This article was updated on July 22, 2022

This article will tell you how to invest in the S&P500 from outside of the United States.

Many people, across the world, are looking to invest in US Stocks and indeed stock markets like the S&P500, Dow Jones and Nasdaq.

It isn’t always easy, however, depending on your country of residency and some other factors.

This article will therefore speak about some of the ways you can invest in this stock market.

If you are looking to invest in the S&P500, you can contact me here, or email me (advice@adamfayed.com).

Remember that some of the facts might always be changing, so for updated information, it is better to contact me directly.

Introduction

The S&P 500 is a stock market index that tracks the stocks of 500 large-cap US companies.

It displays the results of the stock market, reporting on the risks and returns of the largest companies. Investors use it as a benchmark for the entire market against which all other investments are compared.

As of August 31, 2020, the S&P 500 had an average 10-year annualized return of 12.66%. S&P stands for Standard and Poor, the names of the two founding financial companies.

The S&P 500 was officially introduced on March 4, 1957 by Standard & Poor. McGraw-Hill acquired it in 1966. It is now owned by S&P Dow Jones Indices and is a joint venture between S&P Global (formerly) McGraw Hill Financial, CME Group and News Corp, owner of Dow Jones.

So the S&P 500 tracks the prices of large-cap US stocks or stocks in companies with a total value of over $ 10 billion. By following the S&P 500, you can easily see whether the largest US stocks are rising or losing.

This is why the S&P 500 is often viewed as a metric to describe the overall health of the stock market or even the US economy.

How it works?

The S&P 500 tracks the market capitalization of companies in its index. Market capitalization is the total value of all shares issued by a company.

It is calculated by multiplying the number of issued shares by the share price.

A company with a $ 100 billion market cap gets 10 times more representation than a company with a $ 10 billion market cap. As of July 2020, the total market capitalization of the S&P 500 was $ 27.05 trillion.

The committee selects each of the index’s 500 corporations based on their liquidity, size and industry. It rebalances the index on a quarterly basis in March, June, September and December.

To qualify for the index, a company must be located in the United States and have an unadjusted market cap of at least $ 8.2 billion.

At least 50% of the shares of the corporation must be publicly available. Its share price must be at least $ 1 per share. He must submit a 10,000th annual return. At least 50% of its fixed assets and income must be in the United States. Finally, he must have at least four consecutive quarters of positive earnings.

Promotions cannot be listed on pink sheets or sold without a prescription. It must be listed on the New York Stock Exchange, Investors Exchange, Nasdaq, or BATS Global Markets.

As of August 31, 2020, the top 10 market capitalization weighted companies in the S&P 500 included:

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Amazon.com Inc. (AMZN)

- Facebook Inc. A (FB)

- Alphabet Inc. A (GOOGL)

- Alphabet Inc. C (GOOG)

- Johnson and Johnson (JNJ)

- Berkshire Hathaway B (BRK.B)

- Proctor and Gamble (PG)

- Visa Inc. A (V)

Note that some companies appear more than once – Alphabet Inc., Google’s parent company, appears twice. This is because Alphabet and other companies have more than one class of sizable stocks. For this reason, the S&P 500 can hold more than 500 shares, although it only includes 500 companies.

Can you buy S&P 500 stock?

The S&P 500 is not a company itself, but a list of companies, also known as an index. Thus, while you cannot buy S&P 500 stocks, you can buy stocks in an index that tracks the S&P 500.

In fact, this is one of the best ways for budding investors to get their feet wet in the stock market. Some of the most popular index funds that track the S&P 500 include:

- Vanguard 500 Index Investor Shares (VFINX)

- Fidelity 500 Index Fund (FXAIX)

- Schwab S&P 500 Index Fund (SWPPX)

- T. Rowe Price Equity Index 500 Fund (PREIX)

And now, for investors who are interested in S&P 500 companies, and want to invest but don’t know where to start, let this article be a quick guideline for you.

- How to invest in The S&P 500?

As mentioned earlier, you cannot invest in the S&P 500 index itself. But you can invest in an S&P 500 index fund that mimics the performance of the S&P 500. Instead of buying 500+ individual stocks (which are constantly changing anyway), this is an opportunity to invest in one fund.

Another way to invest in the S&P 500 is to invest in an exchange-traded fund (or ETF) that mirrors the index. An ETF is a low-cost, tax-efficient fund that allows an investor to remain diversified when investing in the stock market. They are traded on stock exchanges and can be bought and sold like stocks.

You can invest in the S&P 500 in a variety of ways – with the help of a bank, broker, discount brokerage, financial advisor, or robo advisor.

A bank:

A bank may seem like the most convenient way to invest in the S&P 500 because it allows you to keep all of your accounts – checking, savings and index investment accounts – in one place.

The downside is that banks can have high fees and you may not always get the personalized, personal investment service you do when you need to talk to someone, such as your checking account or a loan. This is because investment is a side business for banks. (Their main purpose is to accept and lend money.)

Banks also tend to overcharge and are trading on brand name.

Discount brokerage:

A discount broker or trading platform has consistently low commissions, but you are completely on your own – there are no tips to help you navigate your investment approach. It’s completely DIY.

This might work great for investors who understand their financial landscape and know how investing in the S&P 500 index fund fits into their investment puzzle, but most experts agree that it is wise to get some advice before investing.

This is a great option for the minority of people who have the self-control needed to invest by themselves.

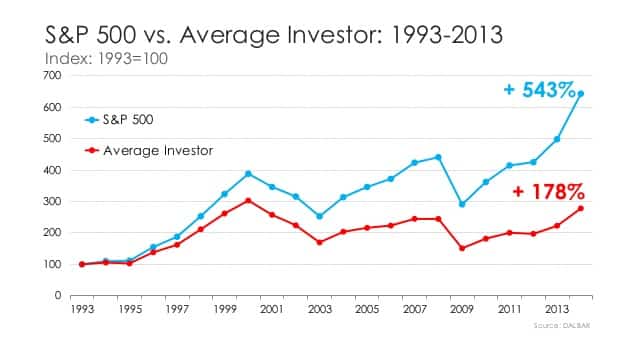

With that being said, it is a statistical reality that DIY investing doesn’t work compared to using advisors.

In the March 2020 crash, Fidelity claimed that 35% of people panic sold between March and May.

This helps explain results like these:

Everybody says they won’t be emotional when markets crash, yet few people seem to be able to follow up with actions when a crash happens.

Financial Consultant:

A financial advisor can of course help you with this type of investment. A financial advisor knows your complete financial vision, has a complete financial plan for you, and is knowledgeable about how investing in an index like the S&P 500 can help you – especially you – achieve specific financial goals.

People think advisors can help with knowledge. This is true, but as per the last paragraph, assisting with emotional control is even more important.

Robo Advisors:

Robo-advisors are becoming more and more popular because many of them combine the benefits of low fees with the opportunity to discuss your investment approach with a real person.

They are less practical than financial advisors because they use algorithms to help them figure out which investments are right for you. Some robotics advisors offer the opportunity to speak with a financial planner, especially if you are investing large amounts of money.

- A quick guide on how to invest in the S&P 500

To make an investment in S&P 500, you have to complete some easy steps. Let’s see the succession of the investing process with the following steps.

Step 1

Open a brokerage account

If you want to invest in the S&P 500, you first need a brokerage account. This can be a retirement account such as a traditional IRA or Roth IRA sponsored by an employer 401 (k) or similar, or your own traditional taxable brokerage account.

There are many brokerage companies to choose from. Look at the buying and selling fees for mutual funds and ETFs if you are opening a new account intending to invest in the S&P 500. Many brokerages offer their own funds or a group of partner funds without commission for trading mutual funds. For ETFs, you must pay any trading fees.

Step 2

Choose between mutual funds and ETFs

You can buy the S&P 500 index funds as mutual funds or as ETFs. Both track the same index and work in the same way, but there are some key differences you should be aware of.

- Mutual funds are designed to be held for a relatively long period of time. They only trade once a day after the close of the market. Some have a minimum investment amount and a minimum investment period. And early withdrawals can lead to fines. On the other hand, you can buy and sell mutual funds in round dollars.

- ETFs are bought and sold like stocks. The price is constantly changing throughout the day as traders buy and sell. Most major discount brokerage firms allow you to trade all ETFs for free. There is no minimum hold time or minimum purchase amount other than the price of one share. In some cases, ETFs can have lower expense ratios and can be purchased through brokers such as Public.com, which is known for its low fees and zero fees.

For most people, ETFs will be a more attractive way to start investing in the S&P 500. However, mutual funds also have their advantages. It’s up to you to decide what works best for your portfolio.

Step 3

Choose your preferred S&P 500 fund

Once you decide between ETFs and mutual funds, you can start comparing more specific details to pick your favorite fund. First, look at any costs and fees. You don’t want to overpay if you can get pretty much the same thing from multiple sources.

Here are the fees for popular mutual funds:

- Schwab charges 0.02% on the Schwab S&P 500 Index Fund (SWPPX) with a $ 100 minimum.

- Fidelity charges just 0.015% on its Spartan S&P 500 Index Investor Class (FXAIX) shares with no minimum investment.

- The Vanguard 500 Index Fund (VFINX) has a commission of 0.14% and a minimum of $ 3,000.

And here are the fees in the ETF world:

- The Vanguard S&P 500 ETF (VOO) is worth 0.03%.

- iShares Core S&P 500 (IVV) costs 0.04% per year.

- The largest and oldest S&P 500 ETF is the State Street Global Advisors SPDR S&P 500 ETF (SPY) with a 0.0945% expense ratio.

Here it is! Now you are an Index Fund Owner.

- The best way to invest in the S&P 500

There is no best way. Each person is different. If you are a DIY investor that has successfully invested for 25 years, and never panic sold, then DIY investing might be best.

If your financial situation is complex (let’s say you are an expat), or you are likely to panic sell during a crash, then having advice is best.

Each investment approach has its merits, depending on a person’s specific situation.

Since the S&P 500 Index Fund includes 500 different companies, it is inherently a diversified investment.

And you can certainly invest in a fund that only tracks S&P 500 companies. But investment management companies offer many different fund types and portfolio recommendations.

For example, there are funds that include the S&P 500, but also include other types of investments — for example, foreign stocks or technology companies — that simply do not meet the S&P criteria for a “big giant American company.”

No matter how passionate about the S&P 500 you are, you should still view those 500 as one investment in your basket – you don’t want all of your investment eggs to be put into it.

It is better to also own a bonds index, and an international one, in tandem with the S&P500 index.

Investing money in an index like the S&P 500 means that the value of your investment can fluctuate a lot over time.

A wise investor doesn’t just put money into an account and doesn’t forget about it. Actually, let’s fix this: a wise investor can throw money into an account and forget about it if that investor has someone adjusting the investor’s portfolio to accommodate changes in the market.

When choosing an investment platform with portfolio rebalancing, you take into account market changes.

This means that you maintain the same asset allocation over time – for example, a portfolio that contains 50 percent of stocks and 50 percent of bonds – in line with what you designated when you started investing.

With the frequency you choose, your robot advisor will execute certain transactions that will return your interest to where you want it.

What is the average return on the S&P 500?

For nearly the last century, the S&P 500’s average annualized total return (including dividends) has been about 10%, unadjusted for inflation.

However, keep in mind that this does not mean that you can expect to receive a 10% return on your investment in the S&P 500 Index Fund every year.

For example, in 2008 the S&P 500 ended the year with a staggering 37% drop. The next year it grew by 26%. Achieving an annualized return of 10% requires a long-term investment mindset and a willingness to overcome market volatility.

Benefits of Investing in the S&P 500 Index Fund

One of the benefits of investing in a fund that reflects the S&P 500 is that large-cap companies – those included in the S&P 500 – are generally considered more stable (read: less risky) investments and tend to increase the value of the stock.

Another advantage of combining several companies into one index is that it makes it easier to invest in all of these companies at the same time. If you want to invest in the S&P 500, you can of course buy shares of every single company in the S&P 500. That means 500 separate transactions.

This could mean a lot of clicks or phone calls – and it could mean talking to your very confused stockbroker or financial advisor, who will then tell you about a much easier way to invest in the S&P 500: simply by investing in the S&P 500 Index Fund. You can invest in one transaction in all 500 companies at the same time.

And another benefit of investing in an S&P 500 fund is its inherent diversification based on a wide range of components across a variety of industries. The nature of the stock market is unpredictable, but experts often recommend investing in index funds that track general market benchmarks, such as the S&P 500.

How to compare the S&P 500 to other indexes?

The S&P 500 is one of several leading stock indices used to measure and understand the performance of the US stock market. Here is a comparison with other common stock indexes.

S&P 500 / NASDAQ

The NASDAQ tracks one hundred of the largest and most actively traded non-financial domestic and international securities on the NASDAQ stock market.

Like the S&P 500, the NASDAQ uses a market cap weighting formula, although other factors also influence the inclusion of stocks. To be part of the NASDAQ, a stock must have a minimum daily trading volume of 100,000 shares and be traded on the NASDAQ for at least two years.

Unlike the S&P 500 and the Dow, the NASDAQ includes some foreign companies and is heavily focused on technology companies. Because of this, the NASDAQ does not reflect the overall US market so much as the attitude of investors towards the tech industry.

Over the past 10 years, the NASDAQ has averaged 42.6% per annum, while the S&P 500 has 11.2%. However, keep in mind that its high profitability in recent years is largely due to its heavy technological weight.

S&P 500 / DJIA

The Dow Jones Industrial Average (DJIA), also known as the Dow, tracks far fewer companies than the S&P 500. The Dow tracks 30 US blue-chip companies that are considered the largest, most stable and most successful and well-known companies that are leaders in their industries.

Unlike the S&P 500, the DJIA is weighted by price, not market capitalization. This means that the percentage of a company in the index is proportional to its share price. The components with higher stock prices receive more weight in the index. This has several important consequences:

- Smaller Dow components can have a disproportionate impact. Since the weighting is based on stock price, companies with higher stock prices have a greater impact on the DJIA level than on the weighted market cap index, regardless of their market cap. A company with less expensive shares but a much larger market cap will play a smaller role in influencing the direction of the Dow Jones.

- DJIA may face greater volatility. Because of its price weight, the Dow may also experience sharper and more frequent ups and downs than the S&P 500. Consider this: XYZ is worth $ 200. When it drops in value by $ 1, the DJIA falls by a larger percentage than if the company with the cheaper shares lost the same amount. This happens even though $ 1 is a lesser percentage of $ 200 than, say, $ 20.

However, over the long term, the S&P 500 and the Dow show similar rates of return. From January 1920 to 2020, the DJIA averaged 10.1% per annum with dividend reinvestment, and the S&P 500 index averaged 10.3%.

So the S&P 500 is a stock index that tracks the stock prices of the 500 largest publicly traded companies in the United States. The S&P 500 is one of the main tools used to track the dynamics of US stocks.

Here every investor can find his goals and follow them, the most important thing to remember is to diversify your funds and not be focused on one index fund.

Further Reading

I am the most widely read author on Quora.com on financial matters, getting over 223 million views in the last three years.

In the article below, taken from my Quora answers, I speak about:

- How can somebody invest in the US stock market from Kenya and do it productively?

- What makes a good stock investor? Emotional control or technical knowledge?

- If somebody is worth millions in their 30s, can they really become a billionaire before they die? What is the likelihood?

- How can the stock market grow more quickly than GDP?

To read more click below: