The investment landscape is diverse and complex, offering a wide array of options to investors.

Among these options, Exchange Traded Funds (ETFs) have gained popularity due to their simplicity, cost-effectiveness, and potential for high returns.

One such ETF that has caught the attention of many investors is the Vanguard High Dividend Yield ETF (VYM).

In this article, we will dive deep into the intricacies of VYM, analyzing its performance, risk, costs, dividends, and much more.

This article is in no way intended to be investment advice nor a recommendation. It is always best to consult with a personal financial advisor who knows of your goals, investment horizon, and risk tolerance when making investments.

If you want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

What is the Vanguard High Dividend Yield ETF (VYM)?

VYM is an exchange-traded fund that provides investors with diversified exposure to high-yield stocks.

The fund, which trades on the New York Stock Exchange (NYSE) under the ticker symbol VYM, is managed by Vanguard, one of the largest and most reputable asset management companies globally.

As an ETF, VYM tracks the FTSE High Dividend Yield Index. As of end of 2022, dividend yield over the next 12 months is projected for large and midcap firms in the FTSE USA Index (excluding REITs).

For the first half of 2023, however, VYM did not see any notable growth.

Stocks with dividend yields in the top 50% are chosen for inclusion in the index. Paying attention to dividend yield can introduce risk into the portfolio and give it a value focus. Having less money to reinvest in the company’s growth could be a result of a high dividend payout.

Stocks with weakening fundamentals and falling prices (known as “value traps”) might be a threat to dividend funds.

This tactic, however, reduces the firm’s exposure to potentially dangerous businesses. Stock-specific risks are mitigated by the portfolio’s broad coverage of the dividend-paying universe, which includes roughly half of all companies.

It also uses a market capitalization weighting system, which gives more weight to larger, more established companies that are more likely to be able to sustain dividend payments in the long run. Since the value of value traps diminishes as prices fall, this reduces their overall impact.

Favoring established businesses reduces dividend yield potential. The fund’s yield of 3.08% is higher than the yield of the Russell 1000 Value Index by more than 1%. The fund’s performance was also stable, with a standard deviation that was 11% lower over a five-year period than its benchmark.

The fund’s sector weighting may differ significantly from the category index, as is the case with other dividend-oriented funds.

Market-cap weighting helps keep these gaps manageable, but in extreme cases, the fund could avoid investing in a sizable chunk of the market. The fund’s allocation to financial equities, for example, lagged behind the Morningstar Category average by as much as 15% between 2010 and 2018.

The widespread dividend cuts that followed the 2008 financial crisis explain this phenomenon. Although this did not adversely affect the fund’s relative performance, there is no assurance that future bets of similar nature may not significantly hinder or improve the fund’s overall results.

The Vanguard High Dividend Yield ETF is particularly appealing to investors who favor consistent dividend income and potential for attractive dividend growth. Moreover, it offers a convenient way to participate in the U.S. stock market gains through a large, diversified basket of blue-chip dividend-paying companies.

What are the pros?

One of the major advantages of investing in ETFs like VYM is their cost-effectiveness.

The fund has a remarkably low expense ratio of 0.06% per year, making it one of the best deals you’ll find in the dividend space.

This low cost can be attributed to Vanguard’s economies of scale and their customer-first approach.

Investing in high-yield stocks can be risky, but VYM has managed to strike a good balance between yield and risk. The ETF’s historical performance shows that it has provided consistent returns with lower volatility compared to the broader S&P 500 Index.

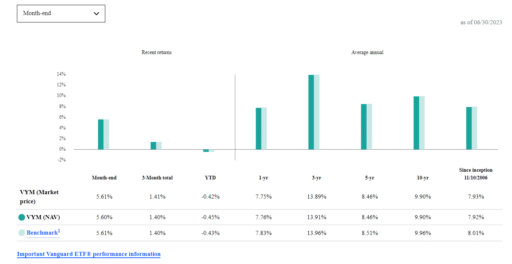

Over the past decade, VYM has provided an annualized return of around 13.4%, roughly in line with the broader S&P 500 Index. Its standard deviation, a measure of absolute volatility, is lower than that of the S&P 500 over the trailing three-, five-, and 10-year periods.

Moreover, VYM’s beta, a measure of relative volatility, is around 0.90 over the trailing five- and 10-year periods. This suggests that the fund is less volatile than the market, making it a suitable choice for investors with a moderate to conservative risk tolerance.

Contrary to what its name suggests, VYM does not offer a high dividend yield in absolute terms. The fund’s trailing 12-month yield is around 3.2%, which is significantly higher than the approximately 2% yield of an S&P 500 Index fund, but not exactly high in absolute terms.

This moderate yield is a result of the fund’s investment approach. VYM tracks the U.S. component of the FTSE All-World High Dividend Yield Index, which includes high-yielding stocks, but weights them by market cap, emphasizing larger, more stable firms that are likely to continue making dividend payments.

This strategy might not maximize the dividend yield, but it reduces the risk of value traps by limiting exposure to distressed firms, making VYM a decent combination of current dividend and projected dividend growth.

Since its inception in November 2006, VYM has returned more than 8% yearly through the end of 2022.

This performance is noteworthy, considering that the ETF was launched near a stock market peak and just before the onset of a significant bear market. It underscores the importance of long-term investing and diversification in achieving favorable outcomes.

VYM shines in the area of low cost, as reflected in its expense ratio. The fund’s expense ratio is a mere 0.06%, meaning that for every $1,000 invested in the fund for a year, Vanguard charges only 60 cents. This low cost makes VYM a highly cost-effective option for investors.

Furthermore, if VYM is purchased through a Vanguard brokerage account, the commission on the trade is free. However, if the brokerage account is with another firm, their standard ETF trading commissions apply.

The valuation of VYM can be assessed using a single-stage dividend discount model, which considers the current annual dividend payment and projected dividend growth. Based on these factors, the model suggests that the ETF is trading near its fair value.

However, it’s worth noting that investing small amounts in VYM each month, a strategy known as dollar-cost averaging, can be an effective approach to mitigating the impact of market volatility and potentially enhancing returns over the long run.

Holding VYM in a qualified retirement account, like an Individual Retirement Account (IRA), can provide significant tax benefits. Dividends received in such accounts are not subject to income tax, enhancing the after-tax returns for investors.

In addition, as a passively managed index fund, VYM minimizes stock trading, which reduces exposure to capital gains tax. This makes the ETF fairly tax-efficient, although individual tax situations can vary, and it’s always advisable to consult a tax advisor for personalized advice.

Another of the appealing features of ETFs like VYM is the low minimum investment requirement. Investors can get started with as little as the purchase of a fractional share, making it accessible to a wide range of investors.

Should you invest in the Vanguard High Dividend Yield ETF?

When considering VYM, it’s useful to compare it with other dividend-focused ETFs. For instance, Vanguard also offers the Vanguard Dividend Appreciation ETF (VIG), which focuses on dividend stocks with lower yields but faster dividend growth.

Another option is the iShares Core Dividend Growth ETF (DGRO) by Blackrock, which resembles VIG with a lower dividend yield and higher potential dividend growth.

Ultimately, the Vanguard High Dividend Yield ETF (VYM) is an attractive investment option for those seeking exposure to high-yield stocks. Its low cost, moderate risk, decent yield, and strong performance make it a compelling choice for both beginner and experienced investors.

However, as with any investment, it’s essential to conduct thorough research and consider your risk tolerance and investment goals before investing in VYM.

What are ETFs and why should you invest in them?

Those unfamiliar with the financial markets may find investing to be a challenging task. Exchange-Traded Funds, or ETFs, are a type of mutual fund that have been increasingly popular in recent years due to their low entry barrier and high flexibility.

The term “ETF” refers to an investment fund that is also an exchange-traded vehicle.

Like an index fund, they are meant to replicate the gains made by a predetermined market segment, commodity, or collection of assets. However, unlike mutual funds, ETFs trade like regular equities on stock markets.

Due to their structure, exchange-traded funds (ETFs) are sometimes compared to a “basket” of assets. They are like mutual funds, but with more freedom and lower minimums for trading.

They provide diversified exposure to a market or sector without requiring investors to own every stock or asset in that market or industry.

Investing in an ETF is similar to buying a small portion of a diversified portfolio. The assets within the ETF could include stocks, bonds, commodities, or a mix thereof.

This allows you to diversify your portfolio and reduce the risk of losing money by investing in a single stock or bond.

How do ETFs work?

One of the key characteristics of ETFs is that they are passively managed. This means that instead of a fund manager making active decisions about which assets to buy or sell, the ETF simply aims to replicate the performance of a specific index or sector.

For example, an S&P 500 ETF would aim to mimic the performance of the S&P 500 index by holding the same stocks in the same proportions as the index.

This passive management style results in lower operating expenses, making ETFs a cost-effective investment option. The value of an ETF rises or falls in tandem with the value of the index or industry it follows.

ETFs’ meteoric rise to prominence can be attributed to a number of factors. Let us get into the details of several of these characteristics.

Spreading investments over a number of distinct markets, companies, or other types of assets can help reduce exposure to any one area.

By investing in an ETF, you can achieve diversification instantly because each ETF holds a broad range of different assets. This means that even if one asset within the ETF performs poorly, it could be offset by the performance of other assets within the fund.

Like individual stocks, ETFs can be purchased and sold at any time throughout the trading day at the current market price.

Mutual funds, on the other hand, can only be purchased and sold once a day at the close of trading, and then only at a price equal to the fund’s NAV or net asset value. This flexibility allows investors to respond more quickly to market changes.

ETFs are also a highly accessible investment option. They do not require a large amount of capital to get started, making them suitable for beginner investors.

With some brokers, you can purchase as little as one share of an ETF, and some even offer the option to buy fractional shares. This means that you can start investing in ETFs with just a small amount of money.

How do you start investing in ETFs?

Getting started with ETF investing is a relatively straightforward process. The fundamentals are as follows:

- Open a Stock Trading Account: Creating a brokerage account is the first order of business. A web-based broker or trading platform is necessary for this. After creating an account, you must deposit the funds you intend to invest.

- Pick Your Exchange-Traded Funds The next step is to settle on certain exchange-traded funds (ETFs). Your investment objectives, level of comfort with risk, and preferred industries or markets will all play a role.

- Make the Transaction: Select the ETFs you wish to invest in, and then buy them using your brokerage account. You will need to enter the ticker symbol for the ETF and specify the number of shares you wish to buy.

- Monitor Your Investment: After making your purchase, it’s important to monitor the performance of your ETFs and adjust your investment strategy as needed.

Remember, the number of shares you decide to buy will largely depend on the current price of a share and your personal financial situation. It’s also worth noting that while fees can vary by broker, many offer options with low or no transaction costs.

What are the best practices for ETF investing?

While ETF investing can be a great way to build wealth, it’s important to follow certain best practices to maximize your potential returns and minimize risk.

- Understand Your Investment: Before you invest in an ETF, it’s crucial to understand what it is you’re investing in. This includes understanding the index or sector the ETF tracks, the assets it holds, and its overall investment strategy.

- Consider the Costs: While ETFs typically have lower fees than mutual funds, they still come with costs. These can include expense ratios (the annual fee charged by the fund), as well as any brokerage fees for buying and selling the ETF.

- Diversify Your Portfolio: While investing in ETFs can provide diversification within a certain sector or market, it’s still important to diversify your overall investment portfolio. This could mean investing in several different ETFs, or combining ETF investing with other types of investments.

- Monitor Your Investments: Just like with any investment, it’s important to regularly review your ETF investments and make adjustments as needed. This can help you stay on track towards your financial goals.

What are the drawbacks of ETFs?

While ETFs offer many benefits, there are potential drawbacks to consider. For instance, because most ETFs are passively managed, they will typically only perform as well as the index or sector they track. This means that if the index or sector performs poorly, so too will the ETF.

Additionally, while ETFs typically offer diversification, not all ETFs are diversified. Some ETFs only track a specific sector or subset of the market, which could expose investors to greater risk if that sector or market performs poorly.

Finally, while ETFs can be bought and sold throughout the day like stocks, this can also lead to greater volatility in the ETF’s price. This could potentially lead to losses if the ETF is sold during a period of market downturn.

Given these drawbacks, there are other investment options that can offer even greater returns. As mentioned, ETFs are designed to track the performance of a specific index or sector and trade on major stock exchanges.

While ETFs have their advantages, such as low expense ratios and instant diversification, they also have their limitations.

One of the main drawbacks of ETFs is that they are not designed for high risk, high reward investing. ETFs provide broad market exposure, which means they are less likely to generate exceptional returns compared to more specialized investment options. Additionally, ETFs can be subject to market volatility and lack the potential for explosive growth that can be found in alternative investment strategies.

When it comes to high risk, high reward investing, it’s important to explore alternative options that can offer greater potential for significant gains.

What alternative investment options should I consider?

Stock picking for high risk, high reward investing

One of the most traditional forms of high risk, high reward investing is stock picking. By selecting individual stocks, investors have the opportunity to uncover hidden gems and capitalize on their potential for exponential growth.

However, it’s important to note that stock picking requires thorough research, careful analysis, and a strong understanding of the market.

Investing in individual stocks comes with a higher level of risk compared to ETFs, as the success or failure of your investment will depend on the performance of a single company.

To mitigate risk, it’s crucial to diversify your stock portfolio and invest in a mix of established companies and promising startups.

Venture capital and angel investing

Angel investing and venture capital offer a more hands-on approach to high-risk, high-reward investing. These methods of investing entail financing startups in exchange for a share of ownership.

The contributions of VC companies and angel investors to the success of startups and the growth of the innovation economy cannot be overstated. The risks associated with funding new businesses are considerable, but the payoff might be enormous.

By getting in on the ground floor of a promising company, you have the opportunity to reap significant returns if the startup succeeds. However, it’s important to note that venture capital and angel investing require a high level of expertise and due diligence to identify the most promising opportunities.

Forex trading for high risk, high reward potential

To profit from the swings in exchange rates, people engage in Forex trading, also known as foreign exchange trading.

The foreign exchange market (Forex) is the world’s largest and most liquid market, providing investors with several chances for high-risk, potentially lucrative trades.

However, forex trading necessitates an in-depth familiarity with technical analysis, geopolitical events, and economic indicators.

Successful forex trading relies on careful analysis, risk management, and the ability to make informed decisions based on market trends. It’s crucial to develop a solid trading strategy and consider using stop-loss orders to limit potential losses.

Real estate investing

Real estate has long been considered a stable investment option, but it can also offer significant opportunities for high risk, high reward investing. Investing in real estate can involve strategies such as flipping properties, investing in rental properties, or participating in real estate development projects.

While real estate investments can generate substantial returns, they also come with their fair share of risks, such as market fluctuations, property management challenges, and regulatory changes.

Conducting thorough market research, analyzing potential returns, and diversifying your real estate portfolio can help mitigate risks and maximize potential gains.

Commodities and futures trading

Commodities and futures trading involve investing in tangible assets, such as gold, oil, or agricultural products, with the expectation of profiting from price fluctuations.

These investments can be highly volatile and are considered high risk, high reward due to the potential for significant gains or losses.

Understanding the supply and demand dynamics, geopolitical variables, and global economic trends is essential when trading commodities and futures.

It is important to know what is going on in the market, keep an eye on how prices are changing, and implement risk management strategies like stop-loss orders and sensible position sizing.

While high risk, high reward investing can offer the potential for substantial gains, it’s important to remember the importance of diversification.

Diversifying your investment portfolio is a crucial risk management strategy that helps spread risk across different asset classes and investment options.

By diversifying, you can reduce the impact of any individual investment’s poor performance on your overall portfolio.

Consider allocating a portion of your investment capital to different high risk, high reward options mentioned in this article, as well as more stable investments such as ETFs and bonds.

Striking the right balance between high risk and low-risk investments can help you achieve long-term growth while minimizing potential losses.

Bonds: a stable and low-risk investment

Bonds are often considered a safer alternative to ETFs as they offer fixed income and lower volatility.

Buying bonds is similar to lending money to a government or a company in exchange for interest payments and the promise of repayment of the principal when the bond matures.

For investors who are searching for safety and security, bonds can be a great option.

In addition to treasury bonds, corporate bonds, municipal bonds, and government bonds are also available.

If you want to invest in something safe, buy a government bond because it has the full faith and credit of the government behind it.

However, the rates and risks associated with corporate bonds are more attractive. Investors in higher tax rates may find municipal bonds issued by local governments appealing because of their lack of taxation.

U.S. Treasury bonds have the “full faith and credit” of the United States government behind them because they are issued by the federal government.

If your portfolio is experiencing instability, you may want to consider diversifying into bonds. Bond prices, however, can still alter in response to shifts in interest rates.

Money market funds: A conservative choice for short-term investing

Money market funds are another low-risk alternative to consider. These funds invest in short-term debt securities, such as Treasury bills and commercial paper, with the aim of preserving capital and providing liquidity.

Money market funds are considered very safe investments as they are subject to strict regulations and invest in high-quality, low-risk securities.

One of the key advantages of money market funds is their stability. The net asset value (NAV) of these funds is designed to remain constant at $1 per share, making them a reliable choice for short-term investing.

Additionally, money market funds offer easy access to your money, allowing you to quickly liquidate your investment if needed.

However, it’s important to note that money market funds are not without risks. While they are considered low-risk investments, they are not guaranteed by the government, and there is a possibility of losing money.

Furthermore, the returns on money market funds are generally lower compared to other investment options, making them more suitable for conservative investors looking for stability rather than high returns.

Certificate of Deposit (CD): a secure investment with fixed returns

Risk-averse investors who want a safe investment with guaranteed returns often choose CDs.

A certificate of deposit (CD) is a short-term (anything from a few months to several years) loan to a bank or other financial institution. You will receive a fixed interest rate and your initial investment back when the bond matures.

The Federal Deposit Insurance Corporation (FDIC) insures deposits in CDs up to $250,000 per depositor at each FDIC-insured bank. Because of this insurance, CDs are a good option for anyone looking for a low-risk investment.

CDs’ predictability is one of its main benefits. The amount of interest you will earn and the date on which you will receive your initial investment are both clearly stated. Because of this, they can be a great addition to a diverse investment portfolio or used to achieve shorter-term financial goals.

However, there are some restrictions that come with CDs that you should be aware of. Their lack of liquidity is a major negative.

There may be penalties for withdrawing money from a certificate of deposit before the end of the term. In addition, when interest rates are low, CDs typically offer lesser returns than alternative investments.

Dividend stocks: Investing in stable companies with consistent payouts

Dividend stocks are another alternative to consider for low-risk investing. These are stocks of companies that regularly distribute a portion of their earnings to shareholders in the form of dividends.

Dividend stocks are generally considered more stable than growth stocks, as they tend to be established companies with a history of consistent payouts.

Investing in dividend stocks can provide a steady stream of income, making them an attractive option for investors seeking regular cash flow. Dividend stocks not only pay out dividends but also have the potential to grow in value.

Researching a company’s financial health, dividend history, and payout ratios is essential before purchasing a dividend stock. Generally speaking, investors can have more faith in a company’s long-term viability and a history of dividend growth.

But you should know that dividends are not guaranteed and could be cut or even cancelled if the company’s finances take a turn for the worse.

Real estate investment trusts (REITs)

Real estate investment trusts (REITs) are a kind of indirect real estate investment that eliminates the need for individual investors to take on the responsibilities of property ownership and management.

REITs provide a sizable amount of its taxable income to shareholders in the form of dividends. These properties can include office buildings, shopping centers, apartments, and hotels.

Due to its low correlation with other traditional asset classes, such as equities and bonds, investing in real estate through REITs can help diversify your portfolio.

In addition to the security of a regular income stream, REITs also present the chance for financial growth as property prices rise.

Real estate investment trusts (REITs) are not without their own unique dangers. Real estate investment trusts (REITs) are vulnerable to real estate market shifts, interest rate volatility, and economic upheaval.

Overall results can be affected by the fact that dividends from REITs are typically taxed at the individual’s ordinary income tax rate.

Peer-to-peer lending: Earning passive income through microloans

P2P lending services have become increasingly popular in recent years due to their excellent return rates and stable income streams.

By linking borrowers directly with individual lenders, P2P lending platforms eliminate the need for conventional financial institutions like banks. Lending money to borrowers allows you, the investor, to earn interest on your capital.

P2P lending platforms offer the potential for higher returns compared to traditional fixed-income investments, as you can earn interest rates that are higher than those offered by banks.

Another point is that P2P lending provides the opportunity to diversify your investment portfolio by lending to a variety of borrowers and spreading your risk.

As with everything else, P2P lending comes with its own set of risks. The borrowers on these platforms may have varying creditworthiness, and there is a possibility of default or late payments.

Additionally, P2P lending platforms are not as regulated as traditional financial institutions, which can result in potential risks and challenges.

What should you consider before you start investing?

When it comes to low-risk investing, diversification is key. Diversifying your holdings across a variety of asset categories and investment vehicles can help mitigate your portfolio’s overall exposure to risk.

One way to strike a balance between security and return is to pool the funds from several low-risk investments.

Diversifying your portfolio means spreading your money out among various securities, commodities, and real estate, as well as cash and other liquid investments.

You can further diversify your portfolio by investing in a wide range of securities within each asset class, such as government bonds, corporate bonds, dividend stocks, and real estate investment trusts.

To make sure your portfolio is in line with your investing objectives and risk tolerance, it should be reviewed and rebalanced on a regular basis. Rebalancing can help you keep your chosen risk profile and optimize possible profits if market conditions change and certain investments outperform others.

There are a few things to keep in mind while weighing the relative merits of several low-risk investment alternatives:

Think about how much you can afford to lose and what you hope to accomplish with your investments. The investment choices highlighted here are quite safe, although all investing involves some degree of danger. Think about how you feel about value and income stability swings.

Think about how long you can afford to invest for. Bonds and CDs are good examples of investments with a shorter time horizon, whereas dividend stocks and real estate are good examples of long-term investments.

Think about how much money you need to bring in each month and see if your investment choices can do that. Bonds and dividend stocks give consistent income, but real estate investment trusts and peer-to-peer lending may offer less stable returns.

Learn the tax ramifications of your financial choices. It is crucial to think about how various investments’ tax treatments would affect your returns.

Risk can be reduced through diversity, which was previously discussed. Consider how each investment option fits into your overall portfolio and ensure you have a well-diversified mix of assets.

If you’re looking for investment alternatives to ETFs that offer low risk, there are several options worth exploring. Bonds, money market funds, CDs, dividend stocks, REITs, and P2P lending platforms all provide opportunities for low-risk investing.

Each option has its own pros and cons, and it’s important to consider your risk tolerance, investment objectives, and time horizon when making investment decisions.

Remember, the key to successful low-risk investing is diversification. By combining multiple low-risk investments, you can achieve a balanced portfolio that provides stability and potential growth. Regularly review and rebalance your portfolio to ensure it aligns with your goals and risk tolerance.

Finding the right investment alternatives for your low-risk strategy requires careful consideration and research. Take the time to evaluate each option, seek professional advice if needed, and make informed decisions that align with your financial goals.

If high risk, high reward investing is more your speed, you can find that it can provide you with exciting opportunities to potentially skyrocket your wealth.

While ETFs have their advantages, exploring alternative options such as stock picking, venture capital, forex trading, real estate investing, commodities, and futures trading can offer even greater potential for significant gains.

With greater potential profits also come greater risks, so keep that in mind. High-risk investments require extensive planning, analysis, and risk management before any money is put in.

You may better align your investing decisions with your financial goals and your level of comfort with risk if you diversify your portfolio and keep up with market developments.

Overall, ETFs are appealing to many investors because of their diversity, adaptability, and ease of use.

You can find an exchange-traded fund (ETF) that is suitable for your investment objectives and comfort level, regardless of whether you are an experienced investor or just starting out.

Like any other type of investment, though, it is crucial to do your research before putting money into high risk assets.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.