Consider something for a moment. From 1802 until today, a dollar invested in the U.S. stock market would have grown to about $12M.

Why doesn’t everybody invest in the markets? One of the reasons is people are more afraid of losing money than making money.

Yet consider something for a moment. If markets go down for a long period of time, a rational investor will actually make more money.

Take the recently past, as a prime example. If somebody would have invested a lump sum into the US Stock Markets at the height of the market before the financial crisis, they would have doubled their money assuming they reinvested the dividends.

However, person 2 who would have invested $100,000 as a lump sum in 2008 and then in March 2009, would have made almost double that amount of money.

This isn’t me advocating market timing, because that just doesn’t work, because nobody can know when markets will rise or fall.

However, in the real world most people have to invest monthly when they have a job. They tend to add lump sums when a life event happens. Such people should be cheering when markets are down.

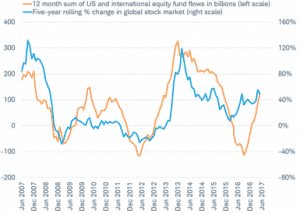

However, all research shows that people panic when markets are down.Just look at the huge outflows that the market saw in 2008:

Remember if you are below 50 and reading this, if markets are down in the next 5-10 years, that will almost certainly help your long-term returns. You are buying at cheaper prices.

You aren’t getting your fingers burned either, unlike all those people who panic sold in 2000 or 2009.