This article will review Prudential’s retirement solutions. Is this a good way to invest? If you want to contact me please email me on advice@adamfayed.com or in the chat function below.

Firstly, who are Prudential?

They are a Fortune 500 company that provides insurance, financial and other investment products around the world.

Originally from American, they have insurance assets of around $1.5trillion USD in the USA alone with $4trillion in life insurance business worldwide.

However, they also offer annuities, retirement solutions and many other investment-specific solutions.

Are Prudential solutions the same worldwide?

No. Prudential aren’t an online-focused firm, and have registered companies around the world. So the solutions are often different in each country to comply with local laws.

For example, Prudential in the UK, have different offerings to Prudential in Cambodia, or Prudential in Philippines.

This is very different from an online platform which is only registered in one country, and therefore offer a standardized product.

How does this difference manifest itself?

In many jurisdictions, fees and commissions have been restricted. In effect, this often means that Prudential’s offerings in the UK, US and other developed jurisdictions, is lower cost than in emerging markets, where they have huge direct sales forces selling to local clients.

How do Prudential’s Retirement and Investment Solutions typically work?

As Prudential operate in multiple countries, I will just pick Prudential Singapore as an example and focus on their PruSelect and PruSelect Vantage Premier.

These are insurance-linked investment products, which are designed for monthly investors. They claim they tab into the investment knowledge of Mercer Investment Solutions to help with Investment Expertise.

You can invest for 5-20 years. If you elect to come out early, you will be hit by a penalty. You get loyalty bonuses as a “reward” for investing every month without fail.

In addition to that you can add insurance “riders”, for example accident benefits, which pays out your loved ones if you are killed by an accident. Critical illness is another rider on offer.

It all sounds very good. You can combine your investments and insurances (life, critical illness etc) into one plan, and it is flexible right?

The problem is, the maths usually dictates that doing insurances and investments separately makes the most sense. Doing it together, as in this plan, usually has several drawbacks with the exception of some low-cost providers.

What are the negatives with Prudential’s plans?

The main negatives are:

- The plans are expensive in most parts of the world. They try to disguise these fees with talk of bonuses but the net fees still remain high. It is true that the direct fees can seem reasonable, but there are many indirect fees as well.

- They usually focus on their own funds – ProFunds. So they aren’t independent. Exceptions do exist to this rule. In some parts of the world they offer an “open architecture” solution which allows for external third -party funds to be chosen.

- You are most likely treated as customer number 100,202. You are merely a number to such a big firm, with customer services and other impersonal service offerings

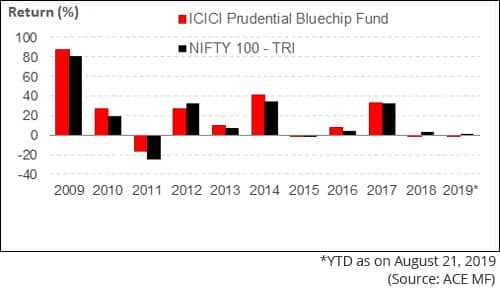

- The majority of their funds underperform their peers in the market and the general index . Take recent years as an example. Markets, with the exception of 2018, have performed very well since 2009. However, many of Prudential’s funds have not:

And the example above, is just one of many examples I could give.

5. They are often relying on brand name and people assuming it is “better to be safe than sorry”.

6. A lot of the stated benefits like “free switching” and “100% invested from day 1” isn’t so good, if you work through the smaller details.

For example, the investment evidence shows you shouldn’t be switching that much anyway, meaning you shouldn’t be taking advantage of this benefit in the first place.

What are the advantages associated with Prudential’s plans?

The only main advantage is that Prudential will probably be around in 25-30 years, so your money is safe.

This shouldn’t be a huge consideration in any case, because most investment firms have checks and balances now, concerning how investment funds are administered.

What’s the difference between term life and whole of life insurance?

Term life insurance is “pure life insurance” with no investment component. For example, you take out life insurance worth $500,000, for a 20 year term, for $100 a month.

If you don’t die, you lose the money, but if you do die, your family gets the money upon your death. With whole of life insurance, in comparison, you get “less bang for your buck” when it comes to the insurance side, but have an investment component.

For example using the aforementioned example, you only get $150,000 life insurance for your $100 premium, but that $100 is then invested into markets.

This means that if you don’t die, you will get back some of the money, often with minimal interest. Sounds good, but in reality, term insurance is usually better value.

With whole of life insurance, you are getting the cost of the insurance and investment in the same plan. So it usually makes sense to separate investments and insurance.

What are some of the names of Prudential Investment-Linked plans?

Some of the names used are: RULink SuperGrowth Account, PRUSelect, PRULink SuperSaver Account, PRUSelect Vantage and PRUSelect Vantage Premier

Apart from investments is Prudential a good life insurance company?

For pure term life insurance, Prudential is likely to pay out claims, as they are likely to still be around in 25-30 years. Providing the premiums are reasonable, therefore, it isn’t a bad option.

It always pays around to shop for term insurance though, and go for the best, cheapest option.

Conclusion

Companies like Prudential are usually fine for pure insurance, but their retirement and investment solutions are usually either high-cost, and/or complex.

There are better options in the market for both expats and locals, when it comes to retirement and investing.

Further reading

1. Prudential Retirement Review navigates retirement solutions, while Hansard International Universal Personal Portfolio 2023 Review delves into customizable retirement plans.

2. Want to look for more productive ways to invest? The article below looks at that.