Vontobel Group, a Swiss private bank with an international focus, was established in 1924 and has its headquarters in Zurich.

It provides asset management services to sophisticated private and institutional clients and partners.

Learn how Vontobel Bank can provide comprehensive cross-border banking services for international investors.

If you want to invest as an expat or high-net-worth individual, which is what i specialize in, you can email me (advice@adamfayed.com) or use WhatsApp (+44-7393-450-837).

The information in this article is for general guidance only. It does not constitute financial, legal, or tax advice, and is not a recommendation or solicitation to invest. Some facts may have changed since the time of writing.

Vontobel Bank Background

Vontobel caters to its clients through three critical business units. They are Private Banking, Investment Banking, and Asset Management & Investment Funds.

Bank Type

Stock exchange bank.

Services Offered

⁃ Asset management

⁃ Wealth management

⁃ Advisory services

⁃ Investment management

⁃ Pension planning

Clients Accepted

High net worth individuals.

Global Reach

Vontobel serves clients worldwide and facilitates international transfers through SWIFT and SEPA transactions.

Delivery Channels

Bank Vontobel AG offers its products and services through various channels, including physical branches and online banking.

Common Shares

Vontobel Holding AG is the publicly listed entity associated with Bank Vontobel AG.

Vontobel’s shares are traded on the SIX Swiss Exchange under the VONN ticker.

Financials

In 2020, Bank Vontobel AG reported total assets of 21,898.37 million CHF, representing a substantial growth of 40.97%.

It ranks as the 27th largest bank in Switzerland regarding total assets, holding a market share of 0.63%.

Additionally, it is the fourth largest stock exchange bank in Switzerland, with a market share of 8.53% among banks in this category.

Deposit Guarantee

The bank participates in Switzerland’s deposit guarantee scheme, provided by esisuisse – Deposit Insurance (ESI). This scheme covers private individuals (Swiss and foreign) and legal entities (Swiss and foreign).

This offers protection of credit balances up to 100,000 CHF per depositor, per bank.

Contact Information

- Address: Gotthardstrasse 43, 8022, Zurich, Switzerland

- Phone: 044 283 71 11

Bank Identifiers

- BIC (SWIFT): VONTCHZZXXX

- LEI: 549300L7V4MGECYRM576

- Company Number: CHE-105.840.858

Bank Supervision

Bank Vontobel AG is authorized and supervised by the Swiss Financial Market Supervisory Authority.

The reference number is CHE-105.840.858.

Bank History

While Vontobel Group was founded in 1924, it appears there may be a discrepancy in the provided founding year (1936), as the earlier date is widely accepted as the establishment of the bank.

Credit Ratings

Moody’s, the rating agency, has conducted assessments and provided ratings for both Bank Vontobel AG and Vontobel Holding AG.

These ratings serve as confirmation of the recognized financial strength and stability of Vontobel.

For BANK VONTOBEL AG, the following ratings and outlooks have been assigned:

- Long-term deposit rating: Aa3 with a Stable outlook

- Short-term deposit rating: Prime-1 with a Stable outlook

- Counterparty risk rating: A2 with a Stable outlook

- Long-term counterparty risk assessment: A1 (cr)

- Short-term counterparty risk assessment: Prime-1 (cr)

For VONTOBEL HOLDING AG, the following ratings and outlooks have been assigned:

- Long-term rating (issuer rating): A2 with a Stable outlook

- Additional Tier 1 Subordinated Bonds: Baa2(hyb)

Are the Credit Ratings good for Vontobel?

Moody’s credit ratings for Vontobel were quite good. This includes the Bank Vontobel AG as well as Vontobel Holding AG.

However, the hybrid rating provided for Vontobel Holding AG’s Additional Tier 1 Subordinated Bonds was “Baa2”.

This means these bonds can be significantly risky, and at the same time, there could be higher returns for bondholders.

Wealth Management Services

In the context of Vontobel Wealth Management, clients have the advantage of a dual consulting concept. Clients have the flexibility to choose between personal guidance from their Relationship Manager.

They have the ability to utilize the digital platform Vontobel Wealth.

The extent to which they wish to integrate these options depends on their individual preferences.

Vontobel Wealth Management offers a wide range of services tailored to meet clients’ unique needs. These services encompass various mandate types, including discretionary and advisory service mandates.

They also have the option to combine additional services such as financing solutions, financial planning, and consulting.

Clients benefit from having a dedicated Personal Relationship Manager who prioritizes their needs, wishes, and financial goals.

Vontobel strongly emphasizes maintaining continuity and fostering long-term sustainability in client relationships.

This is done while ensuring that the Relationship Manager remains a reliable and knowledgeable point of contact over many years.

Furthermore, Vontobel Wealth Management provides sustainable investment solutions. This allows clients to align their investment decisions with their values.

By leveraging these options, clients can support companies that have a proven record of sustainable practices.

At the same time, this can be done while reducing portfolio risks in the process.

The advisory approach at Vontobel considers various aspects of the client’s financial situation. This includes evaluating their assets, liabilities, professional and family circumstances, and values and ideals.

The advisory process also involves prioritizing the client’s plans and goals.

This defines an appropriate investment strategy, assessing risk tolerance, and determining the following steps to achieve their financial objectives.

Leverage Investments

Vontobel Wealth Management offers clients a dual consulting approach.

Depending on their preferences, clients can choose between personal guidance from a Relationship Manager or using the digital platform Vontobel Wealth.

Various services are available to clients, including discretionary and advisory mandates.

Additional options like financing solutions, financial planning, and consulting are available.

Coming to the dedicated Personal Relationship Manager, you get prioritized solutions for your needs and goals.

This ensures continuity in the relationship over the long term.

Vontobel also provides sustainable investment solutions, allowing clients to align their investments with their values.

This supports companies with strong sustainability practices.

The advisory process considers the client’s financial situation, values, goals, and risk tolerance.

This provides experience with financial products to create a tailored strategy for achieving their objectives.

deritrade

deritrade is a leading global platform for creating personalized and structured investment products.

This open-architecture marketplace connects buyers and sellers, allowing users to design custom financial products.

Professional financial service providers and some private investors can use deritrade to create tailored investments.

- Key benefits of deritrade:

Enhanced Investment Performance

The platform optimizes investment performance with advanced technology.

It offers a wide range of structured product categories and underlyings, with a minimum investment of CHF 10,000.

— Real-time Price Comparison

Professional financial providers can instantly compare prices among suppliers, ensuring price transparency.

— Integrated Risk and Compliance

deritrade includes risk and compliance checks throughout the product lifecycle to comply with evolving regulations.

— Streamlined Client Experience

The platform’s modern interface automates the entire process, enhancing the client journey.

Relationship managers can quickly access prices and create structured products, all in seconds.

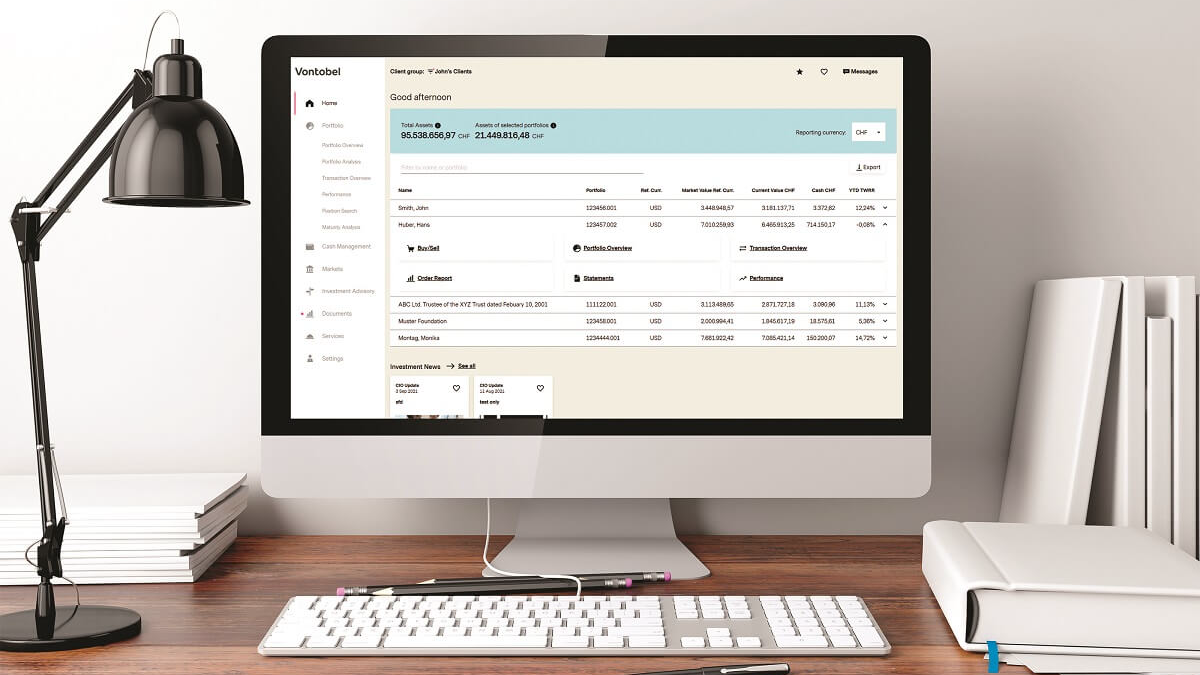

EAMNet

EAMNet by Vontobel is here for external asset managers and their clients.

EAMNet offers external asset managers a centralized platform for trading, reports, research, and more.

With added digital services, Vontobel Wealth lets clients access their portfolios anytime, anywhere.

With EAMNet, you can:

⁃ Keep track of clients and their portfolios.

⁃ Conduct transactions, including bulk trades, across multiple portfolios.

⁃ Monitor maturities and generate reports.

⁃ Access Vontobel Research and investment ideas.

⁃ Explore structured products through deritrade.

Vontobel Wealth provides clients with:

⁃ A comprehensive view of their portfolios.

⁃ Details on individual positions and performance.

⁃ Digital payment services and secure communication.

⁃ User-generated reports and Vontobel information.

The platforms are available 24/7, ensuring efficient action when needed.

Vontobel’s Relationship Management and Investment Advisory services seamlessly integrate with digital capabilities.

Corporate Responsibility

On February 28, 2023, Vontobel released its Sustainability Report for 2022.

The report aims to provide clear insights into Vontobel’s sustainability initiatives, progress, and plans.

Vontobel is dedicated to actively contributing to positive change and striving to achieve its sustainability objectives.

Sustainability

Sustainability is a long-standing commitment for Vontobel’s owner families, now in their fourth generation.

As responsible corporate citizens, they support local community well-being.

Vontobel, as a global investment firm, equips investors with knowledge, tools, and sustainable investment options for shaping better futures.

These efforts align with the UN’s Sustainable Development Goals (SDGs), aiming for a meaningful impact on a global scale.

Vontobel’s Sustainability Commitments

— Achieve net zero by 2030 in banking book investments and operations.

— Provide equality, diversity, and inclusion within the workplace.

— Promote governance and transparency for stakeholder engagement.

— Educate private clients about ESG investments.

— Integrate ESG considerations into active investment decisions.

— Actively engage with the local community.

Sustainable Investing

Vontobel offers sustainable investment solutions that meet environmental, social, and governance criteria.

All of this is being maintained while maintaining competitive earnings potential.

Vontobel strictly avoids investments in controversial weapons like cluster munitions and landmines.

Sustainability is vital in investment decisions, focusing on positive and long-term impacts on the ESG principles without sacrificing returns.

Vontobel has been a pioneer in sustainable investments since the 1990s.

At the same time, it has been providing a wide range of solutions, including equity funds, thematic strategies, and structured products.

For private individuals and entrepreneurs, Vontobel offers modern pension solutions with professional wealth management.

Economic sustainability at Vontobel centers on client focus, long-term growth, and sound capital and risk policies.

Vontobel’s Dedication to Environmental Sustainability

Vontobel prioritizes environmental protection across all its business activities.

It supports the Paris Climate Agreement’s goals, actively contributing to the sustainable transformation of the economy for future generations.

High environmental and sustainability standards guide Vontobel’s:

⁃ Operations

⁃ Emphasizing material efficiency

⁃ Energy conservation

⁃ Reduced greenhouse gas emissions.

Vontobel’s Commitment to Social Sustainability

Corporate responsibility is an integral part of Vontobel’s culture and identity.

This means it extends to the well-being, cohesion, and stability of societies where it operates.

Vontobel values its employees and invests in their development, fostering an inclusive workplace and work-life balance.

It engages in community support.

Vontobel partners with organizations like the ICRC, Munich Security Conference, etc.

It also promotes contemporary photography through its modern art initiative.

Since 2007, Vontobel has actively participated in National Future Day, opening its doors to children across Switzerland.

Sustainable Report

Vontobel strives to offer transparent insights into its sustainability efforts, achievements, and future objectives.

This has been made clear in their sustainability report for 2022.

Investment:

Vontobel has been a trailblazer in sustainable investing since the 1990s.

They manage CHF 107.6 billion in investment solutions integrating ESG criteria.

Their investment teams adhere to four core ESG Investment Principles.

Vontobel is a founding Swiss Sustainable Finance (SSF) association member.

Environment:

They have achieved carbon neutrality for Scope 1, Scope 2, and Scope 3 emissions from operations since 2009.

Their Zurich campus utilizes lake water for heating and cooling, promoting sustainability.

They prioritize collaboration with local providers whenever feasible.

Vontobel is also a founding member of the Swiss Climate Foundation.

Social:

Vontobel is a part of the Corporate Support Group for the International Committee of the Red Cross (ICRC).

They conduct an annual fundraising initiative to support an ICRC project.

Their “A New Gaze” photography prize encourages young contemporary artists.

Alternatives for Bank Vontobel AG

Based on aspects like business focus, total assets, etc., other alternatives for Bank Vontobel AG are as follows.

— Union Bancaire Privee, UBP SA

— Banque Pictet & Cie SA

— Banque Lombard Odier & Cie SA

— Edmond de Rothschild (Suisse) S.A.

— Swissquote Bank SA

Pros and Cons of Vontobel

Whether individuals should become clients of Vontobel depends on their specific financial needs, goals, and values.

Pros of Becoming a Vontobel Client:

- Sustainable Investing

Vontobel strongly emphasizes sustainable and responsible investing, offering an array of ESG-focused investment solutions.

If you prioritize environmentally and socially responsible investments, Vontobel’s offerings align with those values.

- Long-Term Sustainability Commitments

Vontobel has outlined sustainability commitments, including achieving net-zero emissions by 2030 and promoting diversity and inclusion.

Clients who value companies committed to such goals may find Vontobel appealing.

- Financial Services

Vontobel offers various financial services, including wealth management, investment solutions, and advisory services.

This broad range of offerings can cater to different financial needs and objectives.

- Transparency

Vontobel emphasizes transparency in reporting its sustainability efforts.

This can reassure clients who want clear information about the company’s practices and progress.

Cons of Becoming a Vontobel Client:

- Investment Goals

Individuals should assess whether Vontobel’s investment options align with their financial goals and risk tolerance.

- Location

Vontobel operates globally but has its roots in Switzerland.

Potential clients should consider whether the bank’s geographic presence aligns with their needs and location.

- Risk Tolerance

Like any financial institution, Vontobel carries certain risks.

Clients should carefully evaluate these risks and ensure they are comfortable with the risks associated with their investments.

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.