Understanding why you can lose money on property with 3% capital gains + 6% net yields is crucial for effective overseas investment management and maximizing your financial opportunities.

I got a big reaction, mainly of shock, when I said online today that it is possible to lose money on property even if you get 3% net capital gains + 6% rental yields.

This was after I gave the example of somebody who moved to a country like Georgia, for tax reasons, as they levy 0% tax on overseas income in return for a $100,000 investment into real estate.

Let’s go over the numbers again starting with some assumptions:

- You can’t get a mortgage as a non-Georgian. So you can’t leverage your gains.

- The 6% yearly real estate yield is net of fees like taxes (up to 1% per year), maintenance (1%-2% per year) and other fees. So gross 9%-10% per year. Optimistic but possible.

- You will reinvest the $6,000 rental yields (6% of $100,000) into index funds. You will get 8% yearly for 30 years. Remember, this is a full 2% lower than the historical average returns on the S&P500, Dow Jones and about 4% less than the Nasdaq has produced for 25 years. So actually very conservative.

Now let’s compare two people.

Person 1: Invests $100,000 in the S&P500 and gets 8% for 30 years. = $1,006,265 in 30 years

Person 2: Get’s average 3% yearly for 30 years on the property. So after the 30 years, the property is worth $242,726. They then invest the $6,000 a year into the same investments as person 1, and they get $734,075 ($6,000x30x8%). So they have $976,801 total. A full $30,000 less for more work and hassles.

Now of course, there are so many unknown unknowns here. Georgian property might go up more than 3%, and the S&P500 might go up 10% or more yearly, like it has in the past.

In this example, moreover, there is the tax benefit of moving to a lower cost country, which might make up for the 30k loss.

However, this simple example does show:

- Without leverage from a property or significant luck on the capital appreciation side, it is almost impossible to beat passive investments with property.

- Also remember, in other property markets, you might be able to get leverage, but might not get the 6% net yields, like you can in Georgia

- If you adjust for time commitments, the figures would be even more damning.

- The data is publicly available. So if investing in Georgian, London or Californian property was such a no-brainer, why isn’t everybody doing it?

- Think only stupid people lose money in property? Watch the documentary below. The founder of the non-for-profit (Abraham George) sold his business in the 90s to a Fortune 500 firm. He lost almost all his capitals on US beachfront property (he couldn’t find a buyer even to this day).

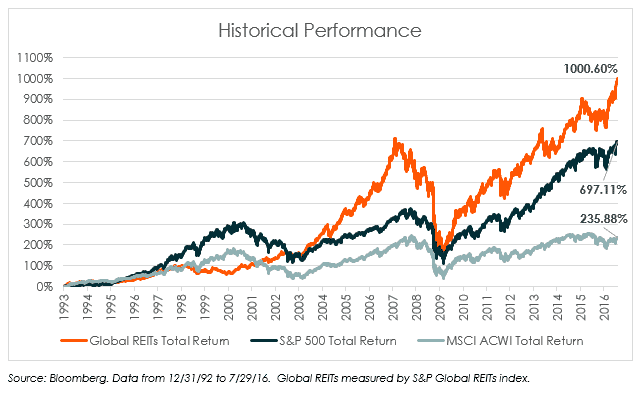

Still like property investments? Well, many REITS pay a yield of 4% net and have increased by an average of 6% in the last 5 years – more if you take account of the last 35 years where some have increased by 1000%:

10% yearly returns if you reinvest the dividend for clicking a few buttons on your screen.

Much easier than hearing your tenants’ dog has chewed up the rug yesterday!

To find out more about investing in real estate without the hassles of being a landlord, click the link.

Pained by financial indecision?

Adam is an internationally recognised author on financial matters with over 830million answer views on Quora, a widely sold book on Amazon, and a contributor on Forbes.