Transfermate, a renowned international payment solution, has transformed the methods by which businesses and individuals conduct monetary transactions across borders.

Established with the vision to streamline global payments, It has been a game-changer in the financial sector, offering innovative solutions to overcome the challenges of international money transfers.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Brief History of Transfermate

It was founded to address the inefficiencies and high costs associated with international payments through traditional banking systems.

Since its inception, It has been committed to delivering faster, more economical, and transparent transactions, gaining the trust of users worldwide.

It has continuously evolved, adapting to the changing financial landscape and user needs, to offer optimized solutions for international money transfers.

Evolution and Growth of Transfermate

Transfermate has experienced significant growth and expansion over the years. It has established a strong presence in multiple countries, catering to a diverse clientele and expanding its range of services.

The company has also secured partnerships with various financial institutions and fintech companies, enhancing its service offerings and reach.

Core Services Offered by Transfermate

It provides a wide array of services designed to cater to the varied needs of its users. Whether it’s making bulk payments or individual transfers, It prioritizes efficiency and user satisfaction.

Individual and Business Transfers

Transfermate facilitates both individual and business transfers, ensuring that whether you are a solo traveler or a multinational company, your international payment needs are met with precision and care.

Currency Exchange Services

Transfermate offers competitive currency exchange services, allowing users to exchange currencies at favorable rates. This service is crucial for businesses operating in multiple countries and individuals traveling abroad.

B2B Payment Solutions

It excels in providing business-to-business payment solutions, enabling companies to manage their international payments efficiently. It offers customized solutions to businesses, ensuring seamless financial transactions and effective management of cross-border payments.

Customer Satisfaction and Trust

Transfermate values its customers and strives to exceed their expectations. The positive feedback and testimonials from satisfied customers underscore it’s dedication to delivering top-notch services and its success in building lasting relationships with its users.

Commitment to Innovation and Technology

It continually invests in technology and innovation to enhance its services and user experience. It employs cutting-edge technology to ensure secure, fast, and efficient transactions, making international payments more accessible and convenient for its users.

It leverages advanced technology to optimize its services and offer innovative solutions. It stays abreast of the latest technological trends and integrates them into its platform to meet the evolving needs of its users.

It also places a high emphasis on research and development to innovate and improve its services. It explores new possibilities and solutions in the financial sector, aiming to set new standards in international payment services.

How Transfermate Stands Out in the International Payment Landscape

The international payment landscape is teeming with numerous service providers, each claiming to offer the best solutions for businesses and individuals.

Amidst this crowded space, Transfermate emerges as a distinguished service, offering unparalleled benefits and features that cater to a diverse range of financial needs and preferences. This section will explore the distinctive attributes and comparative advantages that make Transfermate a preferred choice for international payments.

Unique Selling Propositions (USPs) of Transfermate

It distinguishes itself through several USPs, setting a high standard in the international payment sector.

Speed of Transactions

It commits to delivering rapid transactions, ensuring users don’t have to endure the prolonged waiting times commonly associated with other platforms.

The efficiency of it’s services means that users can expect their funds to reach their intended destinations promptly, optimizing convenience and user satisfaction.

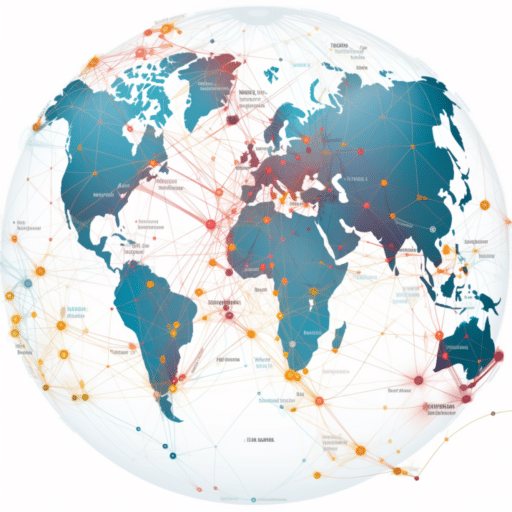

Global Reach and Network

It offers its services to a multitude of countries around the globe. The extensive network that it has developed guarantees that users can send money to almost any location worldwide, making it a versatile choice for international money transfers.

Comprehensive Currency Solutions

Transfermate provides solutions that accommodate a wide array of currencies, allowing users to transact in their preferred currency without hassle.

Multi-Currency Offerings

It supports transactions in numerous currencies, offering flexibility and convenience to users dealing with diverse currency requirements.

Competitive Exchange Rates

It offers favorable exchange rates, ensuring users receive optimal value for their money when converting currencies.

Comparison with Other Payment Platforms

Transfermate not only holds its ground but also surpasses competitors in several key areas, reinforcing its position as a leader in the sector.

Transfermate vs. Traditional Banks

Traditional banks often impose high fees and less advantageous exchange rates on international transactions. In contrast, It offers a transparent and economical alternative, allowing users to make the most out of every transaction.

Transfermate vs. Other Fintech Solutions

The combination of a powerful platform and extensive global reach positions Transfermate ahead of other fintech solutions available in the market.

Its commitment to innovation and user-centric design enhances the overall user experience, making international transactions seamless and straightforward.

Technological Innovation and Integration

It leverages advanced technology to facilitate smooth and secure transactions, integrating seamlessly with various financial systems and software.

API Integration

It offers robust API integration options, allowing businesses to incorporate Transfermate’s services directly into their existing financial systems for enhanced efficiency and streamlined workflows.

Cutting-Edge Security Measures

Transfermate employs the latest security technologies to protect user data and funds, ensuring the integrity and confidentiality of every transaction conducted through its platform.

The User Experience: Navigating the Transfermate Platform

User experience is a pivotal aspect of any financial platform, and Transfermate excels in providing a seamless and intuitive experience for its users.

From the moment you decide to use It, you are greeted with a streamlined process, clear instructions, and a user-friendly interface, making international transactions feel like a breeze.

Registration and Onboarding Process

It ensures a hassle-free registration process for its users, prioritizing efficiency and user convenience. The platform guides users through each step, making the onboarding experience smooth and straightforward.

Required Documentation

To start using It, you’ll need to provide some basic documentation. The platform values user security and ensures that all documents undergo rigorous verification. Transfermate maintains a strict adherence to regulatory compliance, ensuring the safety and security of user information.

Time to Account Activation

Once you submit all required documents, Transfermate activates your account swiftly, allowing you to start transacting immediately. This quick activation time is crucial for users who require immediate access to international payment services, and it excels in meeting this need.

User Interface and Ease of Use

Transfermate boasts a user-friendly interface that even first-time users find intuitive. The design principles followed by it focus on simplicity and functionality, ensuring users can easily navigate through the platform and access the services they need.

Mobile App Review

It’s mobile app brings all the platform’s functionalities to your fingertips. With the app, you can initiate, track, and receive payments on the go. The app’s design is sleek and its layout is logical, making it easy for users to understand and use.

It has ensured that the app is compatible with various operating systems, enhancing accessibility for all users.

Web Platform Insights

It’s web platform offers a seamless experience. Its clean design and easy navigation make managing international payments a breeze. The platform provides clear and concise information, and users can access customer support directly from the website, adding an extra layer of convenience.

It has integrated advanced features into its web platform, allowing users to manage multiple transactions, view transaction history, and access real-time exchange rates.

Customization and Personalization

It understands that every user is unique, and therefore, it offers various customization options to cater to individual preferences and requirements.

User Profile Customization

Users can tailor their Transfermate profiles according to their needs. This feature allows for the adjustment of notification settings, currency preferences, and much more, ensuring a personalized user experience.

Transaction Preferences

It allows users to set their transaction preferences, enabling them to define default values for recurring transactions and streamline the payment process further.

Accessibility and Inclusivity

Transfermate believes in providing an inclusive platform that is accessible to everyone, regardless of their physical abilities or technological proficiency.

Multilingual Support

It offers its services in multiple languages, breaking down language barriers and making it easier for users from different linguistic backgrounds to use the platform effectively.

User Support and Guidance

It provides extensive support and guidance to its users through various resources such as FAQs, tutorials, and customer support, ensuring that users can find help whenever they need it.

Security and Compliance: How Safe is Transfermate?

Security and compliance are paramount in the financial sector, and Transfermate understands this imperative. The platform has instituted rigorous measures to ensure the safety of user data and funds.

By adhering to international financial regulations and employing advanced security protocols, It has established itself as a secure and reliable platform for international transactions.

Security Protocols in Place

It places a high premium on user security, implementing robust security protocols to protect user information and financial transactions.

Data Encryption Standards

It utilizes advanced encryption techniques to protect user data from unauthorized access and cyber threats.

The platform ensures that every piece of information, from login credentials to transaction details, is encrypted, guaranteeing the confidentiality and integrity of user data.

Two-Factor Authentication

To bolster account security, It implements two-factor authentication. This security measure verifies user identity through two separate elements, preventing unauthorized access and safeguarding user accounts against potential breaches.

Secure Socket Layer (SSL) Protection

It employs SSL protection to establish a secure and encrypted link between a user’s browser and the server. This security layer protects sensitive information, such as credit card details and passwords, from interception by malicious actors.

Regulatory Compliance and Licensing

It operates with strict adherence to international financial laws and regulations, ensuring legal and secure services for its users.

Countries and Regions of Operation

It maintains licenses in numerous countries and regions, allowing it to provide legal and compliant services to a diverse and global clientele. This extensive licensing enables Transfermate to facilitate international transactions seamlessly and lawfully.

Regular Audits and Checks

To maintain high standards of compliance and security, Transfermate subjects itself to regular audits and assessments by external bodies. These evaluations verify it’s adherence to financial regulations and assess the effectiveness of its security measures, reinforcing its commitment to providing secure and compliant services.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Policies

It has implemented stringent AML and CTF policies to prevent, detect, and report money laundering and terrorist financing activities.

The platform conducts thorough customer due diligence and monitors transactions to identify suspicious activities, ensuring the safety and legality of its services.

User Education and Awareness

It believes in empowering its users with knowledge to protect themselves against cyber threats.

Security Awareness Resources

It provides resources and guidelines to educate users on best practices for maintaining account security. By staying informed, users can play an active role in safeguarding their accounts and transactions.

Prompt Security Alerts

It promptly notifies users of any suspicious activities or security incidents related to their accounts. Immediate alerts enable users to take swift action to secure their accounts and prevent unauthorized transactions.

Customer Support and Service Quality

Providing exceptional customer support and maintaining high service quality are paramount for any financial service provider, and it excels in these domains.

A dedicated team works relentlessly to ensure that every user finds the help they need, and the quality of service remains unparalleled. Transfermate’s commitment to its users is evident through its responsive support channels and the positive feedback it consistently receives.

Channels of Communication

Transfermate understands the importance of clear and open communication with its users and has established multiple channels to address their needs and concerns.

Live Chat and Email Response Times

Transfermate’s live chat and email support are known for their quick response times. Users can expect to receive accurate and helpful information without unnecessary delays, making the resolution of any issues smooth and efficient.

Phone Support Review

Transfermate offers phone support where users can speak directly to knowledgeable and experienced representatives. The team at Transfermate is trained to provide solutions and advice to ensure that every inquiry is resolved satisfactorily.

Customer Feedback and Reviews

Transfermate has built a reputation for reliability and efficiency, reflected in the positive feedback and reviews it receives from its diverse user base.

Common Praises and Complaints

Users frequently commend Transfermate for its user-friendly interface, swift transactions, and transparent pricing. The platform’s efficiency is a recurring theme in user praises.

Any complaints received are minimal and are usually addressed promptly and professionally by Transfermate, reflecting its commitment to user satisfaction.

How Transfermate Handles Disputes

Dispute resolution is a critical aspect of customer service, and Transfermate handles such situations with utmost seriousness and professionalism. The platform is dedicated to resolving disputes fairly and swiftly, ensuring that users feel valued and heard.

Proactive Problem Resolution

Transfermate goes beyond reactive support and actively works to resolve potential issues before they affect users.

Preventive Measures and User Education

Transfermate implements preventive measures to avoid common problems and educates users on best practices to ensure smooth transactions. By empowering users with knowledge, Transfermate reduces the likelihood of issues arising.

Continuous Improvement through Feedback

Transfermate values user feedback and uses it as a tool for continuous improvement. By listening to its users, Transfermate is able to refine its services and enhance user experience, maintaining its position as a preferred international payment solution.

Accessibility and Inclusivity

Transfermate believes in making its platform accessible to everyone and ensures that its services are inclusive and user-friendly.

Multilingual Support

To cater to its diverse user base, Transfermate provides support in multiple languages, allowing users from different backgrounds to communicate in their preferred language.

User-Centric Approach

Transfermate adopts a user-centric approach in designing its services and support. Every feature and support channel is developed with the user in mind, ensuring ease of use and satisfaction.

Conclusion: Is Transfermate Right for You?

Transfermate brings to the table a plethora of advantages, including its extensive global reach and an exceptionally user-friendly platform. However, it’s crucial to acknowledge that no platform is without its areas for improvement.

By carefully considering the pros and cons, you can ascertain whether Transfermate is the optimal choice for your international payment needs.

Comprehensive Global Network

Transfermate’s extensive network allows users to transact in numerous countries, making it a versatile choice for those dealing with multiple currencies and international partners.

User-Centric Approach

Transfermate places a strong emphasis on user experience, ensuring that both the web and mobile platforms are intuitive and accessible, even to those new to international payments.

Areas for Improvement

While Transfermate excels in many areas, user feedback suggests there is room for enhancement in aspects such as expanding the list of supported countries and currencies.

Tailored Recommendations for Varied User Demographics

Transfermate caters to a diverse user base, offering tailored solutions to meet the distinct needs of businesses, individuals, and freelancers alike.

Optimal Solutions for Businesses and Corporates

Transfermate stands out as a preferred platform for businesses and corporates due to its ability to handle bulk payments efficiently and its provision of competitive exchange rates.

Businesses can leverage Transfermate’s features to optimize their international transactions and manage their global partnerships effectively.

Streamlined Transactions for Individual Users and Freelancers

Transfermate offers individual users and freelancers the convenience of swift and transparent transactions, enabling them to manage their international payments with ease and confidence.

Whether receiving payments for services or sending money abroad, freelancers and individuals find Transfermate to be a reliable partner.

Current Market Positioning and User Sentiment

Transfermate continues to solidify its position as a leading international payment solutions provider. The positive acclaim from users and its growing presence in the international payments market underscore its reliability and efficiency.

Making an Informed Decision with Transfermate

When choosing Transfermate, you are opting for a platform that combines convenience, reliability, and innovation. By evaluating your specific needs and preferences, you can determine whether Transfermate’s offerings align with your international payment requirements.

Every user has unique needs and preferences when it comes to international transactions. Transfermate’s diverse range of services allows users to select the options that best suit their requirements.

By analyzing Transfermate’s features, pricing, and user feedback, you can assess whether the platform offers the right value proposition for your international payment needs.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.