This Saxo Bank review should help expats see if this platform is worth investing in. Let’s find out what assets you can access through the firm and what costs you could be getting yourself into.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Who is Saxo Bank?

Founded in 1992 by Kim Fournais in Copenhagen, Saxo Bank initially operated as a brokerage firm. It was an early innovator in the financial sector since it provided an online trading platform where traders could gain access to several asset markets and sophisticated trading tools.

The creation of this ground-breaking platform in 1998 gave non-professional investors access to the same resources and marketplaces as their professional counterparts.

Saxo Bank places great emphasis on regulatory compliance and operates within the framework of strict regulatory requirements in 15 jurisdictions like Denmark, the UK, and Singapore, among others.

What account types are available?

Saxo Account

You can trade, hedge, and invest with greater flexibility when you open a Saxo Account, with more than 72,000 stocks, exchange-traded funds, bonds, mutual funds, options, futures, and other leveraged products available. In addition, you can use any of 18 different currencies to fund and deposit into your Saxo account.

If you put cash into your Saxo account, you may rest easy knowing that the Danish Guarantee Fund will back your money up to 100,000 USD .

Joint Account

Only married individuals, siblings, parents, and children are eligible to open a joint account. The minimum age for opening a joint account is 18 for both account holders. The starting balance for a joint checking account is 50,000 USD. A person can be a part of just one joint account at a time.

Corporate Account

Traders with corporate accounts get access to a high-quality trading platform designed specifically for commercial use. Personal, one-on-one service from knowledgeable account managers is available at any time during the trading process.

Professional Account

To trade with more freedom and avoid regulatory safeguards designed for less experienced traders, you might choose to reclassify as an Elective Professional customer and meet at least two of the following:

- have a net worth greater than 500,000 USD

- have executed at least 10 relevant deals over the preceding year

- have worked, or are working, in the financial industry for at least 12 months

Sign up for an account, if you haven’t yet. The next step is to connect into Saxo’s system as a verified professional and then go to “Your account,” “Account status,” and “Request professional status.” Simply fill out the form and attach any relevant materials.

For the sake of novice traders, industry-wide regulations have been put in place. If you choose Elective Professional status, though, you’ll give up these safeguards in return for more freedom in your trading.

You will still be entitled to certain safeguards, such as protection against the USD 100,000 personal deposit insurance cap imposed by the Guarantee Fund. You can always ask to be reclassified, and if you’re a natural person, you should be able to use the Danish Complaint Board for Banking Services if you have any issues.

If you opt out of these protections, however, you will no longer be bound by the leverage limits that apply to Retail customers. You will also not be afforded any sort of safeguard against incurring a negative balance.

Account Tiers

Your account’s initial funding within the first 30 days will determine your starting tier. After three months of trading, however, you will be upgraded automatically to the volume-based category without having to make any extra payments.

The Classic tier offers various benefits, including industry-leading entry prices, tight spreads, digital service and support, and technical and account assistance 24 hours a day for five days a week. The minimum initial funding for this tier is 2,000 USD or an equivalent of 120,000 points.

For those looking for even tighter spreads and commissions, the Platinum tier is available. By meeting a trading volume of 500,000 points or a minimum initial funding of a million dollars, traders in this tier can enjoy up to 30% lower prices, along with the same digital service and support, technical assistance, and priority local-language customer support.

The VIP tier provides the ultimate trading experience with the best prices and service. To qualify for this exclusive tier, traders need to meet specific criteria, which include the highest trading volume or a substantial minimum initial funding.

VIP members gain access to Saxo’s very best prices, best-in-class digital service and support, 24/5 technical and account assistance, a personal relationship manager fluent in their local language, direct access to trading experts around the clock, one-on-one SaxoStrats access, and exclusive invitations to special events.

These tiered options provide traders with increasing benefits and privileges, allowing them to access better pricing, dedicated support, and personalized assistance based on their trading activity and commitment.

Saxo Bank Investment Offerings and Leveraged Products

Stocks and ETFs

Stocks and ETFs offer investors several choices. Investors may build a diverse portfolio with over 23,500 equities from key global markets including New York, Hong Kong, and London and over 6,900 ETFs in categories like technology, healthcare, and the environment. ETFs are a cost-effective and efficient way to invest in a basket of companies that mirror market indices or sectors. The commission for buying stocks and ETFs starts at 0.01 USD per share.

Bonds

Over 5,700 global government and corporate bonds are available on Saxo. For online bonds, the minimum trading amount is USD 10,000 and the commission cost is 0.05% for every trade.

Mutual Funds

Saxo offers approximately 17,700 mutual funds managed by leading money managers. The purchase of mutual funds does not involve any commission charges.

Crypto

Saxo allows its customers to participate in cryptocurrency using exchange-traded funds (ETFs) and exchange-traded notes (ETNs). You don’t need a cryptocurrency wallet to follow the price of Bitcoin or Ethereum using these investment vehicles. They minimize the need for cold storage solutions and recovery seeds due to the fractional ownership of crypto assets.

It’s worth noting that cryptocurrency markets can be quite volatile, but that investing in ETFs and ETNs reduces exposure because they are not leveraged.

Saxo does not accept cryptocurrency for deposits or withdrawals.

Trading hours may vary depending on the stock market an ETN is listed on. Many are traded during Swiss exchange hours rather than the weekend since they are listed on the Swiss exchange.

Managed Portfolios

Saxo Bank’s managed portfolios are collections of investments that are picked and rebalanced with great care and attention to market fluctuations. These portfolios are tailored to your individual investing aims and profiles and accommodate investors with low to high risk tolerances.

Saxo’s platform gives you full visibility and control over your investments at all times, letting you check on them whenever you like without any fees. Saxo has worked with industry leaders like BlackRock and Morningstar to provide investors with access to low-cost, institutional-quality portfolios through its SaxoSelect service.

Automatic rebalancing ensures that your portfolio always aims for the maximum possible return, given the amount of risk you’ve selected. While Saxo does not require a minimum investment time, investors should keep in mind that its managed portfolios were created with a long-term outlook in mind.

When you exit a managed portfolio, you can take out all of your money at any moment without penalty. When your account value is at or above the minimum investment amount, you can also make partial withdrawals.

Options

Saxo Bank offers a versatile alternative to trading the underlying securities by permitting clients to trade options on stocks, indices, interest rates, and futures. This strategy has the potential for increased rewards while maintaining the same level of risk.

Investors can take advantage of chances on markets all around the world thanks to Saxo’s access to options from 21 exchanges around the world. Options on stocks traded on exchanges like the Nasdaq can be acquired for 1.25 USD.

An investor might approach options trading based on the size of their account and their prior familiarity with the strategy. Saxo prioritizes allowing investors to buy options as a means of regulating their exposure to risk. There is more at stake when selling options, therefore you’ll need more experience and a bigger account to do it.

If an investor wants to sell options, they need a minimum account balance of 5,000 USD, plus a signed agreement that they understand the risks. The benefits of margin trading, which are made available when selling options, can be used to improve market conditions.

Futures

Saxo gives its customers access to futures contracts in different asset classes, including stock indices, energy, metals, agricultural, and interest rates, over 29 exchanges across the world. Traders that are willing to pay a 1.25 USD commission per deal can take advantage of these situations.

Increased trading volume and promotion to higher account categories such as Platinum and VIP allow traders to save money. Futures spread trading, one of Saxo’s advanced futures tools, lets traders execute multi-pronged strategies by buying and selling on the same order ticket.

Traders can utilize the Depth Trader function, which is based on the Level 2 order book and displays all bids and offers in real time, to place and manage orders. Trading activities on the exchange may be tracked and futures prices can be traded straight from the real-time display with the help of Time and Sales. Futures contracts on margin allow investors to leverage a very small margin deposit into substantial market exposure.

Traders must keep track of their futures contracts’ Notice Days, expiration dates, and first notice dates (FND). Saxo Bank does not provide actual delivery of underlying assets, so investors are encouraged to terminate their contracts well in advance of the due date. Saxo will manage open positions at expiration appropriately, which may include charging fees.

It’s important to keep in mind that for some contracts, Saxo’s FND may vary from the FND issued by the appropriate exchange. Before entering into any contracts, traders should carefully review the terms and conditions listed on the site and the trade ticket.

Saxo Bank’s services and assistance are designed to meet the specific requirements of traders. The self-service support center, email helpdesk, and training modules all work together to provide comprehensive digital support. During trading hours, you can reach out to customer service at any time for help with account questions or technical issues. Relationship managers and sales traders who are solely devoted to assisting active traders are invaluable resources.

The finest deals, fastest service, and invitations to private events are all part of the VIP treatment that is also on offer. Traders of all sizes can expect first-rate service from Saxo Bank.

Forex

Over 189 Forex pairs (majors, minors, and exotics) and dozens of other assets are available for trading with Saxo Bank. The firm offers its customers some of the lowest spreads in the industry, beginning at 0.6 pips. A large and stable pool of liquidity is ensured by the fact that the prices are compiled from an array of Tier 1 institutions including banks, market-making organizations, and Electronic Communication Networks.

Saxo Bank protects its customers from untimely stop-outs by executing stop orders on the other side of the spread at a neutral price obtained from a key inter-bank venue. Clients are safeguarded against losing money owing to the market being volatile.

In addition, Saxo provides superior control to traders by enabling them fully personalized order options. When there is no asymmetry in slippage, customers may see significant price increases on every trade they make.

The company’s dealing practices are fully disclosed, and it says it never trades against its clients in the market.

FX Options

Traders can access over 40 FX vanilla options through Saxo, with maturities ranging from one day to a year. This allows investors to customize their trades to the prevailing market conditions by choosing an expiration date and striking price.

FX options provide traders with more risk-management tools than merely stop-loss orders. They can be used to protect against losses in existing foreign exchange positions or to signal an expectation of future volatility in the forex market. Traders can improve their risk management strategies and refine their execution with the help of this offering.

Crypto FX

Bitcoin and Ethereum can be traded against the US dollar, euro, and Japanese yen. FX pairings eliminate currency conversion fees while selling crypto.

Market participants are not limited to “bullish” periods but can profit from both up and down market cycles. Traders can “go long” or “go short,” which means to buy and sell, respectively, in response to price fluctuations in either direction.

Buying power is one thing that can be improved by trading Crypto FX pairs. With the help of leverage, investors can increase their buying power and, subsequently, their potential for profit. Traders can increase their purchasing power and possible gains by using leverage. When using leverage, traders need to tread cautiously and keep their risks under control.

Contract for Difference (CFD)

Saxo lets customers trade over 8,900 instruments long or short with tight spreads and cheap commissions. Contract for differences on more than 7,600 equities and over 1,100 ETFs from major worldwide exchanges are available. Thirty index-tracking CFDs, including Germany 40, US 500, and UK 100, have tight spreads at Saxo Bank.

CFDs on 7 FX pairings like EURUSD and AUDUSD, plus eight government bonds, including the German 10-year bund, can diversify a portfolio. Saxo offers 20 CFDs on certain sectors like energy, agriculture, metals, softs, and emissions. Index CFDs include SPX and DJX, among others. Elective Professional clients pay 1.5% for major index CFDs, while Retail clients pay 5%.

Commodities

Saxo offers commodities trading alternatives, allowing traders to use different tactics and communicate their commodity price predictions. Commodity traders can trade CFDs, futures, options, spot pairings, or Exchange Traded Commodities.

With leverage levels up to 5:1, traders can long or short 20 commodity CFDs in energy, agriculture, metals, and pollution. Exchange-traded futures contracts and many futures options on various industries allow commodity price predictions. Gold, silver, platinum, and palladium are traded against 12 major currencies, including USD, euro, yuan, and Swiss franc.

Investors can also watch particular commodities, the commodity sector, or sub-sectors. Saxo Bank lets investors buy mining and oil company shares. These offers give traders many ways to trade commodities and meet their financial goals.

Services

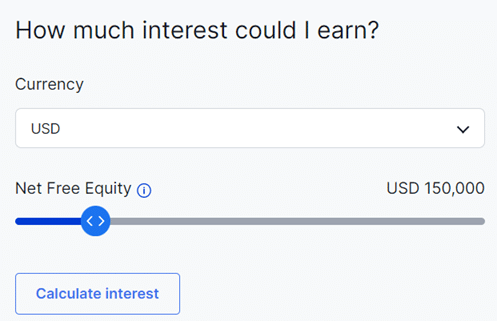

Without a minimum balance or time commitment, you can earn interest on your available funds. Your money will continue to accrue interest and be accessible for withdrawal or investment at any time.

The interest calculator is a handy tool for estimating how much money you will earn in interest over time, given a specific deposit amount and currency.

Saxo Bank Platforms

SaxoTraderGO

Traders can benefit from enhanced trade tickets, which provide a streamlined interface for placing trades. Charting, options chain, and performance analysis tools are also available on the platform. Account management and portfolio overview are easy for traders.

SaxoTraderGO lets traders diversify across many asset types. It also has a versatile, user-friendly interface. Traders can use one screen or drag charts to a second screen. Traders may monitor and execute transactions from anywhere using the mobile and desktop platforms.

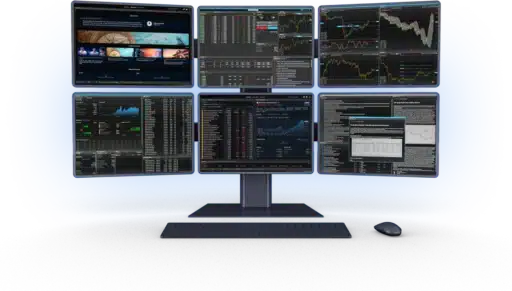

SaxoTraderPRO

SaxoTraderPRO is a configurable professional platform with six screens for experienced traders. Its key characteristics include algorithmic orders, single-click trading, options chains, and comprehensive charting tools. Traders can review their performance in the platform’s refreshed account area.

Traders can also diversify their portfolios and take advantage of various investing opportunities. They may effortlessly handle various modules and customize their workplace.

The platform offers multi-channel connecting for easy navigation across sections. Traders can use SaxoTraderPRO on PC or MAC.

What are the costs?

Here are some general charges that you must be aware of:

Interest on Deposits

You can earn interest on your cash balance at Saxo Bank if you are a client and a trader. However, the interest computation will be affected by any open holdings in margin goods. Your interest rate is based on the Saxo Bid/Ask rates plus a markup or markdown, depending on whether you have a Classic, Platinum, or VIP account.

To determine how much interest to charge on your primary account, your Net Free Equity (NFE) or your Cash Balance plus or minus any NFE adjustments, is used. Interest accrued across various currency sub-accounts is determined by the aggregate adjusted value of those accounts.

Settlement

Interest is computed per day and settled monthly, with payment made no later than seven business days after month-end. Conventions for counting days and market standards are used to determine interest, as shown in the table for Saxo Bid/Ask Interest Rates on their website.

Negative Net Free Equity

Overdraft rate due to negative Net Free Equity occurs when financing margin requirement plus unrealized P&L on margin products exceeds cash balance.

If your account’s Net Free Equity is negative, any foreign currency gains or losses on a position’s closing day will be translated to your base currency at the FX spot mid-price plus or minus 1%. VIPs pay up to 0.5% and Platinum members pay up to 0.75%.

Currency Conversion fee

The margin collateral does not incur additional costs while converting currencies. When you buy or sell stocks for cash, or pay or get options premium, these are the only transactions for which you will be charged a conversion fee.

Custody fees

Stocks, ETFs/ETCs, and bonds all incur a 0.15% yearly cost plus at least 5 euros monthly for custody. The maximum annual percentage rates for platinum customers are around 0.12% and for VIP customers around 0.09%. Accounts in default are always charged the minimum custodial fee. These costs are assessed on a monthly basis depending on the previous month’s closing values.

There may be rate differences depending on where you live. There’s also a value added tax assessed on top of the custody fee.

Inactivity fee

Should a client’s account remain dormant for 180 consecutive days, an inactivity fee worth 100 USD or currency equivalent will be assessed.

Manual order fee

A manual order fee of 50 euro each will be charged to customers who place orders through phone, chat, or email. There may be exceptions for some products that aren’t allowed to be exchanged on the platform.

Reporting Fee

When a client on the Classic service tier requires online reports to be provided by email, they will be charged 50 USD or the equivalent cost in the client’s account currency. This cost will also be incurred when a third party, like an auditor, wants a report.

1042-s form

Requesting Forms 1042-S will incur a EUR 1,000 processing cost every income year unless one of the following is true:

- You can show that you’ve been asked to submit a Form 1042-S by the IRS.

- The US relief-at-source tax rate that Saxo Bank used for your account was incorrect.

The annual charge will be more than EUR 1,000 if more than 10 forms are needed for each income year.

Charge for adding an instrument on the platform

Each additional instrument will incur a 200 USD surcharge for Classic and Platinum clients, while it’s free for VIP clients.

Saxo Bank Review: Bottom Line

Saxo Bank may be a good option for those who have enough funds to pay for the deposit requirements. Always be mindful of the fees and hidden charges, if any, before you invest.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Can you tell me regarding Castlestone Private Equity and Woodville if they are risky investment or safe