Top countries with no taxes – that will be the topic of today’s article.

Nothing written here should be considered as financial advice, nor a solicitation to invest.

For any questions, or if you are looking to invest as an expat, you can contact me using this form, or via the WhatsApp function below.

Introduction

Taxes are obligatory, individually free payments levied from organizations and individuals in the form of alienation of funds belonging to them by right of ownership, economic management, or operational management of funds in order to financially support the activities of the state and municipalities.

There are lucky people in the world who do not pay income tax at all – these are residents of rich oil-producing countries (UAE, Saudi Arabia, Qatar, Kuwait), the Bahamas and Bermuda, the Principality of Monaco, etc. In a number of other countries of Eastern Europe have a flat scale taxation.

That is, the rate is the same for a person with any amount of income. In our country, it is 13%, the same in Belarus, in Lithuania – 15%, in Ukraine – 18%. The lowest is in Kazakhstan – 10%. But in most countries, there is a progressive tax on income: the higher the earnings, the higher the rate.

You are definitely not the only one who is tired of the fact that a significant portion of your hard-earned income is disappearing due to exorbitant taxes. It is no secret that many developed Western countries such as the USA, Canada, Australia, as well as many European countries, levy huge income taxes on their highly paid citizens.

In recent years, there has been a growing trend of people seeking tax advantages abroad, thankfully in large part due to the dissemination of information and the lowering of barriers. There are a number of options that exist depending on the circumstances and the type of assets involved, including everything from moving to tax-free countries to re-domiciling or restructuring business operations and investment portfolios.

Proper planning and structuring of assets can usually reduce, and in some cases completely eliminate, the tax burden. One of the best ways, although it may not be the easiest one, is to become a tax resident of a country that has no income tax.

This article will explain if it is possible to move to a tax-free country, the problems that can arise in the process, and our list of some of the best countries in the world that have no income tax.

Is it really possible not to pay taxes?

For those accustomed to high taxes, it may seem like a distant reality to imagine countries in which one can live without taxes.

You may be wondering how these countries generate enough income to survive without collecting taxes from their citizens?

Many low / zero-tax countries receive government revenues from other sources. This may differ depending on the country. For example, many Gulf countries do not levy income taxes because they receive huge revenues from their state-owned oil industry. In addition, there are beautiful island states such as the Bahamas and Belize, where tourism and offshore financial services make up the majority of their tax revenues and GDP.

Most of the income that comes from tax-free and low-tax countries comes from the offshore financial sectors. This means that they offer attractive tax breaks for businesses and individuals if they register and start their own business. Places such as Saint Kitts and Nevis, as well as Vanuatu and the Cayman Islands, are some of these places. These countries can attract huge amounts of foreign investment thanks to tax-friendly legislation without imposing direct income taxes.

So, it is clear that there are indeed countries that do not have taxes, but the next question is whether it is really possible to become a resident of these countries in order to get rid of the need to pay taxes. The short answer is yes!

It is definitely possible. However, this is not necessarily easy and can take a significant amount of time, determination, and, in many cases, significant wealth.

What is the difference between low tax countries and tax free countries?

The difference between tax-free countries and low-tax countries is that tax-free countries have no income tax at all, which often does not include taxation of other forms such as capital gains, withholding tax, corporate tax. There are currently 23 countries in the world that fit this description.

Whereas countries with low taxes have a marginal tax rate that usually does not exceed 10%. Low-tax countries can be a good alternative as they often have a better track record in banking and incorporation.

Low tax countries

There are also countries with extremely low-income tax rates. This includes places such as:

- Malaysia

- Dominican Republic

- Singapore

- Czech Republic

- Mexico

- Guatemala

- Vietnam

- Andorra

- Belize

Countries with a territorial tax system tax income earned only domestically, while income earned abroad is not taxed.

For example, if you are a digital nomad, running an online business, or a global investor with worldwide income, becoming a resident of a country with a territorial tax system will ultimately lead to the same goal as living in a tax-free country.

In many cases, it is easier for foreigners to obtain a residence permit in countries with low taxes and/or territorial tax systems than in tax-free countries. This is largely due to the nature of the tax-free countries’ economies, which have specific financial rules that favor certain industries.

This is beyond the scope of this article as we will focus on tax-free countries, but it is definitely worth considering low-tax countries as a good alternative.

Top countries with no taxes

Just because you decide to move to a country where there is no income tax does not mean that you are exempt from taxes. To completely eliminate your liabilities to pay income tax, you need to establish a tax residency, which means moving your place of residence. This is achieved by obtaining permanent resident status, usually by applying for an appropriate visa and staying in the country for more than 183 days a year.

However, if you are American, it is not so easy for you to leave; you still have to pay taxes on all of your worldwide income, no matter where you live. Although you can deduct over 120,000 income through the Foriegn earned income exclusion. This means you most likely won’t have to pay income tax on any money received abroad up to $ 120,000. Anything beyond that, and you are responsible.

The only way to be completely tax-free if you’re an American is to renew your US citizenship. Fortunately, individuals with different passports around the world are not subject to the same harsh tax regime and are exempt from having to pay income tax if they change tax residency.

More than 20 countries do not have income tax; however, in most of them it is either difficult to obtain a residence permit, or these are countries in which few would like to live from the very beginning. Therefore, let’s see the list of 6 countries that do not have an income tax, taking into account factors such as quality of life, cost of living and ease of obtaining a residence permit.

List of countries without taxes

1. United Arab Emirates

The UAE is one of the few Gulf States that has no income tax (others include Kuwait, Oman, and Qatar), largely due to the revenue generated from their oil exports. In addition, the UAE does not levy any withholding taxes or corporate income tax (for most types of business), and there is no foreign exchange control.

What really makes the UAE apart from its neighbor countries is that it is one of the easiest Gulf countries to live and work in. Best known for its free economy in the world, the UAE welcomes foreign investment and expats who want to relocate and take advantage of the many high-paying job opportunities.

The UAE has recently started issuing 10-year residency visas to foreigners, which are fairly easy to obtain. It is a very comfortable and functional place to live, which is why it is one of the best tax-free countries to pay your attention to.

2. Saint Kitts and Nevis

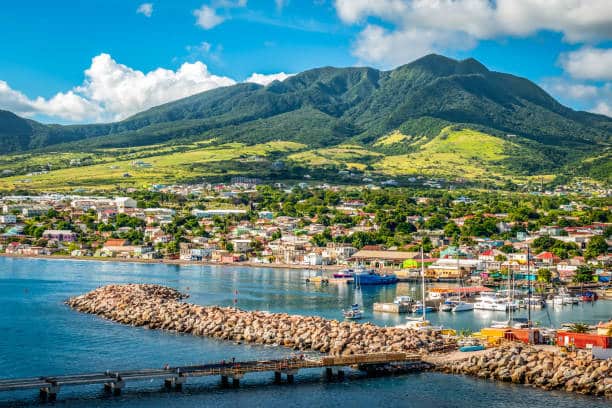

Unsurprisingly, Caribbean tax havens dominate the full list of countries without income tax. And probably the number one choice that makes it easy for you to obtain residency and/or citizenship is the island nation of Saint Kitts and Nevis.

Like other countries on this list, Saint Kitts and Nevis has no income tax at all, nor does it have any taxes whatsoever for that matter. They derive most of their income from tourism and, you guessed it, their offshore financial industry.

Saint Kitts and Nevis is easy to get permanent residency and also offers the oldest and best-known citizenship by investment program. After the devastating damage caused by the hurricane in 2017, they are now offering citizenship with a $ 150,000 discount towards their hurricane relief fund. The entire process of obtaining citizenship can take less than a year.

This can be a relatively small price to pay for wealthy people looking for a second citizenship somewhere that will provide significant tax breaks, a reliable second passport, not to mention a new home in one of the most beautiful and charming Caribbean islands.

3. Cayman Islands

The Cayman Islands is another tax-free Caribbean island nation. Like Saint Kitts and Nevis, they generate large income from tourism and the offshore financial sector.

The Cayman Islands is one of the Caribbean countries with a higher sales market. The cost of living is high and you will need to invest a significant amount to keep your residence permit for a long time. However, it can be a worthwhile option for wealthier investors who would rather stay in a place that offers a premium lifestyle in a developed country.

The Cayman Islands are not well known for offering citizenship by investment, but they tend to allow permanent residency for those earning over $ 100,000 a year and investing significant amounts in real estate or local businesses. Hence, this is a viable option worth considering.

4. Bahamas

The Bahamas is our third tax-free Caribbean paradise on this list. It is one of the most popular tourist destinations in the world, so as you can imagine, it is also a great place to live!

It is extremely easy to obtain an annually renewable temporary residence permit in the Bahamas for $ 1000. However, you will need to invest at least $ 250,000 in real estate in order to obtain permanent residency, which allows you to become a tax resident and therefore completely gets rid of income tax in the long run.

The Bahamas also lacks a citizenship by investment program to speak of. The significant amount of money you will need to maintain a permanent residency may pay off for those looking to escape to one of the most popular beach paradises and tax havens.

5. Vanuatu

The Pacific Island of Vanuatu is one of the easiest, fastest, and cheapest tax-free alternatives for the Caribbean to obtain citizenship by investment. With a total cost of approximately $ 200,000, you can become the proud owner of a Vanuatu passport in just two stunning months!

Vanuatu’s only potential drawback is that it is fairly isolated and, so to speak, “off the grid.” Traveling there often can be a bit of a hassle. However, it is certainly a worthwhile option for anyone who needs to get a reasonably affordable second citizenship quickly enough to get rid of their tax bills.

6. Monaco

The only European country on this list, Monaco has become internationally renowned as one of the best tax-free countries for the mega-rich to relocate to.

Monaco is a beautiful and wealthy city-state located on the Mediterranean coast on the French Riviera. It is also one of the few countries that does not levy zero tax on its residents and citizens.

Obtaining a residence permit and/or citizenship in Monaco is relatively easy but very expensive. You will need at least a few million dollars to prove you are wealthy enough to obtain permanent residency.

If Monaco sounds like the perfect destination for you, then you will join an elite group of wealthy expatriates leading a tax-free luxury life.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 349.1 million answers views on Quora.com and a widely sold book on Amazon