This article will discuss a hot topic; robo advisors and investment apps. It will discuss some misconceptions and answer some frequently asked questions (FAQs)..

It will end with some exciting news, on a new forthcoming expat investment app.

My contact details are hello@adamfayed.com and WhatsApp +44-7393-450-837 if you have any questions.

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

What are robo advisors?

Robo advisors are financial advisors that provide advice online, often with minimum human interaction.

Often they are using technology based on mathematical rules or algorithms, to come up with investment strategies and decisions.

However, there are several misconnections about robo advisors. The first misconception, is that human interactive is always zero.

Often times, advisors and companies are using robo advisors to automate some parts of the process, but are still insisting on human interaction.

For example, several firms have stopped using asset managers they have previously used, and instead are using AI, which is using algorithms, to help come up with investment strategies or to lower costs for the clients.

In other words, in this model, the technology and advisory company are working in tandem with one another, to reduce the costs for the clients, and speed up processes.

When did robo-advisors start?

They became more popular around 10 years ago, after the 2008-2009 Financial Crisis.

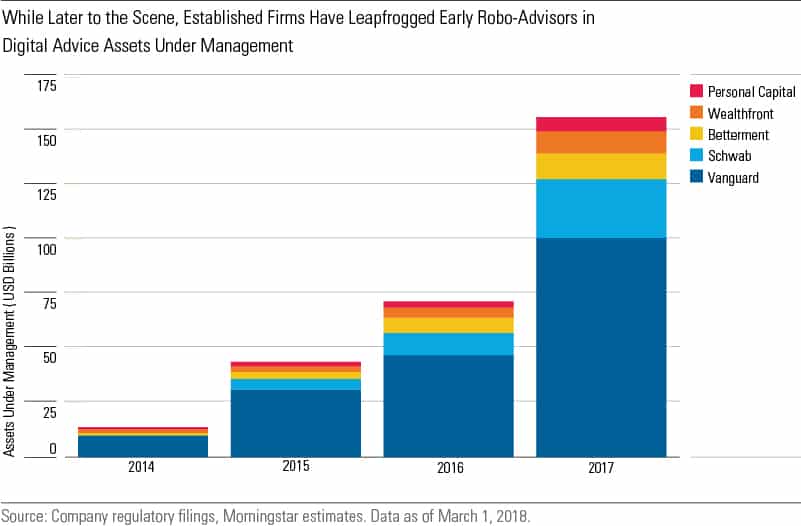

They have subsequently became more popular over time. The graph below shows how some bigger providers, like Vanguard, have grown:

Are robo-advisors always cheaper?

One of the misconceptions about robo-advisors is that they are always cheaper.

It is true that many charge a low fee, often 0.50% per annum as an example, but asset management costs also apply.

A robo advisor that picks expensive mutual funds, with high total expense ratios, can actually be quite expensive, indirectly.

Pros and Cons of robo-advisors

Pros

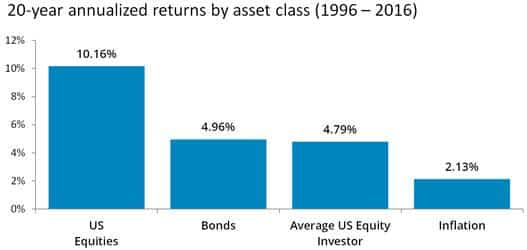

Study after study, has shown that DIY investors get bad average returns. The main reason for this is emotional; so many investors panic when markets are going down and get too excited when they are going up.

A robot doesn’t have emotions, so is making decisions based on more objective criteria.

The robo-advisors are also good at building questionnaires, and making portfolios according to your risk tolerance.

Used in conjunction with an advisor, moreover, and you can potentially have the best of both worlds; the personal touch and reduced costs.

Cons

The main negatives about the technology, is they tend to be good for investing, and less focused on your overall financial planning situation.

In other words, the technology doesn’t help with getting out of debt, building up an emergency fund or anything specific, which goes beyond investment and retirement advice.

In addition to that, the technology doesn’t give always give personalized advice. If you are an expat, who is planning on moving to 3-5 countries in the next 20 years, or you have a very specific situation, the technology isn’t yet up to speed with such complexity.

That is one reason why higher-net-wealth individuals prefer an advisor, who also utilizes the technology, but doesn’t rely completely on it.

In addition to that, many people like to have a personal relationship with an advisor, so prefer at least reasonable amounts of advisor interaction, even if that is just done by phone and email.

Many robo-advisors will try to stock pick. Essentially this means buying thousands of stocks, to find winners.

There is no conclusive evidence, as of yet, that robo advisors can beat the S&P and other index funds long-term, using this approach.

What they can do effective, is rebalance yearly and as you age. As an example, if your risk tolerance suggests you should have 20% in bonds and 80% in stocks, but stocks outperform bonds for the year, many of the robo advisors can rebalance to maintain the 80%-20% balance.

Can robo-advisors always help with the “behavior gap”?

Many investors get lower returns than the market, due to their own behavior as the graph below shows:

No. If markets are going crazy, either up or down, it is unlikely that a Robo-advisor will have the same affect as a human telling you not to do something stupid.

We all know how to get fit, but many see the benefits of using a personal trainer to get fit, nertheless.

Likewise in investing, an investment expert can act as a check and balance, to ensure you don’t do stupid things with your money.

Ever been in a situation where you have heard about a “hot investment opportunity” at a dinner party?

I am sure, in that instance, speaking to a human advisor about whether the “hot investment” is a good idea, is more effective than a robot.

How about more specifically for expats?

The more complex your financial situation, and the more money you have, the less gaps the technology can fill.

However, for smaller clients and expats with more straight forward financial planning needs, the technology can be an excellent.

This doesn’t mean the technology can’t be used for higher net wealth clients, merely that human interaction will still need to be relied upon extensively.

Are there tax implications?

The tax implications are no different to if you invest yourself, or if you have a traditional advisor.

How much tax is due, depends on your country of residency, how often the securities are traded and many other things.

Where are robo advisors gaining the most traction?

In general, robo advisors are gaining more traction in the lower ends of the market.

The high-net-wealth market, and even niece’s like the expat market, still wants a lot of human interaction, but still appreciate any moves to make the process more efficient and digital.

However, for younger investors and those without account minimums, robots advisors are becoming increasingly popular.

In markets like the US, UK, Singapore and several others, many advisors have high account minimums, often $250,000+ for advice.

This is one of the reasons for the increasing popularity of robo advisors amongst the younger generation, and investors without such account minimums.

Where are robo advisors available?

They are available worldwide but have gained traction in some of the more developed markets, such as the UK, US, Singapore and Hong Kong.

They have, in recent times, been gaining traction in several emerging markets as well.

Is Betterment available in Canada, the UK and to expats?

Currently, they are not. Likewise, Vanguard is currently not available in all locations, or to overseas Americans.

Are all robo-advisors the same?

No there can be huge differences in fees, whether you have access to an advisor or DIY, minimum investments, investment strategy and add on services such as rebalancing.

Some robo-advisors also use “tax loss harvesting”. This is the practice where securities that have lost money are sold, to reduce the taxes on your capital gains.

Are there any expat specific apps and investment platforms?

There are countless robo-advisers, and especially apps, which are tailored for the expat market.

The benefits of expat-specific platforms is that they are more likely to follow you if you move countries.

In comparison, many platforms have been known to close down accounts, if clients move countries. This can not only be inconvenient but can lead to unexpected tax bills.

Do you use robo-advisors and investment apps?

I do have an agreement with a few robo-advisory technology firms to start trailing the technology. That doesn’t mean I am not involved in the investments, however. The technology merely facilities the process.

In the coming months, I will be developing an expat investing app, which is mobile-friendlyy, and available to most people, with the exception of people living in the United States.

There will be a range of investment options and would be suitable for monthly and lump sum investors.

The less labour-intensive nature of the app, will make it suitable for investors who can’t meet my current account minimums.

At first, the app will only be available in English, but that could change in the future.

Conclusion

Robo-Advisors can be good for people who have small amounts of money to invest, as most advisors and firms have account minimums.

Likewise, where they can be used by advisors to lower cost and make the process more seamless, they should be used.

The more complex your financial planning needs, the less value this technology can build.

That isn’t to mention that many robo-advisors cannot be accepted outside the US and some other markets, so the options are limited in the overseas market.

The fact that many robo-advisors have seen huge outflows in funds during the stock market declines and volatility of March 2020, should serve as a warning.

The single biggest reason investors fail isn’t knowledge or which platforms they use.

It is that they buy when the market is high (1999) and sell when it is low (2008 and 2020) due to emotional reasons.

So the most important thing isn’t whether you use a robo advisor or general advisor.

It is if you can control your emotions during very volatile periods. Sometimes a human voice can do that better than an app.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Nice article Adam

cheers Henry