This article will discuss how you can send money from Cyprus to other countries.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via advice@adamfayed.com

It is usually better to “kill two birds with one stone” and invest as an expat, rather than send money home to buy shares or a house.

Introduction

Cyprus is located at the crossroads of Europe, Asia, and Africa. Its relaxed atmosphere, opportunities for an active lifestyle, beautiful beaches, low taxes, and affordable cost of living may seem too inviting to let go of. Because of this, many expats have decided to live in the country.

As an expat or a local, there are many reasons why you would need to send money from Cyprus to other countries. Whatever that may be, convenience, affordability, security, and speed are of the utmost priority. With this in mind, we’ll take a look at six different platforms that provide you with just that.

How to Send Money Out of Cyprus to Other Countries

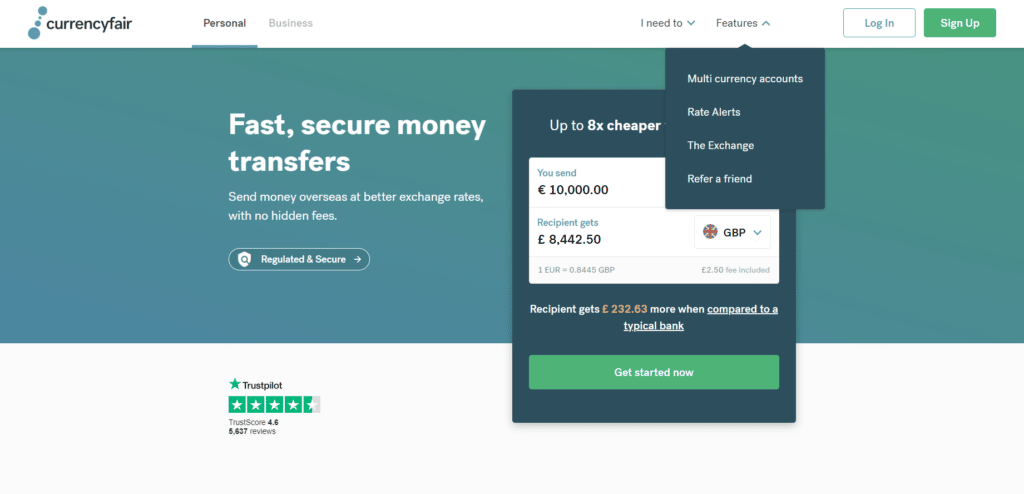

1. CurrencyFair

CurrencyFair is a provider of online cross-border payment and foreign exchange services. It was launched in 2010. With this platform, you can send and receive money to and from over 150 countries. At the same time, it supports more than 20 currencies.

To send money from Cyprus to other countries using CurrencyFair, you will first need to create an account for free. This involves an identity verification process. Then, once approved, you can start making use of their services.

Depositing funds into your account can only be done by bank transfer. Payments through debit cards, credit cards, cash, cheques, or bank drafts are currently not accepted. CurrencyFair will not charge fees for the deposit transaction into your account with them. However, your bank may charge you their respective fees for the transfer.

When sending money, CurrencyFair will charge a flat fee of 3 EUR, or its equivalent. Apart from that, they have a foreign exchange margin of around 0.45%. This is a small price to pay, especially in comparison to the rates of the banks. You can save up to 8 times more with CurrencyFair.

The minimum amount that you can send is 8 EUR, while the maximum amount is 10,000,000 EUR. Money transfers will be completed on the same day.

For example, sending 10,000 EUR from Cyprus to the UK will be charged 2.50 EUR. With a conversion rate of 1 EUR = 0.8372 GBP, the recipient will get 8,369.50 GBP.

CurrencyFair is fully regulated in the countries they operate in. This ensures that your money with them is always safe and secure.

2. TransferGo

TransferGo was launched in 2012 as a payment service provider. Today, they support 22 currencies in 47 different countries across the world.

To use their services, you must create an account. Then, you can fund your transfer through a debit card or bank transfer. You will usually need to input the bank details of the recipient, such as a SWIFT code and account number.

The fees charged by TransferGo for international transfers depend on the delivery time. For money transfers completed within 30 minutes, a fee of 2.99 EUR will be charged. However, this service is not available in all countries. On the other hand, money transfers processed within the day or the next day will be charged 0.99 EUR. It is important to note that the fees previously mentioned are those generally charged. Specific fees can change depending on the receiving country and the amount sent.

Furthermore, your first 2 transfers with TransferGo will also come at no cost. So, it would be good to take advantage of this offer in order to save on transfer fees.

For example, sending 10,000 EUR from Cyprus to the UK will be charged 0.99 EUR. With an exchange rate of 1 EUR = 0.83750 GBP, the recipient will get 8,375.00 GBP.

TransferGo is regulated by the Financial Conduct Authority (FCA) and overseen by HM Revenue and Customs (HMRC).

3. Wise

Wise, previously known as TransferWise, was launched in 2011. Today, they support transactions that involve over 50 currencies in more than 80 countries.

You must create an account with them, which is as easy as signing up with your email address. Then, to fund your transfer, you can pay with your debit card, credit card, SOFORT, Trustly, or make a bank transfer. You have to know the bank details of the recipient because this is how they’ll get the money. The recipient does not need an account with Wise for the transfer.

Wise charges a fixed fee plus a certain percentage of the amount to be converted. For example, when sending money from Cyprus to the United Kingdom, a fixed fee of 0.46 EUR will be charged. Then, the percentage of the amount ranges between 0.3% and 0.47%, with the lowest percentage applied to transfers amounting to more than 1,187,230 EUR.

At the same time, there are different types of transfer. Specifically, they are as follows: fast transfer, low cost transfer, and easy transfer. Each has their own payment methods, transfer fees, and accepted amounts of transfer. Sending 10,000 EUR from Cyprus to the UK can be charged at 47.24 EUR for a low cost transfer or 87.88 EUR for a fast transfer. With a conversion rate of 1 EUR = 0.839750 GBP, the recipient will get either 8,357.83 GBP or 8,323.70 GBP.

There is no minimum amount that you can transfer. But the maximum amount that you can send is 1,200,000 EUR. It usually just takes seconds for the money to arrive at the recipient. This may vary depending on the payment method that you use.

Wise is regulated by the Financial Conduct Authority (FCA) in the UK.

4. WorldRemit

WorldRemit was founded in 2010. Currently, they serve 130 different countries and support 70 currencies across the globe.

There are different ways in which you can fund your transfer with WorldRemit. In particular, you can pay through a debit card, credit card, prepaid card, or Trustly. The maximum amount that you can send is 8,000 EUR or 20,000 EUR every 24 hours, depending on the payment method that you use.

The money will arrive at the recipient within minutes. But there are instances where it can take up to 7 days, depending on how the recipient gets the money. In general, the recipient can get the money through their bank account, mobile money account, airtime top-up, cash pick-up, or home delivery.

For example, you send 7,500 EUR from Cyprus to the UK, which will be received through bank transfer. This will be charged a fee of 3.99 EUR and will be transferred within the next working day. With a conversion rate of 1 EUR = 0.82816 GBP, the recipient will get 6,211.23 GBP.

There is no minimum amount required to make use of WorldRemit. However, the total amount that you can pay should be lower than 8,000 EUR. This takes into consideration the amount to be sent plus the fees charged. As such, the maximum amount that you can send is roughly around 7,996 EUR.

Given that WorldRemit is an authorized Electronic Money Institution, your money with them is safeguarded. This means that there is a possibility that not all of your deposits will be returned to you should WorldRemit become insolvent. The refund may also take longer compared to bank institutions that are under the protection of the Financial Services Compensation Scheme.

5. Instarem

Instarem was established in 2014. Today, users can send money to more than 50 countries.

To transfer money through Instarem, you can create an account online or through their mobile app. Then, to send money, you can fund your transaction through an electronic funds transfer (EFT), bank transfer, or wire transfer. Payment by credit card, cash, or a third party is not allowed. Regarding the unacceptance of third party payment, this means that the account that you use to fund the transaction should have the same name as your Instarem account.

In general, the fees charged by Instarem range from 0.25% to 1%. And, the processing time for a money transfer will depend on the receiving bank. Cash pick-up is only available to recipients in the Philippines.

The minimum amount that can be sent is 1 EUR if the native currency is used. However, there is no minimum amount if other currencies are transferred. There is also no limit to the amount of money that you can send through Instarem. But it is important to note that the country where the recipient resides may regulate the amount of money that they can receive.

For example, sending 10,000 EUR from Cyprus to the United Kingdom can be funded through a debit card or bank transfer. When using a debit card, a 20 EUR transaction fee will be charged, but this is often faster. On the other hand, when using a bank transfer method, no fees will be charged. With a conversion rate of 1 EUR = 0.836 GBP, the recipient can get either 8,343.28 GBP or 8,360 GBP.

Instarem is a licensed service provider in the countries where they operate.

6. Paysend

Compared to the others on the list, Paysend was only established in 2017. However, they have grown to serve over 150 countries and a similar long list of currencies.

An account can be created either online or through their mobile app. Then, to send money, you can make use of your bank card, bank account, or mobile number through Paysend Link. On the other hand, the recipient can get the money through their MasterCard or bank account. They also have the option of choosing the method of how they’ll receive the money through the Paysend Link.

Paysend Link is a unique feature of the platform because it allows users to send and receive money with just a mobile number.

Paysend charges a fee of 1.5 EUR and the transfer is usually completed on the same day. The processing time will be highly dependent on the receiving bank.

For example, sending 10,000 EUR from Cyprus to the UK will be charged 1.50 EUR. With a conversion rate of 1 GBP = 1.2039 EUR, the recipient will get 8,304.83 GBP.

Paysend is authorized by the Financial Conduct Authority (FCA) in the UK.

Conclusion

We have listed six different international money transfer platforms that you can use to send money from Cyprus to other countries. But it is important to note that the foreign exchange rate is as of this writing. It will change later on, so the best way to determine the rates, fees, and other considerations is to head to their respective platforms.

In general, they provide secure and fast services with competitive foreign exchange rates and low fees. At the same time, the maximum amount that you can transfer per transaction is often beyond 6 digits, or sometimes even none. Lastly, being digital platforms, they provide the convenience of just using your gadget and the internet to send money from Cyprus to other countries.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 760.2 million answer views on Quora.com, a widely sold book on Amazon, and a contributor on Forbes.