We will review the Prudential International Portfolio Bond that Prudential International Assurance has been offering to UK advisers from 2020.

In late 2022, financial services company M&G rolled out the Prudential International Portfolio Bond in the Channel Islands and the Isle of Man. The product will expand the available investment opportunities for advisers in the applicable territories.

This includes if you have a policy and aren’t happy.

Who are Prudential International Assurance and M&G?

Prudential and M&G are two separate entities that were previously part of the same company, British life insurance and financial services provider Prudential plc.

If you want to invest as an expat or high-net-worth individual, which is what I specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

Historically, Prudential plc operated as a single company with various divisions and subsidiaries, including its insurance operations and its asset management business known as M&G. However, in 2019, Prudential announced its intention to separate into Prudential plc and M&G plc.

Prudential plc retained its insurance operations, primarily focusing on life insurance, health insurance, and related financial services. Meanwhile, M&G offers a comprehensive variety of financial products and solutions to individual and institutional clients as an independent investment manager.

Despite the demerger, the two firms aren’t totally strangers.

Ireland-based Prudential International Assurance, commonly known as Prudential International, offers life insurance, savings accounts, and investment options. The company is a unit of Prudential plc.

Understanding the Prudential International Portfolio Bond

What is the Prudential International Portfolio Bond?

The International Portfolio Bond is an offshore bond made for those who want to put away a lump sum money for a considerable period of time. It offers online applications for individuals and visual representation and breakdown of potential investment outcomes and financial projections for corporations and trustees.

This product allows investors to access the PruFund Range of Funds, the PruFolio Risk Managed Active and Passive Funds, and funds managed by other respected external fund managers. Clients may maximize their returns and reduce their tax liability since this investment option provides favorable tax treatment.

The offering also allows customers some leeway in the amount of policies they choose for their bond, with a minimum investment of 20,000 pounds.

Depending on the underlying investment choice, the product’s appropriateness and investment profile may change.

This product comes in two types. First is the Lives Assured version which is an investment bond with a single premium that lasts for the bondholder’s whole life and pays out a nominal sum upon death. The second is the Capital Redemption version which is a 99-year bond with a single premium that may gain value over time and pays out if it isn’t cashed in sooner.

Let’s dig into each type further.

International Portfolio Bond Lives Assured

This investment product is aimed at increasing the value of your investment over a medium to long-term period of 5 to 10 years. It does this by investing in Prudential International PruFund and other funds.

This product offers the flexibility to make regular tax-efficient withdrawals and provides access to the value of your investment at any time. The minimum initial investment required for this product is pounds 20,000, with a minimum additional investment of 5,000 pounds. The maximum amount that may be invested across all PruFund funds is a million pounds. Investments are only accepted in British pounds.

If you hold the bond jointly with someone else, both investors will be considered to have invested the full amount, meaning a joint investment of 1 million pounds would reach the maximum limit for both individuals.

Depending on the underlying investment choice selected, the International Portfolio Bond Lives Assured may or may not be suitable for investors looking to invest a large quantity of money for the medium to long term.

In the event of the death of the chosen life assured, a death benefit of 100.1% of the bond’s cash-in value will be payable. The value of external assets will be determined based on the day they can be sold, and this amount may differ across assets. Unlike traditional investment products, this bond does not have a specified maturity date but will terminate immediately upon the death of the life assured. It is recommended to hold the bond for a minimum of 10 years.

Additionally, this product includes a cash account. Funds may be held in the cash account for various reasons, such as as part of selected funds, in anticipation of investing in other chosen funds, to fulfill requested withdrawals, pay applicable charges, or as a precursor to paying out the death benefit. The cash account may also receive extra funds from investment-generated income, dividends, or interest payments.

International Portfolio Bond Capital Redemption

The International Portfolio Bond offers a Capital Redemption version, which shares similarities with the life version. This offering invests in a variety of funds during the life of your product to increase your investment over the medium to long term. It allows investors to make regular tax-efficient withdrawals and provides the flexibility to access the product’s value whenever needed.

Also, the Capital Redemption option does not have a specified maturity date unlike traditional investment products although each plan is designed to mature after 99 years from its start date.

This product has a minimum investment requirement of 20,000 pounds. It gives investors extra control over their money since they may withdraw at any moment.

However, this version does not offer a death benefit. It also does not include any protection against future market performance, so there is a risk of losing some or all of your investments. Should Prudential International be unable to fulfill its financial obligations, there is a potential risk of losing the entire investment.

The International Portfolio Bond, whether in its Lives Assured or Capital Redemption version, can be suitable for individuals seeking to diversify their investments across many options. Whether investing individually or jointly with someone else, this product offers the potential to explore various investment opportunities and tailor the portfolio to meet specific financial goals and preferences.

Who can invest?

Anyone who is at least 18 years old and a UK resident may apply for an International Portfolio Bond. It may be held by one owner or a group of up to 10 people.

For the Lives Assures version, you have the option of either being the life assured or becoming the life assurer for up to 10 other persons. At least one of the individuals covered by the policy must be no older than 90 years old at the start.

What funds are available?

You and your financial adviser have the flexibility to select the funds that align with your investment goals from a designated range of options. Prudential International Assurance provides a variety of multi-asset funds, including passive funds, active funds, and smoothed funds such as the PruFund range of funds.

Whether you prefer a hands-off approach with passive funds, an actively managed strategy, or the stability offered by smoothed funds, the range of choices ensures that you can find investments that suit your needs and investment strategy.

Some funds have the ability to invest in multiple asset types, aiming to mitigate the risk of potential losses by not relying solely on the performance of individual assets or assets of the same type. Prudential International’s existing PruFund range prioritizes responsible investing, incorporating exclusions to avoid harmful investments and addressing environmental, social, and governance risks.

This commitment to ESG factors is applied across all managed funds, enabling the incorporation of ESG considerations into investment decisions to manage risk, generate sustainable long-term returns, and drive improvements in areas such as diversity and climate impact.

The PruFund funds are designed to achieve medium- to long-term growth while mitigating the extreme short-term fluctuations commonly associated with direct stock market investments. This is achieved through a well-established smoothing process, aiming to provide investors with a more stable growth rate compared to being directly exposed to daily changes in the underlying investment performance of the fund.

In case you decide you want to switch investing strategies, you may do so whenever you want. You may move your money around among the various funds as long as you stay within the range of options. But there are restrictions on the PruFund range of funds in particular, so keep that in mind. You can make only one change into or out of PruFund funds every three months.

It’s worth mentioning that Prudential International Assurance does not currently impose any charges for making these fund transfers.

Can I lose money?

The capital of Prudential International is more than the required. Albeit unlikely, Prudential International, its parent, the fund manager, or the fund custodian might also fail to meet their financial responsibilities that could make you lose money. The Financial Services Compensation Scheme (FSCS) in the UK or other financial guarantee programs from the government do not cover Prudential International products.

What are the charges and costs of the Prudential International Portfolio Bond?

Bond Fees

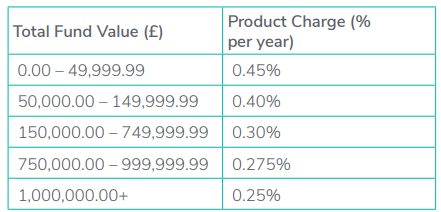

When establishing and managing your bond, there are certain administrative costs involved. Prudential International Assurance applies a product charge, which is deducted from your bond on a monthly basis. The exact amount of the charge is determined as a percentage of the total fund value of your bond at that specific time. As your bond’s value changes, so does the percentage charged.

Fund Fees

The fund manager charges a fee for most funds to cover management and administration expenses. This charge is incorporated into the unit price of the fund, meaning it is reflected in the value of each unit. It’s important to note that this charge can differ among funds and may change over time as determined by the fund manager.

This charge is the Annual Management Charge for PruFund. It represents the cost of overseeing and maintaining the PruFund investments. It’s essential to be aware of this charge when investing in PruFund or any other funds, as it will impact the overall performance and returns of the investment.

Additional fees may also be incurred. These costs are typically borne by the relevant fund itself and are associated with specific activities or services related to the fund’s operations like transaction, legal, or auditing fees. These additional costs can have an effect on the overall performance of the fund.

Adviser Fees

Prudential International Assurance provides the option for you and your financial adviser to agree on specific charges related to the services provided. These charges can include financial advisory fees or other agreed-upon expenses. You may also ask the corporation to pay these expenses straight from your investment.

To initiate this process, you would need to provide an instruction specifying the charges you wish to have paid. Prudential International will transfer the necessary amount from your payment or bond to your financial adviser after receiving it.

Long-Term Costs

For an investment of 10,000 pounds, the total costs upon cashing in after one year can range from 45 pounds to 758.14 pounds. Similarly, for a five-year holding period, the costs can range from 236.71 pounds to 3,561.91 pounds, while for a 10-year holding period, the costs can vary between 505 pounds and 7,485.73 pounds. These figures include potential early exit penalties.

The impact on the return, measured as the Reduction in Yield or RIY per year, is also provided. For a one-year holding period, the RIY ranges from 0.46% to 7.72%. For a five-year holding period, the range is 0.46% to 6.90%, while it is 0.46% to 6.80% for a 10-year holding period.

The costs can be further categorized into one-off costs, ongoing costs, and incidental costs. One-off charges include entry costs, which range from 0% to 0.10%, and exit costs, which range from 0% to 0%.

Ongoing costs consist of portfolio transaction fees, ranging from 0% to 0.76%, and other ongoing charges, which range from 0.46% to 3.22%.

Incidental costs encompass performance fees, ranging from 0% to 2.72%, and carried interests, which range from 0% to 0%.

Costs may vary from those shown. Product alternatives throughout your investment may incur additional fees. The fund fees are based on the range of funds projected to be accessible over the estimated lifespan of your investment, including those that may not be available when you invest.

How can I withdraw money?

You may cash out your bond in a single lump sum or set up automatic payments at regular intervals.

For regular withdrawals, the amount is distributed equally across all the policies within your bond. You have the option to schedule regular withdrawals per month, per quarter, half year, or 12-monthly basis. You may adjust the withdrawal schedule to suit your own circumstances and personal preferences.

One-time bond withdrawals can be done partially or in full. Partial cash out allows you to withdraw a portion of the funds from all the policies in your bond while full cash out involves withdrawing the entire value of selected policies. Please note that the minimum withdrawal amount for any type of payment is 50 pounds.

There may be various tax considerations based on the withdrawal strategy you choose. If you want to know the exact tax implications of your withdrawal plan, you should talk to a tax expert or financial adviser.

The contract may be canceled within 30 days of getting your bond papers. This cancellation period begins from the day you initially receive the bond documents. If you decide to make additional investments into your bond, each subsequent investment also entitles you to a separate 30-day cancellation period.

If you cancel within this time frame, you will receive the full amount invested in a PruFund Fund. If your other funds have declined in value, you may not get your money back.

Holding the product for at least 10 years is advised for investors seeking medium- to long-term returns from investment markets. The specific holding period may vary depending on individual investment objectives. This longer time frame allows for potential recovery from short-term volatility in investment markets, promoting a more favorable outcome for your investment.

What are the tax considerations?

These are specific to UK tax.

Capital Gains Tax

Your bond offers certain tax advantages, including exemption from capital gains tax. However, any money you cash out of your bond might be liable to income tax. You may take 5% of your investments tax-free each year. This can be done through regular or one-off withdrawals by partially cashing in the policies in your bond. You may roll over unused 5% allotment to subsequent years.

However, once you have withdrawn 100% of the amount you invested, the allowance ends. If you exceed the 5% limit in any year, you may have to pay Income Tax. Note that such allowance applies to further investments.

Furthermore, Income Tax may be applicable in certain circumstances. This includes when you cash in your bond or any policies within it, transfer legal ownership of your bond, or when your bond matures.

You may be able to trim the amount of tax you owe on the profits obtained while you were not a UK resident. That is if you were outside of the country during the time you had the policy. Consult a tax professional to understand your unique tax duties and rights.

Inheritance Tax

There is a chance that Inheritance Tax will apply to your estate if your bond is not held in trust when you pass away. This means that your estate might be required to pay Inheritance Tax on the value of the bond.

Additionally, if you become a resident in Ireland, Irish Exit Tax will be deducted from your bond under certain circumstances. This includes every eight years, when any benefits are paid out, or when there is a change in ownership of the bond. The deducted tax is then paid to the Irish tax authorities.

If you are not a resident of Ireland, however, you may avoid paying Irish Exit Tax by certifying that fact on the Declaration of Residence Outside Ireland form.

Tax Implications for Trusts and Corporate Investors

There are special tax rules that apply if your bond is established under a trust. Meanwhile, UK corporate investors are not eligible to benefit from the 5% annual tax-deferred allowance. Different tax considerations may apply to corporate investors as well.

The tax implications associated with your bond depend on your individual circumstances and the choices you make. It is crucial to take into account that tax regulations can change in the future, potentially impacting the tax treatment of your bond.

What are the benefits and risks of the Prudential International Portfolio Bond?

Benefits

One of its key advantages is diversification, as it provides access to a wide range of investment options including Prudential International PruFund and funds from external managers. This allows investors to minimize reliance on the performance of any single investment.

Flexibility is another significant benefit of the bond. Investors may adjust their portfolio to reflect shifting market circumstances or investing aims since they have access to many funds from which to pick. Additionally, the bond allows for regular or one-off withdrawals, providing liquidity and accessibility to funds when required.

Tax efficiency is a notable feature of the International Portfolio Bond. While capital gains tax does not apply to the bond, income tax may be applicable on withdrawals. However, investors are also allowed to take 5% of their investment per year tax-free. Unused portions of the allowance can be carried forward, which is a potential upside.

The bond aims to deliver long-term growth while mitigating risk. It employs an established smoothing process that helps protect against extreme short-term market fluctuations, offering a more stable rate of growth compared to direct stock market investments. This feature can be particularly appealing to investors seeking steady and consistent returns over the medium to long term.

Risks

Investment value might change, and you may get back less than you invested. If the charges and costs associated with the bond exceed the investment growth, the value of the investment will decrease.

It’s also crucial to keep in mind that future fee hikes may have an effect on the investment’s overall performance. Bonds lose value if interest and principal payments are taken out at a faster rate than the bond’s underlying investment grows.

Each investment choice within the International Portfolio Bond has its own set of risks, which can affect the value of the bond. Additionally, some investment choices may have restrictions on withdrawals or transferring funds between investments. It is advisable to discuss these risks and limitations with your financial planner.

Also, exceptional circumstances may arise, causing delays in buying, switching, or selling units within the funds.

Lastly, if the value of the bond funds falls below a thousand pounds, Prudential reserves the right to cancel the bond and reimburse the investor with the remaining investment value after deducting any applicable charges.

Given these considerations, prospective buyers of the Prudential International Portfolio Bond would be wise to consult with a financial advisor to be sure the bond is suitable for their needs and risk tolerance.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.