In this article, you’ll find out how to send money out of Monaco.

Nothing written here should be considered as financial advice, nor a solicitation to invest.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via advice@adamfayed.com

It is usually better to “kill two birds with one stone” and invest as an expat, rather than send money home to buy shares or a house.

Introduction

Monaco, officially called the Principality of Monaco, is a sovereign city-state located on the French Riviera. With a land area of 1.95 km2, it only takes up less than 0.01% of the Earth’s land area. This makes it the second smallest country in the world, next to Vatican City. It is home to around 39,000 people. And given its small size, it is one of the most densely populated countries worldwide.

The country is under a constitutional hereditary monarchy, with His Serene Highness Prince Albert II as the Chief of State. Alongside is the recently appointed Minister of State, Pierre Dartout.

Monaco has much to offer with its diverse attractions and opportunities for personal advancement. With 300 days of sunshine every year, beautiful scenery, a glamorous lifestyle, and a favorable taxation system, the country continues to attract high-net-worth individuals of all nationalities. It comes as no surprise that living in Monaco comes with a hefty price to pay, especially when it comes to real estate. Without taking into account expenses for rent, a single person will need 1,333.79 EUR per month to live comfortably.

Whether you are in the country for business or personal matters, how to send money out of Monaco is a situation that you’re bound to encounter. As such, we’ve listed them down below for you.

How to Send Money Out of Monaco

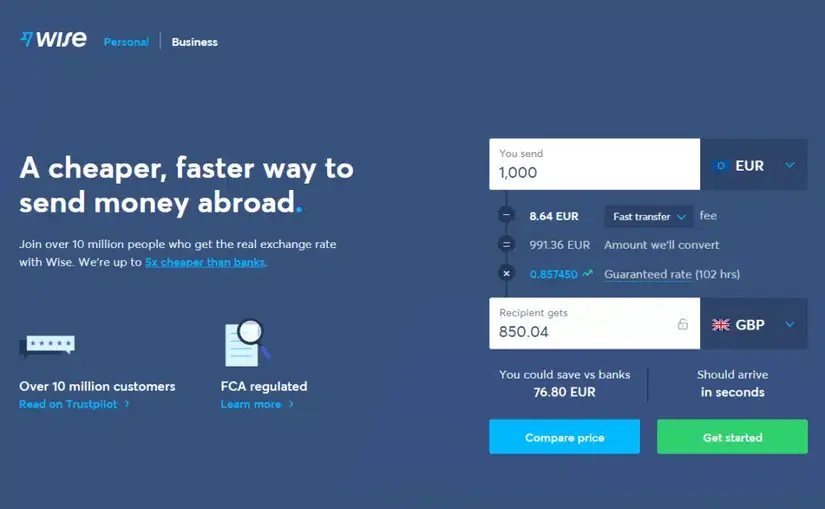

1. Wise

Wise is well-known for offering affordable, simple, and fast international money transfers ever since it was launched in 2011. They offer three transfer types, namely, fast transfer, low cost transfer, and easy transfer. Each has its own payment method, transfer fee, and processing time.

The money transfer can be paid for by debit card, credit card, bank transfer, SOFORT, and Trustly. On the other hand, the recipient will get the money through their bank account in seconds or within one day.

In the case of sending money from Monaco to the United Kingdom, Wise charges a fixed fee of 0.46 EUR plus a certain percentage of the amount to be transferred. The percentage ranges between 0.3% and 0.47%. The highest percentage is applied to transfers of up to 117,827 EUR, while the lowest percentage is applied to transfers of more than 1,178,270 EUR.

For example, sending 10,000 EUR from Monaco to the UK will be charged 47.24 EUR for a low cost transfer. Wise will convert 9,952.76 EUR using the mid-market exchange rate of 1 EUR = 0.849000 GBP. With this, the recipient will get 8,449.89 GBP. The maximum amount that can be transferred through Wise is 1.2 million EUR.

2. TransferGo

TransferGo operates in 63 different countries. They offer three transfer types, which differ in the length of time in which the transaction will be completed. Specifically, there are transfers that can be processed within 30 minutes, within the day, or after one day. Each has its own transfer fee, with the fastest processing time being charged the most.

The money transfer can be paid for by bank transfer, credit card, debit card, Google Pay, or Apple Pay. The recipient will get the money through their bank account. For example, sending 10,000 EUR to the UK will cost 0.99 EUR. With an exchange rate of 1 EUR = 0.84401 GBP, the recipient will get 8,440.10 GBP within 2 days.

A maximum of 10,000 GBP, or its equivalent (11,777.85 EUR), can be transferred per transaction if paying by card. However, there is no limit to the number of transactions that can be initiated. This means that multiple transactions can be done should you need to transfer higher amounts of money. On the other hand, there is no transfer limit applied by TransferGo when paying by bank transfer.

3. XE

XE offers an affordable and fast way to send money from Monaco to over a hundred countries. The money transfer can be paid for by bank transfer, credit card, or debit card. The recipient will get the money through their bank account or cash pick-up within 1–4 business days. A maximum amount of GBP 350,000, or its equivalent (412,224.75 EUR), can be transferred. However, documents to ascertain the source of funds may be requested by XE when initiating large transfers.

A “send fee” of 2 EUR is charged for transfers that are less than 250 EUR. Transfers of amounts greater than 250 EUR are free of charge. For example, sending 10,000 EUR from Monaco to the UK will come at no cost. With an exchange rate of 1 EUR = 0.8401 GBP, the recipient will get 8,401.00 GBP within minutes.

4. Xendpay

Xendpay offers a fair, fast, and safe international money transfer service that is accessible in over 170 countries worldwide. The money transfer can be paid for by bank transfer, debit card, or credit card. The recipient will get the money through their bank account or mobile wallet within 1 to 4 business days.

The maximum amount that can be transferred is 100,000 GBP (117,709.35 EUR) per transaction. This is available to holders of verified Xendpay accounts. On the other hand, a limit of 5,000 GBP (5,886.42 EUR) is applied for money transfers that are paid by card. Multiple transactions are allowed should you need to send more money.

Xendpay operates under a “Pay What You Want” scheme in relation to the transfer fee. This means that users can choose to pay a transfer fee that they consider fair for making use of the institution’s service. However, this is only applicable to cumulative transfer amounts of up to 2,000 GBP (2,354.19 EUR) per year for holders of personal accounts. In general, Xendpay recommends paying a fee of 3.50 EUR per transfer.

For example, sending 10,000 EUR to the UK will not be charged any transfer fees. With an exchange rate of 1 EUR = 0.84977 GBP, the recipient will get 8497.00 GBP.

5. Money Transfer through Banks

Another option to send money from Monaco would be to use the services of the local bank with which you have an account. In terms of total assets, the largest banks in the country are Barclays, Bank Julius Baer, CFM Indosuez, CMB Monaco, and UBS Monaco. However, they often have higher transfer fees and less competitive foreign exchange rates.

Conclusion

With this, we have listed a couple of options for sending money out of Monaco. It is important to note that the fees and exchange rates mentioned above are subject to change. Because of this, it would be best to head on over to the site of the institution themselves to determine the actual cost and feasibility of the international money transfer that you plan to make.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.