Best International CFD Brokers 2023 – that will be the topic of today’s article.

In general, we don’t recommend that most people should invest with CFD brokers, but have put together a list for those who are.

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Introduction

Today, we will be talking about some of the best CFD brokers available in the world in 2023. Before we get to that, let us have a brief insight into CFDs for a better understanding.

CFD, Contract for Difference, allows you to generate profits by speculating on the price movement of an asset. Unlike mainstream securities like shares, CFDs don’t provide ownership to the underlying asset.

CFDs are very complex financial instruments and without proper knowledge and expertise, most people tend to lose money.

If you want a sound solution with less risky investment opportunities, I suggest you have a look at the services I offer.

I also did an article that has some extensive information on CFDs, which includes the pros and cons. Reading that might allow you to have a better understanding of whether CFDs are profitable for you.

It is also important to note that around 80% of retail investors tend to lose money when they are trading with CFDs.

That being said, let us start our topic for today, i.e., Best International CFD Brokers in 2023.

Kindly remember that the evaluation of these brokers has been done based on their features, fees, compatibility, etc.

You might find a broker that looks more advantageous to trade with, yet I found these to be some of the best available.

As there are many brokers available, we are only going to cover some of the key features of each broker and what is best about them.

Let us begin.

IG

IG is one of the best CFD brokers available while offering some great features for traders.

Let us have a brief look at some of the features offered by IG.

Products and Markets

The clients can access the following at IG.

— CFDs

— ETFs

— Forex

— Stocks (some countries)

— IPOs

Clients from certain countries such as the UK are allowed to trade with real stocks. In the UK, IG also offers robo-advisory services to clients.

Popular products like mutual funds and bonds are not available at IG, and most clients can only access CFDs, forex, and options.

Talking about the CFDs, the available CFD products at IG are as follows.

Stock Index CFDs – 78

Stock CFDs – 10,500

ETF CFDs – 1,900

Commodity CFDs – 47

Bond CFDs – 13

Account

The account opening process at IG is simple and can be done completely online. However, IG may not be among the providers that offer a fast account opening process.

Deposits and Withdrawals

There are six base currencies available at IG, which are USD, GBP, AUD, EUR, SGD, and HKD.

Deposits are free at IG, while withdrawals are only free for credit/debit cards. International bank transfers, as a mode of withdrawal, at IG cost £15.

When depositing with the help of a bank transfer there is no requirement for a minimum deposit. However, depositing with the help of credit/debit cards or PayPal requires a minimum deposit of €300.

Trading Platforms

The web trading platform of IG is considered to be suitable for beginners and experts alike. It has a good interface, comes with all the necessary functions, and can be easily customized.

The mobile trading platform of IG is also considered one of the best and offers some good features.

There is no dedicated desktop platform at IG.

Research and Education

IG offers features like news flow and charting tools; however, it lacks fundamental data.

The educational resources at IG are great, and you’ll get access to a demo account, courses, webinars, and educational videos.

Safety and Regulation

IG is regulated in various countries by some of the top-tier financial authorities. They are:

— Financial Conduct Authority (FCA)

— Federal Financial Supervisory Authority (BaFin)

— Swiss Financial Market Supervisory Authority (FINMA)

— Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

— Australian Securities and Investment Commission (ASIC)

— Financial Markets Authority (FMA)

— Monetary Authority of Singapore (MAS)

— Japanese Financial Services Authority (FSA)

— Financial Sector Conduct Authority (FSCA)

— Dubai Financial Services Authority (DFSA)

— Bermuda Monetary Authority (BMA)

IG is hands down one of the brokers regulated by this many authorities on a global scale.

Investor protection is also offered to the clients of IG, who are from the UK and Europe.

IG Group, the parent company of IG, is listed on the London Stock Exchange, however, it does lack a banking license.

Fees

There is an inactivity fee, which is charged only after two years of inactivity. The inactivity fee can be around $12 to $18 depending on the entity of IG from which the clients acquire services.

The financing rates at IG are some of the highest compared to most other brokers.

The CFD fees, which is one of the downsides to this broker, are comparably higher.

What I think

When it comes to CFD trading, IG can be a great broker with maximum safety. The trading platforms are good, education and research are great, and customer support is not bad.

However, it would have been great if the fees were a bit lower because IG has some of the highest forex and stock CFDs.

Kindly note that up to 80% of retail accounts tend to lose money while trading CFDs with IG.

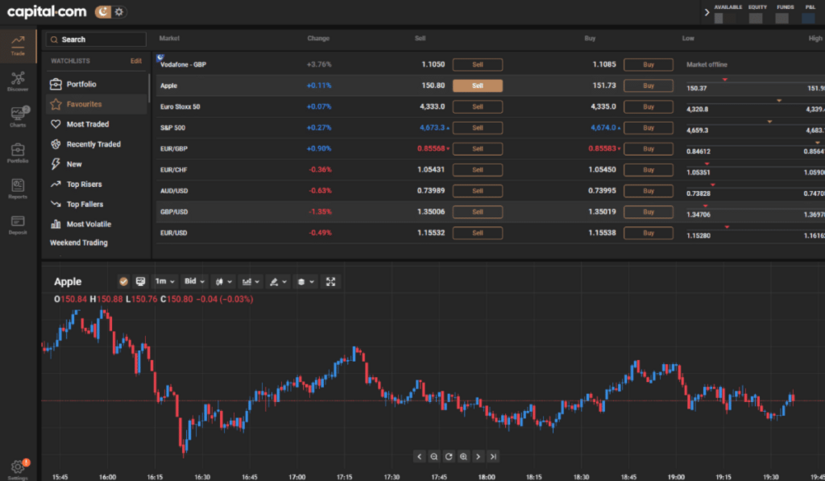

Capital.com

Capital.com can be said as a CFD broker, which offers advanced features, and is a great option for advanced traders.

Let us have a brief look at some of the features offered by Capital.com.

Products and Markets

The clients can access the following at Capital.com.

— CFDs

— ETFs

— Stocks

— Spread betting (UK)

Spread betting is offered to clients from the UK, yet they can’t access Cryptocurrencies.

Talking about the CFDs, the CFD products available at Capital.com are as follows.

Stock Index CFDs – 26

Stock CFDs – 5,430

ETF CFDs – 150

Commodity CFDs – 48

Account

The account opening process at Capital.com is simple, intuitive, and fast. However, it does not clients from certain countries and the US is among the list of those countries.

Deposits and Withdrawals

The minimum deposit is $20, but the deposits made with help of bank transfers are around $250.

Deposits and withdrawals can be made using bank transfers, credit/debit cards, and e-wallets like PayPal and Apple Pay.

The deposits and withdrawals are free, but these must be made into the accounts that are in the clients’ names.

Trading Platforms

Mobile and web trading can be done through the proprietary trading platforms of Capital.com.

MetaTrader4 is available for web trading and desktop trading at Capital.com. TradingView is also available for web trading

The mobile trading platform, i.e., Capital.com application, is the best among all the options available.

Research and Education

Capital.com offers features like a news feed, market analysis, and great charting tools.

The educational resources at Capital.com are great, and you’ll get access to a demo account, courses, articles, and educational videos.

Even while having some of the best educational resources, Capital.com is not a great choice for beginners as it mainly concentrates on CFD offerings.

Safety and Regulation

Capital.com is regulated in multiple countries by some of the top-tier financial authorities. They are:

— Financial Conduct Authority (FCA)

— Cyprus Securities and Exchange Commission (CySEC)

— Financial Services Authority of Seychelles (FSA)

— Australian Securities and Investment Commission (ASIC)

Investor protection is also offered to the clients of Capital.com, who are from the UK and Europe (excluding Belgium, Cyprus, and Norway).

Fees

Fees are what make Capital.com one of the best CFD brokers available. The commissions and spreads charged by this broker are lower compared to most competitors.

Capital.com does not charge any non-trading fees such as account fees, deposit fees, withdrawal fees, and inactivity fees.

What I think

When it comes to CFD trading, Capital.com can be a great broker with a good amount of safety. The trading platforms are good, education and research are great, and customer support is efficient.

The fees are also low, which makes it a great choice among CFD traders looking for a cost-efficient option.

However, it is considered to be best for clients who have a good amount of experience with trading CFDs.

Kindly note that more than 85% of the retail clients at Capital.com tend to lose money while trading CFDs at Capital.com.

eToro

eToro is one of the leading CFD brokers that is known to be a good choice for beginners.

Let us have a brief look at some of the features offered by eToro.

Products and Markets

The clients can access the following at eToro.

— CFDs

— ETFs

— Forex

— Stocks

— Cryptos

Features such as social trading and Smart Portfolios are also available at eToro, which is advantageous for beginners.

People living in the United States can only access stocks, ETFs, options, and cryptocurrencies.

Non-leveraged long positions in stocks, ETFs, and cryptos will be traded as real assets.

eToro, while trading with CFDs, gives access to the following number of products in each asset class.

Stock Index CFDs – 16

Stock CFDs – 2,000

ETF CFDs – 264

Commodity CFDs – 24

Currency pairs – 49

Account

The account opening process at eToro is simple, quick, and can be done completely online. The minimum deposit at eToro is relatively low (in many countries) compared to most other brokers.

Deposits and Withdrawals

The base currency available at eToro is the USD, which means people would have to convert their money into USD before they can start trading at eToro.

Deposits and withdrawals can be made with the help of the following methods at eToro.

— Bank Transfer

— Credit/Debit Card

— PayPal

— Skrill

— Neteller

— China UnionPay

— Klarna

There are no deposit fees, but the withdrawals are charged $5 with a minimum withdrawal amount of $30.

Trading Platforms

The web trading platform of eToro is considered to be suitable for beginners and experts alike. It is user-friendly, and the design is great, but the customizability is limited.

The mobile platform offers certain great features like two-step login, biometric login, etc.

There is no dedicated desktop platform at eToro.

Research and Education

eToro offers good charting tools; however, it lacks in-depth fundamental data.

The educational resources at eToro are great, and you’ll get access to a demo account, trading platform tutorial, courses, webinars, and educational videos.

Safety and Regulation

eToro is regulated in various countries by some of the top-tier financial authorities. They are:

— Financial Conduct Authority (FCA)

— Australian Securities and Investment Commission (ASIC)

— Cyprus Securities and Exchange Commission (eToro)

Investor protection is also offered to the clients of eToro, while the protection amount differs depending on the client’s country.

Clients from the EU and Australia also get negative balance protection at eToro.

Fees

The trading fees for CFD trading are low, which is one of the best features of this broker.

However, there is a withdrawal fee of $5 and an inactivity fee of $10 per month following one year of inactivity.

What I think

eToro is a great choice for beginners, especially people who have access to other products apart from CFDs.

It stands out when it comes to stock and ETF trading, features like social trading, etc.

Nevertheless, it falls back in certain aspects such as having only one base currency, non-trading fees, etc.

While trading with CFDs, eToro does get to have a place in the list of the top brokers available in 2023.

It is important to note that more than 80% of retail CFD traders lose money when they are trading CFDs at eToro.

XTB

Despite being a CFD broker, XTB also offers access to commission-free stocks and ETFs in Europe.

Let us have a brief look at some of the features offered by XTB.

Products and Markets

The people can access the following at XTB.

— CFDs

— ETFs

— Forex

— Stocks

— Fractional Shares

— Cryptocurrencies

Real stocks and ETFs can only be traded by clients who are from the EU, excluding those from Cyprus and Hungary.

Talking about the CFDs, the CFD products available at XTB are as follows.

Stock Index CFDs – 40

Stock CFDs – 1,900

ETF CFDs – 140

Commodity CFDs – 21

Currency pairs – 56

Account

One of the fastest account opening processes compared to any other broker, an account can be opened within 15 minutes after uploading the documents.

Deposits and Withdrawals

The base currencies available at XTB are USD, GBP, EUR, HUF, and PLN.

There is no requirement for a minimum deposit at XTB. The deposits can be made with bank transfers, credit/debit cards, and e-wallets, while withdrawals can only be made with bank transfers.

Deposits are free unless you make a deposit with an e-wallet, where e-wallet deposits cost 1-2% of the total amount deposited.

Withdrawals are only free when the amount withdrawn is more than $50 or €200 depending on your country.

Trading Platforms

XTB has its own dedicated trading platform that goes by the name of xStation 5, which offers different order types and technical indicators.

Unlike most other brokers, XTB gives you access to trading through a web platform, mobile app, and desktop platform.

However, the MetaTrader4 and MetaTrader5 are not available at XTB, which is inconvenient for traders who are used to them.

Research and Education

XTB offers a wide range of educational tools such as a demo account, platform tutorial videos, educational videos, webinars, and educational articles.

Safety and Regulation

XTB is regulated in various countries by some of the top-tier financial authorities. They are:

— Financial Conduct Authority (FCA)

— Cyprus Securities and Exchange Commission (CySEC)

— National Securities Market Commission (CNMV)

— Polish Financial Supervision Authority (KNF)

— Dubai Financial Services Authority (DFSA)

— International Financial Services Commission of Belize (IFSC)

It is a company listed on the Warsaw Stock Exchange and offers investor protection in the UK and the EU.

Fees

An inactivity fee is applicable following one year of inactivity, which is €10 per month. CFD fees charged by XTB are relatively low compared to many competitors, which makes it one of the best brokers.

What I think

Overall features make it clear that the trading fees are low, trading platforms are good, and educational resources are exceptional.

It may lack the features required by advanced traders such as MetaTrader4 and MetaTrader5 platforms. However, it is a great CFD broker for beginners who are relatively new to the field of CFD trading.

It is important to note that more than 75% of retail CFD traders lose money when they are trading CFDs at XTB.

Plus 500

Plus 500 is an international CFD broker that is the best choice for global traders.

Let us have a brief look at some of the features offered by Interactive Brokers.

Products and Markets

Plus 500 mainly offers CFD products, which provide access to different types of asset classes. Given below are the CFD products available for trading at Plus 500.

Stock Index CFDs – 29

Stock CFDs – 1,900

ETF CFDs – 96

Commodity CFDs – 22

Currency pairs – 66

Account

The account opening process is quick, and simple and can be done completely online at Plus 500. It takes up to one day the completion of the account opening process at Plus 500.

Deposits and Withdrawals

There are various base currencies available at Plus 500 are USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, and SGD.

The minimum deposit when made through debit/credit cards is $100, whereas, for bank transfers, it is $500.

Deposits and withdrawals at Plus 500 can be made through bank transfers, credit/debit cards, PayPal, and Skrill.

Deposits are free at Plus 500, while the broker only provides 5 free withdrawals per month. Each additional withdrawal in a given month would cost an additional $10.

The minimum withdrawal amount is $50 for PayPal and Skrill, and it is $100 for bank transfers and card options.

Trading Platforms

The web trading platform of Plus 500 is great in terms of design and user-friendliness, however, it lacks customizability.

Just like the web trading platform, the mobile application of Plus 500 also comes with a great design and is easy to use. It also provides an efficient search function and a two-step login feature.

Research and Education

The research tools available with Plus 500 are not the best compared to most other brokers. It offers robust charting tools and market analysis but does not offer recommendations or fundamental data.

Similar to the research, the educational tools at Plus 500 are also limited because it does not provide webinars. The education section is not organized, yet it offers basic videos and articles on trading.

Safety and Regulation

Plus 500 is regulated in various countries by some of the top-tier financial authorities. They are:

— Financial Conduct Authority (FCA)

— Cyprus Securities and Exchange Commission (CySEC)

— Australian Securities and Investments Commission (ASIC)

— Financial Markets Authority (FMA) of New Zealand

— Financial Sector Conduct Authority (FSCA) of South Africa

— Monetary Authority of Singapore (MAS)

— Israel Securities Authority (ISA)

— Seychelles Financial Services Authority (FSA).

It is a company listed on the London Stock Exchange and offers investor protection in the UK and the EEA.

Negative balance protection is also provided by Plus 500 for its clients.

Fees

The inactivity fee is applicable only when the trader does not log into their account, which is charged as $10 per month after 3 months of inactivity.

Even though the deposits are free, you only get five free withdrawals per month, and following that, each additional withdrawal costs $10 per month.

The trading fees are considered to be average compared to most of the industry-leading competitors.

What I think

It does perform well in offering some great trading platforms, yet lacks in certain aspects like fees, research, education, etc.

However, it is among the brokers regulated by multiple financial authorities all over the world.

Plus 500 is a good choice, but it does fall back when it comes to certain features, and because of that, I have a neutral opinion on the broker.

It is important to note that up to 80% of retail CFD traders lose money when they are trading CFDs at Plus 500.

Honorable mentions

Given below are some other global CFD brokers that are worth noting.

— Saxo Bank

— CMC Markets

— City Index

— FXTM

— HYCM

— TMGM

— FOREX.com

— IFC

These brokers are worth mentioning because they also happen to offer certain unique features.

Bottom Line

First of all, I would like to say that all the information provided here is accurate and up-to-date at the time of writing.

However, these details might change by the time you are reading this, and because of that, it is wise to do some research on your own before choosing them.

By research, I mean access to the markets, fees, and some other important details.

It is important to note that this list is to provide information about the best CFD broker, and it is evaluated mainly on the number of CFD products available for trading.

By keeping that aspect in mind, IG can be said as one of the best brokers available for CFD traders.

There are some other aspects to consider as well, such as fees, research, education, trading platforms, etc.

You should remember that these brokers have been listed as the best according to my opinion, and you may find other brokers to be more advantageous based on your requirement.

I think that CFD trading may not be one of the best modes of investments available for growing your wealth.

The statistical data on the internet suggests that around 80% of retail CFD traders happen to lose their hard-earned money. Therefore, it is wise to stay away from such high-risk investments or limit them to a small percentage of your portfolio.

Having said that, most people may or may not have the necessary expertise to take care of their investments. If they have all the skills and experience, they might not have enough time, and I completely agree with the fact that time is precious.

Therefore, it is wise to acquire the services of a financial professional who can tend to your financial needs and grow your wealth.

If you are looking for someone who can help with your investments or wealth management needs, then you have come to the right place.

I offer services that help individuals grow their wealth and secure their futures so that they can attain financial freedom.

Does it feel like I can be of service to your financial needs? Then do not hesitate to get in touch with me to know whether or not you can benefit from the services I provide.

I strongly hope that the information in this article is helpful for you in finding the information you needed.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.