TransferWise Review – that will be the topic of today’s article.

Transferwise, which offers currency transfers and bank account services, and therefore is a popular app amongst expats around the world.

Review TransferWise in 2022 and its ranking among other options, with insights from the Utmost International Collective Redemption Bond Review.

For any questions, or if you are looking to invest, you can contact me via email (advice@adamfayed.com) or use the WhatsApp (+447393450837).

It usually makes sense to invest in a portable manner rather than send money home to invest, especially for expats.

For those that prefer visual content, I have summarised my opinions in the video below:

Introduction

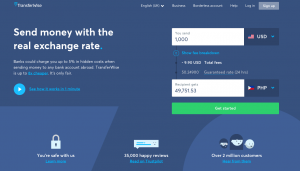

Want to send money internationally? Don’t want to pay high markups for bank transfers? We then recommend that you continue reading our TransferWise review, an in-depth analysis of an international money transfer platform with low rates and a simple interface.

When it comes to currency exchange rates, not all are created equal. This is especially true when you want to transfer money and your bank or transfer service intervenes.

Let’s say you are located in the United States and want to send USD to a UK account. Your bank promises you there is a “0% commission fee” and they definitely offer “free money transfers”.

Unfortunately, hidden fees are often included, and if you ask, banks will simply say it’s part of the exchange rate or international fee.

Inevitably, some margin is added to the transaction and you don’t get what you call “mid-market rate” which is basically the real rate.

What if we said that you can get the market average rate by sending money between different countries and there will not be any unexpected charges. If this sounds good to you, then TransferWise is the solution.

TransferWise charges a small fraction of the fees you incur when sending or receiving money overseas with your bank. Many times, you will find that the fees are close to zero.

Keep reading to see our comprehensive TransferWise review, filled with pros, cons, and breakdowns of each product and feature.

TransferWise Overview

TransferWise is a UK based company that believes that money shouldn’t have borders. The company is the creation of Kristo Käärmann and Taavet Hinrikus.

Taavet worked for Skype in Estonia and was paid in euros even though he was in London. Kristo, on the other hand, worked in London and paid for his mortgage in his native country – Estonia.

Their strategy was simple. They looked up each month to discover the average market rate. Christo then sent the pounds to the UK account of Taavet and Taavet sent euros to the account of Christo.

They both got the money they were promised, and no other hidden payments were made.

From that moment, TransferWise was born, which generated accounts all over the world. Now you simply deposit money into a TransferWise bank account in the country of your choice, and they pay your recipient the correct exchange rate.

Since it started in 2011, TransferWise has grown to over 6 million customers and is backed by investors from companies like Virgin and PayPal.

TransferWise’s features are broken down into several categories depending on how you plan to use the service. At its core, TransferWise is a money transfer service that is most commonly used for international transfers to keep rates low and stick to the actual exchange rate.

Most of the features we will state in our TransferWise review use the same procedure, both when sending and receiving money withing the service. TransferWise then converts the money or saves it in the same currency by depositing it into the account of your choice.

That is pretty much everything TransferWise does. For some reason, the process of sending and /or receiving money overseas may seem complex to you, but TransferWise’s interface makes it quite simple and convenient.

Below are listed the products and services that TransferWise offers to its clients:

- Simple money transfers from one bank account to another.

- Large amount money transfers.

- International money transfers with fast and inexpensive exchange.

- Multi-currency account for accepting, spending, and storing money in several currencies.

- A debit card that is linked to a multi-currency bank account. It helps when you need to spend money abroad in a physical setting.

- Tools for paying bills to multiple people around the world.

- Integration with some of the most popular billing software.

- API access to automate most of your payments and the collection processes of that payments.

- A transparent transfer calculator that allows you to see how much commissions you are charged (usually close to zero), what the current exchange rate is and how long it will take for the money to arrive at the needed destination.

- Monthly reports to keep track of how much you have spent and received in your accounts.

- Options to complete transfers, even if your client or contractor does not have a TransferWise account.

TransferWise also offers a mobile app so you can make transfers on the go.

To speed up the payment process, you can also review previous payments and repeat them with the click of a button. This is ideal if you have regular monthly payments. Moreover, they have recently added Apple Pay to transfer funds.

The app is easy to use for business and personal exchanges. You can see the history of your transfers and payments, send money to all of your contacts, and convert money between the accounts you keep with TransferWise.

Another advantage of this app are the notifications your receive about your payments. You can also check the status of your payment if any details re dates are needed to provide.

TransferWise tells you exactly where the money is, whether it’s converted to the end of it or sent to a bank account. They also tell you the approximate date of receipt of money in the mobile application.

In addition, the mobile app of TransferWise provides a quick button to freeze and unfreeze your debit card. Everyone who travels has stories of lost or stolen items. The last thing you want is another person trying to use your debit card while you are abroad. If you are having issues with finding the card, go to the app and block it from being used.

TransferWise Pros

- Fees – Compared to the fees you would pay when transferring via a bank account, TransferWise blows it out of the water. For example, a £ 1,500 to EUR transfer fee is only 0.402% compared to up to 10% fees with the alternatives.

- Transparency – With TransferWise there are transparent fees, and the company is built on that spirit. The only additional fees apply to debit and credit cards, and all this information is listed in their help section.

- Speed - Transfer speed is a big plus for TransferWise. The speed varies from 24 hours to a full week, but this is no different from a regular bank transfer.

- Security – TransferWise complies with FCA regulations, so all your funds are held in a segregated account without borders.Your money is safe in case anything happens to TransferWise.

- Business account – The ability to send, receive and spend money in over 40 currencies is a fantastic advantage for international business. You can create accounts for local businesses in minutes, even without an address in those countries.

- User Friendly – Transferwise’s interface is simple and easy to use.

- Various payment methods – Transferwise accepts a variety of payment methods for your convenience.

- No minimum transfer amount is required – Feel free to send even $ 1 if you want to.

- A high daily transfer limit – you can send up to $ 49,999 to $ 199,999 every day using Transferwise.

TransferWise cons

- Register – Having to show two documents can be time consuming. The fact that a mobile phone bill cannot be used causes frustration among users.

- Bank transfers only – There is no option for cash or check. Instead, with Transferwise, you can only send money to the recipient’s bank account.

- Social Security Number required – You will need to provide an SSN to send money via Transferwise (which is not convenient for everyone).

- Can’t pay recipients through checkout – Since Transferwise uses a percentage system to calculate transfer fees, the more you transfer, the more money you pay them. Over time, you may find that the flat rate pricing model is more cost effective for you, especially if you are sending large amounts of money frequently.

- Limitations – If you work with clients and clients scattered around the world, Transferwise may limit your options. More than 60 countries and 100 currencies are supported, but there are restrictions in some areas.

- Chances are Transferwise will disable your account – When you reach a certain transfer threshold, Transferwise will ask for additional documents and ID. If you are unable or unwilling to comply with these requirements, chances are they will suspend your account.

How does TransferWise work?

Registration is needed for those who are going to send transfers or use a multi-currency account. The registration process is very simple: prepare a passport, email and phone number.

Below is the process presented step by step:

- Start registration. Go to the registration page. To enter, you can use your email address, Facebook or Google account. Choose the type of account you want to open (either personal or business) Enter your email address, password and country of residence.

- Determine the purpose of the account. Choose how you want to use your account: send, receive funds or store money in a multicurrency account. If necessary, you can select all the items, and then change the selection.

- Create a personal profile. Click on the person icon and in the drop-down list, choose “create a personal profile”. Enter your first and last name in Latin – the way it is indicated in your passport. Then enter your date of birth and mobile number. You will be prompted to confirm the number. After, you will need to enter the zip code, country, city and address of residence.

- Set up a personal profile. Confirm your email address: follow the link in the received letter. Enable 2-step authentication to secure your account. Done!

- Verification: The next step is account verification, which takes up to 2 days. You will need to be verified in order to make TransferWise money transfers.

Verification is this factor that affects the ability to transfer money without delay. Account verification is also needed to keep your money safe as well as to prevent the legitimization of illegal earnings.

You will need to verify your identity and residential address with different documents (only passport is not enough) for each type of verification.

- ID confirmation: It is advisable to verify the identity before the first transfer. This will prevent delays. Both passport and driver’s license are suitable for this step. Internal passport is not supported.

- Proof of address: To verify the address, use a bank card statement or a receipt for payment of utilities. It is important that the selected document is not older than 3 months. Also, the specified address and name must match those that you specified in your account.

How to make transfers?

Basically, you can send TransferWise money transfers from your bank account. A debit or credit card will often work. All countries support payments in EUR and USD, even if the local currency is different.

Please follow below instructions to transfer money with TransferWise.

- Start your transfer by entering the needed amount, then select the sending and receiving currency.

- Find out the email address of your recipient. You will not need to know neither bank details nor mobile number. Make sure you uncheck the box “I know the recipient’s bank details” when entering the email address.

- Notify the recipient. This step is optional but will come in very handy if your recipient rarely views incoming letters.

It is important to note that:

- Processing of transfers takes place from Monday to Friday from 9:00 to 17:00.

- Intermediary banks may charge additional fees for bank SWIFT transfers. This means the amount received will be slightly less than expected.

- For payments by cards other than the currency of your country of residence, a 3.3% commission is applied.

- For payment by card in USD, issued outside the USA, a commission of 0.8% for EU residents, for residents outside the EU – commission 4.55%.

- Recurring payments are supported.

How long does the money transfer take?

On average, most transfers reach the recipient within a couple of minutes. Delivery speed depends on several factors:

- The duration of the processing of the transaction by the recipient’s bank.

- Making payment from a bank account. SWIFT transfer usually takes 2 – 5 days.

- Making a payment on weekdays or weekends. Transfer processes payments only on business days.

- Transferring to some rare countries may take up to 2 days due to currency conversion.

- Verification by the sender before or after the start of the transaction.

Receiving money with TransferWise

To receive a transfer, you do not need to have an account. You can send money to a bank account or card. Different banks are supported for each country and all you need to do is provide the sender with an email. You will receive instructions from TransferWise on how to enter the details.

It is very important that the name of the recipient does not differ from the name of the owner of the bank card.

Fees & Commissions

TransferWise offers cheap transfers with transparent fees. And, most importantly, a very favorable exchange rate. What is the transparency of commissions? Everything is very simple.

From the moment the payment is created, you can immediately see the full cost. The same applies to the exchange rate of currencies. It’s worth noting that TransferWise fees do not change after the payment is made.

SWIFT transfers are accompanied by commissions of intermediary banks. Transfer does not have access to this information and does not track it. Also, he does not know in advance about the amount of the upcoming commission.

The amount of the commission depends on the amount, conversion rate and method of payment for the transfer. The larger the amount, the higher the commission.

For example, for sending from EUR to CAD:

- 10 EUR will cost € 0.62

- 100 EUR will cost € 1.42

- 1000 EUR will cost € 9.45

Limits

Now let us talk about limitations. It is important to consider the individual user limits in each bank. The maximum amount can be much lower.

Minimum amount: € 1 / $ 2.

Maximum amount: € 1,200,000 / $ 1,000,000.

Exchange rate

The company uses a real-time average exchange rate. This is the course listed on Google, XE, Yahoo Finance, or Reuters. This makes TransferWise money transfers the most profitable on the market. Compared to competitors, this service does not mark up the exchange rate.

Transferring money from TransferWise is is 14 times cheaper than PayPal. That’s because PayPal uses its own exchange rate.

Safety and Reliability

Now let’s touch on the issue of reliability and understand how secure this service is.

TransferWise is quite reliable money transfer company, and here are the main reasons to believe this:

- It is possible to track the transfer.

- You can connect two-step authentication to log into your account.

- A huge number of positive reviews on TrustPilot.

- Account verification is provided.

According to the privacy policy, they encrypt all of their users’ data using the HTTPS protocol. CVC and CVV codes of bank cards are not saved. Every time they need to be entered again. Licensed and controlled by the UK Financial Services Authority FCA.

License 900507, with the right to make transactions with electronic money. Under the rules set by the FCA, TransferWise is required to keep all funds from its customers separate from the money they use to run their company.

Statistics in 2019 showed that every month $ 4 billion is transferred through TransferWise, which speaks of the enormous trust of users. It is also worth mentioning company’s key investors: Richard Branson, PayPal founder Max Levchin and Peter Ciele.

Several other TransferWise security measures include:

- DDoS protection from Cloudflare.

- Regular software updates and fixes.

- Tightly secured servers with audit logs to see who is accessing servers.

- Secure servers with restrictive firewalls.

- TransferWise is SOC 1 Type 2 and SOC 2 Type 2 certified and GDPR compliant.

Customer Satisfaction

One of the things that TransferWise does really well is their customer service. Their helpful and professional personnel can be contacted either by telephone, via email, or, when you are a registered user, by using their instant chat system.

TransferWise offers telephonic customer service for 14 different countries in 10 different languages. They have two separate lines for personal and business users, and these lines are open during office hours from Monday to Friday.

TransferWise has a rating of 4.6 out of 5 on Trustpilot with over 8 million people using their services, making them one of the most popular transfer providers out there.

After researching people’s comments, reviews, and opinions, one can say that the service is legit and rather reliable as many had successfully sent money. However, there are numbers of cases with money transfer delays or accounts problems.

Here are some positive reviews from TransferWise users:

“Use it all the time, it’s not a scam and have been very impressed with the speed in which money is sent. Just set up an account and all the options on how to send are there. You can use your card or bank transfer.” ~SnowWomble on Reddit

“It’s the only thing I always used since I moved from Spain. Super easy to use and fast… On top of that, the cheapest ones out there in terms of fees. They always apply the current exchange when transferring the money.” ~sercosan on Reddit

There are negative reviews as well:

“I had a borderless account with TransferWise, and they deactivate my account for some reasons and from last one month I’m waiting to know the reasons and still waiting for my refund. I’ve already contact to customer service so many times, but they just say they can’t help me with this and I have to email them.” ~Pitanjal on ConsumerAffairs

“I have been using Transfer Wise for a little more than a year now. I was initially very satisfied – transfers were often faster than promised, and fees were low. But recently fees have increased significantly, which has reduced TransferWise’s advantage over services.” ~ Jill on ConsumerAffairs

Conclusion

To conclude, TransferWise is a fantastic platform for sending money internationally. It was created by two people who have experienced the same problems themselves and created a tool out of their own frustrations.

Streamlined onboard play, low fees and excellent transparency ensure it only gets stronger and better. You know that your funds will be protected from huge investors and with the security of the FCA.

While it is primarily a company for European, American, Singaporean and Australian users, TransferWise is expanding its market to various other parts of the world.

What is great is that most of the major currencies are supported in some way.