since its rollout, investors in Percent have earned a weighted average APY of 12.78%.

Who can invest?

As of now, Percent only accepts accredited US investors with US bank accounts. The company said is working on a framework to accommodate international investors with foreign bank accounts and allow them to take part in investment opportunities, albeit with greater entry minimums.

Accredited investor status is determined by several factors:

- Made more than $200,000 personally or $300,000 jointly in each of the last two years. The same level of income should be retained for the present year.

- With a combined or individual net worth above $1 million. The value of the investor’s primary residence is not included in this net worth figure.

- People who qualify as natural persons and have earned specific titles and qualifications in their fields, such as the Series 7, Series 65, or Series 82 licenses. Other licenses can be supported in the future.

- The spouse or “spousal equivalent” of an accredited investor who, together with their spouse, meets the net worth and/or income requirements for accredited investors. Someone who is married to an accredited investor and has access to that person’s financial resources would also meet the criteria for accreditation.

- being “knowledgeable employees” of a private fund.

- LLCs and Family Offices having $5 million or more in managed assets. With the exception of reporting advisors, investment advisors who are registered with the SEC or a state securities regulator may also be considered accredited investors.

- Native American tribes, governmental bodies, funds, and organizations constituted under foreign country laws, provided they have a net worth more than $5 million and were not founded for the primary purpose of investing in an accredited investment.

How does it work?

Individuals can get early access to investment possibilities unique to Percent by creating a free account. Users must present a government-issued ID or passport to prove their identity.

To ensure compliance with Know Your Customer (KYC) rules, Percent uses a top identity verification provider. This service authenticates users by comparing their photo ID with a database of known bad actors, all thanks to the power of AI.

Users must fund their Percent account and acquire digital proof of ownership before they may begin investing. Investors can request for a specific sum and annual percentage yield (APY).

A Percent account can be funded via wire transfers or automated clearing house (ACH) transfers, among others. While ACH payments might take up to five business days to clear, wire transfers normally clear the next business day. When a user’s funds have cleared, the matching amount will show up in their Percent account balance.

Both a requested and a minimum investment can be established by users when making an investment on Percent. The proposed investment amount is met to the greatest extent possible, but in cases of strong demand, this may not be achievable at all. Minimum investment requirements can help in these situations to guarantee investments of a reasonable size.

By following these steps, investors improve their chances of taking part in an offering and lessen the danger of being completely shut out if the offering is overcrowded. In addition, investors no longer have to rely on email alerts to know when a deal has opened. Prior to the funding close, investments can be made at any time.

An investment may be ineligible for a deal if its minimum annual percentage yield or minimum investment amount is too low during times of high demand.

An investor’s investment request will be reimbursed and they will not be included in the offering if the minimum APY they selected is higher than the final APY. However, before the financing cutoff date, investors can increase their chances of taking part in the offering by modifying their investment request by altering the minimum APY option to the lower end of the range.

Both investor demand and the borrower’s ability to take risk in exchange for adequate collateral will determine the offering size and annual percentage yield. If the offering size needs to be reduced, Percent will take the minimum and maximum investment amounts into account when making its decision.

Those who wish to keep tabs on their interest earnings can easily do so. When their investment matures, individuals can either cash out their entire investment or reinvest the principal plus interest.

Is it safe?

Your money is being safely stored at an FDIC-approved financial institution. Deposits with Percent are federally insured up to the maximum value of $250,000.

Percent Investments

Standardized offerings from Percent give investors access to numerous asset classes and geographies. Percent gives investors the freedom to invest how they see fit, be it in small business financing ventures in Latin America or litigation finance opportunities in the US.

Asset Classes

Consumer Loans

Consumer point-of-sale installment loans, auto loans, crypto-backed loans, and short-term unsecured loans are only some of the consumer lending assets offered on the Percent platform. Consumer loan credit quality is assessed using indicators like consumer credit scores.

The degree of security provided by collateral is also crucial. Loans secured by everyday necessities like cars have a greater percentage of repayment than those secured by other types of assets.

Fintech consumer lenders in emerging nations typically target those who lack access to traditional financial services. These people might not have credit scores at all or have a short credit history that can be accessed through a credit check.

However, in mature markets, these lenders seek out certain customer subsets that larger financial institutions might overlook. Smaller borrowers in the fintech space use technology and alternative data in both cases.

Trade Receivables

The Percent platform includes factoring invoices among its trade receivables available for investment. Invoice factoring is the practice of purchasing invoices from companies at a discount. In this deal, the business isn’t actually getting a loan, but rather selling its accounts receivable.

Invoice factoring is very important in industries like trucking and logistics. Creditworthiness of the debtor listed on the invoice is often given greater weight by lenders in this industry than that of the customer who sold the invoice.

In most cases, a factoring company will hold on to both the debtor and the client’s remedy. Typically, a factoring company will advance just 80% to 90% of an invoice’s value and hold the balance in reserve. This reserve serves as an extra safeguard against losses.

SMB Loans

One of the simplest types of assets on the Percent platform are loans to small- and medium-sized businesses (SMBs). Short- and medium-term unsecured and secured loans fall into this category. The credit quality of the borrowing company, as opposed to the credit score or quality of the business owner, is given primary consideration throughout the underwriting process for SMB loans.

The recovery rate and the borrower’s desire to repay improve when a loan is secured or supported by a personal guarantee from the business owner.

There are specialized SMB lenders that use non-traditional data sources in their underwriting. Lenders who specialize in working with online stores may, for instance, use information from an applicant’s Amazon Seller Central account for making credit judgments.

SMB Cash Advances

Often referred to as a “merchant cash advance,” or “MCA,” an SMB cash advance is an unsecured loan used to fund working capital needs. Financial advances are not loans but rather the sale of an asset to cover the payment of a financial shortfall. For this reason, small business cash advances share features with invoice factoring and resemble small business loans in several respects.

SMB cash advances differ from invoice factoring in that they do not rely on past or present deliveries of products or services to guarantee repayment, but rather on anticipated income. As a result, the security of the advance relies heavily on the underlying borrower’s capacity to sustainably earn profits. If a company needs more time to return a cash loan because of a temporary drop in sales, the cash advance’s owner may prolong the payback period.

SMB Leases

SMB leases are a new form of finance made available through the Percent investing platform. One key distinction between leases and other kinds of financing is that the lessor (or lender) rather than the borrower (who would hold the assets subject to a claim by the lender) already owns the assets that secure the loan.

This feature of leases can make repossession less complicated, as the lessor is less likely to face legal challenges from the lessee’s other creditors. Properties, machines, and buildings are only some of the assets that can be used to acquire a lease. Leasing underwriting often takes into account both the lessee’s financial stability and the lease’s monetary worth in comparison to the asset being leased.

Lessees may be less inclined to make lease payments if the present value of the lease payments exceeds the worth of the leased asset. The ability to sell off repossessed assets to make up for late payments could also be hampered.

Depreciation and the resale value of the leased assets are important considerations in lease analysis.

Blended Notes

The Blended Note from Percent gives investors diversified exposure to the company’s existing platform deals. Investors may watch their portfolio expand based on their preferred investment amount, with the help of an algorithm that prioritizes diversification and returns.

Automatic investments in the most up-to-date Percent structured notes are made possible by the Percent Blended Note. These notes have a diversified investing strategy because they are backed by several different types of loans and credit products.

Minimum contributions of $5,000 allow investors to immediately begin creating a varied portfolio. They pay only a 1% administration charge.

Venture Investments

High-growth, venture-backed businesses’ debt can be invested in for $500. Accelerating enterprises can tap into funding for business expansion through venture loan investments.

Investors in this sector often take a short-term view, investing in debt for a period of one to three years in order to gain exposure to a company and perhaps benefit from greater yields between fundraising rounds. Loans of this type are designed to be returned in later rounds of equity funding for the companies.

The next round of equity funding for the companies will be facilitated by this investment structure, which is meant to give investors with favorable terms. Although there is a greater chance of loss with venture loan investments, there is also a greater possibility of gain.

Newer venture-backed enterprises can fuel their growth on a smaller scale by taking out loans, much like large corporations do.

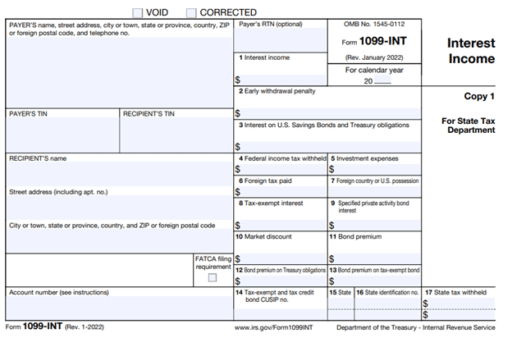

What are the tax implications?

Ordinary income tax applies to any returns earned on investments made through the Percent platform. At the end of each fiscal year, investors will get a single 1099-INT that summarizes all of their investments for tax reasons.

Most ordinary income is taxed in seven tiers in 2022, according to the IRS. Categories of these brackets: 10, 12, 22, 24, 32, 35, and 37 percent.

Raising Capital and Venture Debt on Percent

Capital Raise

Over $800 million has been raised with the help of over 400 structured products since Percent investment’s 2018 rollout. Many accredited individual and institutional investors contributed to this round of funding.

With Percent’s marketplace, borrowers may quickly and easily connect with underwriters and investors to streamline the capital-raising process. The sophisticated technology used in the platform helps bring the private credit markets up to date by streamlining operations and reducing complexity.

Businesses using Percent’s platform gain access to an array of valuable market data streams, allowing them to better shape and develop their future issuances. Through the platform, they obtain significant insights about origination volumes, outstanding balances, historical deal price, and current and prior issuances.

Once a company satisfies the conditions set forth by Percent, it can begin fundraising from a massive group of thousands of investors. The price for the platform is a flat monthly cost that is determined by the total amount of capital still in the company’s account.

Venture Debt Raise

Corporate Loans from Percent let businesses funded by venture capitalists develop and expand with minimal impact to their ownership. High-growth enterprises can expand and optimize their current valuation with the help of these loans, which provide best pricing on the money required to propel the company into the next phase.

Businesses can obtain access to thousands of certified investors by using the platform. Because of their ability to negotiate rates and terms in line with current market conditions, they are guaranteed to acquire the most attractive financing choices currently accessible.

Percent Debt Underwriting

By using the Percent Underwriter service, you may find new corporate borrower clients, help arrange private credit arrangements that meet industry standards, and immediately share your offering to investors.

Users of Percent Underwriter have access to a big pool of prospective corporate borrowers and can negotiate terms with them directly to secure the necessary debt financing.

The service simplifies things by reducing the time spent on document creation, so that users may put more effort into optimizing structures and arranging the credit. Users can model new deals using data from previously closed transactions and use standard documentation, all while utilizing Percent’s integrated multi-party data room.

Using Percent Underwriter, customers can rapidly reach out to a broad spectrum of accredited investors, from individual investors to credit funds, for funding. Borrower clients can receive terms based on demand-driven factors thanks to their efficient order book management.

After a sale has closed, users may focus on closing the next one while Percent handles the operational details. All aspects of the investment process can be managed with this automated system, from subscription agreements and statements to custodial services and asset-level monitoring.

Percent Pros and Cons

The low price of Percent’s regular retail platform is just one of its many benefits. Note investments on this platform provide investors with diversification and profits that are independent of the stock market. In addition, Percent gives you entry to numerous short-term, high-yield investing possibilities. It is important to note that all investments made through Percent are fully guaranteed by assets.

However, the site is only open to accredited investors, which prevents other types of investors from using it. Investors must also actively manage their investments. Some would-be investors may be put off by the platform’s requirement that they put up $500 each note. Deals on the site are typically funded rapidly, so latecomers may find themselves out of luck as well. The investments may also lack liquidity as Percent does not have a secondary market, so investors cannot exit their assets before maturity.

Final Thoughts on Percent Investment Review

While it has only been around for a short while, Percent already holds an incredible list of accomplishments. It provides a venue for accredited investors to have exposure to varying debt instruments and blended note portfolios, which gives diversity in their investment portfolios through private credit investing. The platform is especially attractive to authorized investors because it does not impose any fees on individual deals.

Many renowned corporate borrowers from which the company has formed agreements offer loans to small enterprises and individual customers. Investors who sign up on percent.com can then choose a private credit offer they find appealing and invest in it to help finance a syndicated loan.

However, traders should proceed with caution while dealing with Percent. Investors may feel a false feeling of control due to the platform’s transparency regarding each sale and the short-duration notes.

Despite the site’s helpful features, investors should be aware that private debt is a high-risk asset class, so they may suffer a complete loss of their initial capital in addition to any profits they may have made. When deciding how much to put in Percent, it’s necessary to weigh this risk.

Investors should remember that past success does not guarantee future outcomes. Historical, estimated, or probability returns may not correctly predict future performance.

The risk of complete loss of capital exists with any investment opportunity. Users should be aware that Percent investing does not offer personalized recommendations in the areas of investing, finance, law, or accounting.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.