What are the benefits of having an investment or wealth advisor as an expat or high-net-worth individual (HNWI)?

If you have any questions or want to invest as an expat or high-net-worth individual, you can email me (advice@adamfayed.com) or use these contact options.

Time is money

Many people focus on return on investment (ROI). I don’t blame them, as I used to as well.

However, we have to adjust ROI for two things:

- Risk. So, a risk-adjusted return isn’t the same thing as ROI. For example, beating the stock market by 10% isn’t a good idea if you take 20% extra risk because your luck will run out one day.

- Time-adjusted ROI. There is no point in achieving high returns or even beating the market if you are doing it by using too much of your time. Especially for higher-earners and HNWIs, this latter point is huge.

Limit risks

You might already have another great advisor, but you might want sometimes to get a second opinion, or compare how two advisers operate.

People are often their worst enemy regarding money (more on that later), and you can also fact-check some of your ideas and bias’.

Beyond that, there are many hidden risks for expats and HNWIs which go beyond purely investing. These risks include:

- Losing bank accounts. As I mentioned here, many expats lose bank and brokerage accounts

- Not having proper wealth protection. That could mean insurance or could be related to areas like trusts. I will give you a simple example. Unlike Americans, most British expats living overseas can easily change their tax residency without renouncing UK citizenship. However, your domicile isn’t the same as your tax residency.

- As a result of the last point, many British expats’ beneficiaries might have to pay UK death taxes unless they make proper plans. Moreover, if you have a significant estate linked to illiquid assets such as property, your kids might be unable to afford the inheritance tax due.

- Succession planning. Beyond inheritance tax, you might want a succession plan for your business and assets.

- Dual citizenship and tax. Boris Johnson unexpectedly paid a huge US tax bill. It caught him by surprise. He renounced his US citizenship afterwards, joining Tina Turner and many others in becoming an “ex American”.

- Having solutions which are country specific. For instance, you own an ISA in the UK or use an investment company that can only accept clients living in the EU. If you are a mobile person, it is better to have global solutions

- You have bank accounts and assets in numerous countries and aren’t sure that your next of kin will be able to access them if you die or get sick.

If somebody with the resources of Boris Johnston had to pay a fortune to solve an issue that could have been resolved with planning, then you probably have some hidden risks in your financial life as well.

Be held accountable

It is easy to procrastinate and put off making important decisions. We do it concerning important things such as our wealth and health.

It is easy to look back in retrospect and wish you had done more to help your kids, or to retire earlier.

I have, at various times, struggled with my weight. I have found that seeing a personal trainer has been great for me.

Even when trainers have disappointed me in their performance or knowledge, I have gained in fitness and performance.

The reason is simple. Having a schedule whereby I need to go in twice or three times a week forces me to go in. When I am in, I might stay for longer by myself.

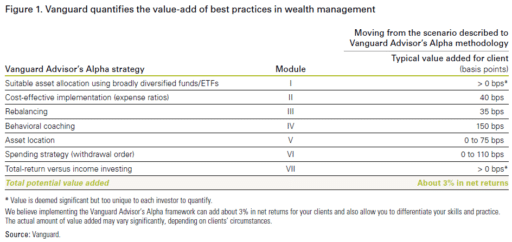

The same is true for wealth. Studies done by the Vanguard Group, who have looked at do-it-yourself (DIY) and advised clients using their funds, have found that advised clients do better in the long term.

The below graphic from Seeking Alpha summarizes their results.

The reasons for the above are complex. One of the main reasons is that a human advisor is more likely to help regulate clients’ emotions when it comes to fear and greed.

We have seen how crazy the real estate, currency, stock and bond markets can be in recent years.

Whenever people are pessimistic about markets, such as in 2023, they seem to do well. When people are optimistic about markets, the opposite can happen!

It is, therefore, important to have emotional balance when it comes to investing. A good advisor can help you in this regard.

A good financial plan isn’t just about getting the highest possible returns.

It is about having a vision and being held accountable to get there.

Get access to assets you can’t get hold of yourself

Most people can’t get access to more sophisticated strategies like downside protection or boutique funds that are taking advantage of idiosyncratic pricing without the help of an advisor.

Or if you can, the large banks will charge an arm and a leg.

Moreover, a good advisor will have many clients, so you can sometimes get higher returns on fixed-return instruments as you go in together on larger trades.

Gain access to a wider network

I have run businesses all around the world. Therefore, I have knowledge and contacts in areas such as:

- Opening bank accounts overseas

- Good second residency and citizenship opportunities

- Tax and legal specialists and much else

Gain access to educational events

As a follow up to the last point, a famous investment advisor might be able to open up other doors for you as well.

I had an exclusive client event with the Shark Tank, and formerly Dragons Den, star Kevin O’Leary.

A clip of the event is below.

The event allowed my clients to ask him questions related to investments.

Other advisors might have other kinds of events and opportunities.

In conclusion, getting advice or guidance isn’t just about investment returns.

Not getting advice can be expensive and more hassle long-term.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters with over 827million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.

Well analysed,and very important information for investors ,thanks

Thanks for the appreciation fir admittedly my requested.

Good thanks