This article will review World Remit, which offers currency transfer services and is thus popular amongst expats around the world.

Explore the World Remit Review 2022 and its efficiency compared to the Utmost International Quilter Collective Investment Bond Review.

For any questions, or if you are looking to invest, you can contact me using this form, or use the WhatsApp function below.

It usually makes sense to invest in a portable manner rather than send money home to invest, especially for expats.

Introduction

As more people and businesses travel and live across international borders, several international money transfer companies have arisen that make it easier to move funds abroad.

People no longer rely exclusively on their banks for their money transfers and increasingly use specialist foreign money transfer companies because of their lower rates, quicker transfer speeds and a variety of other benefits.

A money transfer company is almost always the cheapest way to send money overseas. They can also deliver lower transfer costs than banks, but with the same degree of protection and reliability.

Money transfer providers may have different money transfer rates, mostly based on the prevailing market rate, as well as mitigation factors such as where you send money and the amount you send.

Not all money transfer systems are equivalent, and there is no one-size-fits-all service. Some of them are perfect for small transactions, others work better when sending huge sums of money. The cost and speed of the transfer may also differ considerably, as may the methods of payment and withdrawal available.

Below are listed a couple of benefits of using online money transfer systems:

- Reasonable exchange rates

When using an online money transfer system, you get the best possible exchange rates for the money sent or received. These companies mostly provide rates that banks are unable to offer.

- Safe and secure

Online money transfer systems are known for their safety and multiple security options.

In most cases, even when something happens to the certain money transfer company – you money will stay safe.

- Reduced services charges

The fees for money transfer services over the Internet are always minimal compared to bank and other money transfer methods.

They will often charge you a certain amount of money when transferring money, instead of charging you a certain percentage of the total amount of money you want to receive.

- Easily accessible

When using an international money transfer app to transfer money online, all you need is a secure internet connection.

Whether you’re relaxing at home or working in the office, you can easily send your money without even calling the company’s customer service.

- No paperwork needed

No paper documents are required to send money abroad using an online money transfer, as the whole process will be done over the Internet.

Thus, there is no need to manually do paperwork, for example, fill out a receipt for the transfer of funds or something else.

- Fast transfers

Using online money transfer or international money transfer apps to transfer money abroad is much faster than conventional methods.

You can receive a transfer quickly, even often overnight, by using an online money transfer service rather than a bank transfer.

- 24/7 services

Sending money abroad may not be possible for you on weekends because almost all banks and other money transfer services are closed on non-business days (Sunday or other holidays). But you can send money anytime during the week without any problem.

In this article we’ll talk about the unique features of one of the most popular money transfer systems – WorldRemit.

World Remit Overview

WorldRemit is an online money transfer company that allows you to send and receive money almost anywhere in the world instantly. WorldRemit allows you to send money from 50 countries around the world and receive a transfer in 150 countries. Depending on the direction of the transfer, you may receive the shipment either directly to a bank account, to a mobile wallet (for users who do not have a current account) or in cash at the payment transfer partner points.

WorldRemit was founded in 2010 by Ismail Ahmed, a Somali migrant who came to the UK in the early 1990s to study economics at a university. He regularly sent money back to his family in Somaliland, costing him more than 10 percent in fees at major banks and requiring him to travel across town to the nearest branch.

Ismail later worked at the UN in the area of regulatory compliance, where he discovered the challenges companies face in complying with anti-money laundering and counter-terrorist financing regulations. He began to think about how to make money transfers more efficient and decided to create WorldRemit and headquartered in London. Ismail was convinced that the technology could improve the way money is sent internationally, reduce costs and increase regulatory compliance.

The company achieved great success very quickly and continues to grow rapidly to this day. In 2016, Ismail was honored with the EY Entrepreneur of the Year award for his efforts and “overcoming challenges” and achieving “global significance and success”.

Over the past 9 years the company has earned a strong reputation among online transfer operators and a good customer review ranking for TrustPilot.

According to statistics, almost a third of the total volume of WorldRemit transactions is sent to mobile wallets and mobile phones (which are used as a means of payment in many African countries). This feature is due to the fact that WorldRemit, like many other foreign transfer operators, has the most loyal and competitive offerings in many regions.

For example, the transfers through WorldRemit to Nigeria from Europe, United Kingdom or United States are the most lucrative deals on the market, taking into account competitors commission fees and exchange rates.

In addition, Worldremit provides the best rate of conversion for payments from the United States to Mexico, subject to payment of transfers in cash (at Banco Azteca, BBVA Bancomer, Bancoppel, Telecomm Telegrafos and Pagos Intermex branches) or bank accounts.

Another extremely popular direction in the service, the amount of money transfers that is increasing every year (growth for 2017-2018 was 120), is to be sent to Pakistan, subject to payment of transfers in cash through branches of AL Habib Bank. Furthermore, depending on the amount of the transfer, WorldRemit often provides the best conditions for sending transfers to Morocco, Chile and Colombia.

WorldRemit is the best choice for sending small sums up to 800 GBP/$1000 USD, whereas the preferred route for obtaining a transfer is by cash out at a partner office.

Payment methods offer almost all possible choices, such as: direct payment from a bank card (debit and credit), bank transfer from a bank account, SOFORT, Apple and Android Pay, Poli, Interac, ACH and Trustly.

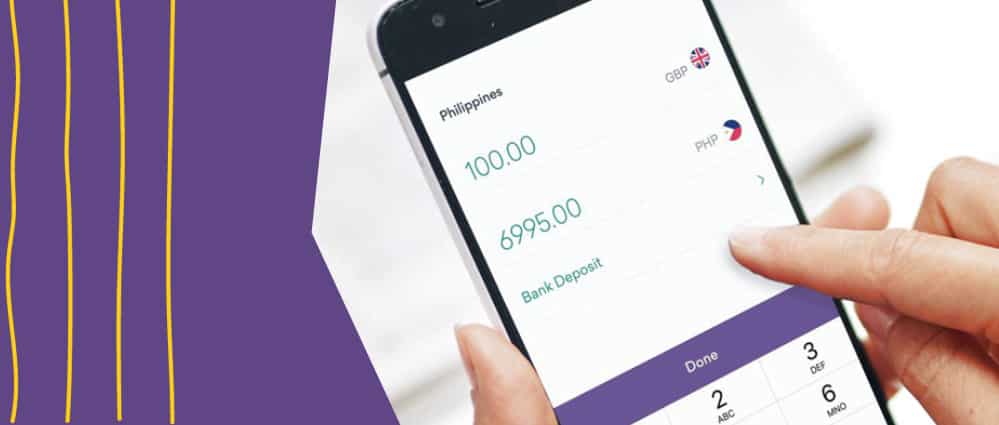

WorldRemit is a company oriented on mobile devices for both sending and receiving money. Its apps, available for both iOS and Android, provide an easy and very convenient way to send money with WorldRemit, from anywhere, anytime. Within the mobile app, you can check WorldRemit exchange rates and fees, set up and track your money transfers, and manage your recipients. Mobile apps have a good rating: 4.5 / 5 in the Google Play store and 4.7 / 5 in the Apple App Store.

WorldRemit offerings

Now let’s have a look at the services that WorldRemit provides.

- Foreign bank transfers – Easily send money online to the foreign recipient’s bank account.

- Cash pick-up – Cash can be collected locally in the destination country. It is widely available, but not in all countries.

- Foreign bill payments – These payments include electricity, credit cards, and television services, but unfortunately are not available for all destinations.

- WorldRemit Wallet – WorldRemit also has a unique feature called WorldRemit Wallet. This allows you to receive money through their vast global network into a multi-currency wallet. Their unique feature is that the WorldRemit wallet can also be used as mobile money.

- WorldRemit Mobile Money – Wherever possible, your mobile money wallet can be used to shop in the store and online, pay school fees, and withdraw cash from authorized agents.

- Auto-recurring transfers – Regular transactions are also supported.

Advantages of using World Remit:

- Worldwide presence to over 150 countries

- Quick transfer speeds (90% transfers approved in minutes)

- Secure encryption system to keep your money safe

- Supports a wide range of payment methods including debit/credit card and bank transfers

- Range of delivery options including cash pick up, airtime top up, and bank transfer

- Mobile application for sending and receiving money

Disadvantages of using World Remit:

- Complex fee structure

- Can have higher exchange rate markups than competitors

- Not the cheapest operator for transfers of large amounts or to bank accounts

- Restrictions on transfers over $ 4500 to some destinations

How does WorldRemit work?

WorldRemit has done a decent job of making it easy to register. Like most providers, they’re only asking for a few personal information, and depending on where the money comes from and goes to, they’re asking for ID and address verification papers.

- The first step is to sign up.

When signing up, you will receive your first three transfers for free (with the code “3FREE” by November 30, 2020).

Then you choose and select the country from which you are transferring money and then also some basic data. Please note, that once you have selected the country, you cannot change it online, you will need to call customer service or send an email to their support service.

To complete the online application process, you just need to provide details such as your name and email address. You can update your date of birth, phone number, address, and confirmation data later.

- The next step is to make a transfer

To do this, you can log in using your computer or the WorldRemit app on Android or iOS.

Regardless of which device you choose, the transfer process will remain the same.

You will need to enter recipient details depending on the transfer method you have chosen. For a bank transfer, you will need to provide the recipient’s personal details as well as bank account details, and for transfers to a mobile wallet and airtime top-up, you will need the recipient’s mobile phone number.

Then you enter the desired amount and make a payment. WorldRemit allows you to choose from a variety of payment methods depending on the currency and country the money is coming from.

How fast is WorldRemit?

When it comes to speed, WorldRemit is just as good as any of the best services out there. In most situations, money transfers come immediately. However, the actual transfer period may vary depending on a variety of factors, such as how the money is collected.

Bank to bank transfer may take longer (like a few days) with transaction time and weekday being factors as well.

Cash pickup is also available for immediate collection in most cases. Mobile money and airtime backup are also available instantly.

There is no service that meets all your needs. If you want to transfer small amounts quickly at a reasonable cost, WorldRemit is a good choice. This is especially good if you need cash pickup.

They are transparent enough about their fees and exchange rates, so you can easily compare services to make the right choice.

Plus, the WorldRemit app allows you to transfer money on the go. This may not be the best option if you need to make medium to large transfers, or if you need human assistance for your transactions.

What currencies does WorldRemit support?

WorldRemit transfers can be sent from over 50 countries and received in over 150 countries. The most popular currencies and transfer directions include the following:

- Mexico: Mexican peso (MXN)

- China: Chinese yuan (CNY)

- India: Indian rupee (INR)

- Philippines: Philippine peso (PHP)

- Vietnam: Vietnamese dong (VND)

- Guatemala: Guatemalan quetzal (GTQ)

- Nigeria: Nigerian dollar (NGN)

- El Salvador: El Salvador colon (SVC)

- Dominican Republic: Dominican peso (DOP)

- Thailand: Thai baht (THB)

Below are some of the outstanding features of WorldRemit’s mobile app:

- Tracking transfers – this function helps you to find out where your money is at any time.

- Exchange Rate Alerts – Receive daily exchange rate information to help you plan your transfers.

- Customer Support – you can access 24/7 customer support through the app

- Manage contacts – you can add and / or remove people from your contact list as you see fit.

- Pickup Locations – You can quickly check nearby pickup locations through the app.

The app has an account called the WorldRemit wallet that allows you to send and receive money, including airtime top-ups.

Fees & Commissions

WorldRemit commissions depend on the transfer amount, direction and method of payment. As a rule, the commission for issuing cash transfers at the point of payment is higher than for payments to a bank account, card, or mobile wallet.

Fees can range from $ 1.99 to $ 24.99 per transaction.

It is known that transfer fees are not the only source of income for online transfer operators. Another way is making money on exchange rate differences.

WorldRemit offers its clients much more favorable conversion rates compared to banking. However, these rates are still higher than the exchange rate in the interbank market. And often these courses can lose to other operators.

To determine at what exchange rate a transaction will be made, simply use the online calculator at Worldremit.com. And to compare the exchange rate with the rates of other operators, use our tool to determine the most profitable service for sending money in real time.

As our calculations show, the real difference in WorlRemit exchange rates versus interbank exchange rates ranges from 1% to 1.5%. Bank interest on courses always starts from 2.5-3%.

WorldRemit does not charge any hidden fees or commissions. However, if you are sending money from a credit card, then be prepared for the fact that the bank that issued the card will charge you an additional fee for debiting funds.

Also, if you send funds to a bank account, there is a possibility that the bank will also charge a fee for crediting funds to the account. In this case, WorldRemit will warn you before completing the transfer.

Safety

Using a secure money transfer service is vital and WorldRemit offers robust security to its customers.

As one of the leading innovators of digital money transfers, WorldRemit operates on a secure 256-bit Secure Sockets Layer (SSL) system that uses RSA-2048 encryption.

The world’s leading banks and financial institutions use exactly the same format, so the transfer of funds using WorldRemit is recognized as absolutely safe and reliable.

What security does WorldRemit have?

WorldRemit is required by the legal framework that it follows to ensure the safety and security of its services for everyone by verifying the identity of its customers.

When registering, customers must provide proof of their identity, indicating their date of birth and place of residence.

Acceptable documentation, such as a valid driver’s license or passport, must include a clear photographic ID and must be uploaded with a birth certificate and utility bills.

Through the secure transmission system WorldRemit, the sender and recipient are informed by email and text message that the transaction is in transit. Each notification is sent to everyone to confirm that it has arrived.

You can also track a money transfer by opening the transaction history link in the app or website.

WorldRemit can be accessed through secure mobile systems such as AndroidPay, ApplePay, iDeal and Trustly.

The security measures adopted by WorldRemit and the platforms they work with are encouraging enough to instill confidence in the millions of satisfied customers who regularly use the service.

Customer Satisfaction

The best way to learn about a service is through real customer reviews. WorldRemit has consistently received excellent customer reviews on Trustpilot with an average rating of 9.3 stars out of 10. Here is a summary of what WorldRemit customers mostly say:

Positive feedback:

- So far, what customers like most about WorldRemit is how quickly it makes a transfer and how quickly the money is delivered.

- The convenience and the simplicity of using WorldRemit is often praised.

- Customers find that WorldRemit’s fees and exchange rates are much better than the ones offered by its competitors.

- WorldRemit is trusted by customers.

Negative feedback:

- Money delay: Many negative reviewers claimed that funds were not received in the recipient’s account on time. In most cases, delays are caused either by bank delays or by compliance issues.

- Poor customer service: There were complaints about poor customer support. Some customers had to wait a very long time before they could speak with a support representative.

- Accounts deactivated: In most cases, account deactivation occurs when a customer fails to comply with regulatory requirements such as proof of identity or address. In some cases, the company may require additional documentation such as the source of funds, and the late submission of these documents may also result in account deactivation.

Conclusion

WorldRemit allows you to transfer funds in over 90 currencies to 150 countries around the world, and last year alone, more than two million people used their services for transfers.

They offer a variety of ways to send money internationally, such as bank deposits, cash withdrawals, and mobile money, and are known to be able to process most transfers within minutes with low fees and upfront exchange rates. WorldRemit has an average rating of 4.4 out of 5 on Trustpilot with over 4 million customers worldwide.

Register and start using WorldRemit services quickly and easily. All you have to do is enter your personal details and provide a valid proof of address for verification. You can simply scan and upload documents. Once your account has been approved, you can transfer money using a variety of payment methods, including bank transfer, debit card, and cash withdrawal.

WorldRemit charges transfer fees and mark-ups at mid-market exchange rates. In addition, you will have to keep an eye out for possible additional fees from your bank. However, WorldRemit announces the fees in advance and you will know exactly how much your transfer will cost before it is completed.

You may have to pay a delivery fee of $ 3.99 to $ 24.99 depending on currency, country, and delivery option. Although WorldRemit charges a premium to exchange rates, they are still lower than the banks offer. Usually the provider charges no more than 1-1.5% mark-up.

WorldRemit offers almost instant funds transfer in most cases, especially when transferring cash. However, bank transfers can take 1-3 days to be credited to the recipient’s account.

Here are three more benefits of WorldRemit:

- A large, growing number of countries and partners

- Highly rated mobile application (for sending and receiving money)

- Inexpensive alternative to high-priced money transfer companies