The Share Centre are an online DIY platform, coming from Buckinghamshire in the UK.

This article will review the platform, speak about the positives, negatives and limitations.

If you have any questions or would like alternative investment options you can email me (advice@adamyfayed.com) or contact me on the chat function below.

What are the main services offered by the Share Centre?

The main services are:

- Ready made portfolios – with a typical cost of 1.7% per year, you can pick cautious, balanced, aggressive and other funds. Each found has a different objective; such as income or accumulation.

- Stocks and shares Junior ISAs – if you have children under the age of 18, you can set up an ISA for them. This allows you to build up a portfolio for your kids to receive on their 18th birthday. The Junior ISA allowance for 2020 is £4,368 a year. After the tax year ends in April, you will be able to carry this sum forward, and a new allowance will be set. You can invest in a ready made ISAs or one that has model portfolios.

- Self-select stocks & shares ISAs – similar to the self-select junior ISAs, this option allows you to DIY invest

What are the typical fees?

If you go through the suggested model portfolios, the indirect fees can be close to 1.7%.

In comparison, with the DIY option, the fees are flat. The exact fees depend on the account.

But I will use the ISA fees for the self managed account as an example:

- Fixed admin fee. 5GBP a month.Dealing option fee

- £24 per quarter if you have a lump sum to invest or are a frequent trader

- Dealing commissions by email or phone – £20 per deal for trades less than £2,000 and 1% for over £2,000.

What are the positives about the platform?

The main positives associated with this option are;

- The technology is good in terms of how easy it is to use. That is the same for most DIY platforms now. The platform looks like the image below:

- The ISAs are tax efficient for UK residents but you can’t continue to contribute in this structure if you leave the UK. This £20,000 a year tax benefit can really add up.

- It is easy to set up and use. For example you can pay with a debit card and don’t need to always send bank transfers to the account.

- The minimums are low – 25 pounds a month if paying by direct debit. There are no other minimums, although the flat fees will eat into smaller accounts.

- It is flexible in terms of withdrawals. Not all ISAs in the UK are flexible though. A Lifetime ISA is a great example of this. In this case you can only withdraw if you are buying your first house, you are above 60 or you are terminally ill with only 12 months to live.

What are the negatives?

One of the negatives is that this option appears to be UK-centric. Unlike some other brokers coming from the UK, it appears this option is only available to UK residents.

That could also potentially mean that if a UK resident emirates overseas, it isn’t possible to continue to contribute.

Other negatives are:

- They are costly for smaller accounts due to their fees

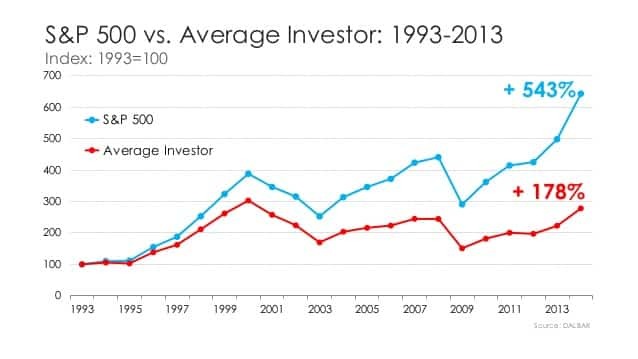

- This isn’t a platform that gives you access to a lot of advice. So you will be reliant on your own investment behavior. Study after study has shown that the average investor tends to panic when markets go down, and get too excited when they are up. This leads to results like this:

3. The more complex your financial services, the less likely you are to get the right answers from platforms like this. If you want to invest money on a monthly, and don’t have complex financial needs, then something like this works. However, if you have complex financial and tax circumstances or are higher-net-wealth, you are less likely to see the same benefits.

4. The ready made portfolios are expensive. You are also relying on their own fund managers which is a conflict of interests in some ways.

5. It doesn’t involve drawdown services, annuities or many other things. It also doesn’t allow the aforementioned Lifetime ISAs.

6. Online reviews are mixed. In general, it appears this is a decent option, but very much a “3/5” option. Everything is relatively OK with no standout features. That is both a positive and a negative.

Some other frequently asked questions about DIY investing

This section will look at some more typical questions I get asked.

Will Brexit affect investing in apps like this?

It shouldn’t do for UK residents who plan to continue to invest in the UK. For UK expats on shorter-term contracts, there has been an increase in firms relocating staff members.

Given that some firms, such as the Share Center, can’t access non-UK residents, you shouldn’t open an account unless you will be in the UK for the long-term.

Is this option safe?

Yes it is, but 99.9% of investment platforms are these days! Almost all have checks and balances.

How long should people typically invest?

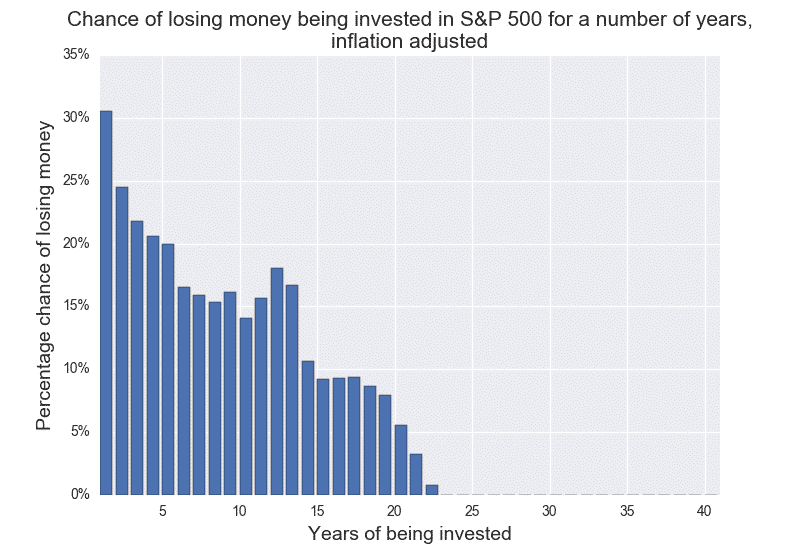

The longer you invest, usually equals the more your total returns due to compounding.So you should invest for as long as you can afford to do so.

In addition to that, longer-term investing is less risky. You are much less likely to lose money as the chart off the S&P500 below shows:

So time, and more specifically being long-term, is one of the only free lunches in investing.

Conclusion

Options like the Share Centre are fine for investors that have 40,000, 50,000 or 60,000GBP portfolios, who are in the UK and don’t plan to move overseas.

It isn’t as good for smaller investors (due to the fixed fees) or net high wealth investors who usually have more specific requirements.

For those looking for advice, want to move overseas or higher net wealth, better options exist.

Further reading

1. The Share Centre Review assesses investment services, comparatively with the secure investment strategies outlined in Friends Provident International Reserve Bond Review.

2. For those interested in why many DIY investors fail, the article below explores the theme.