This article was undated on January 1, 2023

What is the theory behind the global currency reset? That will be the subject of today’s article.

Before reading this article, it would make sense to read this small article concerning why gold is an awful long-term investment, even though it has its place in the sun.

For any questions, or if you are looking to invest, then you can contact me using this form, utilising the WhatsApp function below or by emailing me (advice@adamfayed.com).

It also pays to diversify your portfolio and prepare for different possible events, however unlikely.

For the time poor, I summarise why I don’t think there will a currency reset (and USD weakness) anytime soon:

Introduction

The phrase Global Currency Reset has several meanings. The standard definition would be a return to a global monetary system that all countries would agree to.

The last time the countries came together to agree on a new global monetary system was in Bretton Woods, New Hampshire.

While World War II was still going on, leaders from around the world decided to create a new global monetary system.

This led to the formation of global organizations such as the International Monetary Fund and the GATT, which later became the World Trade Organization.

The allied countries of the world agreed on a fixed exchange rate that was kind of based on the global gold standard.

The US dollar was the currency that countries used to support their currencies under this agreement. The reason for this was that at that time the United States owned most of the world’s gold reserves.

America benefited greatly from this new monetary system and the dollar made it to central banks around the world. Over time, we abandoned the flat rate. Richard Nixon stopped providing US dollars with gold worldwide in 1971.

This was known as the Nixon shock. Today, all major currencies are traded on the world market. Although a few things have changed, we remain on the remnants of the Bretton Woods system. Many central banks still have the dollar in their reserves, and today it is in high demand.

In the aftermath of the global crash of 2008, many assumed that we would return to a different gold standard. Some believe that there will be a completely different monetary system.

Many armchair economists have stated that some countries may even base their monetary values on their resources. All currencies are said to be revalued based on the country’s assets. This will cause gold to skyrocket as people start looking for protection from currency depreciation.

The problem with this theory is that there are major obstacles to overcome. First, central banks around the world will have to agree to this, and this will impose serious constraints on their monetary policy.

Second, it will require active collaboration with governments around the world to implement this new system or revert to the old system. Some countries will benefit from this and others will lose.

Third, countries will want to preserve their wealth as they transition to the new system. If most of their wealth is denominated in dollars, this will be a problem. Fourth, global organizations such as the IMF, WTO and the World Bank are vestiges of the Bretton Woods era. They will struggle to have an appropriate role in the new system.

Those same armchair economists are predicting that the dollar will collapse overnight. They declare that the entire world economy will collapse in one day. This will force countries around the world to negotiate a new global monetary system.

The 2008 economic crisis is widely referred to as evidence of an impending collapse. Others rewrite history and insert bad economic theories into evidence.

Today, the global currency reset has turned into a serious conspiracy theory that believes the dollar will collapse. This theory claims that countries around the world will ditch the dollar. As a result, people began to prepare for a future dollar crash.

They invest in precious metals, buy foreign currency, many have even begun to survive and accumulate food. This conspiracy theory has become big business as many people have made money selling several different types of goods that are associated with the belief that the dollar will collapse instantly any minute.

This belief system has many converts and is iconic in nature. Part of the belief system has its origins in New Age philosophy, while other parts of this belief system are associated with biblical prophecy. As a result, new converts are constantly converted, and people are driven by more emotion and their worldview than sound economic advice and principles.

What is global currency reset (GCR)?

What is the history of the global currency reset, also known as GCR? The Global Currency Reload Theory is one huge conspiracy theory that contains many sub theories. That’s where it came from.

In the second half of the 20th century, many conspiracy theories about the US dollar and the Federal Reserve began to emerge.

One theory is that the Federal Reserve Act was passed in secret. Most of Congress is said to have been at home over the Christmas holidays when this law was passed. This belief is that it was accepted by the minority. It is implied that most of Congress was against this law and therefore it was passed in secret.

Another conspiracy theory says the 16th Amendment was never ratified. Consequently, the United States is not eligible to tax American citizens.

Another conspiracy says that the Rothschild dynasty forced England into the war of 1812 because America refused to renew the charter of the second central bank. As history was being rewritten, many other types of money conspiracy theories began to form.

This was a short explanation of the global currency reset and its history, where it came from. As you may already guess, in this article we will talk about the possible global currency reset, how to prepare for it or which currencies or banks are the most stable.

However, it should be noted that do not believe in any conspiracies here at adamfayed.com.

The fact that many of the people who believe in the “reset” are conspiracy theorists should make you sceptical about the theory.

Is Global Currency Reset real?

The theory behind the global currency reset is that the US dollar will lose its position as a reserve currency because the US is over-leveraged and less competitive with resource-rich developing countries.

After all, the value of a currency is a barometer of people’s trust in government and its ability to pay debts. If there is no trust, then you have no money.

If this happens, it will upset the balance of a system that has been in existence for over a century; as the dollar gained strength due to its former gold standard and America’s efforts to buy coins after both world wars.

Recently, the US has also maintained its currency’s value by ensuring that a significant portion of the world’s financial contracts are denominated in US dollars, including OPEC oil production.

Moreover, not only the United States has a high level of debt, but also almost all large modern economies. The Japanese government has a much larger debt compared to GDP than, for example, the United States.

It is also worth mentioning that the United States is indebted in foreign currency, and alone has a monopoly on printing at its discretion.

Consequently, it does not have the problem of emerging market economies, which can sometimes have dollar-denominated debt but have no means of accessing it.

Without credit, the modern economy stops – it simply cannot support anything but the smallest industries.

So, if one day everyone cashes out their chips and the US dollar falls, it will take most of the major economies with it.

So will there be a Global Currency Reset in this year?

Nobody knows for sure. Nothing lasts forever, including USD dominance.

What we do know is:

- The USD got stronger against other major currencies after QE and 0% interest rates.

- The USD is still stronger in October 2020 than it was in October 2015, and much stronger than in October 2010! So, don’t buy into this theory about USD weakness being caused by QE. The USD isn’t weak compared to ten years ago. It is just weaker than one year ago.

- Whenever there is a crisis (2008 and March 2020) people want Dollars. Gold fell during the worst of the crisis in 2008 and 2020 and the USD got stronger. The USD only tends to weaken once the worst of a crisis is over.

- Back in 2010, a lot of people read too much into higher gold and silver prices. Since then, inflation has been close to 0%, gold has barely moved (in fact it has fallen in real terms compared to its 2011 price) and the USD has gotten stronger.

- Japan have debts of over 200% and there has been no currency devaluation. In fact, the Japanese Yen has gotten stronger. Huge currency depreciations, and massive inflation, usually happen when people are worried about the government in power. It doesn’t happen due to debt and QE.

- The USD has gained, not lost, market share relative to 2005-2007, in terms of foreign currency reserves.

- The same people predicting inflation and doom for the dollar are the same people that predicted hyperinflation after 2008.

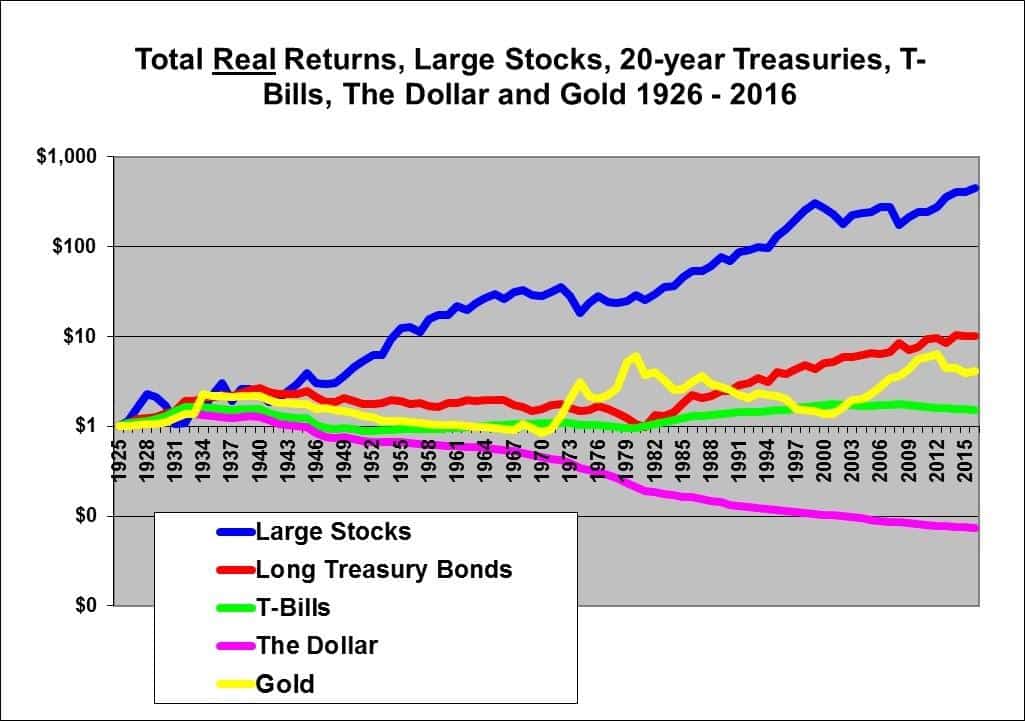

With that being said, we have to remember two other facts, Namely, currencies have never beaten assets like real estate, and especially stocks over time.

The chart below illustrates this point:

So, whilst the USD might be safer than most major currencies, it has never came close to beating the US Stock Market despite the volatility of the later.

Cash, as Ray Dalio and others haver said, is in some ways the riskiest investment. The USD is merely less risky than some other currencies.

We also have to remember that nothing is impossible and 2020 is a unique year.

2020 has varied from the previous years in many ways, and we all know what the reason is.

The coronavirus crisis is very different from the 2008 global financial crisis: instead of a relatively weak US dollar and overheated liquidity, there is a strong dollar and low liquidity in the foreign exchange market.

A decline in the US dollar is believed to be necessary to end the bearish trend in equities and risk sentiment.

The immediate cause of the lending crisis was, of course, the outbreak of the coronavirus, but its severity is the product of a “financed” global system so fragile due to leverage and the abundant use of QE in the latest crisis.

It will take at least a couple more quarters to reach the low per cycle in the markets and the high in USD, although the authorities are making more efforts.

This time, compared with the 2008 financial crisis, treatment involves a much larger distribution of money and much less quantitative easing.

The real GDP growth rate will probably recover slowly, but the nominal one, thanks to the distribution of money, can quickly come back to its previous level.

So, a depreciation of the USD is much more likely than a crash. Indeed a 20%-40% depreciation would only bring the USD back to where it was back in 2006-2008!

Emerging market currencies have collapsed, and G10 small currencies are also under pressure everywhere.

Interestingly, during the initial deleveraging, the US dollar began to decline against the Japanese yen and the euro, but later arranged a broad and powerful rise, similar to what we saw at the worst stage of the 2008-2009 crisis.

And this despite the fact that the Fed, as then, cut rates to zero and launched all sorts of measures of quantitative easing and other methods of providing liquidity.

It looks like, as in the beginning of 2009, the markets cannot be announced that they will pass a bottom or a crisis – a peak until the USD turns down. Just in March 2009, the S&P 500 index passed the minimum, and the USD – the maximum.

All over the world, debt and other instruments are so tied to the US dollar that the Federal Reserve did not quite keep up with the general sell-off in the mad pursuit of cash.

This situation is somewhat reminiscent of 1933, when FD Roosevelt finally devalued the USD against gold (about three years later than it should have been) and the worst phase of the Great Depression began to decline.

We entered this crisis, which has not yet received a name, from the same position as the 2008 financial crisis. The USD was rather weak at the time, as the Fed’s “easy money” policy in 2002-2004 inflated dollar liquidity and investment bank balance sheets; global liquidity was also enhanced by carry trading in JPY and CHF.

This time, even before the outbreak of COVID-19, the dollar was moving up due to the search for profitability from carry. The dollar jump shows that when a crisis hits, the world starts to row dollars and cannot get enough of them.

A reassuring note in a climate of fear: As long-term investors know, crises are points of maximum opportunity for those with money in hand. In the next 6-12 months, various oversold assets, regions and their currencies will turn out to be very valuable, although it is a dubious idea to indicate a specific time.

The forces and factors at work today are very different from those of late and prior to 2008, when the focus was on carry trading and investment flows in the globalized financial system.

Ending USD dependence

The most interesting of the pressing factors for the coming years are the attempts to find an alternative to the US dollar.

The current crisis shows even more clearly than the previous one that the “paper dollar as a global reserve currency” system is worthless, no matter how many attempts to fix it. Finding an alternative is complicated by the fact that in a de-globalizing world, an agreement like Bretton Woods will be very difficult to reach.

How to prepare for a global currency reset?

The best way to prepare for a currency reset isn’t to try to predict the future.

Nor is it to engage in conspiracy theories or put money into gold, silver or coins.

The best way is to have a well diversified portfolio of global stocks and bonds, which is well placed for any economic situation.

Let’s not forget that if the USD depreciates, valuations of stocks will only increase to compensate for that devaluation.

Or let’s put it another way. My British Pound. (GBP) investors have done much better than clients who have invested USD and Euro in the last few years for a simple reason……the Pound has fallen and the assets have taken into account that fact.

So, whilst USD investors have gotten about 12% per year recently in the S&P500, investors into the S&P500 (GBP) have done better than the S&P500 (USD)

Which banks are the safest in 2020?

Firstly, no bank in the world is as safe as keeping money in a diversified investment portfolio.

If you really want to put money into a bank, try some of the major ones in the UK, Switzerland and some other major markets.

Switzerland’s banking industry is relying on its stability and expertise to ensure it has a bright future as a leading center for managing the assets of the rich, despite a concerted global attack on its tradition of secrecy.

Financial stability is a key prerequisite for the functioning of the national economy and the effective conduct of monetary policy.

A stable financial system can be defined as a system whose individual components – financial intermediaries and financial market infrastructure – perform their respective functions and prove to be resilient to potential shocks.

If you really want to invest in a bank, even though we think investing accounts are better, the three below are good options.

UBS

UBS pursues there are three main goals in the area of financial stability: improving the resilience of financial institutions, tackling a problem too big to fail, and strengthening regulation of shadow banking.

A number of efforts linked to resilience are underway at the international level; these are aimed at strengthening the stability of financial institutions.

The main element is the Basel III regulatory framework, which builds on the Basel II regulatory framework issued by the Basel Committee on Banking Supervision (BCBS). This committee established principles for effective banking supervision.

In addition, Basel III imposes stricter requirements for banks’ risk-weighted capital and supplements them with a leverage ratio: this is a simpler, non-risk-based assessment. The third element is the new standards defining minimum liquidity requirements.

These measures strengthen the resilience of the individual institution and the entire banking sector to crisis.

In order to reduce risks to the financial system and strengthen systemically important institutions at the international level, the following measures were taken, among others:

- Measures to identify and assess systemically important institutions

- Establishing loss absorption instruments to enhance the resilience of the institutions concerned and ensure adequate capital in the event of liquidation

- Stricter oversight on governance, risk resilience and stress tests

- Effective liquidation mechanisms to systematically liquidate banks

- More stable infrastructure of the financial market (see also section “Financial market regulation”).

Swiss National Bank

SNB follows some points in order to promote its financial stability, see below:

- Analysis and Research: SNB analyzes events in financial markets and financial market infrastructure. Particular attention is paid to the Swiss banking industry and financial market infrastructure.

- Contributing to the establishment of an appropriate foundation for the financial center: At the national level, the SNB – together with the Confederation and the Swiss Financial Market Supervisory Authority (FINMA) – is involved in reform projects. Internationally, it is permanently represented on the Basel Committee on Banking Supervision and the Committee on Payments and Market Infrastructure (CPMI) of the Bank for International Settlements (BIS) and participates in various international task forces that deal with financial stability issues. … A well-known example is the Financial Stability Board (FSB).

- Liquidity Assistance: SNB acts as Lender of Last Resort (LoLR). As part of this function, it can – under certain conditions – provide assistance in securing liquidity on collateral if local banks can no longer refinance their market operations.

- Supervision: The SNB is responsible for supervising the infrastructure of the financial market, with a particular focus on systems that are essential for the stability of the Swiss financial system. The Swiss Financial Market Supervisory Authority (FINMA) is responsible for the supervision of the Swiss banking sector.

Conclusion

The average person shouldn’t be reading the media, analysing data or paying attention to fortune tellers.

Nobody can predict the future. What we do know from history, however, is that assets outperform cash long-term, regardless of “resets”.

The USD, Euro, Pound and all other global currencies have lost to assets like stock markets long-term.

Stocks are just more volatile than holding cash, which is why holding bonds in conjunction with stock indexes makes sense.

I have noticed a commonality between my clients, associates and friends.

Those that don’t panic and invest for the long-term vastly outperform those that worry about catching trends.

Pained by financial indecision? Want to invest with Adam?

Adam is an internationally recognised author on financial matters, with over 214 million answers views on Quora.com and a widely sold book on Amazon.

Further Reading

Why will the world never be the same again after coronavirus? This video gives two reasons.

Questions- No mention of China? Biggest holder of gold in the world, trying to unhinge the US, seeking to position the Yuan as the world’s reserve currency. Also, no mention of the Derivatives Market representing 1.2 Quadrillion in US Dollars – if this were to collapse, it would be financially catastrophic.

United States and the American Dollar still runs the show because of GDP and all that Americans are purchasing in stuff ! Is something happens to the purchasing in America that will be the end of the world ! Philip